Mitsubishi Corporation

As a global conglomerate that operates businesses in various industries, Mitsubishi Corporation is Japan’s largest “sogo shosha,” uniquely Japanese trading companies.

-

Masakazu Takeda, CFA, CMAPortfolio Manager

Masakazu Takeda, CFA, CMAPortfolio Manager

In 2020, Berkshire Hathaway purchased 5% stakes in five Japanese trading companies, including Mitsubishi, causing a flurry of optimism around the Japanese equity market. In May 2023, Berkshire increased its investment in these stocks and now owns 7.4% each of Mitsubishi Corp, Mitsui & Co., Itochu Corp, Marubeni Corp, and Sumitomo Corp.

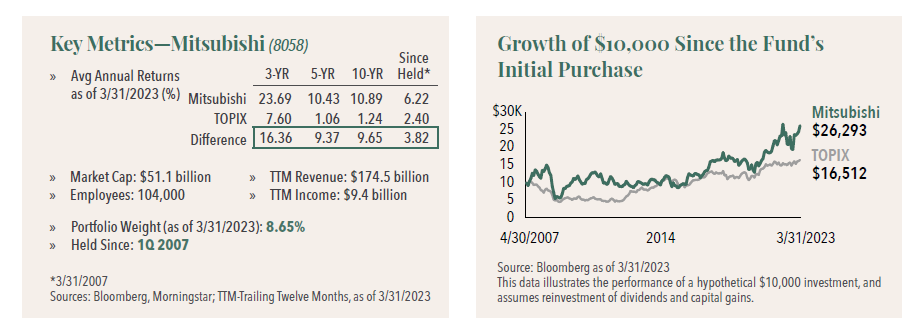

With a focus on globally oriented Japanese companies, Hennessy Japan Fund Portfolio Manager Masakazu Takeda has owned Mitsubishi since 2007 and understands that traditional metrics do not work when evaluating the company given its unique mix of assets. Because Japan remains a mystery for many U.S. investors, active investment management with “feet-on-the-street” in Japan can uncover hidden opportunities often missed by others.

A Global Company with a Long History

Mitsubishi is the largest “sogo shosha,” a collection of trading companies dating back to World War II. With Japan lacking natural resources, sogo shosha were created to help Japanese businesses procure resources from overseas, aid exporters, and recover from the devastation of the war. In the 1980s and 1990s, these companies expanded from commission-based trading businesses to make investments in extremely diverse operating assets across many industries and around the globe.

Mitsubishi was originally a steamship company and currently, the firm’s balance sheet represents a unique collection of operating businesses, assets, and securities with a wide variety of geographical exposure and industries not easily accessible through other means of investments. These investment opportunities are identified by an extensive global network with a long operational history.

Mitsubishi’s assets range globally from energy/commodity projects in Australia, a truck assembly supply chain business in Southeast Asia, electric power plant development/power generation business in Europe and the U.S., and convenience store operation in Japan.

Diversified Business Mix Across the Globe

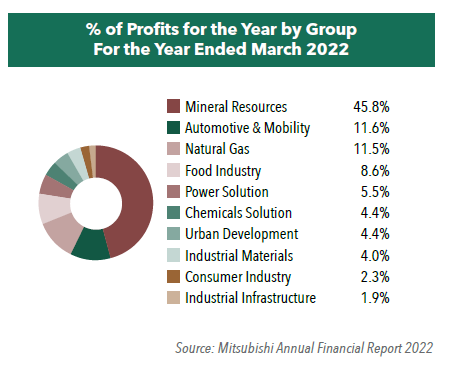

Mitsubishi has a global network of around 1,700 businesses in almost every industry. The current industry groups include:

Natural Gas - Mitsubishi’s energy business focuses on achieving carbon neutrality while continuing to supply reliable energy. Its LNG facilities are located in multiple regions throughout the world, including North America, Southeast Asia, and Australia.

Industrial Materials develops solutions for electric vehicles (EVs), works to enhance its silica sand business that provides the raw materials used for solar power generation panels, and engages in carbon capture and utilization (CCU) initiatives in construction and infrastructure.

Chemicals Solution is involved in the manufacturing and trade of a wide variety of materials, such as petrochemicals, salt and methanol.

Mineral Resources is engaged in trading, business development and investment for a variety of mineral resources and metals including metallurgical coal, iron ore, copper, and aluminum.

Industrial Infrastructure includes a diverse scope of operations in the fields of infrastructure, marine vessels, aerospace, and industrial machinery.

Automotive & Mobility has developed a global value chain that spans the production, sales, distribution, financing, and after-sales services of passenger and commercial vehicles, focused on the ASEAN region.

Food Industry produces and sources raw materials as well as manufactures food resources, fresh foods, consumer products, food ingredients and other products.

Consumer Industry focuses on optimizing supply chains and connecting producers and consumers in sectors such as retail, apparel, healthcare, food distribution, and logistics.

Power Solution includes water businesses to meet diversifying utility needs. Some of its main initiatives include a renewable energy business, the construction of distributed power generation infrastructure, and power trading businesses.

