Japan Fund Spotlight: HOYA Corporation

HOYA is a leading supplier of innovative high-tech and medical products whose diverse business profiles include eyeglasses, medical endoscopes, intraocular lenses, optical lenses as well as key components for semiconductor devices, liquid-crystal display (LCD) panels and hard disk drives (HDDs).

-

Masakazu Takeda, CFA, CMAPortfolio Manager

Masakazu Takeda, CFA, CMAPortfolio Manager

A Global Med-Tech Leader

Founded in 1941 in Tokyo, HOYA is a global med-tech company and optical component maker with two primary business segments:

1. An Information Technology (IT) segment that comprises nearly 40% of revenue. This segment produces mask blanks, a key component for making semiconductors. They are the master plates used to transfer the highly complex circuit patterns for semiconductors onto wafers. This segment also produces HDD glass substrates, which are used for storage in data center servers. It has a dominant market share in each of these industries.

2. The Life Care segment comprises over 60% of revenue and makes glass lenses, contact lenses, intraocular lenses, and endoscopes. HOYA has a strong presence as a leading player globally with approximately 20% market share for glass lenses and contact lenses. Eyeglass lens products account for over 50% of Life Care business sales and are a growth driver for its Life Care business.

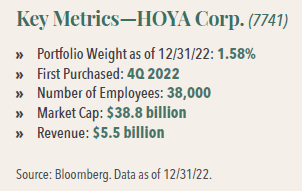

HOYA has more than 38,000 employees in 30 countries around the world. The company was established in 1941 as an optical glass production plant in the city of HOYA, Tokyo.

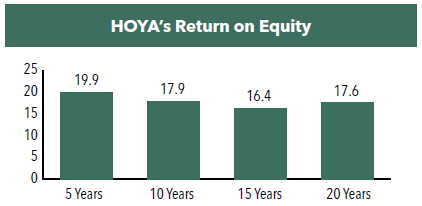

What makes this company stand out is that its return on equity has been among the highest in Japan, recording on average 19.9%, 17.9%, 16.4%, and 17.6% for the last 5, 10, 15, and 20 years, respectively, which was achieved on a balance sheet with oversized shareholders’ equity (70-80% of total assets). In terms of return on capital employed (ROCE), HOYA has recorded a 5-year average of 23.5% and its operating profit margins were approximately 30% as of December 31, 2022.

HOYA’s business and operating strengths include the following:

1. Dominant market share. For example, its extreme ultraviolet (EUV) mask blanks business has roughly 70% of global market share and its HDD glass substrates business possesses a 100%market share. The market sizes of these products are estimated to be roughly $730 million to $1.1 billion, which is much smaller as compared to the broader semiconductor industry, which totals hundreds of billions of dollars. However, the company has a distinct business philosophy of being “a big fish in a small pond,” and identifies niche markets where high barriers to entry can be built by an early mover.

2. A lean manufacturing system for high production efficiency. The company’s historical cash flow statements reveal that annual capital expenditures (capex) consistently run below its depreciation cost. From 2008 through 2022, its tangible fixed assets have increased only marginally from $1.1 billion to$1.2 billion. Yet, HOYA’s top line has grown from $3.5 billion to $4.8 billion, a 40% increase during the period. This implies HOYA has the ability to maximize revenue with a minimal amount of capital invested in production facilities. In addition, HOYA enjoys strong pricing power.

According to the company, management makes it a point to base its capex decisions strictly on the near-term demand projection generally out 2 to 3 years with high visibility of revenue booking. This leads to very little, if any, risk of order cancellations and being left with idle capacity. Instead, the company incrementally adds new capacity accordingly as needed. As such, factory utilization rate continuously averages 80%.

3. Rational capital allocation. HOYA constantly rejuvenates its product portfolio by exiting obsolete businesses and adding products it believes it can leverage its core competence of optical glass technology. The company began as a crystal dining ware manufacturer as its original business line in 1941. In the 1960s, it made the decision to enter glass lens manufacturing, in the 1970s contact lenses and mask blanks (for semiconductors), intraocular lenses in the 1980s, HDD glass substrates in the 1990s, and so on. In some cases, HOYA entered a new field through acquisitions such as endoscopes when the company purchased Pentax in 2007 via a tender offer bid.

Management also exits businesses that have become obsolete where long-term prospects are unattractive. In 2009, HOYA severed ties with the crystal ware business, in 2010, it exited the glass media business (today HOYA focuses on glass substrates only), and in 2011, HOYA sold the digital camera business that came with the Pentax acquisition.

