O’Reilly Automotive—Revved for Growth

O’Reilly Automotive is a leader in the automotive aftermarket parts industry in the U.S. The company’s scale, unique distribution infrastructure, and customer service-oriented culture should allow it to take market share in a fragmented U.S. market for years to come.

-

David Rainey, CFACo-Portfolio Manager

David Rainey, CFACo-Portfolio Manager -

Ira Rothberg, CFACo-Portfolio Manager

Ira Rothberg, CFACo-Portfolio Manager -

Brian Macauley, CFACo-Portfolio Manager

Brian Macauley, CFACo-Portfolio Manager

An Industry Leader in Automotive Parts

From a single store in 1957, O’Reilly Automotive Inc. has grown to become an industry leader within the specialty retail space for automotive parts, tools, supplies, equipment, and accessories. The company currently operates over 6,400 stores across the U.S., Mexico, and Canada.

O’Reilly has built a reputation for strong customer service and product availability. Its 31 distribution centers provide its stores with same-day or overnight access to an average of 153,000 unique store keeping units (SKUs), and often include hard-to-find products not stocked by other auto part retailers. Additionally, the company maintains a robust online presence, allowing customers to view inventory availability and place orders to be picked up in store or delivered.

O’Reilly sells premium name brand products as well as proprietary private label products that consist of house brands and nationally recognized proprietary brands. Mechanics and do-it-yourselfers increasingly trust O’Reilly’s private label parts to deliver the same form, fit, and function as premium name brand parts. Private label sales offer a higher margin than name brand products and have expanded from approximately 30% of sales a decade ago to greater than 45% today.

![]()

O’Reilly’s Dual Market Strategy

Over four decades ago, the company pioneered a “dual-market” business model and set itself apart in the automotive aftermarket by adeptly serving both the Do-It-Yourself (DIY) customer and the Do-It-For-Me (DIFM) professional service provider. This foundational approach allows O’Reilly to capture sales from both segments.

• DIY customers, typically price-sensitive individuals performing their own vehicle maintenance, are catered to through convenient retail locations, extensive product availability, and knowledgeable staff.

• DIFM customers—professional repair shops and dealerships—prioritize rapid part delivery, broad coverage including specialized items, and consistent quality, recognizing that idle mechanics represent significant costs.

O’Reilly addresses these needs via a sophisticated hub-and-spoke distribution network, facilitating multiple daily deliveries and access to a vast inventory of SKUs. This dual approach provides O’Reilly with a wider customer base, enhanced resilience across varied economic conditions, and an ability to enter smaller markets where there is less competition.

The automotive aftermarket is currently undergoing a notable shift, with the DIFM segment expanding its market share relative to DIY. This trend is driven by several factors. Modern vehicles are increasingly complex, integrating advanced electronics and requiring specialized diagnostic tools, which makes repairs challenging for the average DIYer lacking specialized knowledge and equipment. Time constraints for consumers, a return to pre-pandemic work schedules, and busy lifestyles also limit the time available for DIY vehicle maintenance. Furthermore, the average age of vehicles on the road has reached a record high of 12.6 years as of 2024, leading to more frequent and complex repairs typically handled by professionals.

DIFM customers also highly value the expertise, experience, and convenience offered by professional service providers, often outweighing potential DIY cost savings. Additionally, tariffs on imported new vehicles and parts can increase new car costs, prompting consumers to keep older vehicles longer, further boosting demand for professional maintenance and repairs. Despite this general shift towards DIFM, cost savings remain a primary motivator for DIY behavior, especially for simpler tasks like fluid changes and brake-related work.

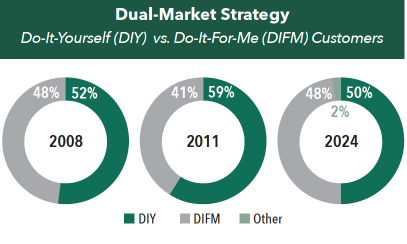

O’Reilly’s business mix has evolved significantly, particularly following its acquisition of CSK Auto Corporation in 2008.

Prior to the purchase, O’Reilly had a balanced model, with sales split roughly 52% from DIY customers and 48% from DIFM. CSK, however, was heavily skewed toward DIY, with only about 10% of sales from installers.

The acquisition expanded O’Reilly’s presence in the Western U.S. and required major integration work. O’Reilly converted CSK’s DIY-focused stores and distribution system to its dual-market approach by:

• Consolidating distribution networks

• Moving from weekly to daily restocking

• Retrofitting distribution centers

• Resetting store inventory to carry more professional-grade parts

The goal was to grow CSK’s installer business closer to O’Reilly’s balanced mix, which it had achieved by 2025, as you can see on the following page.

