CIO Year in Review: Why Long-Term Investors Remain Bullish

Chief Investment Officer, Ryan Kelley, summarizes a look back over a volatile 2022 and reinforces that time in the market can smooth out the choppy markets, and he believes the outlook for U.S. stocks remains positive.

-

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager

What a year it has been. By the close of the second trading day of 2022, we witnessed new all-time highs in both the S&P 500® Index and the Dow Joens Industrial Average, while the NASDAQ Composite Index hits an all-time high in November 2021. The market's triumph was short-lived, however. By the last day of our fiscal year on October 31, 2022, all three major indices were down significantly, with bleak year-to-date total returns of -8.42%, -17.70%, and -29.32% for the Dow, the S&P 500, and the NASDAQ respectively. After almost 13 years of incredible resilience following the Financial Crisis of 2008, the equity markets have been shaken by stinging inflation, rapidly rising interest rates, soaring energy costs, and slowing economic growth teetering on recession. While many investors would like to forget 2022, we prefer to maintain perspective in this market downturn.

We believe time is on our side... when it comes to investing. Experiencing negative market movements on any given day can seem disappointing. Downdrafts lasting a month can feel relentless. Almost a full year of negative returns with little respite along the way? That is downright painful. However, equities generally trend up and to the right. Over the past 100 calendar years, the Dow had an average annual total return of 10.25%. While we admit that long-term returns like these make it easy to be a “consummate bull,” market bulls have been right over the long-term. Yet over shorter periods, market returns can be “choppy.”

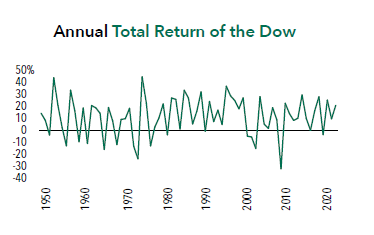

Looking at the chart below depicting annual total returns of the Dow Jones Industrial Average from 1950 to 2021, we see how volatile the market can be on an annual basis.Investors experienced 16 years of negative returns during this time, the most painful being -31.93% in 2008.

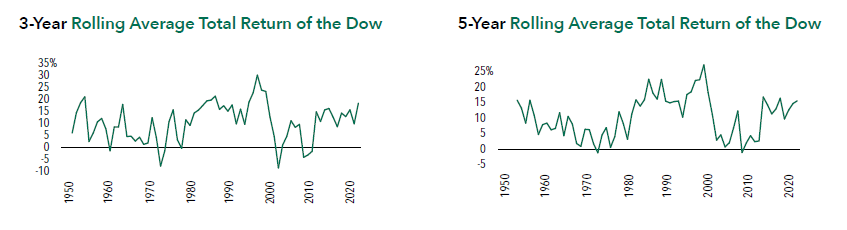

Time is what smooths out choppy markets. When we extend our investing intervals and stop focusing on annual returns, the ups and downs feel less and less—and appear less and less. The two charts below depict the three-year and five-year rolling average total returns of the Dow over the same time period as the chart above. Each chart shows decreased volatility, with lower peaks and higher troughs, even though the charts show the same cumulative return of the Dow over the past 71 full calendar years.

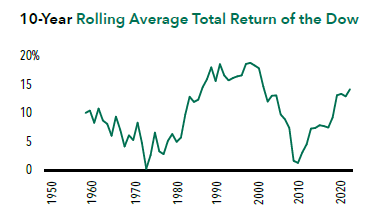

When we extend our chart out to ten-year rolling averages, we can clearly see how investing over the long term can make an investor bullish. In the past 71 years, there has never been a negative 10-year rolling average total return of the Dow.

Never. The worst ten-year rolling average total return was a positive 0.29%, from 1965 to 1974, a period including the Great

Inflation of the 1970s marked by dismal total returns of -13.28% in 1973 and -23.58% in 1974. The ten-year period from

2000 to 2009, which included both the bursting of the dot-com bubble in 2000 and the Financial Crisis of 2008, produced a

positive average annual total return of 1.31%. Note that in the chart below, the line never crosses below zero.

When it comes to investing, time, time, time… is on our side, yes, it is! This is why we invest for the long-term at Hennessy,

focusing on fundamentals, valuations, and strong businesses, ever mindful of downside risk.

Notwithstanding a difficult market environment over the last twelve months, we believe that the outlook for U.S. stocks remains positive. We continue to believe that equities are attractive from a valuation standpoint, even as interest rates rise. We believe that the prospect of slower economic growth may dampen inflationary pressures. While the Federal Reserve has raised rates several times in calendar 2022, we believe tempered inflation will allow the Federal Reserve to take a more neutral stance toward future rate hikes. The unemployment rate is near record lows, there are elevated levels of cash on the balance sheets of U.S. companies, and there is the prospect of a more dovish Federal Reserve in 2023. While volatility and uncertainty may continue to impact the markets in the short term, we encourage investors to stay the course, maintain a diversified portfolio, and keep a long-term perspective.

We thank you for your continued interest in our Funds, and we are grateful for your trust.

- In this article:

- Overall Market

- Cornerstone Growth Fund

- Focus Fund

- Cornerstone Mid Cap 30 Fund

- Cornerstone Large Growth Fund

- Cornerstone Value Fund

- Total Return Fund

- Equity and Income Fund

- Balanced Fund

- Energy Transition Fund

- Midstream Fund

- Gas Utility Fund

- Japan Fund

- Japan Small Cap Fund

- Large Cap Financial Fund

- Small Cap Financial Fund

- Technology Fund

You might also like

-

Market Outlook

Market OutlookStaying Disciplined, Finding Opportunity

Ryan C. Kelley, CFAChief Investment Officer and Portfolio ManagerRead the Commentary

Ryan C. Kelley, CFAChief Investment Officer and Portfolio ManagerRead the CommentaryAgainst a backdrop of dominance of large-cap technology companies and artificial intelligence (AI), Ryan Kelley, Chief Investment Officer, shares his views on compelling opportunities that offer a favorable setup for long-term investors.

-

Market Outlook

Market OutlookThe More Things Change, the More They Trade the Same

Neil J. HennessyChief Market Strategist and Portfolio ManagerRead the Commentary

Neil J. HennessyChief Market Strategist and Portfolio ManagerRead the CommentaryAlmost 50 years in the market taught me one truth: the headlines change, the patterns don’t.

-

Market Outlook

Market OutlookHennessy Funds 2025 CIO Roundtable

Neil J. HennessyChief Market Strategist and Portfolio Manager

Neil J. HennessyChief Market Strategist and Portfolio Manager Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager Ben Cook, CFAPortfolio Manager

Ben Cook, CFAPortfolio Manager Masakazu Takeda, CFA, CMAPortfolio ManagerRead the Commentary

Masakazu Takeda, CFA, CMAPortfolio ManagerRead the CommentaryHennessy Funds’ Portfolio Managers recently gathered for our annual CIO Roundtable. For the 11th year in a row, they discussed the latest market trends, shared insights, and explored strategies for navigating the ever-changing investment landscape.