How Japan's Economic Recovery Could Benefit Smaller Companies

The Portfolio Managers of the Hennessy Japan Small Cap Fund discuss the portfolio, their positive outlook on smaller Japanese stocks, and how they believe the recovery of the domestic economy will benefit small and mid-cap stocks.

-

Tadahiro Fujimura, CFA, CMAPortfolio Manager

Tadahiro Fujimura, CFA, CMAPortfolio Manager -

Takenari Okumura, CMAPortfolio Manager

Takenari Okumura, CMAPortfolio Manager

How is the Fund positioned to take advantage of Japan’s GDP growth?

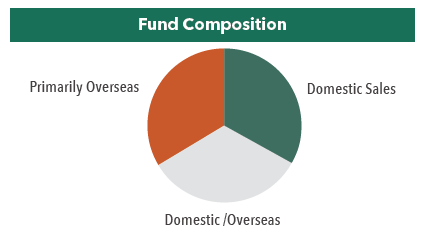

Roughly dividing the portfolio, one-third of the companies rely purely on domestic sales, one-third of the companies have primarily domestic sales as well as some overseas sales, and the remaining one-third mainly rely on overseas sales. In other words, more than 50% of the portfolio is domestic sales.

We believe that small- and mid-cap stocks generally have more domestic sales than large-cap stocks, so they are more likely to benefit from Japan’s GDP growth. In the Hennessy Japan Small Cap Fund, there are more companies with overseas growth expectations than the benchmark. We invest in many companies that can be expected to grow both through overseas sales and the domestic economic growth.

Would you please discuss how the weaker Japanese Yen is affecting smaller Japanese companies?

Given the composition of the Fund, the depreciation of the Yen will likely benefit Japanese manufacturing in the future. We believe the portfolio will benefit from the depreciation of the Yen even more than the benchmark. Japanese companies that used to produce their products overseas are moving back to domestic production, and there is a movement to look for domestic suppliers again. We believe that small and medium-sized manufacturing companies that have not been overseas until now will benefit in the future. In addition, we believe that capital investment and construction investment will recover on the domestic manufacturing industry returns.

How has the recent pullback in the market changed the Fund’s watchlist?

Japanese stocks have not adjusted as much as the U.S., so there is not much change to the Fund’s watchlist. We would like to invest in companies with undervalued stocks that will benefit from the recovery of the Japanese economy and the return of the manufacturing industry. On the other hand, growth stocks, which are already overvalued, are sluggish overall in Japan, partly due to the impact of the NASDAQ. We see this as an opportunity to find good companies at discounted prices.

What sectors or types of companies currently look the most/least attractive in the current environment?

We believe automobile-related industries are attractive investment destinations in anticipation of future recovery in the construction, capital investment-related, and the automobile production industries.

On the other hand, inflation is accelerating due to rising raw material and fuel prices and the impact of the weaker Yen. Therefore, we are cautiously watching domestic consumption-related companies, which have not made progress in passing on costs to their products.

In addition, we are cautiously considering Internet-related companies that have received too much benefit from the impact of COVID-19, as there is concern that the benefits of the pandemic may fade away.

With manufacturing excellence a strength of Japan, how are these smaller manufacturing companies incorporated into the portfolio?

With the support of a weaker Yen, we think domestic production will recover. Therefore, we believe the demand for renewal of aging factories and equipment will increase, so we are investing in machinery stocks that are strong in small and medium-sized factories. We are also focusing on construction-related and parts processing companies.

Would you please discuss any notable deletions from the portfolio over the past quarter?

Since we would like to reduce the risks associated with investing in China, we sold a machine manufacturer that has a high proportion of sales in China. In addition, the company’s performance was driven by the machinery used to manufacture smartphones, but the maturity of the smartphone market in the future has eroded room for further growth.

Would you please provide an outlook for the Fund for the rest of the year.

The Fund was still unable to demonstrate the momentum of the recovery in performance despite the weak Yen in the Japanese manufacturing industry due to parts shortages and lockdowns in China. In addition, Japan’s relatively strict measures against the coronavirus also contributed to the relative delay in the recovery of the domestic economy.

We believe we will see a full-fledged recovery in the second half of this year. The recovery of the domestic economy will greatly benefit small and medium-cap stocks, and we have a positive outlook for Japanese stocks as a whole, and an even brighter outlook for small and mid-cap stocks

- In this article:

- Japan

- Japan Small Cap Fund

You might also like

-

Investment Idea

Investment IdeaCompelling Valuations in Japan

Masakazu Takeda, CFA, CMAPortfolio Manager

Masakazu Takeda, CFA, CMAPortfolio Manager Angus Lee, CFAPortfolio Manager

Angus Lee, CFAPortfolio Manager Tadahiro Fujimura, CFA, CMAPortfolio Manager

Tadahiro Fujimura, CFA, CMAPortfolio Manager Takenari Okumura, CMAPortfolio ManagerRead the Investment Idea

Takenari Okumura, CMAPortfolio ManagerRead the Investment IdeaJapanese equities are currently trading at compelling valuation levels compared to other developed equity markets around the world and relative to their own historical averages. We believe the Japanese market deserves a closer look.

-

Investment Idea

Investment IdeaWhy Active Matters When Investing in Japan

Masakazu Takeda, CFA, CMAPortfolio Manager

Masakazu Takeda, CFA, CMAPortfolio Manager Angus Lee, CFAPortfolio Manager

Angus Lee, CFAPortfolio Manager Tadahiro Fujimura, CFA, CMAPortfolio Manager

Tadahiro Fujimura, CFA, CMAPortfolio Manager Takenari Okumura, CMAPortfolio ManagerRead the Investment Idea

Takenari Okumura, CMAPortfolio ManagerRead the Investment IdeaWhen investing in Japanese businesses, we believe it is imperative to select a manager who is immersed in the culture and can perform in-depth, company-specific research to build a concentrated portfolio of Japanese companies that can outperform a benchmark and weather volatility.

-

Portfolio Perspective

Portfolio Perspective

Japan Small Cap FundA Focus on Japanese Small-Caps Making Big Corporate Improvements

Takenari Okumura, CMAPortfolio Manager

Takenari Okumura, CMAPortfolio Manager Tadahiro Fujimura, CFA, CMAPortfolio ManagerRead the Commentary

Tadahiro Fujimura, CFA, CMAPortfolio ManagerRead the CommentaryThe Portfolio Managers discuss their view of the Japanese small-cap corporate landscape amid many shifting factors, including a new Prime Minister, finalized tariff situation, currency volatility, and attractive valuation environment.