How The Election Outcome and COVID-19 Vaccine Could Affect Financials

Portfolio Managers Dave Ellison and Ryan Kelley discuss how a Democratic administration and a vaccine might affect financial stocks. They also provide their thoughts on current valuations and the attractiveness of payment processors.

-

David EllisonPortfolio Manager

David EllisonPortfolio Manager -

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager

How might a new administration impact the regulatory environment for banks?

Prior to the presidential election, the broader market had been concerned about a regulatory environment under a Democratic administration. However, the Federal Reserve has been maintaining strict policies for years, such as prohibiting large banks to increase dividends or pursue share buybacks until the end of 2020. Against this backdrop, we currently see little reason that the Fed would change its stance because of new presidential leadership.

Importantly, banks have been able to successfully operate in this strict regulatory environment, and we expect them to continue to do so regardless of who sits in the White House. We also expect the Fed to remain accommodative and provide liquidity to boost the economy

What effect would a COVID-19 vaccine have on the Financials sector?

We believe several factors could move bank stock prices higher:

• Vaccine Availability. While a widespread deployment of a COVID-19 vaccine would be encouraging for the market in general, we are enthusiastic about how beneficial it would be for financial stocks. With a distributed vaccine, the overall economy would likely improve and expand, allowing the Fed to resume its policy of interest rate normalization. Additionally, banks have been heavily setting aside reserves for potential future problem loans. We could see a boost to earnings in 2021 if this trend reverses due to an improving economic outlook.

• Higher Interest Rates. Rising rates will likely generate higher levels of inflation as well as improve banks’ net interest margins, which is the difference between income generated from loans and the cost of funds. A wider margin should improve the profitability of banks, especially smaller banks that have a larger percentage of revenue from net interest margins.

• Merger and Acquisition Activity. We anticipate a resurgence of merger and acquisition activity within the Financials sector, which has been backlogged for years. Bank management has been focused on increasing efficiencies to lower costs and drive earnings growth, and we believe more banks will choose to consolidate as the economy improves. There have already been a few deals announced, including PNC’s purchase of BBVA USA Bancshares for $11.6 billion, the second-biggest banking merger since the financial crisis.

Would you please discuss current valuations?

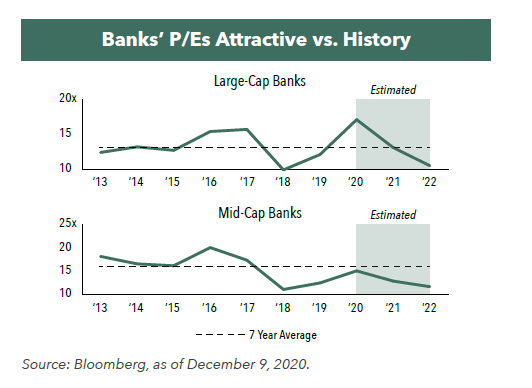

As of December 9, 2020, valuations remain compelling relative to their historical average. Large-cap banks, as measured by the KBW Bank Index, are trading at 13.1x 2021 earnings estimates and 10.5x 2022 earnings estimates, compared to a seven-year historical average of 13.1x.

Mid-cap banks, as measured by the KBW Regional Banking Index, currently trade at 12.9x 2021 earnings estimates and 11.7x 2022 earnings estimates, compared to a historical average of 16.0x.

Large-cap banks are trading at exceptionally compelling valuations when considering their potentially higher growth rates. It is estimated that large banks could experience 30% and 25% earnings growth, in 2021 and 2022 respectively, compared to their 8-year average post-financial crisis of 12%.

One reason for this discrepancy is the elevated level of loss reserves banks placed on their balance sheets in early 2020. The rapid onset of the COVID-19 pandemic spurred concerns of increased loan defaults, and banks responded by increasing their reserves. Because these losses have not yet materialized, banks may release these reserves to increase earnings, to buy back shares, and/or to increase dividends.

How might the pandemic permanently change payments trends?

Quarantine and social distancing measures have accelerated the awareness and adoption of online and contactless payments, as many Americans continue to work and stay at home. These trends are paving the way for alternative payment methods and payment processors to enter the market and/or gain market share. Many of the Hennessy Large Cap Financial Fund non-bank holdings have benefited from this trend, including Square, Apple, and PayPal.

We believe these trends will continue post-pandemic and that the longer-term growth trajectory for these companies remains strong.

- In this article:

- Financials

- Large Cap Financial Fund

- Small Cap Financial Fund

You might also like

-

Portfolio Perspective

Portfolio Perspective

Large Cap Financial FundSmall Cap Financial FundSolid Industry Fundamentals & Continued Consolidation

David EllisonPortfolio Manager

David EllisonPortfolio Manager Ryan C. Kelley, CFAChief Investment Officer and Portfolio ManagerRead the Commentary

Ryan C. Kelley, CFAChief Investment Officer and Portfolio ManagerRead the CommentaryPortfolio Managers Dave Ellison and Ryan Kelley review 2025 bank performance, fintech-driven consolidation, attractive valuations, and their constructive 2026 outlook.

-

Portfolio Perspective

Portfolio Perspective

Large Cap Financial FundSmall Cap Financial FundSeeking Innovation in the Financials Industry

David EllisonPortfolio Manager

David EllisonPortfolio Manager Ryan C. Kelley, CFAChief Investment Officer and Portfolio ManagerRead the Commentary

Ryan C. Kelley, CFAChief Investment Officer and Portfolio ManagerRead the CommentaryPortfolio Managers Dave Ellison and Ryan Kelley discuss what’s driving performance in the Hennessy Large Cap Financial Fund, how tariff increases affect banks, the interest rate environment, and the opportunities in financials.

-

Viewpoint

ViewpointNavigating the Financial Landscape in 2025

David EllisonPortfolio ManagerWatch the Video

David EllisonPortfolio ManagerWatch the VideoHennessy Funds Portfolio Manager Dave Ellison discusses the key drivers behind the financial sector's strong performance in 2024, the impact of potential rate cuts and regulatory changes, and the evolving landscape of banking in 2025. He also explores the challenges and opportunities facing both large and small banks, the role of AI, and the critical risks to watch, from traditional credit concerns to transformative technological shifts.