Finding Attractive Investments Focusing on Growth, Valuation and Momentum

In the following commentary, the Portfolio Managers of the Hennessy Cornerstone Growth Fund discuss the Fund’s formula-based investment strategy and how it drives the Fund’s sector and industry positioning.

-

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager -

L. Joshua Wein, CAIAPortfolio Manager

L. Joshua Wein, CAIAPortfolio Manager

What is the Hennessy Cornerstone Growth Fund’s investment strategy?

The Fund utilizes a formula-based approach in building a portfolio of attractively valued stocks whose stock prices are exhibiting strong relative strength. The strategy seeks to combine elements of both value and momentum investing. From the universe of stocks in the S&P Capital IQ Database, the Fund selects the 50 stocks with the highest one-year price appreciation that also meet the following criteria:

» Market capitalization exceeding $175 million

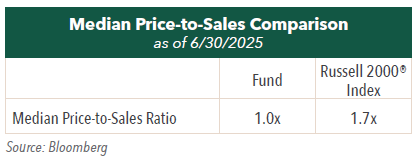

» Price-to-sales ratio below 1.5

» Annual earnings higher than the previous year

» Positive stock price appreciation over the past three- and six-month periods

Why does the Fund use these screening criteria?

The Fund uses a sales-based value criterion because sales are more difficult to manipulate than earnings. The price-to-sales ratio works well under many conditions, including when a company’s profitability may be temporarily depressed or when earnings may be artificially inflated.

Higher year-over-year earnings help identify attractive companies, including those that are operating successfully in growth markets, gaining market share, or increasing profitability.

Positive price appreciation over three- and six-month periods generally reflects market recognition of improving underlying fundamentals in the near term.

Why does the formula select stocks with the highest one-year price appreciation?

From among the companies that meet the screening criteria, the Fund selects the 50 with the highest one-year price appreciation. We believe this ranking by relative share price strength can be a good predictor of future price appreciation, or outperformance.

What is the Fund’s current market cap?

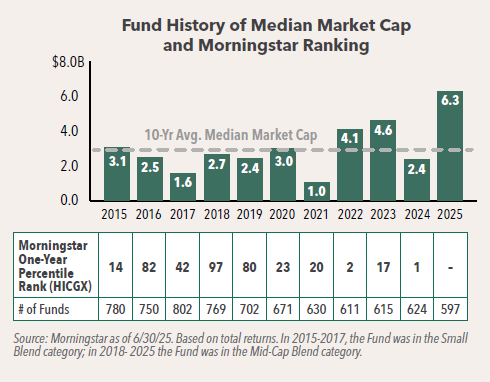

As of June 30, 2025, the Fund has a median market cap of approximately $6.3 billion, the largest it has been for over a decade. We are pleased that historically, this small-cap Fund has performed well against its peers when the market cap is higher than average. For example, in all the past years where the market cap was above its 10-year average of $3.0 billion, the Fund’s annual rank was in the top quartile (25%) or better.

How does the Fund seek to provide a return to investors?

We believe the Fund’s investments present the potential for capital appreciation as a result of earnings growth and potentially increasing valuations.

How often does the Fund rebalance its portfolio?

The universe of stocks is re-screened and the portfolio is rebalanced annually, generally in the winter. Holdings are weighted equally by dollar amount with 2% of the Fund’s assets invested in each.

How does the Fund’s portfolio differ from its benchmark?

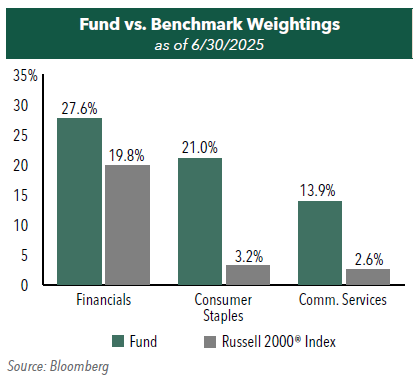

Compared to its benchmark, the Russell 2000® Index, the Fund has significant weightings in the Financials, Consumer Staples, and Communication Services. While the next largest weighting is Industrials, we note that they it is underweight the benchmark by about 8.4%. Lastly, the Fund has holdings in all sectors except Materials.

The Fund’s largest sector weighting is Financials, at almost 28% of the portfolio, with a significant allocation to insurance, mainly property and casualty but also life and health. Consumer Staples, at 21% of the portfolio, and Communication Services, at almost 14%, round out the top three sectors and comprise nearly two-thirds of the portfolio. In general, these three sectors, and especially the individual stocks in the portfolio, are generally viewed as more defensive in nature and less volatile in times of uncertainty. Given that the most recent portfolio rebalance occurred after the disruptions in the global equity markets due to tariff announcements, we believe the Fund’s sector allocations reflect the tumult in the market thus far in 2025.

- In this article:

- Domestic Equity

- Cornerstone Growth Fund

You might also like

-

Portfolio Perspective

Portfolio Perspective

Focus FundSeeking Companies with Strong Growth at Attractive Valuations

David Rainey, CFACo-Portfolio Manager

David Rainey, CFACo-Portfolio Manager Ira Rothberg, CFACo-Portfolio Manager

Ira Rothberg, CFACo-Portfolio Manager Brian Macauley, CFACo-Portfolio ManagerRead the Commentary

Brian Macauley, CFACo-Portfolio ManagerRead the CommentaryThe Portfolio Managers rely on their strategy of owning durable, well-run businesses capable of turning adversity into opportunity and adapting to macroeconomic surprises. The following Hennessy Focus Fund Commentary recaps the 2025 market and highlights areas of opportunity ahead.

-

Portfolio Perspective

Portfolio Perspective

Focus FundFrom Rate Cuts to AI: Positioning the Portfolio for Potential Opportunity

David Rainey, CFACo-Portfolio Manager

David Rainey, CFACo-Portfolio Manager Ira Rothberg, CFACo-Portfolio Manager

Ira Rothberg, CFACo-Portfolio Manager Brian Macauley, CFACo-Portfolio ManagerRead the Commentary

Brian Macauley, CFACo-Portfolio ManagerRead the CommentaryThe Portfolio Managers discuss holdings that could potentially benefit from lower rates, tariffs, and artificial intelligence (AI). The team also provides an update on AST SpaceMobile and discusses potential opportunities in select Technology and Health Care companies.

-

Company Spotlight

Company Spotlight

Focus FundO’Reilly Automotive—Revved for Growth

David Rainey, CFACo-Portfolio Manager

David Rainey, CFACo-Portfolio Manager Ira Rothberg, CFACo-Portfolio Manager

Ira Rothberg, CFACo-Portfolio Manager Brian Macauley, CFACo-Portfolio ManagerRead the Spotlight

Brian Macauley, CFACo-Portfolio ManagerRead the SpotlightO’Reilly Automotive is a leader in the automotive aftermarket parts industry in the U.S. The company’s scale, unique distribution infrastructure, and customer service-oriented culture should allow it to take market share in a fragmented U.S. market for years to come.