A Focus on Japanese Small-Caps Making Big Corporate Improvements

The Portfolio Managers discuss their view of the Japanese small-cap corporate landscape amid many shifting factors, including a new Prime Minister, finalized tariff situation, currency volatility, and attractive valuation environment.

-

Takenari Okumura, CMAPortfolio Manager

Takenari Okumura, CMAPortfolio Manager -

Tadahiro Fujimura, CFA, CMAPortfolio Manager

Tadahiro Fujimura, CFA, CMAPortfolio Manager

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by viewing the fact sheet or by clicking here.

Key Takeaways

» We believe the government’s emphasis on economic growth is positive for Japan’s economy and domestic companies.

» We have been more intentionally balancing stocks that could either benefit from yen strength or weakness in an effort to reduce currency risk.

» Business improvements in capital efficiency are progressing primarily by companies analyzing surplus assets and reforming business portfolios through withdrawal from unprofitable operations and fixed cost reductions.

» Although Japanese small-cap stocks have outperformed their large-cap peers year-to-date, valuations remain discounted on both price-to-earnings (P/E) and price-to-book (P/B) metrics relative to large-caps.

» Japan’s move from deflation to inflation, along with corporate governance reforms, is boosting corporate capital efficiency, and our ongoing bottom-up research continues to uncover tangible progress in corporate awareness and structural reform.

What is driving the YTD outperformance of the Russell/Nomura Small Cap™ Index over the TOPIX and how does the Hennessy Japan Small Cap Fund compare?

The main factors behind this year’s outperformance of small-cap stocks are:

1. Small-cap companies faced less impact from yen appreciation and tariffs compared with large-cap stocks.

2. An increasing number of companies implementing corporate governance reforms.

3. More attractive valuations relative to large-cap stocks.

In particular, regarding corporate governance reforms, activist investor activity has contributed to share price rises in companies that have shifted towards improving capital efficiency. However, when viewed across the entire small-cap market, these changes have only just begun. Corporate governance reform is a structural change within Japan’s economy and is considered inevitable as the country fully transitions into an inflationary environment.

We are pleased in this environment, the Fund has outperformed both indices on a year-to-date and 1-year basis through September 30, 2025. In 2025, the Fund (HJSIX) has increased 28.97% through the third quarter while the Russell/Nomura Small Cap™ Index has returned 27.22% and the TOPIX has gained 22.68%. Over the one-year period ended September 30, 2025, HJSIX rose 28.34% against the Russell/Nomura Small Cap™ Index’s 19.90% and the 17.73% return of the TOPIX.

With the resignation of Prime Minister Shigeru Ishiba, how might a new Prime Minister’s policies affect domestic companies in Japan?

In the Liberal Democratic Party (LDP) leadership election, former Economic Security Minister Sanae Takaichi is highly likely to be elected Prime Minister, and if so, will become Japan’s first female prime minister. Takaichi inherits the economic policy framework of former Prime Minister Shinzo Abe’s “Abenomics,” centered on bold monetary easing and flexible fiscal policy. Compared with Shigeru Ishiba, who emphasized fiscal reconstruction, her leadership represents a shift towards growth-oriented economic policies.

However, lingering concerns persist over deteriorating fiscal conditions, accelerated inflation, and doubts over the ruling party’s limited ability to enact policy due to their minority status. As of the beginning of October, information immediately after the leadership election is limited in predicting future governance. Nevertheless, we believe the emphasis on economic growth as a positive development for both Japan’s economy and domestic companies.

How does currency volatility factor into the Fund’s risk management and stock selection?

As a basic approach, we construct the Fund’s portfolio around stocks that are neutral to, or less affected by exchange rate fluctuations. However, given the recent rise in currency volatility, we have been more consciously balancing the weighting of stocks that could benefit from yen appreciation and those that are poised to benefit from yen depreciation, thereby reducing overall currency risk.

With the U.S.-Japan tariff policy finalized, what type of domestic companies in Japan could be positively or negatively impacted?

The tariff agreement has been broadly welcomed across industries. Tariff rates were kept lower than initially expected, reducing future uncertainty. As a result, Japanese corporate sentiment has clearly improved compared with the third quarter period. Business sentiment in the manufacturing sector—particularly among automakers as shown above—has improved significantly. With strong demand for hybrid electric vehicles (HEVs), a further recovery in performance is expected.

What significant changes were made to the portfolio in 3Q25?

We initiated new investments in the manufacturing sector, which have become more attractively valued. Within domestic demand-oriented stocks, we took profits on consumer-related names while reallocating to companies expected to see profitability improvement ahead. From a governance perspective, we sold stocks that had already been revalued upward following corporate actions and reinvested in underappreciated names with renewed potential for governance improvement.

