2021 CIO Roundtable: A Review of 2021 and Outlook for 2022

A summary of the discussion with Ryan Kelley, CIO, and our Portfolio Managers sharing their views on current market events, including the outlook for the U.S. and Japanese markets, the Federal Reserve and interest rates, inflation, supply chain disruptions, and the expanding energy landscape.

Message from our Chief Investment Officer - Ryan Kelley

What a year this has been! The S&P 500® Index has risen over 23% year-to-date through November 30, after a tumultuous 2020. As we reflect on how far we have come from the outset of the pandemic, it is reassuring to witness the resiliency of our economy. As we approach 2022, U.S. GDP is strong and growing, interest rates remain low, and earnings growth and profitability remain robust. We believe stocks, on a collective basis, are trading at reasonable valuations when evaluating various metrics such as price-to-earnings, earnings growth, and corporate profitability.

We believe corporate balance sheets are healthy, with high levels of excess cash, which could support organic growth, dividend increases, share buybacks, and future acquisitions.

Uncertainty and volatility can manifest at any time, and the current market is no different. Many investors have concerns regarding heightened inflation levels, supply chain disruptions, and the strength of future corporate earnings. While these concerns are warranted, we continue to believe the positives outweigh the negatives and bode well for the continuation of the bull market.

On the following pages, we provide our insight on these issues as well as the opportunities we believe lie ahead. I hope you enjoy the insights from our team of talented and seasoned Portfolio Managers, who have an average of 25 years of industry experience.

-Ryan Kelley

Continued Bull Market Expected in 2022

The strong bull market has continued after a tumultuous 2020 in which the S&P 500® Index plunged more than 30% at the beginning of the pandemic and recovered dramatically to end the year up 18.40%. In 2021, we’ve seen the market reach over 65 new highs—the largest number of annual new highs since 1995.

Looking ahead, we believe the market will likely continue its advance in 2022. As one Portfolio Manager noted, there is a self-sustained momentum trend as animal spirits run strong. History has demonstrated that this trend tends to continue until disrupted by an unforeseen event. For example, in late 2021, we witnessed how investors reacted when the new COVID-19 Omicron variant appeared—stocks quickly dropped at the end of November.

Several factors are critical to the ongoing bull market. As such, supportive fiscal policy and accommodative governmental spending is likely to be a tailwind to the economy, driving markets higher.

However, the Federal Reserve’s reaction to rising inflation could weigh on equities if they choose to raise rates too quickly and higher than expected. In recent years, the Fed remained more accommodative when the market or

the economy began to weaken. This has led investors to assume that the Fed will be a backstop to the equity market. Therefore, any volatility or an unfolding of the slow tapering that the Fed has planned could continue to boost equity multiples and move the markets higher.

Midterm 2022 elections could be another important market factor as political leaders could determine the direction of the tax and spending proposals. If some of the less business-friendly proposals are sidelined, it would likely be encouraging for market-related assets.

The economy appears to have room to grow further. One Portfolio Manager tracks the Transportation Security Administration checkpoint travel numbers of total daily fliers. By this measure, there is some room to make up before we return to normal economic behavior. As COVID-19 cases continue to subside and business and leisure travel resume, this activity may be a tailwind for the economy.

The Impact of Inflation and Higher Prices

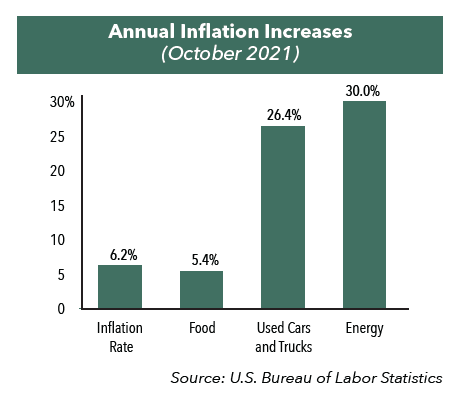

Over the past several months, the U.S. has seen inflationary pressures across a multitude of consumer items. In October 2021, the annual inflation rate in the U.S. was 6.2%, the highest since 1990. Food prices increased 5.4%, used cars and trucks were up 26.4%, and energy prices rose 30.0% over the past year as of October 2021.

