Long-Term Investor of Well-Run, Durable Businesses

The Portfolio Managers of the Hennessy Focus Fund discuss the strong performance, recent detractors from returns, earnings growth rates and valuations, how the Fund is insulated from the tariff discussions, and an update on AST SpaceMobile.

-

David Rainey, CFACo-Portfolio Manager

David Rainey, CFACo-Portfolio Manager -

Ira Rothberg, CFACo-Portfolio Manager

Ira Rothberg, CFACo-Portfolio Manager -

Brian Macauley, CFACo-Portfolio Manager

Brian Macauley, CFACo-Portfolio Manager

Key Takeaways

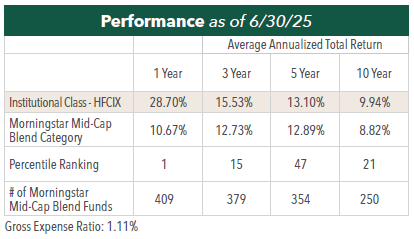

» The Fund was the top performer in the Morningstar Mid-Cap Blend Category over the 1-year period ended 6/30/25.

» The Fund’s performance was driven by AST SpaceMobile and Brookfield Corporation, the two largest positions in the portfolio.

» At the beginning of the third quarter of 2025, the Fund offered a lower valuation with a slightly lower expected growth rate versus the benchmark Index.

» We believe our businesses are relatively well insulated from the tariff disputes, and in some cases benefit from tariffs.

» AST SpaceMobile appreciated significantly in June as the company reported a number of important developments.

Would you please discuss performance over the past quarter?

We are pleased the Fund (HFCIX) was the top performer among 409 Morningstar Mid-Cap Blend Funds over the 1-year period as of June 30, 2025. The Fund’s returns over both the 1-year and the threemonth time periods were driven by the strong performance of the Fund’s two largest positions: AST SpaceMobile, Inc. and Brookfield Corporation. Shares of AST SpaceMobile and Brookfield Corporation appreciated by approximately 300% and 50%, respectively, over the one-year period.

AST SpaceMobile reported favorable operational, strategic, and regulatory developments during the quarter. These developments are discussed in greater detail on the next page. Brookfield Corporation reported strong growth in distributable earnings and fee-related earnings during the quarter, alongside significant capital deployment and share repurchases.

Would you briefly discuss the top detractors over the past quarter?

The Fund’s leading detractors during the quarter included Cogent Communications Holdings, down 20%, Aon PLC, down 10%, and CarMax, Inc., down 14%. Cogent Communications sold off with a slower-than-expected ramp in wavelength sales. We continue to have a positive outlook for the company’s wavelength opportunity and expect it to build a sizable and very profitable new business line here in the coming years. Aon faces a short-term headwind from moderating property and casualty insurance pricing pressuring organic revenue growth. CarMax shares declined as concerns grew that higher new car prices resulting from tariffs would put upward pressure on used car prices and crimp demand.

Would you provide an update of the Fund’s largest holding, AST SpaceMobile?

Shares of AST SpaceMobile appreciated by over 100% in the month of June as the company reported a number of important developments. On June 13, the company announced progress toward securing 45 MHz of premium lower mid-band spectrum in North America with the signing of a settlement term sheet with Ligado, Viasat, and Inmarsat. This brings AST a step closer to securing a scarce asset that would provide more network capacity, increase bargaining power with mobile network operators, and box out potential competitors. On June 18, the company announced a partnership with India’s Vodafone Idea (Vi) that would allow Vi’s more than 200 million subscribers to access 4G and 5G directly from space with everyday smartphones when the constellation is built out. On June 26, AST announced the successful demonstration of the world’s first Non-Terrestrial Network (NTN) tactical satellite communications delivering high-throughput data, voice, and video using unmodified mobile devices in collaboration with Fairwinds Technologies. The demonstration included active participation from U.S. Indo-Pacific Command, including representation from the U.S. Navy, Marine Corps, Army, U.S. Space Command, and the Office of the Under Secretary of Defense for Research and Engineering FutureG team.

AST SpaceMobile is at a pivotal moment. The rapid expansion of its satellite constellation and the impending launch of commercial service are set to transform its numerous Memoranda of Understanding (MOUs) into definitive, revenuegenerating agreements. The company has MOUs with about 50 mobile network operators (MNOs) globally, collectively reaching approximately three billion subscribers. While only a few have become firm contracts, like the long-term commercial agreement with Vodafone and the signed contract with AT&T, these early agreements clearly show significant interest and future potential. We expect a definitive agreement with Verizon, already a strategic partner and investor, to be announced soon.

As AST SpaceMobile increases satellite production to six per month later this year and plans to launch over 60 satellites during 2025 and 2026, the path to continuous commercial service in key markets such as the U.S., Europe, and Japan is becoming clearer. This concrete progress and the promise of imminent service are crucial for MNOs to commit to binding agreements. We anticipate the planned start of commercial service in select markets will accelerate the conversion of MOUs with MNOs in other regions into definitive commercial agreements over the next 18 months.

With non-continuous commercial service set to kick off in the first half of 2026 and continuous service in the United States, Europe, and Japan targeted for late 2026, we believe the company is poised for rapid subscriber, revenue, and ultimately profit growth.

You have previously indicated that tariffs could have a positive direct impact on O’Reilly Automotive, Inc. Would you please discuss the effect of higher new car prices and the resulting impact on demand for maintenance and repair parts?

Tariffs on steel, imported vehicles, and imported auto parts increase the cost of new cars. When new cars become more expensive a portion of wouldbe new car buyers are priced out of that market. These buyers then shift their focus to the used car market, seeking more affordable alternatives. This increased demand for used vehicles drives up their prices. When new and used vehicles become more expensive, consumers are more likely to keep their existing vehicles for longer. This directly translates to increased demand for maintenance and repair parts.

