Market Commentary and Fund Performance

Masa Takeda of Tokyo-based SPARX Asset Management Co., Ltd., sub-advisor to the Hennessy Japan Fund, shares his insights on the Japanese market and Fund performance.

-

Masakazu Takeda, CFA, CMAPortfolio Manager

Masakazu Takeda, CFA, CMAPortfolio Manager

Fund Performance Review

For the month of August, the Hennessy Japan Fund (HJPIX) returned 4.73%, outperforming the Russell Nomura Total Market™ Index, which rose 2.95%, and the Tokyo Stock Price Index (TOPIX), which returned 3.07%.

Among the best performers were our investments in Daikin Industries, Ltd., the leading global manufacturer of commercial-use air conditioners, Recruit Holdings Co., Ltd., Japan’s unique print and online media giant specializing in classified ads as well as providing human resources services, and Misumi Group Inc., the maker and distributor of metal mold components and precision machinery parts.

As for the laggards, SoftBank Group Corp., the telecom and Internet conglomerate, Mercari, Inc., an operator of “Mercari,” a flea market application having accumulated one hundred million of downloads, and Hitachi, Ltd., a general and heavy electric manufacture detracted from the Fund’s performance.

Click here for full, standardized Fund performance.

We began investing in Mercari, the online marketplace operator for secondhand items, in the fall of 2020. Our first encounter with Mercari goes back to its pre-2018 IPO days in the news. It was already touted as one of the largest unicorns in the Japanese private equity space. The company’s mission statement read, “Create value in a global marketplace where anyone can buy & sell.” It was extremely rare for a Japanese internet company to have a global ambition at such an early stage, and this got our attention.

As we wrote in previous letters, unfortunately Japan does not have too many world-class tech companies to begin with. There are many small domestic “wannabes” in the internet/software-as-a-service/cloud space, but most fall outside of our investment scope due to their small addressable markets (we look for “big elephants” with compelling global growth opportunities). This is in stark contrast to China where many tech titans have been minted. To our surprise, they not only have a global presence but also some are quite dominant as has been demonstrated by ByteDance, whose short-video app has taken the world by storm. Examples like ByteDance and Sea (Singapore-based gaming/e-commerce company growing rapidly in Southeast Asia and Latin America) have shown that the global internet business is not off-limits to Asian companies (traditionally dominated by U.S. behemoths). We think this should apply to Japan as well. Why not a Japanese global internet company someday?

What makes Mercari stand out in Japan’s internet space is not the fact that it dominates Japan’s online flea market, which is extremely profitable and cash-generative. Today the company has 19.5 million monthly average users (MAUs), an annual run-rate gross merchandise value (GMV) of JPY 800 billion ($7.3bn) and an average take-rate of 9.4% (derived from Japan revenue divided by the GMV). Just barely one year after its inception, the company launched the same service in the U.S., believing that if you want to create a global internet service, you must conquer the U.S. first. This was a bold move considering that the company was still hemorrhaging cash heavily to build a domestic marketplace in the budding online industry. However, today the company has proven its mettle.

Last year was a key inflection point in the company’s long-journey. In the wake of the COVID pandemic, Mercari experienced a spike in app usage bringing the U.S. business to above breakeven almost instantly. We all know that in the internet business how profits can rise non-linearly once revenue reaches breakeven. So we would like to focus our comments on its U.S. business below.

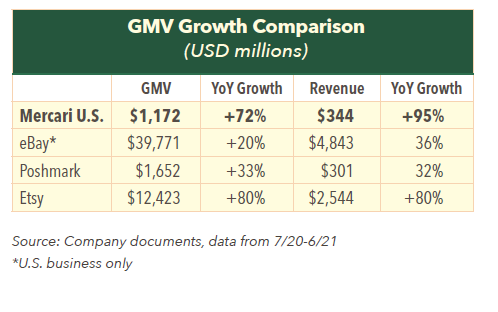

The U.S. business’s GMV has recently been significantly outperforming its peers such as eBay and Poshmark, and is on par with Etsy (the handmade/vintage item e-commerce operator). Its MAUs more than doubled to 4.6 million since before the COVID outbreak.

To understand what could be driving this success, we would like to offer a few possible reasons.

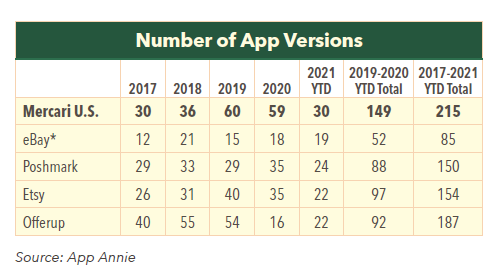

First, in order to facilitate the use of its app, Mercari goes the extra mile to solve pain points around the listing process, buy and sell transactions, payments and delivery services, etc. To illustrate this point, the number of iterations (versions) released in the last 3 years is shown below:

Secondly, the Mercari app features are differentiated from its rivals in the following aspects:

• Mercari is positioned as a “sell anything” app (any legal items including apparel, toys, collectibles, manga/books, gaming, electronics, baby items) versus other players are mostly fashion/apparel-focused (i.e. Poshmark, Depop, ThredUP, Vinted, Kidizen).

