Growth Opportunities in Smaller Japanese Companies

Portfolio Manager Tad Fujimura shares his thoughts on Japanese stock valuations, structural reform progress, and the best way for investors to gain exposure to Japanese small-cap stocks.

-

Tadahiro Fujimura, CFA, CMAPortfolio Manager

Tadahiro Fujimura, CFA, CMAPortfolio Manager

Following the recent decline in Japanese stock prices, would you comment on the current valuation levels of small-cap stocks? How do valuations of small-cap stocks compare to those of large-caps?

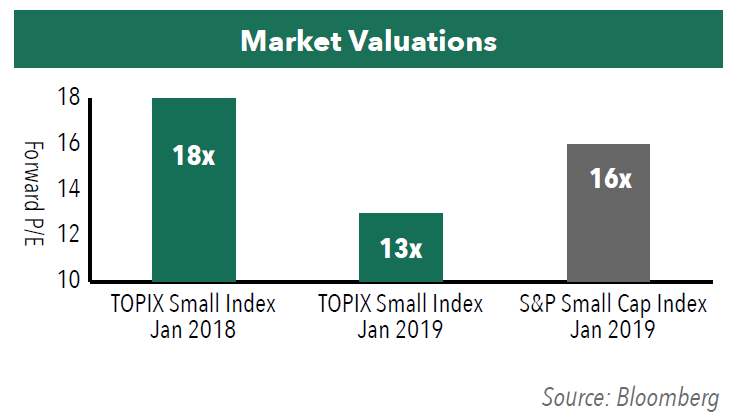

We believe current valuation levels of small-cap stocks in Japan look attractive. As of January 2019, small-cap stocks are trading at 13x forward earnings, below their five-year average of 15x, and down from almost 18x at the start of 2018. From a comparative standpoint, U.S. small-caps, as measured by the S&P Small Cap Index, currently trade at 16x forward earnings.

Japanese small-cap stocks also look attractive relative to Japanese large-cap stocks, trading at just a small premium while offering the opportunity for faster earnings growth.

Would you please give us an update on progress with structural reforms?

The Japanese government made good progress with structural reforms in 2018, especially with labor market reforms. New rules were aimed at reducing the long hours worked in Japan, seen as the primary cause of the country’s low labor productivity. Reforms passed in 2018 included:

- Pay for performance. Professionals will now be paid on merit rather than hours worked.

- Limits on overtime. Overtime work has been formally capped at 100 hours per month.

- Equal pay for equal work. The pay gap between contract employees and full-time employees for equivalent work is being narrowed.

- Immigration. Low-skilled foreign workers will be allowed entry into Japan beginning in April 2019. This legislation should be especially beneficial to the construction, restaurant, and nursing care industries which are currently experiencing acute labor shortages.

Other reforms were also passed in 2018, including a revised corporate governance code, which calls for clear management succession plans, greater diversity in the boardroom, and further reduction of cross-shareholdings.

With consumer confidence drifting lower over the past year and Japan’s sales tax set to increase this year, what is your outlook for consumption growth in 2019?

We believe consumption was temporarily depressed last year by several natural disasters, including an earthquake and typhoon. An increase in the gasoline price as a result of the weaker yen and high oil price also impacted consumer spending. With the labor market continuing to improve, and employment levels very high, we expect that consumer spending will bounce back in 2019.

The planned October 2019 consumption tax increase from 8% to 10% will be offset by other tax breaks and exemptions on frequently purchased consumer products, such as groceries, and therefore, we expect the impact on economic growth will be small.

How dependent are the Fund’s holdings on the domestic Japanese economy?

Approximately 40% of the Fund is invested in stocks with purely domestic exposure. Another 25% is invested in stocks with a preponderance of overseas exposure. The balance, or 35%, is invested in stocks with a blend of domestic and overseas exposure.

What is your outlook for the Japanese markets heading into 2019?

We are optimistic about the outlook for Japanese equities and especially small-cap stocks in the coming year. We believe corporate earnings for small to mid-cap companies have room to grow as a result of the return to a more normal inflationary environment, thereby giving companies the ability to raise prices. In addition, deregulation, higher standards of corporate governance, and a new emphasis on return on investment is creating growth opportunities for agile, smaller companies.

- In this article:

- Japan

- Japan Small Cap Fund

You might also like

-

Portfolio Perspective

Portfolio Perspective

Japan Small Cap FundJapanese Small-Caps’ Earnings Resilience and Improving Returns on Capital

Takenari Okumura, CMAPortfolio Manager

Takenari Okumura, CMAPortfolio Manager Tadahiro Fujimura, CFA, CMAPortfolio ManagerRead the Commentary

Tadahiro Fujimura, CFA, CMAPortfolio ManagerRead the CommentaryIn the following commentary, the Portfolio Managers cover small-cap outperformance drivers, pro-growth fiscal policy, governance reform, yen volatility, portfolio repositioning, profitability and capital efficiency trends, valuation gaps, and their 2026 outlook.

-

Portfolio Perspective

Portfolio Perspective

Japan FundA Differentiated Portfolio Focused on Margin of Safety and Upside Potential

Masakazu Takeda, CFA, CMAPortfolio Manager

Masakazu Takeda, CFA, CMAPortfolio Manager Angus Lee, CFAPortfolio ManagerRead the Commentary

Angus Lee, CFAPortfolio ManagerRead the CommentaryThe Portfolio Managers summarize the significant events that drove markets over 2025 and how the Fund remains focused on quality, capital discipline, and valuation, with a clear preference for stock picking over index exposure.

-

Investment Idea

Investment IdeaCompelling Valuations in Japan

Masakazu Takeda, CFA, CMAPortfolio Manager

Masakazu Takeda, CFA, CMAPortfolio Manager Angus Lee, CFAPortfolio Manager

Angus Lee, CFAPortfolio Manager Tadahiro Fujimura, CFA, CMAPortfolio Manager

Tadahiro Fujimura, CFA, CMAPortfolio Manager Takenari Okumura, CMAPortfolio ManagerRead the Investment Idea

Takenari Okumura, CMAPortfolio ManagerRead the Investment IdeaJapanese equities are currently trading at compelling valuation levels compared to other developed equity markets around the world and relative to their own historical averages. We believe the Japanese market deserves a closer look.