CIO Outlook: Looking Ahead to 2022

Ryan Kelley, Chief Investment Officer for Hennessy Funds, shares his thoughts on what's driving the strong stock market, reflecting on where we have come from and where we may be going in 2022.

-

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager

What a year this has been. While it doesn’t feel that we are out of the “pandemic” phase of the coronavirus crisis, we look forward to a day when we will eventually see fewer cases and potentially less severe new variants. We feel extremely grateful to the many healthcare workers who have continued to work tirelessly during the recent surge. As we move through the next year, we hope that new U.S. cases will decline and that many other parts of the world will see improvements as well.

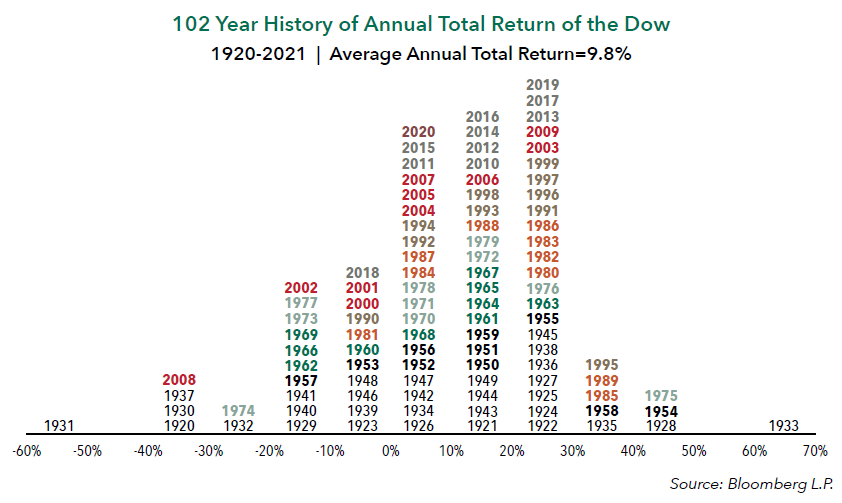

What a year this has been! As measured by the total return of the S&P 500® Index, as of December 6, 2021, the market was up 23.87% calendar year to date. This comes in the wake of a tumultuous 2020 in which it plunged in the beginning of the pandemic and recovered dramatically to end the year up 18.40%. Interestingly, 18% appears to be a repeating number in the past dozen years. From the low point of the Financial Crisis (March 9, 2009) to the high achieved just prior to the COVID-19 pandemic (February 12, 2020), the S&P 500® Index was up 18.27% per year. We are well aware that past results are not predictive of the future, and, naturally, we find ourselves skeptical of such strong returns. But, as shown in the chart below, we find that the most common annual total returns of the market over the past 102 years range between 20% and 30% with the second most common being between 10% and 20%.

We will say it again, after showing a chart like the one above: Past results are not predictive of the future. Instead, we look at where we are right now—in the economy, in the market, in the business cycle—to reflect on where we have come from and where we may be going. U.S. GDP is strong and growing, interest rates remain low, and earnings growth and profitability remain robust. We believe, as a whole, stocks are trading at reasonable valuations, with the S&P 500® Index at 21.0x estimated earnings for 2022. We believe corporate balance sheets are healthy, with high levels of excess cash, which could support growth, increases in dividends, increases in share buybacks, and future acquisitions. Uncertainty and volatility can manifest at any time in the stock market, and the current market is no different. Investors have questions about inflation, worldwide supply chain issues, and what could drive the next leg up in earnings. While these concerns are warranted, we continue to believe that overall the positives outweigh the negatives, and, at Hennessy, we continue to see opportunity in the market and in our Funds.

What a (fiscal) year this has been!!! For our full fiscal year ended October 31, 2021, the S&P 500® Index rose 42.91% on a total return basis, setting a new all-time high on the final day of the period. The market has been on a continuous march higher, except for a short 21 trading day period, which began on September 2 and where the market fell 5.13%, only to rebound to new highs 13 trading days later. We saw a dramatic shift in market leadership, as many of the sectors that soared in 2021 underperformed last year. Small-caps beat mid-caps, which in turn beat large-caps. The Energy and Financials sectors skyrocketed during the twelve-month period, as shown by the S&P 500® Energy Sector’s total return of 111.29% and the Russell 1000® Index Financials’ total return of 70.87%. Both of these sectors were among the worst performing in 2020, so a bounce back in 2021, while not a foregone conclusion, was a distinct possibility.

Overall, we are pleased with the performance of our mutual funds during this fiscal year. While some of our Funds certainly benefited from being in the “right” sector at the “right” time, we also believe this was a favorable period for our investment style of high-conviction investing and concentrated portfolio construction.

What will the coming year bring? As mentioned in the last CIO letter (June 2021), we understand that even the greatest bull markets experience corrections along the way, and the last time the S&P 500® Index dropped over 10% was in February/March of 2020. Whether or not a correction occurs sooner or later, we believe the market as a whole has more room to run. Strong GDP growth and increasing corporate earnings, a potentially lower-for-longer interest rate environment, accommodative fiscal and monetary policies, a healthy and robust financial system, low unemployment and solid wage growth, and strong corporate balance sheets with plenty of cash all support the market moving higher from here.

Thank you for your interest and for investing with us. We remain committed to managing our portfolios for long-term performance, ever mindful of downside risk. With so many investment options available to you, we are grateful for the trust you put in us and for your continued interest in our family of Funds. Should you have any questions or would like to speak with us, please don’t hesitate to call us directly at (800) 966-4354.

- In this article:

- Overall Market

You might also like

-

Market Outlook

Market OutlookStaying Disciplined, Finding Opportunity

Ryan C. Kelley, CFAChief Investment Officer and Portfolio ManagerRead the Commentary

Ryan C. Kelley, CFAChief Investment Officer and Portfolio ManagerRead the CommentaryAgainst a backdrop of dominance of large-cap technology companies and artificial intelligence (AI), Ryan Kelley, Chief Investment Officer, shares his views on compelling opportunities that offer a favorable setup for long-term investors.

-

Market Outlook

Market OutlookThe More Things Change, the More They Trade the Same

Neil J. HennessyChief Market Strategist and Portfolio ManagerRead the Commentary

Neil J. HennessyChief Market Strategist and Portfolio ManagerRead the CommentaryAlmost 50 years in the market taught me one truth: the headlines change, the patterns don’t.

-

Market Outlook

Market OutlookHennessy Funds 2025 CIO Roundtable

Neil J. HennessyChief Market Strategist and Portfolio Manager

Neil J. HennessyChief Market Strategist and Portfolio Manager Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager Ben Cook, CFAPortfolio Manager

Ben Cook, CFAPortfolio Manager Masakazu Takeda, CFA, CMAPortfolio ManagerRead the Commentary

Masakazu Takeda, CFA, CMAPortfolio ManagerRead the CommentaryHennessy Funds’ Portfolio Managers recently gathered for our annual CIO Roundtable. For the 11th year in a row, they discussed the latest market trends, shared insights, and explored strategies for navigating the ever-changing investment landscape.