Rate Hikes and Loan Growth Could Boost Bank Margins

Portfolio Managers Dave Ellison and Ryan Kelley discuss how the Federal Reserve’s plans will likely affect banks and how the market has reacted to the Fed’s rate increase. They also cover valuations, loan growth, mergers and acquisitions, and the benefits of active management.

-

David EllisonPortfolio Manager

David EllisonPortfolio Manager -

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager

Would you please discuss how the Federal Reserve’s plans will likely affect banks?

In March 2022, the Fed increased the fed funds rate 25 basis points, which was the first rate hike since 2018. The Fed has indicated there could be at least six 25 to 50 basis point hikes in 2022 in an attempt to ease inflation.

As the Fed seeks to reduce its $9 trillion balance sheet and raise interest rates, these actions would provide banks the opportunity to expand their revenues, increase their margins, and grow their loan portfolios, which they have not been able to do in years. This slow period of loan growth has created a dramatic mismatch between banks’ loans and deposits. For instance, deposits at the top four banks in America currently exceed their loan balance by almost $4 trillion.

How has the market reacted to the Fed’s rate increase?

Any change in expectations for rate hikes by the Fed appears to drive investor interest. Although the March rate hike was highly anticipated, Financials outperformed and rates climbed higher. In 2021, the Russell 1000® Index Financials rose 35% while large-cap banks, as represented by the KBW Bank Index, climbed over 38%, outperforming the S&P 500® Index and even the Technology sector.

Rates similarly rose: the 2-year and 10-year Treasury yields surged over 200 basis points and nearly 60 basis points, respectively, over the year ended 3/31/22.

Although rising rates are generally positive for bank margins, a slow and steady rise in rates and the shape of the yield curve are important. As such, both factors weigh into our investment decisions.

Would you please discuss valuations of banks and financial companies?

Bank valuations continue to look attractive relative to the overall market. As of 3/31/22, the KBW Bank Index traded at about 10.5x 2023 earnings compared to 18x for the S&P 500. Valuations are also lower relative to historical averages, as the price to earnings ratio for banks has averaged 12.9x for the past 10 years.

In comparison, financial technology companies typically trade at a premium to the market given their faster growth profiles. However, their stock prices have corrected in the past six months. As of quarter end 2022, they are trading at about 25x 2023 earnings, below its 10-year average of 38x.1 Looking ahead through 2023, earnings could more than double from 2021 levels, and the five year annual growth rate of earnings would be approximately 15% per year despite a significant drop in 2021.

Would you discuss your expectations for loan growth in the near term?

Loan growth, along with margins, asset quality, and expense control, is an important part of our investment thesis. These factors are more important for smaller banks that lack revenue opportunities from other business lines, such as capital markets or asset management.

Loan growth has been fairly anemic for the past few years. In concert with the recovering economy, loan growth has improved. Excluding the commercial and industrial category, loans outstanding at the largest 25 banks in the U.S. grew 6.9% and small banks’ loan balances rose 8.5% over the past year as of 3/23/22.

Specifically, we see relative strength in certain categories of lending including consumer, commercial real estate, and multi-family housing. Barring any significant downturn in the economy, we expect solid and steady growth to continue and potentially accelerate.

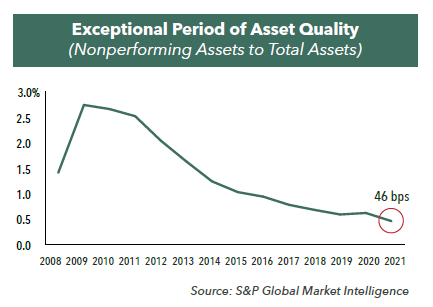

The banking industry is also experiencing an exceptional period of asset quality. In 2021, nonperforming assets to total assets were 46 bps, down from almost 300 bps in 2009. Aggregate net charge-offs (the amount charged off when a loan becomes uncollectible) to average loans were 24 basis points for the year; in 2009, it was 267 basis points.

After a strong year for mergers and acquisitions (M&A) in the banking industry, do you expect consolidation to continue in 2022?

Yes. In 2021, there were 215 bank and thrift mergers with an aggregate deal value of nearly $80 billion--surpassing the highest level since before the global financial crisis. We believe M&A transactions will continue as consolidation is ever-present in the banking industry. For instance, in the early 1980s, the number of FDIC-insured institutions peaked at over 14,000, and as of the end of 2021, there were only about 4,200.

There are many factors driving the continued consolidation trend, including increased competition from Fintech companies, the need to reduce expenses due to inflationary pressures and the desire to increase market share and profitability.

In the Hennessy Small Cap Financial Fund, consolidation and M&A activity have been a value proposition. We tend to own the consolidators as there can be significant value and accretion to the earnings and the book values of these acquiring companies.

What are the benefits of an actively managed portfolio in the financial sector?

We believe active management in the Financials sector provides the following benefits:

1. Our experience drives our investment decisions. Portfolio Manager Dave Ellison has been managing both the Hennessy Large Cap Financial Fund and the Hennessy Small Cap Financial Fund for over 25 years.

2. Stock selection drives performance. We look for opportunity rather than follow Index composition. We focus on owning high-quality financial companies with a compelling risk/return proposition. By being highly selective in our investment decision-making, the Funds’ portfolios differ from their primary benchmarks. For example, the Hennessy Small Cap Financial Fund has an 89% active share, and the Hennessy Large Cap Financial Fund has a 62% active share, as of 3/31/22.

3. Ability to invest in opportunity. As active fund managers, we can invest in companies that are not confined to banking. As such, we have owned financial-related companies including MasterCard, Visa, and PayPal. Over the past decade, these stocks have had periods of significant outperformance when banks and traditional financials have underperformed.

- In this article:

- Financials

- Large Cap Financial Fund

- Small Cap Financial Fund

You might also like

-

Portfolio Perspective

Portfolio Perspective

Large Cap Financial FundSmall Cap Financial FundSolid Industry Fundamentals & Continued Consolidation

David EllisonPortfolio Manager

David EllisonPortfolio Manager Ryan C. Kelley, CFAChief Investment Officer and Portfolio ManagerRead the Commentary

Ryan C. Kelley, CFAChief Investment Officer and Portfolio ManagerRead the CommentaryPortfolio Managers Dave Ellison and Ryan Kelley review 2025 bank performance, fintech-driven consolidation, attractive valuations, and their constructive 2026 outlook.

-

Portfolio Perspective

Portfolio Perspective

Large Cap Financial FundSmall Cap Financial FundSeeking Innovation in the Financials Industry

David EllisonPortfolio Manager

David EllisonPortfolio Manager Ryan C. Kelley, CFAChief Investment Officer and Portfolio ManagerRead the Commentary

Ryan C. Kelley, CFAChief Investment Officer and Portfolio ManagerRead the CommentaryPortfolio Managers Dave Ellison and Ryan Kelley discuss what’s driving performance in the Hennessy Large Cap Financial Fund, how tariff increases affect banks, the interest rate environment, and the opportunities in financials.

-

Viewpoint

ViewpointNavigating the Financial Landscape in 2025

David EllisonPortfolio ManagerWatch the Video

David EllisonPortfolio ManagerWatch the VideoHennessy Funds Portfolio Manager Dave Ellison discusses the key drivers behind the financial sector's strong performance in 2024, the impact of potential rate cuts and regulatory changes, and the evolving landscape of banking in 2025. He also explores the challenges and opportunities facing both large and small banks, the role of AI, and the critical risks to watch, from traditional credit concerns to transformative technological shifts.