Small-Cap Japanese Stocks Poised to Recover

Portfolio Manager Tad Fujimura shares his insights on Japan’s economic recovery, small-cap valuations, attractive sectors, and notable additions and deletions from the portfolio.

-

Tadahiro Fujimura, CFA, CMAPortfolio Manager

Tadahiro Fujimura, CFA, CMAPortfolio Manager

Can you discuss Japan’s pandemic recovery as it relates to other countries?

We have not yet started the vaccine distribution in Japan as of this writing. Japan has not been able to develop its own vaccines and has been slow to approve other available ones as well. We don’t think the vaccine will make economic recovery happen any faster in Japan.

We agree that China will lead the COVID-19 economic recovery in the short run. The Chinese government has imposed strict regulations to contain infections and provided economic stimulus that has brought about its remarkable economic recovery so far. In the long run, however, we believe we should be concerned about the potential side effects of the government-led recovery.

With regard to the pace of economic recovery, however, Asia as a whole is not recovering as fast as Europe and the United States. In terms of the absolute number of new cases, it tends to be smaller for Asian countries, and we believe this is partly due to our mask-wearing culture. Some other Asian countries like Taiwan and South Korea, where the share of the technology sector in the economy is high and infections have been contained successfully, are also doing relatively well. Japan, on the other hand, is different. We believe that Japan is slow to recover because we are extremely cautious in terms of economic activities regardless of the level of infections. Thus, we cannot say that the short-term recovery of the Japanese economy will be strong, but we have much more room to grow as our starting point is below that of other countries.

How has the pandemic impacted Japanese tourism?

Reduced inbound tourism in Japan has had a significant impact on domestic retail and tourist-related industries. Small-cap companies have a high proportion of domestic retail and service-related demand, which has had a significant negative impact until now and has caused stock prices to underperform as well. However, we think there is also plenty of room for recovery when we resume normal economic activities.

Has the market priced in a recovery for 2021, or do economically sensitive small-caps have room to run?

Over the past two years, small-cap stocks have performed poorly and have a lower valuation than large-cap stocks. Therefore, we believe that small-cap stocks will outperform if the economic recovery becomes pronounced.

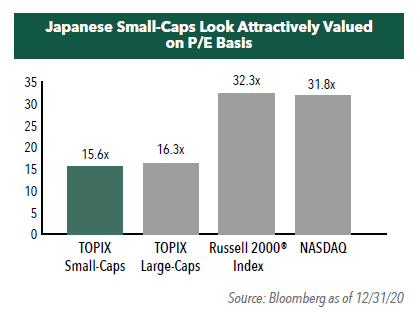

How do valuations of Japanese small companies compare to large-caps and U.S. small-cap companies?

In our earnings estimates based on the assumption of an economic recovery in the next fiscal year, domestic demand-related small-cap stocks have a P/E of around 15x while the average for large-cap stocks is around 17x. The P/E ratios of the U.S. small-cap Russell 2000, NASDAQ, and other stocks are well above these numbers, so we think Japanese small-cap valuations are very compelling.

What sectors look particularly attractive heading into 2021?

We think housing-related stocks remain attractive because they benefit from changes in demand with the introduction of telework, and they are very attractively valued. In addition, healthcare-related stocks are currently experiencing deterioration in hospital management due to the impact of COVID-19, and we believe there is a high possibility of recovery in the future. Financial stocks have also lagged, and we are considering investments in the future with the timing of deregulation and recovery.

Would you please discuss any notable addition/deletions from the portfolio?

In the housing-related industry, we initiated a position in Nichiha Corporation, which produces ceramics-related building materials. The company is increasing its market share in Japan and the U.S., and we believe that it will continue to benefit from growth in the housing market, its lighter weight with new materials, and its sophisticated design. We are investing in Rengo Co.,Ltd., a major cardboard producer. Although the paper market is sluggish with the trend to go paperless, we believe cardboard products will benefit from the shift from lumber and plastics to lighter materials as the expansion of e-commerce continues.

Meanwhile, we sold CyberAgent, Inc., which handles Internet advertising and other services. Although the stock price rose as a beneficiary of COVID-19, we took profits because we believed it had become overvalued.

Would you please discuss Japan’s manufacturing excellence with regard to domestic small-cap companies?

Japanese companies maintain a strong competitiveness in factory automation and infrastructure machinery brands. In addition to large-cap stocks, there are many small-cap companies that supply parts and manufacture specialized machinery, and we incorporate them into our portfolio.

Would you provide an example or two of a holding you anticipate benefitting from in today’s environment?

Since the Suga administration took up clean energy policies, Iwatani Corporation, which operates in the field of hydrogen energy, has recently contributed to the Fund’s performance. Before Prime Minister Suga took office, we had been investing in the company in the hope of expanding hydrogen-related businesses and recovery in demand for industrial gases, but the stock finally began to attract attention.

Musashi Seimitsu Industry Co., an automotive parts company, has been strengthening its electric vehicle-related parts business and we have initiated a position given its attractive valuation. Environment-related and EV-related stocks may be volatile, but we have good expectations from them in the long term.

- In this article:

- Japan

- Japan Small Cap Fund

You might also like

-

Investment Idea

Investment IdeaCompelling Valuations in Japan

Masakazu Takeda, CFA, CMAPortfolio Manager

Masakazu Takeda, CFA, CMAPortfolio Manager Angus Lee, CFAPortfolio Manager

Angus Lee, CFAPortfolio Manager Tadahiro Fujimura, CFA, CMAPortfolio Manager

Tadahiro Fujimura, CFA, CMAPortfolio Manager Takenari Okumura, CMAPortfolio ManagerRead the Investment Idea

Takenari Okumura, CMAPortfolio ManagerRead the Investment IdeaJapanese equities are currently trading at compelling valuation levels compared to other developed equity markets around the world and relative to their own historical averages. We believe the Japanese market deserves a closer look.

-

Investment Idea

Investment IdeaWhy Active Matters When Investing in Japan

Masakazu Takeda, CFA, CMAPortfolio Manager

Masakazu Takeda, CFA, CMAPortfolio Manager Angus Lee, CFAPortfolio Manager

Angus Lee, CFAPortfolio Manager Tadahiro Fujimura, CFA, CMAPortfolio Manager

Tadahiro Fujimura, CFA, CMAPortfolio Manager Takenari Okumura, CMAPortfolio ManagerRead the Investment Idea

Takenari Okumura, CMAPortfolio ManagerRead the Investment IdeaWhen investing in Japanese businesses, we believe it is imperative to select a manager who is immersed in the culture and can perform in-depth, company-specific research to build a concentrated portfolio of Japanese companies that can outperform a benchmark and weather volatility.

-

Portfolio Perspective

Portfolio Perspective

Japan Small Cap FundA Focus on Japanese Small-Caps Making Big Corporate Improvements

Takenari Okumura, CMAPortfolio Manager

Takenari Okumura, CMAPortfolio Manager Tadahiro Fujimura, CFA, CMAPortfolio ManagerRead the Commentary

Tadahiro Fujimura, CFA, CMAPortfolio ManagerRead the CommentaryThe Portfolio Managers discuss their view of the Japanese small-cap corporate landscape amid many shifting factors, including a new Prime Minister, finalized tariff situation, currency volatility, and attractive valuation environment.