Market Commentary and Fund Performance

Masa Takeda of Tokyo-based SPARX Asset Management Co., Ltd., sub-advisor to the Hennessy Japan Fund, shares his insights on the market and Fund performance.

-

Masakazu Takeda, CFA, CMAPortfolio Manager

Masakazu Takeda, CFA, CMAPortfolio Manager

Fund Performance Review

For the month of July 2020, the Fund rose 3.15% (HJPIX) while the Tokyo Stock Price Index fell 2.07%. The Russell/Nomura Total Market™ Index, the benchmark for the Fund, fell 0.75% over the same period.

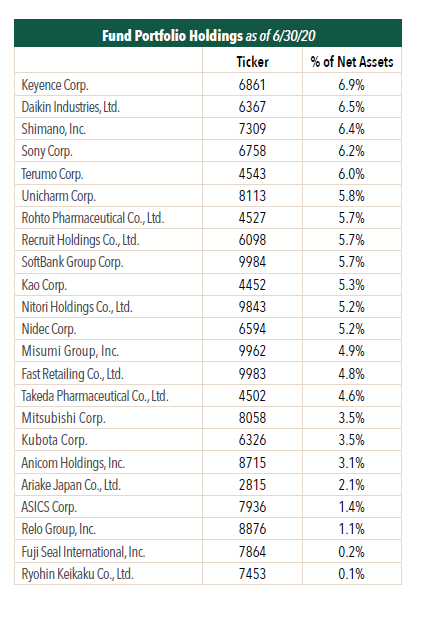

Among the best performers were our investments in SoftBank Group Corp., the telecom and Internet conglomerate, Nidec Corporation, the world’s leading comprehensive motor manufacturer, and Sony Corporation, a diversified consumer and professional electronics, gaming, entertainment and financial services conglomerate.

As for the laggards, Kao Corporation, Japan’s largest manufacturer of home care and personal care goods, Recruit Holdings Co., Ltd., Japan’s unique print & online media giant who specializes in classified ads as well as providing HR services, and Fast Retailing Co, LTD., the operator of UNIQLO brand casual wear stores, negatively affected the Fund’s performance.

This month, among the positive contributors to the Fund’s performance were Shimano, Nidec Corporation, and SoftBank Group. These companies are so-called “owner-operators.” Since 2001, Shimano has been run by a third generation member from the founding family (current CEO Yozo Shimano). Both Nidec Corporation and SoftBank Group are still led by their respective founders, Shigenobu Nagamori and Masayoshi Son.

Great business and exceptional management are the holy grail to long-term investment success. The former is characterized by high returns on capital, sustainable long-term above-average earnings growth, and strong cash flows, while the latter should come with sensible capital allocation skills, integrity, and strong leadership. Shimano is a case in point. The global bike parts behemoth for high-end sports bicycles enjoys significant economies of scale thanks to its dominant market share on the manufacturing side as well as consumer brand recognition, which allows it to have strong pricing power over its products. As such, the company generates high margins, which in turn results in high Return on Equity (ROE) and a cash-rich balance sheet.

In terms of management quality, we would also rate Shimano as first-class. Its multi-decade track-record of having been an entrenched leader speaks to this point. Due to the durable and discretionary nature of the product, the sports bicycle industry (which includes both road bikes & mountain bikes) has been prone to purchasing cycles in the past to some degree. This requires well-timed capital expenditure (capex) plan decisions on the part of management, and they have been executing very well. For example, in the first decade of this millennium, the company saw no material increase in fixed tangible assets (property, plant, and equipment, or PPE), during which revenue and profit grew by over 50%, respectively. This reveals the company’s operational excellence and pricing power as the company grew its top and bottom line in the absence of corresponding increases in production equipment, in our view. Then, in the most recent decade, management stepped up capex significantly to build out production capability for new products such as e-bike parts, construct a new state-of-the-art research and development (R&D) facility, and to increase manufacturing capacity. Fixed tangible assets grew almost three times in the span of 10 years. As a result, despite its late arrival to the e-bike scene, Shimano has recently confirmed that they are emerging as the second largest player in this new segment and steadily closing the gap with Bosch, the current category leader.

We are also encouraged by the recent sharp uptick in global bicycle sales triggered by strong demand from commuters seeking more effective social distancing as well as new bicycle hobbyists amid the COVID-19 pandemic. These trends should accelerate the payback from the previously mentioned capital spending activities. Shimano management is also shareholder-oriented. In light of rising surplus cash levels due to muted capex during the 2000s, management conducted a large-scale share buyback from 2003 through 2008, which saw its share count shrink by 20%. Based on our past conversations with management, they seemed to be cognizant of basic buyback principle as well, i.e. buy only when the share price is deemed undervalued.

While Shimano meets both the “great business” and “exceptional management” criteria at a high level, these two attributes seldom co-exist at other companies. That said, we do believe that sometimes an exceptional management can turn a not-so-great business into a great one, making for a great investment case. Here, we would cite the precision motor manufacturer Nidec Corporation as a prime example. Unlike Shimano, Nidec’s customers do not purchase its motors because of the brand. Rather, Nidec’s competitive edge rests on price competitiveness, superior product functionality, and short lead times, etc. These advantages are harder to maintain than long-standing consumer brands. Durable consumer brands require much less in the way of investment to maintain a leading position, as the brand image is so deeply ingrained in consumers’ minds. For these reasons, we consider Nidec’s business as less attractive than Shimano’s. However, the company’s management strength has been nicely complementing the relative weakness in business attraction.

- In this article:

- Japan

- Japan Fund

You might also like

-

Portfolio Perspective

Portfolio Perspective

Japan Small Cap FundJapanese Small-Caps’ Earnings Resilience and Improving Returns on Capital

Takenari Okumura, CMAPortfolio Manager

Takenari Okumura, CMAPortfolio Manager Tadahiro Fujimura, CFA, CMAPortfolio ManagerRead the Commentary

Tadahiro Fujimura, CFA, CMAPortfolio ManagerRead the CommentaryIn the following commentary, the Portfolio Managers cover small-cap outperformance drivers, pro-growth fiscal policy, governance reform, yen volatility, portfolio repositioning, profitability and capital efficiency trends, valuation gaps, and their 2026 outlook.

-

Portfolio Perspective

Portfolio Perspective

Japan FundA Differentiated Portfolio Focused on Margin of Safety and Upside Potential

Masakazu Takeda, CFA, CMAPortfolio Manager

Masakazu Takeda, CFA, CMAPortfolio Manager Angus Lee, CFAPortfolio ManagerRead the Commentary

Angus Lee, CFAPortfolio ManagerRead the CommentaryThe Portfolio Managers summarize the significant events that drove markets over 2025 and how the Fund remains focused on quality, capital discipline, and valuation, with a clear preference for stock picking over index exposure.

-

Investment Idea

Investment IdeaCompelling Valuations in Japan

Masakazu Takeda, CFA, CMAPortfolio Manager

Masakazu Takeda, CFA, CMAPortfolio Manager Angus Lee, CFAPortfolio Manager

Angus Lee, CFAPortfolio Manager Tadahiro Fujimura, CFA, CMAPortfolio Manager

Tadahiro Fujimura, CFA, CMAPortfolio Manager Takenari Okumura, CMAPortfolio ManagerRead the Investment Idea

Takenari Okumura, CMAPortfolio ManagerRead the Investment IdeaJapanese equities are currently trading at compelling valuation levels compared to other developed equity markets around the world and relative to their own historical averages. We believe the Japanese market deserves a closer look.