Market Commentary and Fund Performance

Masa Takeda of Tokyo-based SPARX Asset Management Co., Ltd., sub-advisor to the Hennessy Japan Fund, shares his insights on the market and Fund performance.

-

Masakazu Takeda, CFA, CMAPortfolio Manager

Masakazu Takeda, CFA, CMAPortfolio Manager

Fund Performance Review

For the month of December 2020, the Fund generated a positive return of 2.58% (HJPIX), while the Tokyo Stock Price Index rose 3.99%. The Russell/Nomura Total Market™ Index, the benchmark for the Fund, increased by 3.64% over the same period.

Click here for full, standardized Fund performance.

Among the best performers were our investments in SoftBank Group Corp., the telecom and Internet conglomerate, Keyence Corporation, the supplier of factory automation-related sensors, and Sony Corporation, a diversified consumer and professional electronics, gaming, entertainment, and financial services conglomerate.

As for the laggards, Rohto Pharmaceutical Co. Ltd., a leading skincare cosmetics and over-the-counter ophthalmic medicines producer, Nidec Corporation, the world’s leading comprehensive motor manufacturer, and Daikin Industries, Ltd., the leading global manufacturer of commercial-use air conditioners, detracted from the Fund’s performance.

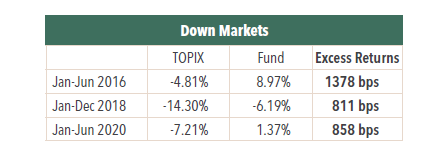

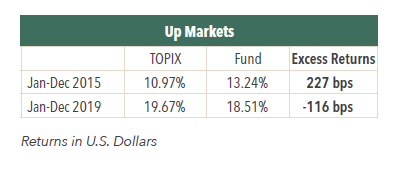

In the tumultuous 2020, the Fund has performed well in both absolute and relative terms. The Fund also lived up to our expectations of being resistant to the market downside in the first half of the year. The performance characteristics have been fairly consistent in that we tend to perform better in bear markets than in bull markets versus the Index. In the past, greater excess returns were recorded during weak market periods such as:

In up markets, the Fund slightly underperformed or barely outperformed.

In the last month’s letter, we explained why our investment strategy opts for “growth stock“ over “value stock.” We want to further discuss below that within the growth category, there is also a wide range of styles: Some funds concentrate on hyper-growth/nose-bleed valuation stocks while others are focused on more reasonably valued, moderately above-average growers. We believe we are in the latter camp.

In the case of 2020, the former group trounced the broader market as the global COVID-19 pandemic significantly changed people’s lifestyles, accelerating the society-wide adoption of “disruptive technologies,” namely internet commerce, software as a service (SaaS), artificial intelligence (AI), fintech, property tech, insurtech, medtech, human resources tech and so on.

These hyper-growth businesses are thrilling to own in the portfolio while the momentum lasts. However, the danger is that they tend to be less time-tested and less proven of a business model (disrupters are newcomers by definition), rendering their long-term outlook opaque. We get particularly wary of hyper-growth disruptors that only operate in Japan with no prospects for global expansion. At the end of the day, Japan is an addressable market with a population of only 120 million, making the growth runway more limited. During our careers, we have seen many fast-growing domestic-centric businesses hitting a wall in 10-15 years.

When a hyper-growth business misses expectations or starts to show even the slightest signs of deceleration, the stock price often gets severely hammered through reduction of earnings and, to a larger extent, a sharp contraction of P/E multiples. This often results in a very quick and large decline in share price. It is possible that yesterday’s winner can become a huge detractor overnight. The reason for our general aversion to hyper-growth stock is this potential double-whammy risk.

On the contrary, the Fund aims to own more down-to-earth, above-average sustainable growers with expected earnings compound annual growth rate (CAGR) of high-single digit to low-teens. (As opposed to hyper-growth names with, say, 50+% CAGR). To this end, the Fund seeks to invest in Japanese companies with a global footprint which have a proven management track record, a more time-tested business model, and a much longer growth runway. While expected growth rates may seem less exciting than hyper-growth ones, these businesses can help us develop higher conviction (hence large, concentrated positions) than hyper-growth yet unproven businesses.

