Compelling Valuations in Japan

Japanese equities are currently trading at compelling valuation levels compared to other developed equity markets around the world and relative to their own historical averages. We believe the Japanese market deserves a closer look.

-

Masakazu Takeda, CFA, CMAPortfolio Manager

Masakazu Takeda, CFA, CMAPortfolio Manager -

Angus Lee, CFAPortfolio Manager

Angus Lee, CFAPortfolio Manager -

Tadahiro Fujimura, CFA, CMAPortfolio Manager

Tadahiro Fujimura, CFA, CMAPortfolio Manager -

Takenari Okumura, CMAPortfolio Manager

Takenari Okumura, CMAPortfolio Manager

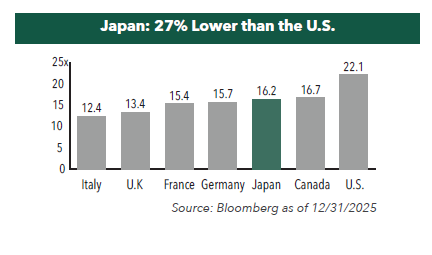

1. Attractive Price-to-Earnings Multiple

The price-to-earnings multiple, or P/E ratio, is the most common measure used to value equities. Japanese large-cap equities, as represented by the Tokyo Price Index (TOPIX), are currently trading on a P/E multiple of 16.2x 2026 forward earnings, 27% lower than the U.S.

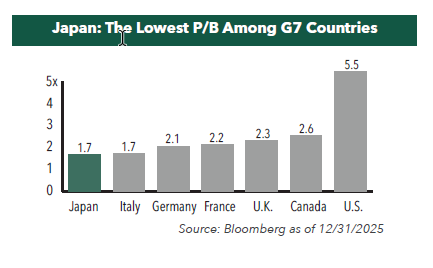

2. Low Price-to-Book

On a price-to-book basis (P/B), Japanese equities are also offering investors great value compared with other global developed equity markets. TOPIX is trading at just 1.7x book value, about a third lower than the average among the top developed equity markets and more than two-thirds lower than the U.S.

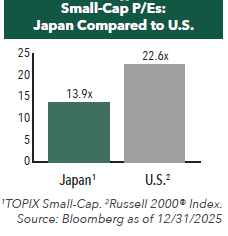

3. Japan Small-Caps at a Discount

Small-cap Japanese companies are also trading at a discount to international peers. Small-cap stocks in Japan are trading on just 13.9x 2026 forward earnings, and as a point of reference, a 38% discount to U.S. small caps trading at 22.6x.

4. Japan’s Attractive P/E Relative to History

Summary

We believe Japan’s growth story is just starting to unfold. Following the advent of Abenomics, many Japanese companies are experiencing higher profitability due to corporate restructuring, better governance, and a more competitive currency. With Japanese equities currently offering attractive valuations compared to G7 developed country equity markets and relative to history, we believe Japan deserves a closer look as a component of an investor’s portfolio.

- In this article:

- Japan

- Japan Fund

- Japan Small Cap Fund

You might also like

-

Portfolio Perspective

Portfolio Perspective

Japan Small Cap FundJapanese Small-Caps’ Earnings Resilience and Improving Returns on Capital

Takenari Okumura, CMAPortfolio Manager

Takenari Okumura, CMAPortfolio Manager Tadahiro Fujimura, CFA, CMAPortfolio ManagerRead the Commentary

Tadahiro Fujimura, CFA, CMAPortfolio ManagerRead the CommentaryIn the following commentary, the Portfolio Managers cover small-cap outperformance drivers, pro-growth fiscal policy, governance reform, yen volatility, portfolio repositioning, profitability and capital efficiency trends, valuation gaps, and their 2026 outlook.

-

Portfolio Perspective

Portfolio Perspective

Japan FundA Differentiated Portfolio Focused on Margin of Safety and Upside Potential

Masakazu Takeda, CFA, CMAPortfolio Manager

Masakazu Takeda, CFA, CMAPortfolio Manager Angus Lee, CFAPortfolio ManagerRead the Commentary

Angus Lee, CFAPortfolio ManagerRead the CommentaryThe Portfolio Managers summarize the significant events that drove markets over 2025 and how the Fund remains focused on quality, capital discipline, and valuation, with a clear preference for stock picking over index exposure.

-

Investment Idea

Investment IdeaWhy Active Matters When Investing in Japan

Masakazu Takeda, CFA, CMAPortfolio Manager

Masakazu Takeda, CFA, CMAPortfolio Manager Angus Lee, CFAPortfolio Manager

Angus Lee, CFAPortfolio Manager Tadahiro Fujimura, CFA, CMAPortfolio Manager

Tadahiro Fujimura, CFA, CMAPortfolio Manager Takenari Okumura, CMAPortfolio ManagerRead the Investment Idea

Takenari Okumura, CMAPortfolio ManagerRead the Investment IdeaWhen investing in Japanese businesses, we believe it is imperative to select a manager who is immersed in the culture and can perform in-depth, company-specific research to build a concentrated portfolio of Japanese companies that can outperform a benchmark and weather volatility.