From Rate Cuts to AI: Positioning the Portfolio for Potential Opportunity

The Portfolio Managers discuss holdings that could potentially benefit from lower rates, tariffs, and artificial intelligence (AI). The team also provides an update on AST SpaceMobile and discusses potential opportunities in select Technology and Health Care companies.

-

David Rainey, CFACo-Portfolio Manager

David Rainey, CFACo-Portfolio Manager -

Ira Rothberg, CFACo-Portfolio Manager

Ira Rothberg, CFACo-Portfolio Manager -

Brian Macauley, CFACo-Portfolio Manager

Brian Macauley, CFACo-Portfolio Manager

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance quoted. Performance data current to the most recent month end, and standardized performance can be obtained by viewing the fact sheet or by clicking here.

Key Takeaways

» The Fund’s holdings with significant shortterm debt stand to benefit most directly from the Fed’s rate cuts, while others could see secondary gains from improved affordability and stronger demand.

» O’Reilly Automotive has had a positive impact from the tariffs as it gained from higher repair demand, pricing power, and market share.

» The portfolio is well positioned to benefit from AI, with Brookfield, Applied Materials, and AST SpaceMobile poised to gain most from the technology’s infrastructure, hardware, and connectivity demands.

» Over the past six months, AST SpaceMobile has shifted from research and development to becoming an operational, manufacturing focused business nearing global deployment.

» We see long-term opportunities emerging in select Technology and Health Care companies despite current sector challenges and valuations.

Would you please discuss the Fund’s performance over the year-to-date period compared to the Russell 3000® Index?

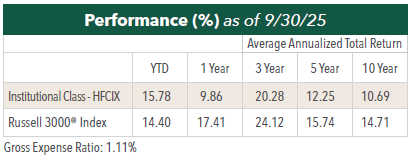

For the year-to-date the Fund (HFCIX) is up 15.78% compared to the Russell 3000® up 14.40%. Over this period, the leading contributors have been AST Space Mobile, O’Reilly Automotive, and Brookfield Corporation, and leading detractors were Cogent Communications, RH, and CarMax.

What holdings could benefit the most from the Fed’s rate cuts?

First, there is always interest rate uncertainty. We accept this fact and do not position the Fund based on rate forecasts. Many of our holdings do use debt to fund their businesses so we underwrite each investment to account for a firm’s use of leverage to understand its economic sensitivity to up and down cycles. With the Federal Reserve’s quarter point reduction in short interest rates in mid-September, we are now beginning an easing cycle hastened by the new uncertainty in economic growth and employment.

The most direct effect of lower rates will be on holdings with the most short-term debt (those likely to see interest savings in 4Q25) including Brookfield Corp., American Tower Corp., Ashtead Group, Cogent Communications Holdings, and CarMax, Inc. On an intermediate term basis, lower short- and long-term rates should allow our holdings to rollover/refinance forward maturities over the next few years at better rates as well as support overall valuations through the reduction in equity discount rates.

A secondary or indirect impact of lower rates would be better affordability and therefore higher demand for products and services of several of our holdings. Examples include: lower auto finance rates at CarMax leading to stronger used unit demand, lower financing rates for commercial construction projects supports Ashtead’s equipment rental business and lower mortgage rates driving stronger demand for NVR’s residences and Floor & Decor Holdings’ remodeling products.

How have tariffs impacted the current portfolio companies?

We believe the net direct impact of tariffs on our portfolio has been positive. The majority of our holdings are insulated from direct tariff effects as they are service-oriented or domestically focused. One of our largest holdings, O’Reilly Automotive, has directly benefited from the tariffs in three key ways.

1. Tariffs on steel, vehicles, and auto parts have raised the cost of new and used cars, which has prompted consumers to keep their existing vehicles longer, increasing demand for maintenance and repair parts.

2. While O’Reilly sources a significant portion of its inventory from regions affected by tariffs, the company has successfully passed these increased costs to customers, maintaining or even improving its gross profit margins.

3. O’Reilly’s superior sourcing and distribution network, along with its financial strength, have put pressure on smaller competitors, allowing the company to gain market share during a period of disruption.

Would you discuss a position that was sold in the third quarter?

