AST SpaceMobile: Transforming How the World Connects

AST is building the first and only space-based cellular broadband network accessible directly by everyday smartphones with both commercial and government applications.1 With strategic investments from leading technology players such as AT&T, Verizon, Vodafone and Google, AST has the bold goal to provide uninterrupted broadband connectivity, everywhere.

-

David Rainey, CFACo-Portfolio Manager

David Rainey, CFACo-Portfolio Manager -

Brian Macauley, CFACo-Portfolio Manager

Brian Macauley, CFACo-Portfolio Manager -

Ira Rothberg, CFACo-Portfolio Manager

Ira Rothberg, CFACo-Portfolio Manager

Eliminating Connectivity Gaps in Broadband

AST’s vision is to provide mobile broadband wireless coverage to existing cell phones in partnership with today’s global, mobile network operators (MNOs). Supplemental coverage from space through AST’s satellites would be a breakthrough for the wireless and satellite industries, allowing satellite delivered mobile wireless service to expand beyond niche applications we see today to broad consumer adoption.

Addressable Market

Even in 2025, billions of people around the world have no or limited mobile internet access. Among a global population of 8.2 billion, 5.8 billion unique cellular subscribers move in and out of basic and broadband wireless coverage daily, while more than 3.4 billion people are unable to access cellular broadband. Of these, 3 billion have a usage gap and 400 million have no cell coverage.

In fact, ~90% of the Earth’s surface has no cell coverage whatsoever.2 Even in covered areas, there are millions of dead zones and grey zones in existing terrestrial networks. AST plans to eliminate these gaps by providing an overlay or supplemental broadband service that mobile subscribers can opt into through their MNO’s domestic service plans—resulting in broadband coverage for the unconnected billions.

AST’s Vision and Growing List of Partners

AST plans to eliminate connectivity gaps by launching a constellation of 248 satellites into low earth orbit— between 320-450 miles above the earth—over the next five years. Seven years in development, these BlueBird satellites use a novel design, internally developed software and custom hardware that is then spliced into the wireless operators’ “core” network through a partnership with Nokia. This technique allows the cell phone to see a virtual cell tower broadcasting on the carriers’ existing terrestrial spectrum.

A Growing List of Wireless Carrier Partners

AST plans to provide broadband voice, data, and video service on a wholesale basis to MNOs. In exchange for a 50/50 revenue split, the MNOs promote the service to their subscribers, manage billing, customer service, and network integration and benefit from incremental revenue and a more reliable network to reduce customer churn.

Currently AST has preliminary agreements and/ or memorandums of understanding with more than 50 mobile network operators with over 3.0 billion unique subscribers. AST also has strategic commitments and/or investments from AT&T, Google, Verizon, and Vodafone.

AT&T is the first MNO to complete a definitive commercial agreement with AST and several additional operators are expected to sign on in the coming months.3

Additionally, AST’s strategic partnership with Verizon includes a $100 million combined commitment. The emergence of Verizon as a partner in 2024 effectively doubled the addressable market for AST in the U.S.—the most lucrative wireless market in the world—while advancing AST’s capital plan. Further, it is a major endorsement of AST’s technology, given Verizon had historically been a vocal skeptic of AST’s capabilities.

AST extended its partnership with Vodafone for another ten years and entered into a joint venture (JV) with Vodafone in Europe to create a “jointlyowned European satellite service business to serve MNOs in European markets.” This JV preserves AST’s economics, solves for European sovereignty issues, and could lead to additional midband spectrum opportunities.

Government Opportunity

AST has an opportunity to provide services to the military, intelligence agencies, and first responders. While the U.S. opportunity is the largest, there is significant potential with other nations as well.

U.S. Department of Defense (DOD) – Communications Services

The most obvious use case for AST is enabling secure voice, video, and data communications to military personnel on nearly every square mile of the planet. To this end, a June 2025 demonstration in Hawaii with AST and its partner, Fairwinds Technologies, showcased key defense-related use cases for USINDOPACOM forces (including representation from the U.S. Navy, Marine Corps, Army, and Space Command), including real-time connectivity to the Tactical Assault Kit (TAK) over a VPN, multimedia streaming via TAK, and secure multi-party video calls, all executed on standard, unmodified smartphones.

These use cases are closely related to AST’s commercial services, so this demonstration provides additional evidence of the core technology working well in a real-world setting.

