Portfolio Drivers: Energy, Consumer Discretionary and "Keepers"

Cornerstone Mid Cap 30 Fund Portfolio Managers Ryan Kelley and Josh Wein review the Fund’s investment strategy, discuss the most recent rebalance, and highlight a few fundamental drivers of the portfolio.

-

Neil J. HennessyChief Market Strategist and Portfolio Manager

Neil J. HennessyChief Market Strategist and Portfolio Manager -

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager -

L. Joshua Wein, CAIAPortfolio Manager

L. Joshua Wein, CAIAPortfolio Manager

What is the Fund’s investment strategy?

The Cornerstone Mid Cap 30 Fund utilizes a formula to select 30 domestic, mid-cap stocks with market capitalizations between $1 and $10 billion that exhibit both value and momentum characteristics. The formula selects stocks with higher year-over-year earnings, positive stock price appreciation, and lower price-to-sales ratios. The universe of mid-cap stocks is screened using these criteria, and the portfolio is rebalanced annually, generally in the fall. Each stock is equally weighted at approximately 3.3% of the portfolio at the onset of the rebalance, although stock price movements can cause relative weights to change over time.

Would you please discuss the composition of the Fund?

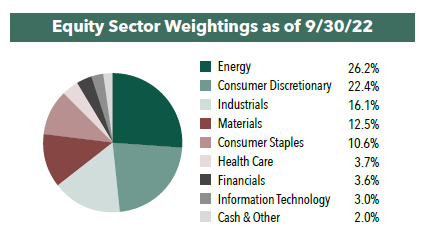

Following the most recent annual rebalance in September 2022, the Fund’s holdings include stocks representing eight of the 11 GICS sectors; there are no holdings in the Communication Services, Real Estate, or Utilities sectors. The largest sector exposure is Energy with eight holdings, and the second largest is Consumer Discretionary with seven holdings. For the first time in many years, we saw nearly a third (nine out of 30) of the Fund’s holdings remain from last year’s portfolio: stocks which we refer to as “keepers.” Finally, while the Fund overall remains highly concentrated in merely 30 stocks, we view this year’s portfolio as one of the more diversified given that it has representation in eight of the 11 GICS sectors.

Compared to the Russell Midcap® Index, Energy is the most significantly overweight sector. With persistently high energy prices, significantly strong cash flows, and continued global geopolitical disruptions, we believe many of the Fund’s investments in the Energy sector could continue to perform well. Additionally, the Fund has a substantial overweight position in consumer-related stocks, both Consumer Discretionary and Consumer Staples. While inflation and rising rates remain a concern, we believe a robust job market and a healthy consumer could continue to drive spending, which in turn may drive higher growth in earnings and positive stock price performance for many of the Fund’s consumer-related holdings.

Is there a common investment theme in the current portfolio?

With over one quarter of the portfolio comprised of Energy stocks, we believe the primary driver of relative performance this year could be Energy. The Fund has holdings up and down the supply chain, including exploration and production companies, pipeline companies, and refineries, with exposure to petroleum, natural gas, ethanol, coal, and other sources of energy. The surge in energy prices have benefited many energy companies, a trend which we believe should continue into 2023 as growth in production should continue to lag increasing demand as worldwide supply constraints persist.

This year, there were nine “keepers” in the portfolio, a substantial increase from an average over the past five years of less than three. Three were Energy stocks, three were Consumer Discretionary, and the rest were one each of Consumer Staples, Materials, and Industrials. Given that our process focuses on valuation and momentum, we believe this indicates a certain amount of consistency of investment drivers over the past year. Additionally, the “keepers” as a whole outperformed the rest of the portfolio since last year’s rebalance, and much of the Fund’s outperformance compared to the broader market can be attributed to these nine companies.

What is the median market capitalization of the Fund’s holdings following the most recent rebalance?

The Fund selects its holdings from a universe of mid-cap stocks with market capitalizations ranging from $1 billion to $10 billion. As of September 30, 2022, the median market cap of the Fund was $3.9 billion, down from last year’s $5.4 billion at the end of the rebalance in 2021 and less than half the median market cap of the Russell® Midcap Index. We believe mid-cap stocks offer untapped potential and that investors may be surprised to learn that mid-cap stocks have outperformed both small- and large-cap stocks over the past twenty-year period with less risk than small-cap stocks.

Would you please discuss the relative valuation of the Fund’s holdings compared with the benchmark?

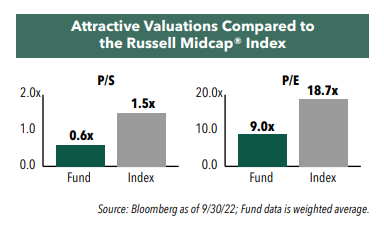

Attractive valuation is an important criterion in the Fund’s stock selection process. The Fund uses price-to-sales as its primary valuation metric because it is a simple metric, can be universally applied, and is difficult for companies to manipulate. The Fund selects stocks with price-to-sales ratios below 1.5x. The weighted average price-to-sales ratio of the portfolio was just 0.6x as of September 30, 2022, compared to 1.5x for its benchmark index, the Russell® Midcap Index.

The Fund’s holdings are also trading at a significant discount in terms of price-to-earnings. The Fund’s weighted average price-to-earnings ratio was 9.0x as of September 30, 2022, versus 18.7x for its benchmark index.

- In this article:

- Domestic Equity

- Cornerstone Mid Cap 30 Fund

You might also like

-

Portfolio Perspective

Portfolio Perspective

Focus FundSeeking Companies with Strong Growth at Attractive Valuations

David Rainey, CFACo-Portfolio Manager

David Rainey, CFACo-Portfolio Manager Ira Rothberg, CFACo-Portfolio Manager

Ira Rothberg, CFACo-Portfolio Manager Brian Macauley, CFACo-Portfolio ManagerRead the Commentary

Brian Macauley, CFACo-Portfolio ManagerRead the CommentaryThe Portfolio Managers rely on their strategy of owning durable, well-run businesses capable of turning adversity into opportunity and adapting to macroeconomic surprises. The following Hennessy Focus Fund Commentary recaps the 2025 market and highlights areas of opportunity ahead.

-

Portfolio Perspective

Portfolio Perspective

Focus FundFrom Rate Cuts to AI: Positioning the Portfolio for Potential Opportunity

David Rainey, CFACo-Portfolio Manager

David Rainey, CFACo-Portfolio Manager Ira Rothberg, CFACo-Portfolio Manager

Ira Rothberg, CFACo-Portfolio Manager Brian Macauley, CFACo-Portfolio ManagerRead the Commentary

Brian Macauley, CFACo-Portfolio ManagerRead the CommentaryThe Portfolio Managers discuss holdings that could potentially benefit from lower rates, tariffs, and artificial intelligence (AI). The team also provides an update on AST SpaceMobile and discusses potential opportunities in select Technology and Health Care companies.

-

Company Spotlight

Company Spotlight

Focus FundO’Reilly Automotive—Revved for Growth

David Rainey, CFACo-Portfolio Manager

David Rainey, CFACo-Portfolio Manager Ira Rothberg, CFACo-Portfolio Manager

Ira Rothberg, CFACo-Portfolio Manager Brian Macauley, CFACo-Portfolio ManagerRead the Spotlight

Brian Macauley, CFACo-Portfolio ManagerRead the SpotlightO’Reilly Automotive is a leader in the automotive aftermarket parts industry in the U.S. The company’s scale, unique distribution infrastructure, and customer service-oriented culture should allow it to take market share in a fragmented U.S. market for years to come.