The Power of Mid-Caps

We believe U.S. mid-cap companies offer untapped potential for investors. With many small- and large-cap funds extending their reach to the mid-cap space, some investors may assume they have covered all asset classes with an allocation to only small- and large-cap stocks, perhaps neglecting mid-caps altogether. Investors could be missing out on the power of a mid-cap allocation.

-

Neil J. HennessyChief Market Strategist and Portfolio Manager

Neil J. HennessyChief Market Strategist and Portfolio Manager -

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager -

L. Joshua Wein, CAIAPortfolio Manager

L. Joshua Wein, CAIAPortfolio Manager

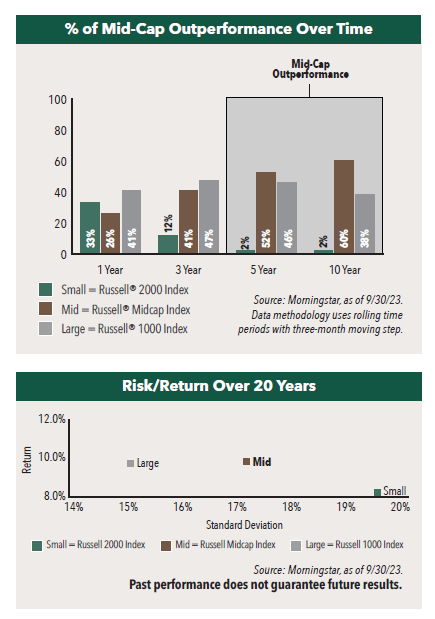

Mid Caps Dominate in Long-Term Performance

In any given 1-year rolling period since 2003, small-, mid-, and large-cap stocks have outperformed 33%, 26%, and 41% of the time. However, the longer mid-cap stocks are held, the more often they outperformed. In fact, 60% of the time, mid-caps outperformed small- and large-cap stocks over any 10-year rolling period in the past 20 years.

Lower Volatility, Better Risk-Adjusted Performance

Not only have mid-cap stocks generated higher absolute returns over a longer time frame, they have also provided these returns with less associated risk. Over the 20-year period ended 9/30/23, investors in mid-caps have experienced higher returns and lower risk relative to investors in small-caps. In addition, while mid-caps had more risk than large-caps, investors have been rewarded with a higher return over the same period.

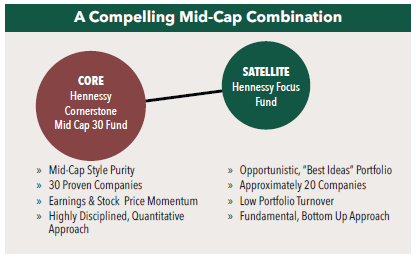

Hennessy Funds’ “Dynamic Duo”

Consider increasing your clients’ mid-cap exposure through a combination of two complementary, Hennessy Funds.

CORE:

Hennessy Cornerstone Mid Cap 30 Fund generally holds 30 purely mid-cap companies that exhibit both value and momentum attributes. The Fund has been managed since inception by Neil Hennessy.

SATELLITE:

Hennessy Focus Fund maintains a concentrated, high-conviction portfolio of 25 companies with approximately 60% to 80% of the assets in the top 10 holdings. The Fund’s three Portfolio Managers have been working together continuously on this Fund for nearly two decades.

- In this article:

- Domestic Equity

- Cornerstone Mid Cap 30 Fund

You might also like

-

Portfolio Perspective

Portfolio Perspective

Focus FundSeeking Companies with Strong Growth at Attractive Valuations

David Rainey, CFACo-Portfolio Manager

David Rainey, CFACo-Portfolio Manager Ira Rothberg, CFACo-Portfolio Manager

Ira Rothberg, CFACo-Portfolio Manager Brian Macauley, CFACo-Portfolio ManagerRead the Commentary

Brian Macauley, CFACo-Portfolio ManagerRead the CommentaryThe Portfolio Managers rely on their strategy of owning durable, well-run businesses capable of turning adversity into opportunity and adapting to macroeconomic surprises. The following Hennessy Focus Fund Commentary recaps the 2025 market and highlights areas of opportunity ahead.

-

Portfolio Perspective

Portfolio Perspective

Focus FundFrom Rate Cuts to AI: Positioning the Portfolio for Potential Opportunity

David Rainey, CFACo-Portfolio Manager

David Rainey, CFACo-Portfolio Manager Ira Rothberg, CFACo-Portfolio Manager

Ira Rothberg, CFACo-Portfolio Manager Brian Macauley, CFACo-Portfolio ManagerRead the Commentary

Brian Macauley, CFACo-Portfolio ManagerRead the CommentaryThe Portfolio Managers discuss holdings that could potentially benefit from lower rates, tariffs, and artificial intelligence (AI). The team also provides an update on AST SpaceMobile and discusses potential opportunities in select Technology and Health Care companies.

-

Company Spotlight

Company Spotlight

Focus FundO’Reilly Automotive—Revved for Growth

David Rainey, CFACo-Portfolio Manager

David Rainey, CFACo-Portfolio Manager Ira Rothberg, CFACo-Portfolio Manager

Ira Rothberg, CFACo-Portfolio Manager Brian Macauley, CFACo-Portfolio ManagerRead the Spotlight

Brian Macauley, CFACo-Portfolio ManagerRead the SpotlightO’Reilly Automotive is a leader in the automotive aftermarket parts industry in the U.S. The company’s scale, unique distribution infrastructure, and customer service-oriented culture should allow it to take market share in a fragmented U.S. market for years to come.