U.S. Department of Defense (DOD) – Non-Communications Services

The new Trump administration, recognizing that we are inadequately prepared to defend ourselves against novel weapon systems such as drones, hypersonic missiles, and advanced ICBMs, has accelerated modernization efforts across the U.S. military. Obsolete programs are being discontinued, and resources are being poured into capabilities to counter these new threats. Central to this effort is advancing U.S. capabilities in space, headlined by the Golden Dome program.

Legacy missile defense systems—often composed of ground radar, GEO satellites, and terrestrial interceptor batteries—are designed to neutralize traditional short- and long-range missiles. The trajectory of these missiles is predictable from shortly after launch, making them relatively easy to intercept. We saw an example of this in June, when Israel’s Iron Dome intercepted 80-90% of the more than 500 ballistic missiles fired at it by Iran.

However, newer long-range missiles, such as hypersonic and advanced ICBMs, can change trajectory during travel, and sometimes include decoys and multiple warheads made to fool existing missile defense systems. This makes these missiles much more challenging to neutralize. The U.S. and its allies are vulnerable to these advanced weapons and need a faster, more accurate, and more distributed missile defense system in response.

The unprecedented size and power of AST’s LEO satellites makes them especially well-suited to assist in tracking modern missiles, along with a variety of other high value functions. Research reveals excellent effective isotropic radiated power (output power of a signal when it is concentrated into a smaller area by the antenna) and gain-to-noise temperature (how well the system can detect weak signals amidst noise), enabling a variety of novel capabilities. Possible DOD uses include:

• Radar – Supporting high-value military radar applications such as synthetic aperture radar (high-resolution imaging using radar signal reflections), ground-moving target indication, and missile tracking.

• Assured and Alternative PNT (Position, Navigation, and Timing) – Providing a stronger, jam-resistant signal compared to existing GPS, improving indoor reception and cybersecurity through authentication and encryption.

• Blue Force Tracking (BFT) & Identify Friend or Foe (IFF) – Improving situational awareness of troop and asset locations, reducing friendly fire incidents.

• UAS/drone control – Enabling remote control of unmanned aerial systems (UAS) in areas lacking terrestrial infrastructure.

• Signal Intelligence – Detecting and reading electromagnetic emissions of the enemy.

• Signal Jamming – Jamming enemy signals over large geographical areas, such as maritime zones and remote areas, where terrestrial jammers are impractical.

Growing Momentum with the U.S. DOD

While early, the DOD opportunity is beginning to take shape. We know that AST now has at least six U.S. defense contracts and we believe that there are multiple classified applications running on AST’s satellites today. The evidence is mounting that AST is going to play an important role in national security. Consider:

• On April 23, during a visit to AST’s Texas manufacturing facility, FCC Chairman Brendan Carr and Senator Ted Cruz highlighted the national security benefits from the company’s technology, with Carr stating “Importantly, it’s going to help us secure our national defense, including by making sure we stay ahead of China.”

• On June 6, AST’s CFO, Andy Johnson, commented at AST’s annual meeting that the company is positioned to be a “very important contributor… to the U.S.’s Golden Dome program” while noting that the services it already provides to the government have overlap with the capabilities Golden Dome seeks to achieve.

• Meeting minutes from the June 26 Miami-Dade County Board meeting revealed AST’s plans for a $25-$30 million manufacturing facility on the highly secure Homestead Air Force Base to increase production and “establish (a) satellite operations center and gateways for government projects.”

• President Trump has set an aggressive threeyear timeline to complete Golden Dome. AST’s announced launch cadence aligns well with this timeline. Our most recent tour of AST’s Midland, Texas facility in early July demonstrated that satellite production is ramping nicely, and the company is on a path to meet the pace needed to fulfill the launch schedule.

• And there have been multiple successful field tests with the DOD, with more testing to come.

Funding & Revenue Potential

Initial Golden Dome funding of $25 billion was secured with the July 4 signing of the Big Beautiful Bill. This should be a watershed event for the space defense industry, with spending ramping quickly. We estimate the DOD will spend $14.5 billion on satellites and related services in 2025. Golden Dome and new funding for the Proliferated Low Earth Orbit (PLEO) Satellite-Based Services program are forecast to more than double this spending—to $34 to $37 billion—over the next three years.