Overseas Expansion

O’Reilly has active and opportunistic plans for international expansion, primarily focusing on contiguous North American markets, i.e., Canada and Mexico. Its strategy for entering these markets largely involves strategic acquisitions to leverage existing relationships and local management teams, preferring this approach over greenfield expansion initially in international territories.

Mexico

O’Reilly entered Mexico by acquiring Mayoreo de Autopartes y Aceites, S.A. de C.V. (“Mayasa”) in 2019, which initially added 21 stores. A significant development was the opening of a new Distribution Center (DC) in Guadalajara in July 2023. This state-of-the-art facility is a true prototype O’Reilly DC and is crucial for accelerating store growth in Mexico, and is capable of servicing 250 stores. Prior to this, Mayasa operated six smaller DCs in Mexico.

All stores in Mexico were rebranded from ORMA to O’Reilly Autopartes in December 2023. This rebranding occurred after O’Reilly felt their model was fully up and running to provide the expected parts availability and service.

The company is in the early innings of expansion but gaining momentum, increasing density outside their historical base in Guadalajara. As of July 2025, O’Reilly marked a milestone of 100 stores in Mexico operating in nine Mexican states. The company’s goal is to continue actively expanding its footprint to increase market share. By comparison, AutoZone entered the Mexican market in 1998 and currently has over 800 stores in Mexico.

The Mexican automotive aftermarket is described as extremely fragmented, akin to the U.S. market 20-30 or 40 years ago, presenting significant greenfield and merger and acquisition (M&A) opportunities. The average age of a vehicle in Mexico is 16.5 years, much older than the U.S. average, contributing to a strong parts market.

Canada

O’Reilly entered the Canadian market in January 2024 through the acquisition of Groupe Del Vasto (also known as Vast Auto). This acquisition added two distribution centers and 23 company-owned stores across Eastern Canada, predominantly in Quebec and Ontario, along with New Brunswick and Newfoundland. The company is in the very early innings of its Canadian expansion. The acquired stores are still operating under the Vast name and are not yet rebranded as O’Reilly stores. O’Reilly plans to rebrand them once they are confident they can provide the full O’Reilly parts availability and service experience to Canadian customers, similar to their approach in Mexico. O’Reilly expects to earn a strong return on capital in Canada, similar to the U.S.

Tariffs on Imports

Tariffs on steel, imported vehicles, and imported auto parts increase the cost of new cars, which causes many consumers to keep their existing vehicles for longer, directly translating to increased demand for maintenance and repair parts.

While O’Reilly Automotive sources a significant portion of its inventory from regions potentially subject to tariffs, the company has shown an ability to pass these increased costs on to customers. Historically, this has allowed them to maintain or even improve their gross profit margins, despite higher input costs. The essential nature of auto parts makes consumers more willing to absorb price increases than they might for discretionary goods. Product cost inflation from tariffs leads to accelerated revenue growth and operating leverage.

O’Reilly has consistently gained market share for decades and, as a consequence, supplier partners give the company preferred treatment. In times of stress or disruption, such as those potentially caused by tariffs, O’Reilly’s superior sourcing capabilities, financial strength, and extensive distribution network can put pressure on smaller independent operators and regional competitors. These smaller competitors can face working capital challenges and trouble reworking their supply chains. This could create a market share opportunity for O’Reilly, allowing them to consolidate the fragmented automotive aftermarket further.

Competitive Landscape

The U.S. automotive aftermarket is a vast industry, with O’Reilly’s addressable “dual market” estimated at $150 billion to $160 billion. While the DIY segment is fairly consolidated, the DIFM market remains highly fragmented, with over 50% controlled by small independents. This fragmentation presents a significant opportunity for O’Reilly to expand its market share, aligning with its mission to be the “dominant auto parts provider in all the markets we serve.”

O’Reilly competes intensely with national and regional chains like AutoZone, Advance Auto Parts, CARQUEST, and NAPA, as well as independent jobbers, dealers, mass merchandisers, and online retailers. Despite this competition, O’Reilly differentiates itself through several key advantages:

1. Its “Professional Parts People” provide superior customer service and technical expertise. A strategic, tiered distribution network, encompassing 31 distribution centers and 396 Hub stores, ensures same-day or overnight access to over 153,000 SKUs, crucial for an industry demanding immediate parts availability. This robust distribution model, which competitors have struggled to replicate, positions inventory closer to the customer, leading to faster delivery times and a service advantage, particularly for commercial clients.

2. O’Reilly’s omnichannel growth strategy offers a seamless customer experience across its physical stores and digital platforms, leveraging its extensive footprint, parts knowledge, and local availability.

3. As the second-largest company in the industry, O’Reilly also benefits from substantial buying power, allowing it to secure parts inventory at better prices than smaller competitors. This enables higher profit margins and sustained market share gains.

We believe these advantages will allow O’Reilly to potentially compound earnings per share at an attractive low- to mid-teens rate over the next five to ten years.