Would you please explain your hypothesis on polarizing consumption and companies that could benefit from this trend?

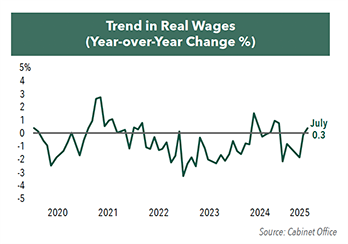

With wage growth starting to catch up to inflation, real wages are approaching positive territory, which we believe will help revive long-stagnant consumer sentiment, supporting a constructive stance on consumption overall. At the same time, consumers are becoming increasingly selective in their spending behavior in response to the inflationary environment.

People tend to economize on essential goods—through private brands or discount stores—while continuing to spend freely on discretionary categories such as travel or branded fashion. This reflects polarization not only between high- and low-income consumers but also within individuals’ spending habits across product and service categories. As consumption becomes more polarized, differences in corporate strategies are more directly reflected in earnings performance, making this a market environment that truly tests stock selection capabilities.

How do valuations of Japanese small-cap companies compare, currently and historically, to large-cap stocks in Japan? What might cause this gap to narrow?

Although small-cap stocks in Japan have outperformed their Japanese large-cap peers year-to-date, valuations remain discounted on both P/E and P/B metrics relative to large-caps. One factor behind this is that large-cap companies have higher exposure to external demand and, therefore, are more affected by currency and U.S. tariff fluctuations.

While it is difficult to predict how the P/E gap will evolve given differing exchange-rate sensitivities, the P/B discount is likely to narrow over time. As corporate governance reforms drive improvement in small-cap companies’ capital efficiency, their valuations should gradually converge toward those of large-caps.

What are your expectations for Japanese small cap companies as we enter 2026?

The shift from deflation to inflation, together with the momentum behind corporate governance reform, represents a critical structural transformation driving improvements in Japan’s corporate capital efficiency. While some companies are being pushed to change under activist pressure, many others are initiating reforms proactively through leadership changes and evolving management mindsets.

The expectations for fiscal expansion under the new administration come with the risk of fiscal deterioration and should not be overly anticipated. That said, we believe Japan’s economic recovery and structural transformation of Japanese companies toward an inflationary era are progressing irreversibly. While operating environments, financial conditions, and decision-making speeds differ across companies, our ongoing bottom-up research continues to uncover tangible progress in corporate awareness and structural reform. We remain focused on identifying compelling investment opportunities and delivering sustainable returns over the medium to long term.

- In this article:

- Japan

- Japan Small Cap Fund

You might also like

-

Portfolio Perspective

Portfolio Perspective

Japan Small Cap FundJapanese Small-Caps’ Earnings Resilience and Improving Returns on Capital

Takenari Okumura, CMAPortfolio Manager

Takenari Okumura, CMAPortfolio Manager Tadahiro Fujimura, CFA, CMAPortfolio ManagerRead the Commentary

Tadahiro Fujimura, CFA, CMAPortfolio ManagerRead the CommentaryIn the following commentary, the Portfolio Managers cover small-cap outperformance drivers, pro-growth fiscal policy, governance reform, yen volatility, portfolio repositioning, profitability and capital efficiency trends, valuation gaps, and their 2026 outlook.

-

Portfolio Perspective

Portfolio Perspective

Japan FundA Differentiated Portfolio Focused on Margin of Safety and Upside Potential

Masakazu Takeda, CFA, CMAPortfolio Manager

Masakazu Takeda, CFA, CMAPortfolio Manager Angus Lee, CFAPortfolio ManagerRead the Commentary

Angus Lee, CFAPortfolio ManagerRead the CommentaryThe Portfolio Managers summarize the significant events that drove markets over 2025 and how the Fund remains focused on quality, capital discipline, and valuation, with a clear preference for stock picking over index exposure.

-

Investment Idea

Investment IdeaCompelling Valuations in Japan

Masakazu Takeda, CFA, CMAPortfolio Manager

Masakazu Takeda, CFA, CMAPortfolio Manager Angus Lee, CFAPortfolio Manager

Angus Lee, CFAPortfolio Manager Tadahiro Fujimura, CFA, CMAPortfolio Manager

Tadahiro Fujimura, CFA, CMAPortfolio Manager Takenari Okumura, CMAPortfolio ManagerRead the Investment Idea

Takenari Okumura, CMAPortfolio ManagerRead the Investment IdeaJapanese equities are currently trading at compelling valuation levels compared to other developed equity markets around the world and relative to their own historical averages. We believe the Japanese market deserves a closer look.