Opportunities for Growth in the Financials Sector

Portfolio Managers Dave Ellison and Ryan Kelley discuss performance and valuations within the Financials sector, buybacks, record merger and acquisition activity, and how investors may be underestimating the attractiveness of investing in banks.

-

David EllisonPortfolio Manager

David EllisonPortfolio Manager -

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager

Would you please discuss the performance within the Financials sector?

Financial stocks have performed very well relative to the overall market in 2021. While the Russell 1000® Index rose 15%, the Russell 1000® Index Financials increased 28%, and the KBW Bank Index of large and regional banks climbed 39% on a year-to-date basis as of 9/30/21.

In general, mid-cap banks have outperformed large-cap banks in 2021. Small- and mid-cap banks have been sought out as investors anticipate higher rates, stronger loan demand, and increased merger and acquisition (M&A) activity.

In addition, large investment firms, such as Goldman Sachs and Morgan Stanley, and credit card companies such as Capital One, have outperformed the overall Financials sector. Many of these firms were up 50% or more year-to-date through 10/14/21. Many traditional banks have also performed well, such as Wells Fargo which was up 52% over the same time frame on a total return basis. By comparison, transaction and payment processors, including PayPal, Square, Visa, and Mastercard, returned on average just 7% year-to-date as of 10/14/21.

We believe this performance gap illustrates the importance of active stock selection as we are able to pursue the best opportunities within the Financials sector for both of the Hennessy Financial Funds.

Given the sector’s exceptional YTD performance, how do valuations look?

Even with the recent rally in Financials, the sector continues to look attractive. Banks are trading at about half that of the overall market on a price-to-earnings (PE) basis: The S&P 500® traded at 21.6x 2021 estimated earnings while the KBW Bank Index traded at 11.3x estimated earnings as of 9/30/21. Over the past 10 years, regional banks' average PE ratio has been about 79% of the PE of the S&P 500®.

One reason for the relative discount is that stocks overall are in a period of exceptional earnings growth, yet bank earnings are growing at a slower pace. From 2019 to 2022 projections, aggregate earnings per share of the S&P 500® is expected to grow 13% per year. Earnings growth for banks, while positive, is expected to be substantially lower than the overall market at about 4% per year. Yet, in a steeper yield curve environment, we believe the Financials sector looks relatively more attractive as many other sectors appear to be priced to perfection due to their strong performance during the pandemic.

What is driving the continued stock buybacks and increased dividends in the sector?

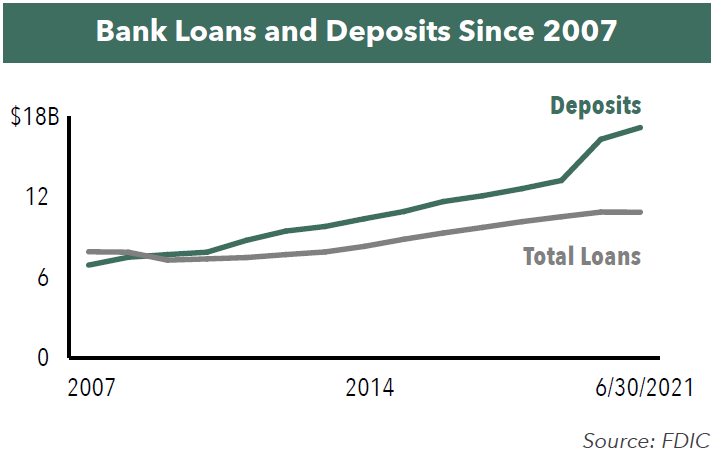

It’s been a challenging growth environment for banks over the past 15 years. Since 2007, total loans for all FDIC institutions (essentially Banks) in the U.S. have grown only 37%, yet deposits have grown 148%, which is almost four times as fast!

As capital continues to rise, banks can choose to pay a larger dividend or buy back stock. Once the U.S. enters a period of rising interest rates coupled with strong economic growth, we believe loan demand will increase. Until then, larger dividends and the stock buyback trend will likely continue.

