Seeking Innovation in the Financials Industry

Portfolio Managers Dave Ellison and Ryan Kelley discuss what’s driving performance in the Hennessy Large Cap Financial Fund, how tariff increases affect banks, the interest rate environment, and the opportunities in financials.

-

David EllisonPortfolio Manager

David EllisonPortfolio Manager -

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager

Key Takeaways

» Tariff increases have been largely irrelevant for banks as they are not in the hard goods trade.

» Proposals to reduce capital levels and ease M&A policies are advantageous for financials, particularly small and mid-cap banks seeking growth through acquisitions.

» Banks trade at a discount to the broader market and near historical averages.

» The Hennessy Large Cap Financial Fund provides exposure to large, diversified banks, insurance and fintech companies, and crypto exchanges.

» The Hennessy Small Cap Financial Fund provides access to small banks poised to benefit from ongoing industry consolidation.

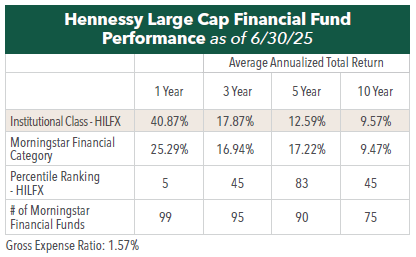

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting hennessyfunds.com. Morningstar rankings based on total returns.

What has been driving the Large Cap Financial Fund’s (HILFX) top 5% Morningstar performance ranking among 99 Financial Funds over the past year as of June 30, 2025?

The Large Cap Financial Fund has benefited from companies that have exposure to financial technology (fintech) and cryptocurrency companies. This exposure has been increasing over the past few years to approximately 27% of the Fund as of June 30, 2025, and is driven by our belief that fintech products are increasingly taking share from traditional bank products. These products include access to cryptocurrency trading and crypto payments, low or no fee checking, more advanced electronic payment platforms, more functional phone apps, and competitive loan and deposit rates for consumers and commercial customers. Recent regulatory changes have also accelerated adoption of these products.

Importantly, we continue to own many of the largest banks as we believe they have the profits to stay competitive in new product adoption.

How are recent U.S. tariff policies, potential tax changes, and regulatory shifts shaping market sentiment and sector performance?

Tariff increases that have been implemented so far have not been as large as expected. However, tariffs are generally not that impactful to banks and most financials companies as most implemented tariffs focus on goods imported into the U.S from Canada, Mexico, and China. Financials companies are not in the hard goods trade. In addition, proposed tax changes are likely not material.

However, regulatory shifts are the most impactful with proposals to reduce capital levels being significantly advantageous for financials. Also, faster and less burdensome merger and acquisition policies are often positive for small and mid-cap banks as this activity allows for more rapid growth than simply adding branches or attracting new customers.

How have changes in the interest rate environment in 2025 affected net interest margins, loan demand, and deposit flows for portfolio holdings?

There have been no material changes in rates this year, and we consider the current level of rates and the yield curve to be favorable for banks. While the Federal Reserve has talked about reducing rates in late summer, we do not believe it will negatively affect financial companies. However, in the event that rates decline materially, it would be negative as it would put pressure on bank margins over the long term.

Would you please discuss bank valuations compared to the broader market and historically?

Bank valuations are significantly less than the broader market but relatively in line with their long-term average. As of June 30, 2025, the price-to-earnings for the BKX (KBW Bank Index) is at approximately 13.0x 2025 estimated earnings, slightly above its 10-year average of 12.6x. Financials, as measured by the S&P Financial Sector, trade at close to 18.0x 2025 estimated earnings, while the S&P 500 Index is at 23.4x 2025 estimated earnings.

Where are you finding opportunity for the portfolios?

For the Hennessy Large Cap Financial Fund, we are finding new opportunities in fintech and crypto exchanges, while remaining heavily invested in the diversified and regional banks, given their welldiversified businesses and their ability to invest in existing and new products. Currently the Fund is positioned in large banks, insurance companies, fintech, consumer finance, and crypto exchanges, as we seek to invest in financials companies that offer new and innovative products.

As it pertains to small banks, we believe many small banks remain attractive due to the potential for consolidation as many small banks could be acquisition targets. In addition, many smaller banks trade at lower earnings multiples and have the potential for higher net interest margins. Finally, regulatory burdens on small banks could ease, allowing them to operate more effectively and reduce compliance costs.

For the Hennessy Small Cap Financial Fund, we continue to focus on holding established banks with experienced management teams.

- In this article:

- Financials

- Large Cap Financial Fund

- Small Cap Financial Fund

You might also like

-

Portfolio Perspective

Portfolio Perspective

Large Cap Financial FundSmall Cap Financial FundSolid Industry Fundamentals & Continued Consolidation

David EllisonPortfolio Manager

David EllisonPortfolio Manager Ryan C. Kelley, CFAChief Investment Officer and Portfolio ManagerRead the Commentary

Ryan C. Kelley, CFAChief Investment Officer and Portfolio ManagerRead the CommentaryPortfolio Managers Dave Ellison and Ryan Kelley review 2025 bank performance, fintech-driven consolidation, attractive valuations, and their constructive 2026 outlook.

-

Viewpoint

ViewpointNavigating the Financial Landscape in 2025

David EllisonPortfolio ManagerWatch the Video

David EllisonPortfolio ManagerWatch the VideoHennessy Funds Portfolio Manager Dave Ellison discusses the key drivers behind the financial sector's strong performance in 2024, the impact of potential rate cuts and regulatory changes, and the evolving landscape of banking in 2025. He also explores the challenges and opportunities facing both large and small banks, the role of AI, and the critical risks to watch, from traditional credit concerns to transformative technological shifts.

-

Portfolio Perspective

Portfolio Perspective

Large Cap Financial FundSmall Cap Financial FundWhat’s Next for Financials After 2024 Outperformance?

David EllisonPortfolio Manager

David EllisonPortfolio Manager Ryan C. Kelley, CFAChief Investment Officer and Portfolio ManagerRead the Commentary

Ryan C. Kelley, CFAChief Investment Officer and Portfolio ManagerRead the CommentaryPortfolio Managers Dave Ellison and Ryan Kelley discuss what drove 2024 performance in the Financials sector and drivers for potential earnings growth in a lighter regulatory and declining interest-rate environment.