One Roundtable participant noted that Americans are not accustomed to an inflationary environment. For approximately 30 years, the cost of living was adjusted by only 2% to 3% per year. The transition to a dramatic increase in the cost of living over the past year has been a shock to many people. Supply chain and labor shortages have challenged many Americans’ expectations, and the longer they continue, the more sustained inflation may be.

In conversations with individual companies, our Portfolio Managers have broadly agreed that many executives have been planning for prolonged inflation. Many companies have been able to work around the supply chain shortages, so input costs may ease in the intermediate term.

The more pressing factor affecting companies is a labor shortage as people have been leaving the workforce in record numbers. In September 2021, approximately 4.4 million U.S. workers quit their jobs and the “quits rate” increased to 3% of the workforce. With a scarcity in labor, many companies are increasing workers’ pay, with the average hourly earnings over the prior 12 months rising 4.8%. As a result, U.S. companies may be in a new paradigm where wage inflation may become a more persistent issue.

We believe inflation may get worse before it gets better. As one participant noted, some level of demand must be reduced to solve some of the supply chain issues and price increases. Inflation could get to the point where people simply refuse to pay a certain price for an item. Instead, they may choose to purchase fewer durable goods and spend their money on experiences, such as dining in restaurants and traveling.

Interest Rates May Be Lower for Longer

Due to the strengthening of the economy and a tightening labor market, Fed policymakers have indicated they may begin to accelerate the tapering of their bond-buying program. In November 2021, the Fed began reducing its $120 billion in monthly bond purchases on a pace that would end all purchases by June 2022. The Fed may also look to increase the near-zero fed funds rate in 2022.

At Hennessy Funds, we believe the Fed should start tapering and raising rates sooner rather than later. However, on a historical basis, interest rates would still be relatively low, albeit higher than they are now. For the economy to continue growing, the Fed will need to delicately balance raising rates with turning off the stimulus faucet.

One Portfolio Manager emphasized the extraordinary amount of stimulus dollars circulating in the economy. In the last two years, there has been approximately $15,000-20,000 allocated per person in stimulus money, which is three times the amount during the Great Recession and five times the amount during World War II.

The flattening shape of the yield curve will be an important factor to watch. In November, the 30-year Treasury yield was, at one point, only 68 basis points higher than the five-year yield. Historically, the flatter the curve, the more likely credit spreads widen relative to Treasuries and equity markets sell off. A flatter yield curve tends to herald a slower growth environment.

Drivers of the Financials Sector

It’s been a challenging growth environment for banks over the past 15 years with excess liquidity, anemic loan growth, and a low interest rate environment. From 2007 to 2021 total loans for all FDIC institutions, which is primarily U.S. banks, have grown only 37% on a cumulative basis, yet deposits have increased 148%, which is nearly four times as much. We look forward to drivers that could reduce industry liquidity, which include the tapering of bond purchases by the Fed, stronger loan growth, and modest increases in lending rates. If the U.S. can achieve normalized rates, such as a fed funds rate of 1-2% and mortgage rates at 4-5%, it will likely result in significant earnings growth for banks.

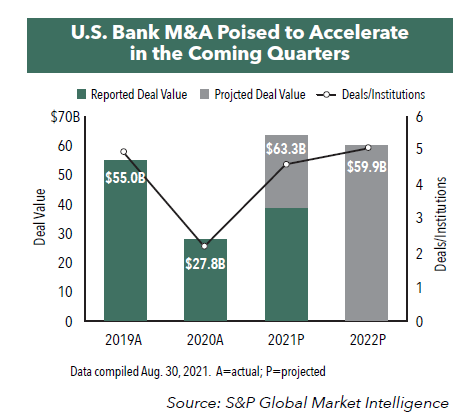

Over the longer term, the industry faces stiff competition for customers from other banks and fintech companies. We anticipate that this desire to grow and compete will drive consolidation and continued mergers and acquisitions activity. In 2021, U.S. bank M&A is projected to be $63 billion and 2022 deal value could reach another $60 billion. Banks will also need to continue to innovate and deepen their digital banking capabilities to compete.