Has this increased capital position driven bank M&A activity as well?

Yes. Without a steady increase in loans, banks have been looking for other opportunities to grow and compete with other banks and fintech companies.

Year-to-date through 9/30/21, there have been 161 acquisitions in the banking space. On an annualized basis, there could be around 215 transactions in 2021, which is lower than in past years. As a point of reference, from 2012 to 2019, 250 to 300 acquisitions were completed each year.

However, total deal value has been much more significant. As of the end of the third quarter of 2021, there has been $52 billion in total M&A deal value. At this pace, by the end of the year, it could total $70 billion—the highest since 2007. Unlike in past years where small banks were acquired, larger companies are being purchased in 2021. For example, U.S. Bancorp recently agreed to buy MUFG Union Bank’s core retail banking operations for $8 billion.

We believe M&A is critical for many smaller banks as they compete with larger banks and fintech companies to provide technological solutions for their customers. Some smaller banks do not have the capital to offer high-end digital products and services compared to their larger peers. We believe certain smaller banks will either need to bear the costs of implementing the technology themselves or consider being acquired.

How might investors be underestimating the attractiveness of investing in the Financials sector?

We believe investors may underestimate the significance that an uptick in interest rates could mean for the sector, especially for smaller banks. The net interest margin (NIM), which is the difference between income generated from loans and the cost of funds, is a fundamental part of a bank’s earnings stream. Approximately 75% to 80% of smaller banks’ revenues come from NIM. Therefore, if the U.S can achieve normalized rates, such as a Fed Funds rate of 1-2% and mortgage rates at 4-5%, it will likely result in significant profit growth. Notably, higher inflation than we’ve seen recently may force the Federal Reserve to increase rates, which should have a significant impact on margins.

In addition, banks remain financially healthy. From an asset quality perspective, in 2021, annualized net loan charge-offs at commercial banks were 29 basis points through 6/30/21, which is the lowest amount in at least 30 years.

- In this article:

- Financials

- Small Cap Financial Fund

- Large Cap Financial Fund

You might also like

-

Portfolio Perspective

Portfolio Perspective

Large Cap Financial FundSmall Cap Financial FundSolid Industry Fundamentals & Continued Consolidation

David EllisonPortfolio Manager

David EllisonPortfolio Manager Ryan C. Kelley, CFAChief Investment Officer and Portfolio ManagerRead the Commentary

Ryan C. Kelley, CFAChief Investment Officer and Portfolio ManagerRead the CommentaryPortfolio Managers Dave Ellison and Ryan Kelley review 2025 bank performance, fintech-driven consolidation, attractive valuations, and their constructive 2026 outlook.

-

Portfolio Perspective

Portfolio Perspective

Large Cap Financial FundSmall Cap Financial FundSeeking Innovation in the Financials Industry

David EllisonPortfolio Manager

David EllisonPortfolio Manager Ryan C. Kelley, CFAChief Investment Officer and Portfolio ManagerRead the Commentary

Ryan C. Kelley, CFAChief Investment Officer and Portfolio ManagerRead the CommentaryPortfolio Managers Dave Ellison and Ryan Kelley discuss what’s driving performance in the Hennessy Large Cap Financial Fund, how tariff increases affect banks, the interest rate environment, and the opportunities in financials.

-

Viewpoint

ViewpointNavigating the Financial Landscape in 2025

David EllisonPortfolio ManagerWatch the Video

David EllisonPortfolio ManagerWatch the VideoHennessy Funds Portfolio Manager Dave Ellison discusses the key drivers behind the financial sector's strong performance in 2024, the impact of potential rate cuts and regulatory changes, and the evolving landscape of banking in 2025. He also explores the challenges and opportunities facing both large and small banks, the role of AI, and the critical risks to watch, from traditional credit concerns to transformative technological shifts.