We exited our long-held position in Encore Capital Group during the third quarter. The company’s business is highly cyclical, thriving when credit card delinquencies and charge-offs are rising. That trend appears to be peaking in the U.S., making the unusually high returns from acquiring domestic debt portfolios increasingly tenuous.

Because the company already has a high market share in a concentrated U.S. market, its long-term growth will likely depend on international expansion. We have observed that the company’s returns in their targeted international markets have not been as strong, as the barriers to entry are not as high. The clear and highly profitable capital allocation choices of the past few years are likely to become more difficult, and we lack confidence in the management’s ability to make optimal decisions going forward.

Which portfolio companies are poised to benefit most significantly from artificial intelligence (AI) over the next five years?

We believe our portfolio is well positioned to benefit from AI. Brookfield Corporation, Applied Materials, and AST SpaceMobile are likely to see the largest benefit over the next five years.

Brookfield is well positioned to benefit from the AI boom, which management estimates is a $7 trillion opportunity and one of the most significant investment events in the last 50 years. Brookfield is ideally suited to capture this growth due to its core assets, including existing power, real estate, adjacencies, and compute infrastructure. Management is dedicating substantial capital to “AI factories,” recognizing the massive infrastructure demands, such as the anticipated doubling of power grids globally. AI infrastructure may become the company’s largest business within 10 years, positioning Brookfield as a premier vehicle for accessing this fundamental trend.

As it relates to Applied Materials, the CEO believes that “AI is the biggest inflection of our lifetimes.” An AI server has 8 times more foundry/logic content, 8 times more Dynamic Random-Access Memory (DRAM) content than a traditional server. Power consumption is a critical factor for AI servers due to its impact on operational costs, environmental sustainability, and the ability to scale AI operations effectively. Applied is positioned to capture over 50% of the incremental spending on some of the technologies that will enable performance and power consumption requirements of AI servers. These technologies include gate all around (offering a 30% improvement in power consumption) and backside power (25% improvement in power consumption).

AST SpaceMobile is uniquely positioned to benefit from AI by providing the foundational, global high-speed data fabric required for ubiquitous AI deployment. We expect its forthcoming directto- device broadband service will close coverage gaps, enabling the massive scaling of Global IoT and Edge AI applications for billions of sensors and autonomous systems, including drones relying on real-time processing. This resilient, ubiquitous connectivity should allow the company to secure a significant role in military applications, where it would support secure, AI-enhanced tactical networks (like the Tactical Assault Kit) for mission-critical command and control in remote or denied environments.

Would you provide an update on the Fund’s largest holding, AST SpaceMobile?

We have seen important developments in the last 180 days, a period in which AST clearly began its transition from a research and development focus to an operationally and manufacturing focused business on the cusp of global operations for both commercial and government customers.

AST announced that its Block 2 BlueBird 6 satellite will be flown to India on October 12 for subsequent launch aboard an ISRO rocket, B2BB 7 is headed to Cape Canaveral in late October for a likely Falcon 9 rideshare in November and that B2BBs 8-16 are in various stages of production. Subsequent launches of these low-band satellites should occur in batches of 3-4x or 6-8x per rocket every 1-2 months, on average, resulting in thirteen launches adding 40- 55 satellites by the end of next year.

AST reached a final agreement though bankruptcy court hearings to settle Viasat/Inmarsat’s opposition to Ligado’s planned restructuring. Once approved by the FCC, AST, now in partnership with Ligado, will gain access to 40-45 MHz of L-band MSS spectrum in the US/Canada for 80 years through a leasehold arrangement. This spectrum will be accessible through their next generation Block 3 BlueBird satellites currently in design. We believe AST will begin launching B3BBs in 2027, which will enable them to use and monetize the L-band spectrum to supplement and enhance constellation throughput in conjunction with their MNO partners. By supplementing low-band MNO spectrum with MSS L-band spectrum, AST should be able to offer wireless subscribers more robust broadband data capabilities in time. Further, there is also an opportunity for AST to add up to 60 MHz of additional MSS S-band spectrum through their recent agreement to acquire global S-Band spectrum priority rights held under the International Telecommunication Union (ITU).