Our Independent Research and Key Insights

For each of the holdings in the Hennessy Focus Fund, the Portfolio Managers employ independent, fundamental research, with a primary focus on key investment criteria. The following are highlights from their research insights.

Competitive Position

• Unique distribution model enables higher service levels, sales per trade area, and inventory turns.

• Customer-centered culture provides a valuable service and execution advantage.

• As the 2nd largest company within the industry, it has substantial buying power.

• These advantages have enabled the company to generate a greater than 30% return on invested capital for many years.

Growth Opportunity

• Although an industry leader, O’Reilly only has an 10% share of a $168 billion addressable market.

• We expect many years of organic store growth in the U.S as the store count increases from about 6,400 to 8,000.

• The company’s expansion into Mexico offers access to a highly fragmented market, and leverages the company’s strong operations and buying power.

• We expect the company to expand into additional countries over time.

Management Quality

• We view Vice Chairman David O’Reilly and Executive Chairman Greg Henslee as an exceptional capital allocators who have successfully shepherded the company through five major acquisitions.

• 75% of senior leaders have been with O’Reilly for 10 years or more. The CEO and Chief Financial Officer have been promoted from within and are skilled operators with more than 50 years of combined experience.

Valuation

• As of mid-September, the company traded at 30x our 2026 earnings per share (EPS) estimate.

• From the beginning of 2011 through late July 2025, the company has repurchased 1.46 billion shares of its common stock at an average price of $18.27. There were about 849 million shares outstanding as of August 2025.

• The company has modest financial leverage and one of the strongest balance sheets in the industry.

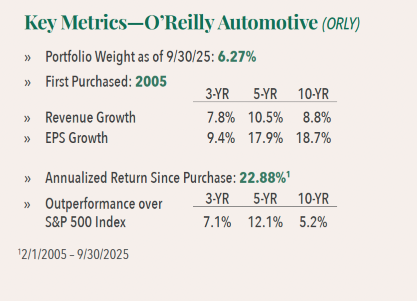

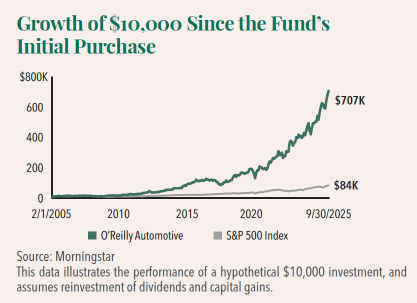

• O’Reilly has experienced an annualized EPS growth rate of 19% over the past 10 years (2014-2024).![]()

![]()

![]()

- In this article:

- Domestic Equity

- Focus Fund

You might also like

-

Portfolio Perspective

Portfolio Perspective

Focus FundSeeking Companies with Strong Growth at Attractive Valuations

David Rainey, CFACo-Portfolio Manager

David Rainey, CFACo-Portfolio Manager Ira Rothberg, CFACo-Portfolio Manager

Ira Rothberg, CFACo-Portfolio Manager Brian Macauley, CFACo-Portfolio ManagerRead the Commentary

Brian Macauley, CFACo-Portfolio ManagerRead the CommentaryThe Portfolio Managers rely on their strategy of owning durable, well-run businesses capable of turning adversity into opportunity and adapting to macroeconomic surprises. The following Hennessy Focus Fund Commentary recaps the 2025 market and highlights areas of opportunity ahead.

-

Portfolio Perspective

Portfolio Perspective

Focus FundFrom Rate Cuts to AI: Positioning the Portfolio for Potential Opportunity

David Rainey, CFACo-Portfolio Manager

David Rainey, CFACo-Portfolio Manager Ira Rothberg, CFACo-Portfolio Manager

Ira Rothberg, CFACo-Portfolio Manager Brian Macauley, CFACo-Portfolio ManagerRead the Commentary

Brian Macauley, CFACo-Portfolio ManagerRead the CommentaryThe Portfolio Managers discuss holdings that could potentially benefit from lower rates, tariffs, and artificial intelligence (AI). The team also provides an update on AST SpaceMobile and discusses potential opportunities in select Technology and Health Care companies.

-

Portfolio Perspective

Portfolio Perspective

Cornerstone Mid Cap 30 FundPortfolio Drivers: Consumer Discretionary and Industrials

Neil J. HennessyChief Market Strategist and Portfolio Manager

Neil J. HennessyChief Market Strategist and Portfolio Manager Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager L. Joshua Wein, CAIAPortfolio ManagerRead the Commentary

L. Joshua Wein, CAIAPortfolio ManagerRead the CommentaryCornerstone Mid Cap 30 Fund Portfolio Managers Ryan Kelley and Josh Wein review the Fund’s investment strategy, discuss the most recent rebalance, and highlight the recent change in market cap range of potential investments.