How We Dealt With the Market Turmoil During the Pandemic

As investors, we have been constantly thinking about human nature in times of crisis. One thing that brought it home to us over the years is that humans are predisposed to over-reaction when confronted with bad news. Marian Tupy, the co-author of the recent book, Ten Global Trends that Every Smart Person Needs to Know,1 says: "Basically it boils down to natural selection. Humans have been around for about 300,000 years or so. For most of that time, life has been incredibly difficult. If one of our ancestors was walking past a bush and thought he heard it rustle, he could either figure it was nothing and keep going or he could run away. Maybe it was nothing, but then again, maybe it was a lion. There’s no penalty for overreacting, but there’s an extreme penalty for underreacting. The genes of underreactors got weeded out of the gene pool. That’s left us with a vast array of negativity biases."

Such knee-jerk reactions driven by human instinct produced huge dislocations in the market earlier last year. During this period, we largely stayed away from emotionally reacting to the market, holding off our next portfolio move until the dust from the chaos has settled (this is equivalent to activating System 2 of the brain as per Daniel Kahneman’s book, Thinking Fast and Slow). Meanwhile, we took time to review all of the Fund’s holdings. It was through this process that we began to realize that quite a few of the portfolio holdings could actually thrive due to the pandemic significantly changing the way people go about their lives. Thus, rather than making big changes, we decided to leave the Fund’s major holdings as is.

Here are examples which we believe will become a beneficiary from the pandemic:

- Nidec: Governments’ post-COVID stimulus measures promoting the global EV industry accelerated the company’s EV traction motor business.

- Sony: PlayStation gaming business grew robustly due to increases in stay-home recreation spending.

- Shimano: Benefited from a global surge in demand for new bicycles as a way of ensuring social distancing during commuting and leisure activities.

- SoftBank Group: the value of its investment holdings was boosted by the tech bull run on remote working and stay-home consumption trend.

- Fast Retailing: Benefited from rising demand for casual wear amid increased time spent at home.

- Keyence: Likely to see higher demand for FA solutions to meet the need for social distancing on manufacturing sites.

- Daikin: Benefited from increased awareness of indoor air quality lending support to the company’s home-use AC products equipped with air purification technology.

- UniCharm: Enjoyed surging demand for facial masks, which people may wear routinely even after the pandemic.

- Nitori: Enjoyed surging demand for home furnishings amid increased time spent at home.

- Anicom: Reported higher demand for pets as companion animals amid increased time spent at home.

Critics might say “You just got lucky on these beneficiaries to be in the portfolio when the pandemic started.” After all, there could have been an “extreme penalty” for our underreacting. But as we described back in May, our tendency is to hold steady insofar as we are convinced that the company has the wherewithal to survive headwinds based on various stress-testing and scenario analysis. For example, one of the crucial considerations is to make certain that the investee companies do not go bankrupt. No matter how strong and sound the business model is, there is no revenue where there is no demand (think of airlines or cruise ship companies last year). It would defeat the purpose of having a wonderful business if the company cannot survive under extreme economic conditions. We highlighted Keyence and Shimano as examples of fortress-like balance sheets, both of which held up relatively well during the market crash and finished the year well ahead of the index.

Consumer Behavior in Times of Crisis

Another key observation about human nature relates to consumer behavior during times of crisis. As the COVID-19 wreaked havoc on the global economy, it seemed obvious at first instance that demand for consumer discretionary items such

as cars, home appliances, property, and home furnishings would be decimated. Who would want to spend big when you think you might lose your job the next day, right? However, consumers have shown quite different attitudes.