AST is positioned to be a major beneficiary with its LEO satellites. We think AST’s unique technology will enable a number of Golden Dome capabilities, and we know the company is one of twenty approved vendors eligible to compete for task orders under the PLEO contract. In addition, we think several of AST’s current defense contracts are likely to develop into “programs of record,” each with multi-hundredmillion dollars of annual revenue. We believe AST will generate $1.0 to $2.5 billion of annual DOD revenue (mostly from recurring services) in the intermediate term. While these are large numbers, they equate to just a mid-single-digit share of DOD satellite spending.

First Responder Opportunity

AST is also poised to enable supplemental coverage for U.S. first responders (law enforcement, fire/rescue, EMS, emergency management) who require full geographic coverage and 100% uptime, including during natural disasters, in order to provide missioncritical services.

AST is already partnered with both AT&T and Verizon. AT&T, through FirstNet, and Verizon, through Frontline, provide communications solutions to more than 12 million first responders. FirstNet officials have confirmed they are in the “final stages” of investing in AST’s direct-to-device technology. We expect high adoption rates of AST’s service from both FirstNet and Frontline users.

If we assume pricing of $20 per user per month (a premium compared to regular commercial pricing, reflecting enhanced features for first responders such as push-to-talk and priority/preemption), a ramp to a 50% adoption rate, and a 50% revenue share with AT&T and Verizon, U.S. first responders would generate $720 million in annual revenue for AST in the intermediate term.

International Opportunity

We believe that most developed nations will want defense and emergency services capabilities similar to the U.S. For example, we understand that NATO’s future SATCOM program is actively exploring using AST for 5G direct-to-device service. And Vodafone, AST’s joint venture partner in Europe, offers mission critical emergency services to first responders. They plan to add direct-to-device mobile broadband satellite services to this offering when it is available.

To estimate AST’s non-U.S. defense opportunity, we begin with our U.S. DOD revenue estimate of $1.0 to $2.5 billion per annum. We haircut this by half to reflect smaller NATO and non-NATO allied nation defense budgets (cumulatively $0.5 trillion vs. $1.0 trillion at DOD), and adjust further because these nations will likely spend a lower percentage of their budgets on satellite capabilities, leveraging the U.S. Golden Dome where permitted. In total, we estimate that AST will generate $300 to $750 million in annual revenue from non-U.S. defense spending in the intermediate term.

To estimate AST’s non-U.S. first responder opportunity, we begin with our U.S. first responder revenue estimate of $720 million per annum. We adjust our U.S. number to account for differences in population and GDP (across all developed nations, ex-China) and further adjust for the likelihood that AST will have lower first responder market share internationally. In total, we estimate that AST will generate $400 million in annual revenue from non-U.S. first responders in the intermediate term.

Total Military, Intelligence, and First Responder Opportunity

In total, as itemized on the previous page, we expect AST will generate $2.4 to $4.4 billion in annual revenue from worldwide military and first responder opportunities in the intermediate term.

Beyond this, the U.S. National Intelligence Program has a budget of about $80 billion (vs. about $1 trillion at the DOD), which we do not specifically account for in this exercise. That said, it seems clear that many of the capabilities that AST is potentially providing to the DOD would also be valuable to intelligence agencies both here and abroad.

The Successful Launch of BlueBird 1-5 Satellites

In September 2024, AST launched its first five commercial BlueBird satellites into space atop a SpaceX Falcon 9 rocket. In October 2024, the company announced that it had successfully unfolded all BlueBirds from the compressed form and in November, the satellites were ready to become operational. This is a significant accomplishment as these satellites are the largest commercial communications arrays ever launched in low Earth orbit (each satellite measures about 700 square feet).4

While these five satellites will provide coverage for less than one hour per day, this is sufficient for some revenue generating government and commercial services. Further, these five begin the march toward the 45 to 60 satellites needed to provide continuous coverage of the continental United States, Europe, and Japan (and other key developed markets) at which point it is expected that AST will be able to offer a compelling value proposition for the consumer mass market.

The company targets continuous commercial service in the United States in late 2026. To achieve this ambitious goal, the company will need to build and launch another 40 to 55 satellites over the next 18 or so months. AST produces its satellites in two locations in Midland, Texas with a combined 185,000 square feet. The company appears to have the capability to produce two satellites per month now (24 per year), and has plans to ramp to six satellites per month by the end of 2025 or 72 per year.