We expect AT&T, Verizon, Vodafone, and Rakuten to begin beta testing using the five B2BBs currently in orbit in their respective territories over the next three months. This will be the first wide field, multi user beta test across thousands of users and is key to fully testing and optimizing integration of their satellite network into their MNO partners’ core networks.

We also expect FCC approval of full U.S. commercial service by the end of 2025 and expect to see Bell Canada and FirstNet definitive commercial agreements over the near term. In early October, AST announced a definitive commercial agreement with Verizon. These definitive agreements should unlock combined, prepaid revenue payments of up to $110mm from AT&T, Vodafone, and Verizon.

We expect Golden Dome updates and awards over the next six months and believe AST is well positioned to win placements with the leadingedge capabilities of its Block 2 BB’s massive phased arrays that integrate both sensing and communications capabilities.

Finally, we would expect limited, or discontinuous commercial operations to begin by year end or early 2026 in the U.S./Canada and select other countries with the potential for EBITDA breakeven or better in 2Q26. We remain excited about AST’s potential and the value creation ahead for shareholders.

Given the Fund’s underweight to Technology and Health Care compared to the Russell 3000® Index, are you finding any opportunities in these areas of the market?

We are finding some interesting opportunities in the Technology and Health Care sectors. There are many areas within heath care that are struggling due to changes in government funding, inflation, and lingering impacts from the pandemic. We are looking at a few businesses now that we believe have promising long-term prospects masked by near-term challenges. The Technology sector has done well lately, so most of these businesses we review are not presenting near-term investment opportunity. However, a few select businesses have drawn our attention.

While we have not added any Technology or Health Care companies to the portfolio recently, it is quite possible that some will find their way into the Fund in the coming quarters.

Regardless of these opportunities, since the start of the year, slower hiring, higher jobless claims, and rising inflation increase the risk of a slowdown. Instead of focusing on short-term cycles, we focus on finding strong businesses that can capitalize on downturns through acquisitions, expansions, or buybacks while weaker competitors retreat.

- In this article:

- Domestic Equity

- Focus Fund

You might also like

-

Portfolio Perspective

Portfolio Perspective

Focus FundSeeking Companies with Strong Growth at Attractive Valuations

David Rainey, CFACo-Portfolio Manager

David Rainey, CFACo-Portfolio Manager Ira Rothberg, CFACo-Portfolio Manager

Ira Rothberg, CFACo-Portfolio Manager Brian Macauley, CFACo-Portfolio ManagerRead the Commentary

Brian Macauley, CFACo-Portfolio ManagerRead the CommentaryThe Portfolio Managers rely on their strategy of owning durable, well-run businesses capable of turning adversity into opportunity and adapting to macroeconomic surprises. The following Hennessy Focus Fund Commentary recaps the 2025 market and highlights areas of opportunity ahead.

-

Company Spotlight

Company Spotlight

Focus FundO’Reilly Automotive—Revved for Growth

David Rainey, CFACo-Portfolio Manager

David Rainey, CFACo-Portfolio Manager Ira Rothberg, CFACo-Portfolio Manager

Ira Rothberg, CFACo-Portfolio Manager Brian Macauley, CFACo-Portfolio ManagerRead the Spotlight

Brian Macauley, CFACo-Portfolio ManagerRead the SpotlightO’Reilly Automotive is a leader in the automotive aftermarket parts industry in the U.S. The company’s scale, unique distribution infrastructure, and customer service-oriented culture should allow it to take market share in a fragmented U.S. market for years to come.

-

Portfolio Perspective

Portfolio Perspective

Cornerstone Mid Cap 30 FundPortfolio Drivers: Consumer Discretionary and Industrials

Neil J. HennessyChief Market Strategist and Portfolio Manager

Neil J. HennessyChief Market Strategist and Portfolio Manager Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager L. Joshua Wein, CAIAPortfolio ManagerRead the Commentary

L. Joshua Wein, CAIAPortfolio ManagerRead the CommentaryCornerstone Mid Cap 30 Fund Portfolio Managers Ryan Kelley and Josh Wein review the Fund’s investment strategy, discuss the most recent rebalance, and highlight the recent change in market cap range of potential investments.