Doug Stephens, a renowned author on topics of retail consumer behavior and the founder of Retail Prophet, points out in an interview2,3 that mass crises often change people’s view about the world in a profound way. This leads consumers to change their behaviors not just in the way of saving money to protect their living but sometimes in quite a contrary manner. That is to say, it actually drives people to spend money on things they have never bought or never tried before despite being under severe economic pressure: "Things like wars, depressions, recessions and terrorist attacks can shatter the illusion of meaning order and self-worth that we’ve created. This is what Terror Management Theory refers to as “mortality salience” — a reminder that life is finite and we aren’t really any more important or valuable than a blade of grass or a bird. Thus, in the face of such events, we attempt to do two things: defend and shore up our world view and re-establish our self-worth and esteem. Spending on material goods can do two things: Give consumers a renewed sense of control over their lives, their security and safety. This tendency explains much of the panic buying we witnessed at the outset of the pandemic. Leaving Costco, for example, with an overflowing cart of essentials instills a sense of control in the midst of chaos. Spending can give us security and control in other ways too. Buying a new pair of pants can give us a better sense of control in preparing for a job interview. So, control and order is the first priority. Second, spending on material possessions can enhance our sense of self-esteem. As a society, we use possessions as a proxy for individual value or worth."

This at least partially explains why discretionary spending remained resilient despite the worst economic contraction in history. Some of our holdings also benefited from it.

Mea Culpa

All that being said, we have to admit that we did make some errors in executing our trades in 2020. While the Fund’s top holdings were left largely intact, we attempted to take advantage of the market turmoil on the margins of the portfolio. As such, last year’s turnover was higher than average (in the mid-to-high teens). However, these trades failed to add value, implying that the 2020 Fund returns are lower than they would have been had we not done the trades. In other words, they were “errors of commission.” In our rough calculation, the Fund was 150-250 basis points worse off for the year. In fairness, however, over the long-term, our portfolio activity has been by and large adding value, be it an investment of a new name or rebalancing of existing positions. Investing is never-ending quest. We will continue to hone our skills on all fronts.

Click here for a full listing of Holdings.

- In this article:

- Japan

- Japan Fund

1 Ten Global Trends Every Smart Person Should Know: And Many Others You Will Find Interesting by Ronald Bailey (Author), Marian L. Tupy , Cato Institute (August 31, 2020).

2 Coronavirus: Why Shoppers Swerve Between Saving and Splurging - Bloomberg. By Mary Duenwald (May 3, 2020).

You might also like

-

Portfolio Perspective

Portfolio Perspective

Japan Small Cap FundJapanese Small-Caps’ Earnings Resilience and Improving Returns on Capital

Takenari Okumura, CMAPortfolio Manager

Takenari Okumura, CMAPortfolio Manager Tadahiro Fujimura, CFA, CMAPortfolio ManagerRead the Commentary

Tadahiro Fujimura, CFA, CMAPortfolio ManagerRead the CommentaryIn the following commentary, the Portfolio Managers cover small-cap outperformance drivers, pro-growth fiscal policy, governance reform, yen volatility, portfolio repositioning, profitability and capital efficiency trends, valuation gaps, and their 2026 outlook.

-

Portfolio Perspective

Portfolio Perspective

Japan FundA Differentiated Portfolio Focused on Margin of Safety and Upside Potential

Masakazu Takeda, CFA, CMAPortfolio Manager

Masakazu Takeda, CFA, CMAPortfolio Manager Angus Lee, CFAPortfolio ManagerRead the Commentary

Angus Lee, CFAPortfolio ManagerRead the CommentaryThe Portfolio Managers summarize the significant events that drove markets over 2025 and how the Fund remains focused on quality, capital discipline, and valuation, with a clear preference for stock picking over index exposure.

-

Investment Idea

Investment IdeaCompelling Valuations in Japan

Masakazu Takeda, CFA, CMAPortfolio Manager

Masakazu Takeda, CFA, CMAPortfolio Manager Angus Lee, CFAPortfolio Manager

Angus Lee, CFAPortfolio Manager Tadahiro Fujimura, CFA, CMAPortfolio Manager

Tadahiro Fujimura, CFA, CMAPortfolio Manager Takenari Okumura, CMAPortfolio ManagerRead the Investment Idea

Takenari Okumura, CMAPortfolio ManagerRead the Investment IdeaJapanese equities are currently trading at compelling valuation levels compared to other developed equity markets around the world and relative to their own historical averages. We believe the Japanese market deserves a closer look.