Market Commentary and Fund Performance

Tad Fujimura of Tokyo-based SPARX Asset Management Co., Ltd., sub-advisor to the Hennessy Japan Small Cap Fund, shares his insights on the market and Fund performance.

-

Tadahiro Fujimura, CFA, CMAPortfolio Manager

Tadahiro Fujimura, CFA, CMAPortfolio Manager

Fund Performance Review

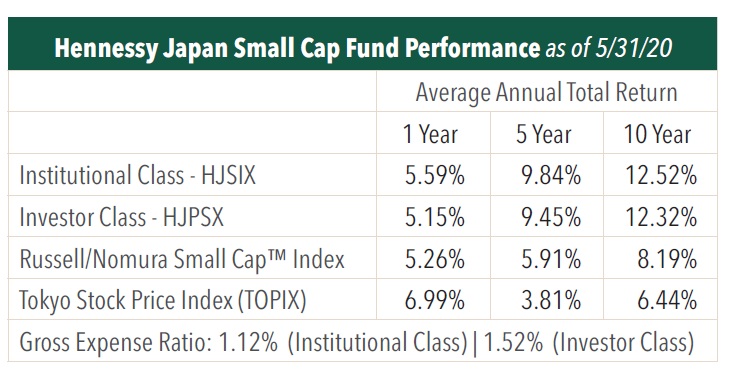

In May, the Japanese stock market had a difficult month in terms of earnings and economic indicators, but the market surged in the end driven by expectations that the state of emergency declaration would be lifted as the number of people infected with COVID-19 declined, and by expectations that economic activity would recover around the world. As in the previous month, small-cap stocks continued to perform relatively well. The promise of vaccines and effective medicines buoyed stock prices for biotechnology and pharmaceutical-related companies, while emerging companies, such as information technology (IT) and artificial intelligence (AI) related companies, also performed well on expectations of continued digitalization. As a result, the Tokyo Stock Price Index (TOPIX) dividends rose 6.03% in May, while the Fund’s benchmark Russell/Nomura Small Cap™ Index gained 8.08% over the same period. The Fund (HJSIX) increased by 11.95%.

The greatest contributor this month was internet-based life insurance provider Lifenet Insurance Company. We believe that the rapid growth in the number of new subscribers due to COVID-19 has been a positive factor in boosting the stock price. SBS Holdings, Inc., a major third party logistics 3PL company, has seen its share price rise on the back of stronger demand for electronic commerce (EC) and expectations of benefits from lower fuel costs, as well as the firm’s announcement that it will make Toshiba Logistics, a Toshiba subsidiary, a consolidated subsidiary.

On the other hand, the stock with the largest negative contribution was Ship Healthcare Holdings, Inc, which sells medical equipment and facilities in bulk. We believe its share price fell in part due to concerns that hospitals are facing a tougher profit environment as they are forced to deal with COVID-19. The share price of Suncorporation, an IT equipment maker dealing in ICT and entertainment-related products, is believed to have fallen as a result of profit-taking following a sharp rise in its share price.

Outlook for June 2020

The Japanese stock market rallied sharply in April and May, returning about two-thirds of the decline that occurred in February and March. Although we believe that stock prices have recovered from the extremely pessimistic price levels of the past two months, it may be difficult to make sure that the market continues rising without slowing down its current hiking pace unless we see a commensurate improvement in the real economy. Other risk factors are the worsening of U.S.-China relations in the wake of the developments in Hong Kong, the spread of COVID-19, and escalating protests from racial discrimination issues in the U.S. On the other hand, there are still a number of stocks that have been left undervalued as the market has rallied led by biotechnology, AI, and other high growth stocks. Our investment strategy is to invest in companies with strong finances who would be able to expand market share, and those companies who can respond to new demand under the circumstances new social and economic activities emerge in the wake of COVID-19.

- In this article:

- Japan

- Japan Small Cap Fund

You might also like

-

Portfolio Perspective

Portfolio Perspective

Japan Small Cap FundJapanese Small-Caps’ Earnings Resilience and Improving Returns on Capital

Takenari Okumura, CMAPortfolio Manager

Takenari Okumura, CMAPortfolio Manager Tadahiro Fujimura, CFA, CMAPortfolio ManagerRead the Commentary

Tadahiro Fujimura, CFA, CMAPortfolio ManagerRead the CommentaryIn the following commentary, the Portfolio Managers cover small-cap outperformance drivers, pro-growth fiscal policy, governance reform, yen volatility, portfolio repositioning, profitability and capital efficiency trends, valuation gaps, and their 2026 outlook.

-

Portfolio Perspective

Portfolio Perspective

Japan FundA Differentiated Portfolio Focused on Margin of Safety and Upside Potential

Masakazu Takeda, CFA, CMAPortfolio Manager

Masakazu Takeda, CFA, CMAPortfolio Manager Angus Lee, CFAPortfolio ManagerRead the Commentary

Angus Lee, CFAPortfolio ManagerRead the CommentaryThe Portfolio Managers summarize the significant events that drove markets over 2025 and how the Fund remains focused on quality, capital discipline, and valuation, with a clear preference for stock picking over index exposure.

-

Investment Idea

Investment IdeaCompelling Valuations in Japan

Masakazu Takeda, CFA, CMAPortfolio Manager

Masakazu Takeda, CFA, CMAPortfolio Manager Angus Lee, CFAPortfolio Manager

Angus Lee, CFAPortfolio Manager Tadahiro Fujimura, CFA, CMAPortfolio Manager

Tadahiro Fujimura, CFA, CMAPortfolio Manager Takenari Okumura, CMAPortfolio ManagerRead the Investment Idea

Takenari Okumura, CMAPortfolio ManagerRead the Investment IdeaJapanese equities are currently trading at compelling valuation levels compared to other developed equity markets around the world and relative to their own historical averages. We believe the Japanese market deserves a closer look.