Market Commentary and Fund Performance

Masa Takeda of Tokyo-based SPARX Asset Management Co., Ltd., sub-advisor to the Hennessy Japan Fund, shares his insights on the Japanese market and Fund performance.

-

Masakazu Takeda, CFA, CMAPortfolio Manager

Masakazu Takeda, CFA, CMAPortfolio Manager

Fund Performance Review

For the month of September, the Hennessy Japan Fund (HJPIX) declined 10.08% while the Russell Nomura Total Market™ Index lost 9.31% and the Tokyo Stock Price Index (TOPIX) fell 9.49%.

Among the best performers were our investments in Rohto Pharmaceutical Co., Ltd., a leading skincare cosmetics and OTC ophthalmic medicines producer, Seven & i Holdings Co., Ltd., a Japanese diversified retail group and operator of 7-Eleven convenience stores, and Ariake Japan Co., Ltd., a producer of natural seasonings and flavorings from meat products.

Click here for full, standardized Fund performance.

As for the laggards, Sony Group Corporation, a diversified consumer and professional electronics, gaming, entertainment and financial services conglomerate, Hitachi, Ltd., one of Japan’s oldest electric equipment and heavy industrial machinery manufacturers, and Mitsubishi Corporation, the largest trading company in Japan, were the main detractors.

Our definition of “attractive business” can be summarized as one that has 1) high returns on capital, 2) above-average long-term earnings growth rates, and 3) strong cash flow generation. Many of our portfolio companies have been boasting above-average return on equity (ROE) and have also compounded their earnings faster than average Japanese companies.

How much a business can earn on a given amount of shareholders’ capital is an important consideration when it comes to assessing the true attractiveness of the business from a shareholder’s perspective. However, as we all know, ROE has its own shortcomings. That is to say, high ROE can be superficially achieved by having a low equity base at the expense of financial stability. This is not healthy.

That is why we sometimes turn to Return on Capital Employed (ROCE) to get a better understanding on the true attractiveness of the business we are invested in. ROCE is a financial ratio to gauge a company’s profitability and capital efficiency, which can be obtained in several ways but the one we prefer is operating profit divided by fixed asset plus net working capital.

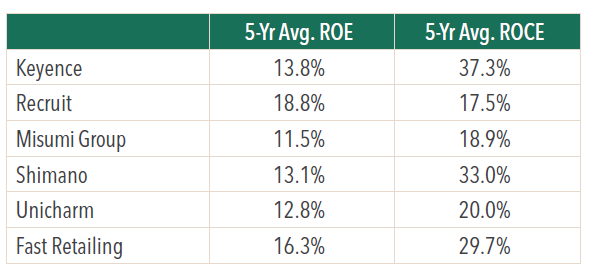

We believe above-average ROE generators accompanied by high ROCE should be considered more valuable than ones that come with high ROE but with mediocre ROCE. Our long-term holdings such as Keyence, Recruit, Misumi Group, Shimano, UniCharm and Fast Retailing score highly on both measures as shown below.

A consistently high ROCE trend usually indicates the business possesses some kind of economic moat, which is readily identifiable in many cases. Let’s think of Recruit, the online human resources and marketing media company who also owns U.S.-based online job advertisement subsidiary “Indeed.” As a media business, its competitive barriers are characterized by its platform effects, in which their proprietary media attracts many advertisers/hiring companies, drawing prospective individual customers/job seekers, which in turn brings in more advertisers/hiring companies, whereby creating virtuous cycles. The company controls the entire process from dealing directly with advertisers to producing proprietary media platforms and attracting individual customers/job seekers through them. As such, the business creates high entry barriers to new entrants. The nature of their business is such that they do not require heavy maintenance expenditures unlike traditional manufacturing to keep its growth, which allows for high ROCE.

Fast Retailing has a strong brand recognition in the world of casual clothing. Brand is the “economic goodwill” that allows you to charge a high markup in relation to what it cost to provide you with the basic functionality of the goods itself. For example, clothing, in its simplest form, is a fabric that you can wear to cover your body, keep you warm in cold temperature or cool in heat, or help you look fashionable. But the cost of goods for these functionalities is usually only a small portion of the retail price itself of well-branded clothing, hence a high ROCE is often the norm.

Misumi Group, maker and distributor of precision machinery parts, Shimano, maker of high-end bicycle components, and UniCharm, maker of personal care products, are manufacturing businesses whose fixed assets relative to their revenues and profits are low compared to manufacturers of commoditized products with low market share, giving them high capital efficiency.