Excellent Management

Supporting our view, we believe that AST founder, Chairman, and CEO, Abel Avellan, has assembled a first-class space and wireless technical team, paired with strong commercial and legal talent. In fact, we met with many of them again during the recent launch event for the five BlueBirds at Cape Canaveral in September 2024. In addition, wireless heavyweights Vodafone, Samsung, and Rakuten are investors and/or board members.

Limited Competition

Starlink, a satellite internet constellation operated by Starlink Services, LLC, a wholly owned subsidiary of aerospace company SpaceX is best known for its satellite to home internet service. But two years ago, Starlink teamed with T-Mobile USA to develop and launch a potential new and well-funded direct-tocell competitor to AST. However, Starlink’s planned voice and data service is now limited to simple texting (not broadband or internet) and requires users to be outdoors with a direct view of the sky.

Summary

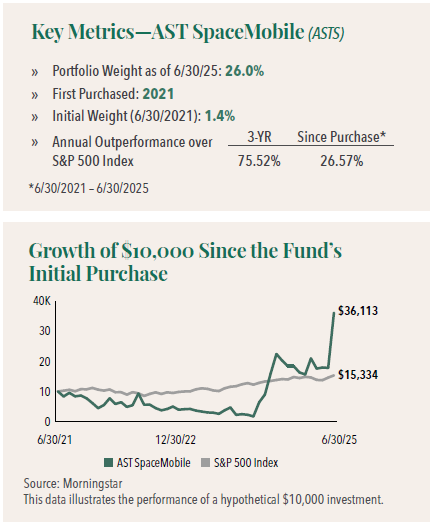

AST is a “special situation” investment for the Hennessy Focus Fund, as it does not meet the Fund’s typical compounder model of historically producing a sustained mid-teens or higher rate of earnings growth. However, we believe it presents a very compelling “emerging compounder” profile with a favorable risk-return profile at today’s price.

AST continues to be a rapidly developing business. We continue to see a host of positive developments on the horizon and anticipate the company will hit multiple milestones over the next 6 months, including additional launches, further military testing, additional financing and potentially grants, new contract wins, and potential strategic partnerships with Apple and/or Blue Origin.

We believe we are on the cusp of a new communication revolution with decades of potential growth in front of it, and believe AST will play an integral role.

- In this article:

- Domestic Equity

- Focus Fund

You might also like

-

Portfolio Perspective

Portfolio Perspective

Focus FundSeeking Companies with Strong Growth at Attractive Valuations

David Rainey, CFACo-Portfolio Manager

David Rainey, CFACo-Portfolio Manager Ira Rothberg, CFACo-Portfolio Manager

Ira Rothberg, CFACo-Portfolio Manager Brian Macauley, CFACo-Portfolio ManagerRead the Commentary

Brian Macauley, CFACo-Portfolio ManagerRead the CommentaryThe Portfolio Managers rely on their strategy of owning durable, well-run businesses capable of turning adversity into opportunity and adapting to macroeconomic surprises. The following Hennessy Focus Fund Commentary recaps the 2025 market and highlights areas of opportunity ahead.

-

Portfolio Perspective

Portfolio Perspective

Focus FundFrom Rate Cuts to AI: Positioning the Portfolio for Potential Opportunity

David Rainey, CFACo-Portfolio Manager

David Rainey, CFACo-Portfolio Manager Ira Rothberg, CFACo-Portfolio Manager

Ira Rothberg, CFACo-Portfolio Manager Brian Macauley, CFACo-Portfolio ManagerRead the Commentary

Brian Macauley, CFACo-Portfolio ManagerRead the CommentaryThe Portfolio Managers discuss holdings that could potentially benefit from lower rates, tariffs, and artificial intelligence (AI). The team also provides an update on AST SpaceMobile and discusses potential opportunities in select Technology and Health Care companies.

-

Company Spotlight

Company Spotlight

Focus FundO’Reilly Automotive—Revved for Growth

David Rainey, CFACo-Portfolio Manager

David Rainey, CFACo-Portfolio Manager Ira Rothberg, CFACo-Portfolio Manager

Ira Rothberg, CFACo-Portfolio Manager Brian Macauley, CFACo-Portfolio ManagerRead the Spotlight

Brian Macauley, CFACo-Portfolio ManagerRead the SpotlightO’Reilly Automotive is a leader in the automotive aftermarket parts industry in the U.S. The company’s scale, unique distribution infrastructure, and customer service-oriented culture should allow it to take market share in a fragmented U.S. market for years to come.