Urban Development develops and manages real estate development projects including logistics facilities, commercial facilities, and residential properties, as well as infrastructure projects including data centers and airports. It also offers financial services such as asset financing.

Addressing Societal Challenges

Mitsubishi has recognized the importance of adapting to changes in the global environment and society. As such, the company aims to create value by addressing key sustainability issues through business activities across numerous industrial sectors. A few of these initiatives include:

• An Industry Digital Transformation (DX) Group. This area deploys Mitsubishi’s capabilities across business operations to add value through DX initiatives and addresses societal challenges by implementing digital technologies.

• The Next-Generation Energy Business Group is responsible for discovering and developing low-carbon/carbon-free technologies and building supply chains for next-generation energy to promote Energy Transformation (EX) initiatives.

Our Independent Research and Key Insights

Mitsubishi has also long been labeled as a value stock, with a price to earnings (P/E) in the single digits and a price to book (P/B) ratio below 1x, but we consider these trading companies to be investment business companies with a worldwide human network. Its balance sheets have a portfolio of business assets that is unique in the world.

We believe the accumulation of these assets will lead to an increase in the intrinsic value of Mitsubishi Corporation, which in turn will be reflected in the growth of their net asset value per share. For example, over the past 5, 10, 15, and 20 years, the company’s net asset value per share has achieved an annualized growth ranging from low single digits to around 10%. Therefore, we view Mitsubishi Corporation as an undervalued growth stock, rather than a value stock with no growth potential.

In terms of the income statement, as the company operates globally in a broad spectrum of industries, it is important to understand that there are profit items that bypass net income but are only reflected in OCI (Other Comprehensive Income) such as “Share of other comprehensive income of investments accounted for using the equity method”, “Gains on other investments designated as FVTOCI (fair value through other comprehensive income)” and “Exchange differences on translating foreign operations.”

These items tend to be overlooked by investors but for an investment house like Mitsubishi, they are just as important in our opinion. For instance, if management chooses to exit from an investment in its consolidated overseas entity, the cumulative unrealized currency gains on the foreign assets will be materialized as real gains.

For fiscal year 2022 ended in March this year, the company reported consolidated net income of 1,271billion yen ($9 billion) and other comprehensive income (OCI) of 507bn yen ($3.6bn) for a total comprehensive income of 1,779bn yen ($12.6bn). As you can see, OCI is about 40% the size of net income accounting for 28% of total comprehensive, which contributes to large increases in shareholders’ equity. This is why we don’t evaluate the business using conventional return on equity but rather use per-share growth rate of book value per share as a proxy for changes in the intrinsic value.

Investment Summary

The unique strength of Mitsubishi and other trading houses, or so-called “sogo shosha,” is that they boast tens of thousands of staff spread all over the world to identify potential investment needs and oversee business activities. It is difficult to find comparable peers with such scale elsewhere in the world. With a P/E of 5.9x, a price to book of 0.84x, and a dividend yield of almost 4% as of May 2023, we believe the stock is an attractive investment.

- In this article:

- Japan

- Japan Fund

You might also like

-

Portfolio Perspective

Portfolio Perspective

Japan Small Cap FundJapanese Small-Caps’ Earnings Resilience and Improving Returns on Capital

Takenari Okumura, CMAPortfolio Manager

Takenari Okumura, CMAPortfolio Manager Tadahiro Fujimura, CFA, CMAPortfolio ManagerRead the Commentary

Tadahiro Fujimura, CFA, CMAPortfolio ManagerRead the CommentaryIn the following commentary, the Portfolio Managers cover small-cap outperformance drivers, pro-growth fiscal policy, governance reform, yen volatility, portfolio repositioning, profitability and capital efficiency trends, valuation gaps, and their 2026 outlook.

-

Portfolio Perspective

Portfolio Perspective

Japan FundA Differentiated Portfolio Focused on Margin of Safety and Upside Potential

Masakazu Takeda, CFA, CMAPortfolio Manager

Masakazu Takeda, CFA, CMAPortfolio Manager Angus Lee, CFAPortfolio ManagerRead the Commentary

Angus Lee, CFAPortfolio ManagerRead the CommentaryThe Portfolio Managers summarize the significant events that drove markets over 2025 and how the Fund remains focused on quality, capital discipline, and valuation, with a clear preference for stock picking over index exposure.

-

Investment Idea

Investment IdeaCompelling Valuations in Japan

Masakazu Takeda, CFA, CMAPortfolio Manager

Masakazu Takeda, CFA, CMAPortfolio Manager Angus Lee, CFAPortfolio Manager

Angus Lee, CFAPortfolio Manager Tadahiro Fujimura, CFA, CMAPortfolio Manager

Tadahiro Fujimura, CFA, CMAPortfolio Manager Takenari Okumura, CMAPortfolio ManagerRead the Investment Idea

Takenari Okumura, CMAPortfolio ManagerRead the Investment IdeaJapanese equities are currently trading at compelling valuation levels compared to other developed equity markets around the world and relative to their own historical averages. We believe the Japanese market deserves a closer look.