For instance, Shimano has been known to many as a dominant player in the high-end sports bicycle components business for decades, and global bike assemblers including Giant Manufacturing (listed in Taiwan) must rely on Shimano for their key parts such as gears and braking systems. A close look at Shimano’s historical financial statements points to their superior capital efficiency. From 1998 to 2011 (our first investment in Shimano was back in 2007), its fixed tangible assets (net basis) went from JPY 43.7 billion ($293.6 million) to 46.8 billion ($314.4 million) showing no material increase. During this period, however, Shimano’s revenue and profit grew by 52% and 45%, respectively. This reveals the company’s operational excellence as it grew top and bottom line in the absence of corresponding increases in production equipment. Even more impressive is that this was achieved during a period of JPY appreciation, which speaks to its manufacturing prowess together with strong pricing power of its franchise

Keyence, the developer and marketer of customized FA sensors, is known for an extremely cash rich balance sheet. The company’s core competence lies in its ability to identify demand in unmet factory automation needs through unrivaled consulting capabilities, then translating it into factory automation sensors by using 3rd party contract manufacturers. The huge pile of cash is hard-earned money from their business over many years. Each year, its business generates hundreds of billions of JPY in free cash flow, the bulk of which is accumulated on their balance sheet in the form of low yielding financial instruments, while only a fraction of the free cash flow is paid out as dividends to its shareholders. As of the end of fiscal year 2021, Keyence had JPY 464 billion ($3.1 billion) of cash, JPY 540 billion ($3.6 billion) of short-term investments, and JPY 939 billion ($6.3 billion) of investment securities, which collectively account for over 83% of the firm’s total assets. Despite all this, the company’s business model is so profitable and so entrenched that its 5-year average ROCE is well above 30%. Better yet, if you strip out the investment securities from fixed assets, then its ROCE would be an eye-whopping 130%.

In our portfolio, there are also companies which have adequately sized shareholders’ equity (unlike Keyence) such that their ROEs have been above average but they do not necessarily command high ROCEs. In our view, these companies’ moats mainly stem from manufacturing-oriented competitive advantages that require high capital intensity and world class management teams that make the business work in a superior fashion. These companies are less attractive than high ROE and high ROCE combos, but they are surely good companies so long as their manufacturing excellence as durable moat remains intact. Hitachi, industrial conglomerate, Nidec, direct current brushless motor, and Daikin, air conditioners, would come to mind.

Click here for a full listing of Holdings.

- In this article:

- Japan

- Japan Fund

You might also like

-

Portfolio Perspective

Portfolio Perspective

Japan Small Cap FundJapanese Small-Caps’ Earnings Resilience and Improving Returns on Capital

Takenari Okumura, CMAPortfolio Manager

Takenari Okumura, CMAPortfolio Manager Tadahiro Fujimura, CFA, CMAPortfolio ManagerRead the Commentary

Tadahiro Fujimura, CFA, CMAPortfolio ManagerRead the CommentaryIn the following commentary, the Portfolio Managers cover small-cap outperformance drivers, pro-growth fiscal policy, governance reform, yen volatility, portfolio repositioning, profitability and capital efficiency trends, valuation gaps, and their 2026 outlook.

-

Portfolio Perspective

Portfolio Perspective

Japan FundA Differentiated Portfolio Focused on Margin of Safety and Upside Potential

Masakazu Takeda, CFA, CMAPortfolio Manager

Masakazu Takeda, CFA, CMAPortfolio Manager Angus Lee, CFAPortfolio ManagerRead the Commentary

Angus Lee, CFAPortfolio ManagerRead the CommentaryThe Portfolio Managers summarize the significant events that drove markets over 2025 and how the Fund remains focused on quality, capital discipline, and valuation, with a clear preference for stock picking over index exposure.

-

Investment Idea

Investment IdeaCompelling Valuations in Japan

Masakazu Takeda, CFA, CMAPortfolio Manager

Masakazu Takeda, CFA, CMAPortfolio Manager Angus Lee, CFAPortfolio Manager

Angus Lee, CFAPortfolio Manager Tadahiro Fujimura, CFA, CMAPortfolio Manager

Tadahiro Fujimura, CFA, CMAPortfolio Manager Takenari Okumura, CMAPortfolio ManagerRead the Investment Idea

Takenari Okumura, CMAPortfolio ManagerRead the Investment IdeaJapanese equities are currently trading at compelling valuation levels compared to other developed equity markets around the world and relative to their own historical averages. We believe the Japanese market deserves a closer look.