Market Commentary and Fund Performance

Tad Fujimura of Tokyo-based SPARX Asset Management Co., Ltd., sub-advisor to the Hennessy Japan Small Cap Fund, shares his insights on the market and Fund performance.

-

Tadahiro Fujimura, CFA, CMAPortfolio Manager

Tadahiro Fujimura, CFA, CMAPortfolio Manager

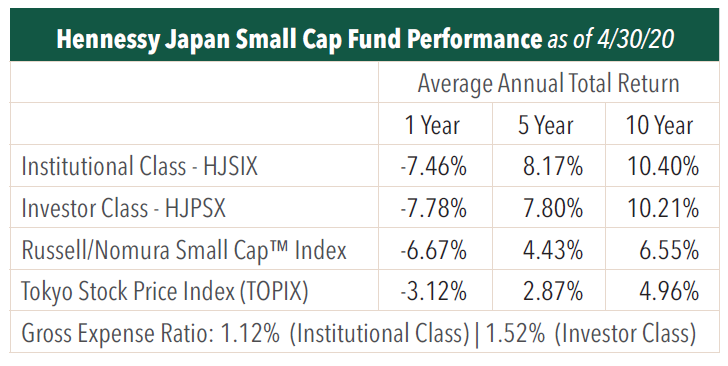

Fund Performance Review

In the first week of April, the Japanese stock market continued March’s downward trajectory, but it later rebounded after plummeting stock prices fueled discount buying. Market expectations about government policies worldwide and hope for a resolution of the pandemic also helped bolster this rebound. Emerging company equities significantly recovered in response to March’s performance, but the Tokyo Stock Exchange small-cap index performed at the same level as its large-cap index. As a result, the Tokyo Stock Price Index rose 5.33% month-over-month, while the benchmark for the Fund, the Russell/Nomura Small Cap™ Index, gained 6.63% over the same period. The Fund’s performance increased by 7.76%, outperforming its benchmark.

One of the best performers during this month was Benefit One Inc., an employee benefits, health check-up, and health guidance third-party administration service provider. Its share price climbed, likely as a rebound from its significant decline. Towa Corporation was another positive contributor to the Fund’s performance. The company manufactures production equipment for semiconductor post-processing steps, including sealing and cutting. Its share price rebounded due to the expected demand for 5G-oriented semiconductors. Nihon Flush Co., Ltd., a manufacturer of interior doors for condominiums, saw its share value grow due to the continuing trend of stronger regulations for furnished condos in China and the growth of the company’s customer base in the country. The market also expects the firm will see demand recover following the emerging recovery from the COVID-19 pandemic.

Meanwhile, stocks that contributed negatively to the Fund’s performance included office furniture and store fixture manufacturer Okamura Corporation. The firm’s share price fell due to a few concerns, namely the negative impact of corporations’ short-term cost cuts due to the worsening economy, the growing use of telecommuting as Japan’s state of emergency extends, and the slowing demand for offices and office furniture. Kawada Technologies, Inc. was another negative performer. This company is a civil engineering firm that works with steel girders, steel bridges, prestressed concrete, and systems construction. Its share price fell due to the announced work suspension meant to prevent the spread of the COVID-19 virus that mainly affected the firm’s general contractor clients. This spurred investor concerns that Kawada would suffer from the extended work suspension.

Outlook for May 2020

In April, the stock market recovered from its rapid decline, but the situation still does not warrant optimism. Many companies are postponing their earnings reports and not publishing their forecasts for the current fiscal year. At the same time, we expect future economic indicator announcements to deliver unprecedented low figures. For the time being, we anticipate cycles of highs and lows as the stock market adapts to the effects of government countermeasures, with little chance for a steady recovery. While the stock market has been on the rise due to hope that the pandemic would soon end, we believe uncertainty will continue, as the statistics showing the impact of COVID-19 become available and as governments extend their strategies to keep the virus under control.

Looking at corporate activity, we believe gaps are emerging depending on strategies corporations are taking in terms of cost-cutting in response to the pandemic and other emergency measures, the handling of financial structures, and approaches to restructuring business models. These gaps should lead to disparities in performance over the next several years. Therefore, while the current situation looks to be severe in the short term, it should provide favorable opportunities for investing in outstanding companies. Therefore, we intend to maintain our management strategy of screening investments with an even greater focus on the individual attributes of each company. With due attention to safety, we look to carefully select investments in corporations that can adequately respond to the emerging status quo and in companies that can grow their market share once the market has recovered.

- In this article:

- Japan

- Japan Small Cap Fund

You might also like

-

Portfolio Perspective

Portfolio Perspective

Japan Small Cap FundA Focus on Japanese Small-Caps Making Big Corporate Improvements

Takenari Okumura, CMAPortfolio Manager

Takenari Okumura, CMAPortfolio Manager Tadahiro Fujimura, CFA, CMAPortfolio ManagerRead the Commentary

Tadahiro Fujimura, CFA, CMAPortfolio ManagerRead the CommentaryThe Portfolio Managers discuss their view of the Japanese small-cap corporate landscape amid many shifting factors, including a new Prime Minister, finalized tariff situation, currency volatility, and attractive valuation environment.

-

Portfolio Perspective

Portfolio Perspective

Japan FundCompelling Japanese Opportunities Amid Attractive Valuations

Masakazu Takeda, CFA, CMAPortfolio Manager

Masakazu Takeda, CFA, CMAPortfolio Manager Angus Lee, CFAPortfolio ManagerRead the Commentary

Angus Lee, CFAPortfolio ManagerRead the CommentaryThe Hennessy Japan Fund Portfolio Managers highlight the effect of the new Prime Minister on the economy and market and how holdings were affected by the final trade agreement. They also discuss currency volatility, valuations, and the most compelling opportunities as we end 2025.

-

Investment Idea

Investment IdeaCompelling Valuations in Japan

Masakazu Takeda, CFA, CMAPortfolio Manager

Masakazu Takeda, CFA, CMAPortfolio Manager Angus Lee, CFAPortfolio Manager

Angus Lee, CFAPortfolio Manager Tadahiro Fujimura, CFA, CMAPortfolio Manager

Tadahiro Fujimura, CFA, CMAPortfolio Manager Takenari Okumura, CMAPortfolio ManagerRead the Investment Idea

Takenari Okumura, CMAPortfolio ManagerRead the Investment IdeaJapanese equities are currently trading at compelling valuation levels compared to other developed equity markets around the world and relative to their own historical averages. We believe the Japanese market deserves a closer look.