Opportunities in Financials During the Coronavirus Outbreak

Portfolio Managers Dave Ellison and Ryan Kelley provide their thoughts on the impact of coronavirus on the Hennessy Large Cap Financial and Small Cap Financial Funds. They discuss banks’ strong financial position, valuations, and recent portfolio changes.

-

David EllisonPortfolio Manager

David EllisonPortfolio Manager -

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager

How are banks able to withstand the coronavirus crisis compared to the financial crisis?

Overall, banks are well positioned to withstand potential financial losses as compared to the financial crisis of 2008-09. Credit quality is strong, and capital positions are significantly higher. Since 2009, large banks have had to pass an annual stress test administered by the Federal Reserve by adhering to its strict compliance standards and maintaining high levels of capital. These measures have provided banks with the financial wherewithal to absorb a financial shock.

Looking ahead, non-performing loans (NPLs) may rise due to the economic shutdown, which could potentially impact smaller banks more than larger, diversified banks. However, banks are financially better able to handle these potential loan losses.

Additionally, we believe the Federal Reserve’s liquidity and the government’s assistance to individuals and companies will help mitigate bank losses from NPLs.

Would you please discuss current valuations in the Financials sector?

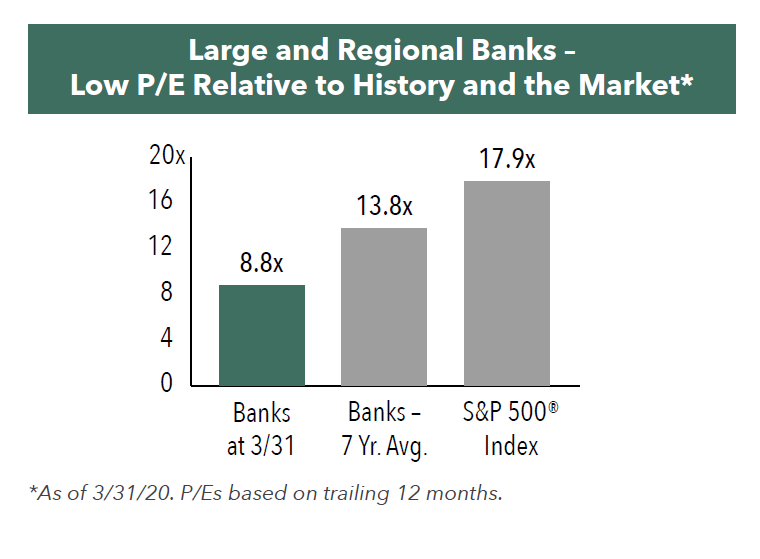

With the unusually large price swings in the Financials sector following the coronavirus outbreak, valuations varied significantly, seemingly on a daily basis throughout the first quarter. As a result, both large-cap and regional banks were trading at the lower range of valuations relative to both history and the broader S&P 500® Index:

• At the end of Q120, large and regional banks were trading 36% below their 7-year historical average price to earnings (P/E) ratio.

• Over the past few years, large and regional banks have traded at a discount of 20-25% to the broader market. By the end of the first quarter, they traded at close to a 50% discount to the S&P 500® Index.

How did volatility influence your investment decisions during the first quarter?

The extreme volatility in 1Q 2020 provided the opportunity to buy at exceptionally low valuations. However, these attractive prices were short-lived and, in some cases, lasted only a matter of hours. For example, as the market bottomed on March 23, 2020, valuations fell to some of the lowest levels in 30 years, with several banks trading below 0.5x book value and 5x earnings. A deep understanding of these banks gained over decades of investing in the Financials sector allowed us the confidence to quickly buy these short-lived opportunities.

Given the low interest rate environment following the Federal Reserve’s rate cuts, financial companies may face lower earnings, which will affect valuations. Even after factoring in lower earnings, the extreme price levels in March presented opportunity to invest in select high-quality companies with well-capitalized, well-structured balance sheets, a conservative lending culture and high-quality deposits.

What changes were made to the portfolios in Q1?

In the Hennessy Large Cap Financial Fund, we have increased exposure to regional banks that we believe have compelling valuations. Upon purchase, these mid-cap banks were particularly inexpensive relative to history and their book value. As a result, we have increased our banking industry weighting to about 2/3 of the portfolio from about 1/2 at 12/31/19.

In the Hennessy Small Cap Financial Fund, we have replaced a significant number of our positions with Usseveral high-quality banks and thrifts trading at significantly discounted valuations. For example, we purchased CIT Group, a regional bank, when the stock represented a tremendous value, trading less than 30% of its book value.

Payment processors comprise approximately 1/3 of the Large Cap Financial Fund. How did these companies perform relative to the overall Financials sector?

In the first quarter of 2020, the Fund’s payment processing companies performed well against the Russell 1000® Financial Services Index. These Fund holdings lost 22%, on average, compared to the Index, which fell 28% over the first quarter.

We believe these companies continue to present compelling opportunities as their operations are less tied to cyclical factors, such as gross domestic product growth or the movement of interest rates than banks. Additionally, consumers and corporations will likely continue to increasingly make payments with a credit or debit card, and network companies such as Visa and MasterCard, as well as integrated credit card providers such as American Express and Capital One Financial, should benefit from this growth.

- In this article:

- Financials

- Small Cap Financial Fund

- Large Cap Financial Fund

You might also like

-

Portfolio Perspective

Portfolio Perspective

Large Cap Financial FundSmall Cap Financial FundSolid Industry Fundamentals & Continued Consolidation

David EllisonPortfolio Manager

David EllisonPortfolio Manager Ryan C. Kelley, CFAChief Investment Officer and Portfolio ManagerRead the Commentary

Ryan C. Kelley, CFAChief Investment Officer and Portfolio ManagerRead the CommentaryPortfolio Managers Dave Ellison and Ryan Kelley review 2025 bank performance, fintech-driven consolidation, attractive valuations, and their constructive 2026 outlook.

-

Portfolio Perspective

Portfolio Perspective

Large Cap Financial FundSmall Cap Financial FundSeeking Innovation in the Financials Industry

David EllisonPortfolio Manager

David EllisonPortfolio Manager Ryan C. Kelley, CFAChief Investment Officer and Portfolio ManagerRead the Commentary

Ryan C. Kelley, CFAChief Investment Officer and Portfolio ManagerRead the CommentaryPortfolio Managers Dave Ellison and Ryan Kelley discuss what’s driving performance in the Hennessy Large Cap Financial Fund, how tariff increases affect banks, the interest rate environment, and the opportunities in financials.

-

Viewpoint

ViewpointNavigating the Financial Landscape in 2025

David EllisonPortfolio ManagerWatch the Video

David EllisonPortfolio ManagerWatch the VideoHennessy Funds Portfolio Manager Dave Ellison discusses the key drivers behind the financial sector's strong performance in 2024, the impact of potential rate cuts and regulatory changes, and the evolving landscape of banking in 2025. He also explores the challenges and opportunities facing both large and small banks, the role of AI, and the critical risks to watch, from traditional credit concerns to transformative technological shifts.