Increasing Shareholding Value

We believe the company does an excellent job of utilizing excess cash generated from its businesses to increase shareholder value via share buybacks. This has the effect of keeping shareholders’ equity from growing beyond an adequate level. For instance, when shareholders’ equity as a share of total assets rose from 57% in 2008 to 81% in 2015 thanks to improved profitability post the 2008 financial crisis, management commenced share buyback programs to keep the equity ratio steady and not dilute return on equity (ROE).

Perhaps, by conventional standards, an 80% equity ratio is more than it needs relative to the inherent risks associated with its business units, but it should be commendable that management has been demonstrating its willingness to address concerns around ROE deterioration. Since initiating share buybacks, per share earnings growth has been outpacing the growth rate of its aggregate net profit by slightly over 1% owing to constant cancellations of purchased shares. It might seem trivial but can add up to a meaningful difference due to the compounding effect over time.

Corporate Board Structure

HOYA is a textbook case for best practice of corporate board structure. It appointed its first independent director in 1995, long before Japan came to embrace corporate governance reforms. Furthermore, in the early 2000s, it amended its articles of incorporation to state that half of the board members be independent directors. Clear division of management and ownership has been the norm for HOYA for a long time. Today, HOYA serves as a role model for best practice in corporate governance and its business track record is a testament to this.

Global Aging Population and Improved Living Standards Could Drive Life Care Business Growth

HOYA’s Life Care business is anticipated to grow with the increasing global aging population and improved living standards in emerging countries. As the global population ages, more people will be affected by the normal deterioration of vision as they age. This trend is expected to boost demand for eyeglasses.

Also, as the purchasing power of people in middle-income populations increases, more people will be able to afford eyeglasses or receive medical treatment. Additionally, it is anticipated that more people will need glasses due to vision impairment caused by the increased use of computers and smartphones for hours on end.

Along with an aging population, worldwide medical expenses are rising. Many governments are promoting disease prevention and early detection of diseases, as well as minimally invasive medical treatments. Medical flexible endoscopes allow physicians to diagnose and treat the patient in a less-invasive way.

Investment Summary

Return on equity as a measure of a business attractiveness can be misleading at times as it can be artificially boosted by increasing leverage on the balance sheet. However, there are companies who produce higher ROEs despite a significant amount of shareholders’ equity on the balance sheet. These companies also generate strong return on capital employed. HOYA Corporation is an example of a high-quality, globally oriented business that fits this description.

- In this article:

- Japan

- Japan Fund

You might also like

-

Portfolio Perspective

Portfolio Perspective

Japan Small Cap FundJapanese Small-Caps’ Earnings Resilience and Improving Returns on Capital

Takenari Okumura, CMAPortfolio Manager

Takenari Okumura, CMAPortfolio Manager Tadahiro Fujimura, CFA, CMAPortfolio ManagerRead the Commentary

Tadahiro Fujimura, CFA, CMAPortfolio ManagerRead the CommentaryIn the following commentary, the Portfolio Managers cover small-cap outperformance drivers, pro-growth fiscal policy, governance reform, yen volatility, portfolio repositioning, profitability and capital efficiency trends, valuation gaps, and their 2026 outlook.

-

Portfolio Perspective

Portfolio Perspective

Japan FundA Differentiated Portfolio Focused on Margin of Safety and Upside Potential

Masakazu Takeda, CFA, CMAPortfolio Manager

Masakazu Takeda, CFA, CMAPortfolio Manager Angus Lee, CFAPortfolio ManagerRead the Commentary

Angus Lee, CFAPortfolio ManagerRead the CommentaryThe Portfolio Managers summarize the significant events that drove markets over 2025 and how the Fund remains focused on quality, capital discipline, and valuation, with a clear preference for stock picking over index exposure.

-

Investment Idea

Investment IdeaCompelling Valuations in Japan

Masakazu Takeda, CFA, CMAPortfolio Manager

Masakazu Takeda, CFA, CMAPortfolio Manager Angus Lee, CFAPortfolio Manager

Angus Lee, CFAPortfolio Manager Tadahiro Fujimura, CFA, CMAPortfolio Manager

Tadahiro Fujimura, CFA, CMAPortfolio Manager Takenari Okumura, CMAPortfolio ManagerRead the Investment Idea

Takenari Okumura, CMAPortfolio ManagerRead the Investment IdeaJapanese equities are currently trading at compelling valuation levels compared to other developed equity markets around the world and relative to their own historical averages. We believe the Japanese market deserves a closer look.