Broader Opportunities in Energy

For many years, the word “energy” in the Energy sector connoted primarily oil and gas investing. Now as policymakers, consumers, and investors with environmental, social and governance (ESG) mandates have encouraged a reduction in greenhouse gas emissions, the world has been transitioning to a broader use of energy sources including solar, wind, hydroelectric, biomass, and geothermal. This focus has reduced the representation of traditional energy in the S&P 500®, with the sector currently comprising only 3% of the Index.

Renewable energy sources are expected to represent a growing share of the global energy mix over the next several decades. Yet many of the renewable sources and technologies are still in the early stages of development and will take time to be used on a scalable basis. Therefore, a variety of fuel sources that include oil and natural gas will continue to make up the global energy mix over the next several decades.

At Hennessy Funds, we place emphasis on investing in companies involved in the global fuel mix that includes both hydrocarbon and renewable energy sources as well as end users of energy and midstream companies.

The Outlook for Japan

In the second quarter of 2021, Japan was in the midst of a fifth wave of the pandemic, and by the fall of 2021, new cases subsided significantly. As of December 2021, there were about 100 new daily cases and about 78% of the population was fully vaccinated. For comparative purposes, the U.S. reported over 85,000 new cases per day with about 60% of the population fully vaccinated. As a result, the Japanese economy is reopening and prospects for growth are brighter.

With regard to Japan’s monetary policy, the central bank remains committed to a zero-rate policy. It has also committed to yield curve control, with the short end of the curve at -10 basis points and 10-year rates pegged at 0%. These rates will likely remain in effect until Japan hits an inflation rate of 2%.

As it relates to current valuations, it appears that the market has already priced in next year’s earnings. Since the start of Abenomics in 2013, the Tokyo Stock Price Index (TOPIX) has risen approximately 170%. Corporate earnings have increased about 170% as of fiscal year ending in March 2023.

However, when evaluating various metrics including price-to-earnings, price-to-book, and return-on-equity multiples, Japan appears attractively valued. The TOPIX price-to-earnings ratio is about 15x and the price-to-book ratio is about 1.3x as of November 2021, which can be attributed to Japan’s lower return-on-equity multiple. However, with the corporate governance initiatives spearheaded by the government, Corporate Japan is working hard to become more efficient in terms of return on capital. While the current return-on-equity multiple in 2021 is only 8%-9%, we believe it can grow to within the low- to mid-teens range given the mindset changes observed in corporate management teams.

- In this article:

- Overall Market

You might also like

-

Market Outlook

Market OutlookStaying Disciplined, Finding Opportunity

Ryan C. Kelley, CFAChief Investment Officer and Portfolio ManagerRead the Commentary

Ryan C. Kelley, CFAChief Investment Officer and Portfolio ManagerRead the CommentaryAgainst a backdrop of dominance of large-cap technology companies and artificial intelligence (AI), Ryan Kelley, Chief Investment Officer, shares his views on compelling opportunities that offer a favorable setup for long-term investors.

-

Market Outlook

Market OutlookThe More Things Change, the More They Trade the Same

Neil J. HennessyChief Market Strategist and Portfolio ManagerRead the Commentary

Neil J. HennessyChief Market Strategist and Portfolio ManagerRead the CommentaryAlmost 50 years in the market taught me one truth: the headlines change, the patterns don’t.

-

Market Outlook

Market OutlookHennessy Funds 2025 CIO Roundtable

Neil J. HennessyChief Market Strategist and Portfolio Manager

Neil J. HennessyChief Market Strategist and Portfolio Manager Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager Ben Cook, CFAPortfolio Manager

Ben Cook, CFAPortfolio Manager Masakazu Takeda, CFA, CMAPortfolio ManagerRead the Commentary

Masakazu Takeda, CFA, CMAPortfolio ManagerRead the CommentaryHennessy Funds’ Portfolio Managers recently gathered for our annual CIO Roundtable. For the 11th year in a row, they discussed the latest market trends, shared insights, and explored strategies for navigating the ever-changing investment landscape.