Modern vehicles are engineered and manufactured with greater durability, enabling them to be reliably driven at higher mileages. This enhanced reliability, combined with elevated new and used vehicle prices, creates a compelling value proposition for consumers. Consumers are increasingly choosing to invest in the necessary repairs and maintenance to keep their existing, older vehicles operational.

As the average age of the U.S. vehicle fleet rises, a larger proportion of total miles are accumulated by vehicles no longer covered by a manufacturer’s warranty. These out-of- warranty, older vehicles are the primary engine of aftermarket demand. They necessitate more frequent routine maintenance, are prone to a higher incidence of mechanical failures, and generally require more comprehensive upkeep than newer vehicles. The automotive aftermarket industry considers vehicles between their warranty expiration (typically three to five years) and approximately 12 years old as the “sweet spot” for demand. Notably, this “sweet spot” has recently extended beyond 12 years, as consumers demonstrate a greater willingness to invest in maintaining these higher-mileage, better-built vehicles deeper into their lifecycles.

Have the tariff policies changed your opportunity set for future holdings? How are macroeconomic factors, e.g., interest rates, inflation, consumer demand, influencing your stock selection?

As long-term, business-focused investors, we accept that macroeconomic surprises are inevitable. We cannot know what twists and turns await, so we prepare in advance by trying to own well-run, durable business that can adapt to almost any circumstance. Indeed, we have observed that the best management teams have an ability to turn adversity into opportunity, ending up in a better place than they might otherwise have been.

When macroeconomic surprises—such as these trade disputes—do arise, we think through how they might impact each of our businesses, and we adjust our forecasts accordingly. Fortunately, we believe that our businesses are relatively well insulated, and in some cases benefit from tariffs. When the market sold off on trade uncertainty earlier this year, we focused our research efforts in sectors most impacted by this volatility, including apparel and footwear, home electronics, and alternative asset managers, among others.

What are the current earnings growth rates and valuations for the Fund vs. the Russell 3000 Index?

At the beginning of the third quarter of 2025, the Fund offered a lower valuation with a slightly lower expected growth rate versus the benchmark Index. The Fund’s expected 2026 earnings-per-share (EPS) growth rate was 14.1% and the Fund was trading at a price-to-earnings (P/E) multiple of 18.3x. By comparison, the Russell 3000 Index, a proxy for the broad equity market, has earnings growth expectations of 15.2% with a P/E multiple of 20.4x. While the Fund’s 2026/2025 EPS growth rate is slightly below that of the benchmark, our expectation is that the Fund’s earnings growth rate over the next five years will exceed that of the benchmark.

What is your outlook for equities and the Hennessy Focus Fund?

We continue to have a positive long-term outlook on the equity market and our portfolio. The Fund’s holdings are predominantly a collection of what we believe to be high-quality growth businesses trading at reasonable valuations. Our expectation is that on average, the Fund will own these businesses over a long-term time horizon, typically five years or longer. We believe the Fund’s return will be primarily determined by the growth and earnings power of these businesses. While there may be short-term setbacks along the way, our expectation is for mid-teens earnings growth over the next five years.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance quoted. Performance data current to the most recent month end can be found here.

Top ten holdings for the Hennessy Focus Fund can be found on the fact sheet or here. Fund holdings and sector allocations are subject to change and should not be considered recommendations to buy or sell any security. Current and future holdings are subject to risk.

- In this article:

- Domestic Equity

- Focus Fund

You might also like

-

Portfolio Perspective

Portfolio Perspective

Focus FundSeeking Companies with Strong Growth at Attractive Valuations

David Rainey, CFACo-Portfolio Manager

David Rainey, CFACo-Portfolio Manager Ira Rothberg, CFACo-Portfolio Manager

Ira Rothberg, CFACo-Portfolio Manager Brian Macauley, CFACo-Portfolio ManagerRead the Commentary

Brian Macauley, CFACo-Portfolio ManagerRead the CommentaryThe Portfolio Managers rely on their strategy of owning durable, well-run businesses capable of turning adversity into opportunity and adapting to macroeconomic surprises. The following Hennessy Focus Fund Commentary recaps the 2025 market and highlights areas of opportunity ahead.

-

Portfolio Perspective

Portfolio Perspective

Focus FundFrom Rate Cuts to AI: Positioning the Portfolio for Potential Opportunity

David Rainey, CFACo-Portfolio Manager

David Rainey, CFACo-Portfolio Manager Ira Rothberg, CFACo-Portfolio Manager

Ira Rothberg, CFACo-Portfolio Manager Brian Macauley, CFACo-Portfolio ManagerRead the Commentary

Brian Macauley, CFACo-Portfolio ManagerRead the CommentaryThe Portfolio Managers discuss holdings that could potentially benefit from lower rates, tariffs, and artificial intelligence (AI). The team also provides an update on AST SpaceMobile and discusses potential opportunities in select Technology and Health Care companies.

-

Company Spotlight

Company Spotlight

Focus FundO’Reilly Automotive—Revved for Growth

David Rainey, CFACo-Portfolio Manager

David Rainey, CFACo-Portfolio Manager Ira Rothberg, CFACo-Portfolio Manager

Ira Rothberg, CFACo-Portfolio Manager Brian Macauley, CFACo-Portfolio ManagerRead the Spotlight

Brian Macauley, CFACo-Portfolio ManagerRead the SpotlightO’Reilly Automotive is a leader in the automotive aftermarket parts industry in the U.S. The company’s scale, unique distribution infrastructure, and customer service-oriented culture should allow it to take market share in a fragmented U.S. market for years to come.