• Mercari has a reputation for mobile user-friendly interface with ultra-easy listing process. Mercari caters to more casual sellers/light users versus eBay who mainly caters to semi-professional individual volume sellers.

• Mercari’s selling fees are among the lowest (12.9%plus $0.3 per item sold including the payment processing fee) and there are no other hidden fees. Unlike eBay, no listing fees are charged.

• Mercari has a younger user demographic compared to eBay which caters to older adults.

• Mercari ensures anonymous transactions with no meet-ups required for delivery (important for user safety). Everything can be completed online including listing, payments, and shipping.

• Mercari has a seller-friendly return policy: Once the item was sold and delivered to the buyer, there will be a 3-day window for the transaction to be finalized and the purchase funds to be released to the seller, whereas eBay has a 30-day return policy, which is often abused by scammers.

• Mercari is focused on broadening shipping options for ease of delivery. For example, in addition to existing nationwide partnerships with USPS, UPS and FedEx, which offer competitive rates, the firm recently announced a tie-up with Uber for shorter-distance local delivery, a first of its kind in the industry.

As you can see, while there is no single feature that is proprietary or is impossible to copy, these subtleties should add up to a competitive moat over time with relentless focus on iterations.

There are certain unique characteristics about the company’s marketplace compared to other venues as a result. For example, according to the data points in the company disclosures, items that Mercari users buy and sell are truly wide-ranging and miscellaneous. Its product category breakdown is as follows: women’s clothing 28%, toys 20%, electronics 17%, men’s clothing 10%, home interior goods 6%, cosmetics 5%, collectibles 6%, baby items 4%, others 5% while most small-scale apps specialize in used-clothing exclusively.

In terms of what brands are sought after on the Mercari platform, here are some examples: Nike (shoes, apparel), Apple (iPad, phones, chargers, watches, accessories, headphones, earbuds), Funko Pops (pop culture figures, collectibles), Nintendo (video games, consoles, toys, plush dolls, collectibles), Sony (consoles, headphones, video games, electronics, TVs, speakers), Louis Vuitton (luggage, accessories), Pokemon (video games, plush toys, Pokemon cards), Air Jordan (shoes), Rae Dunn (home décor, glassware), Disney (DVDs, plush toys, T-shirts, stickers, toys, collectibles).

Furthermore, Mercari’s transactions involve a lot of low value items. For instance, if you divide Mercari’s monthly GMV by user numbers to get a sense of how much average sales are made by an individual user, the number is about $21 per month (= $100 million monthly GMV/4.6 million MAUs). For the women’s fashion and accessories-focused app, Poshmark, if you divide its GMV by the user numbers, you also get around $21, but this is not exactly comparable. Poshmark does not break out MAUs (which Mercari does), but discloses active buyer numbers instead, which is defined as “users who have purchased at least one item on our marketplace in the trailing 12 months regardless of returns and cancellations.” Thus, we suspect Poshmark’s MAU is a lot lower than this, which means that the average monthly transaction per user is actually way higher than the $21, consistent with Poshmark’s primary focus on the more high-end fashion apparel category. We believe Mercari’s breadth of product coverage down to small/trivial articles caters to a much wider audience, making it a more durable franchise.

All that said, at this point in time, we have to admit that Mercari U.S. is still a minnow in the vast ocean of e-commerce apps. On the U.S. app store rankings, Mercari is still trailing behind other competing apps (e.g. eBay, Etsy). Nevertheless, in recent years it has developed into one of the most commonly used, go-to apps for American users. This can be confirmed by various customer online reviews such as on YouTube.*

High returns on capital, High operating leverage, High growth rate

We generally use the “seven key investment criteria” to determine the attractiveness of the business for investment. But examining a potential for “exponential” growth opportunity, the following criteria might be more appropriate.

• Does the business have high returns on capital?

• Does the business have high operating leverage?

• Does the business have a long-term secular high growth rate?

Even in the most well-known high-quality businesses in the world, we often realize that these three dimensions do not necessarily co-exist. For example, Costco, the venerable U.S. big box retailer, boosts high returns on capital but operating leverage is rather low so profit growth trajectory is quite linear due to large variable costs as a percentage of revenue. In other business models, high returns on capital and high operating leverage may be present at the same time, but the expected growth rate can be low. A dominant yet mature software company falls under this type. Microsoft during the 2000s would come to mind.

On the contrary, Mercari appears to be in the sweet spot given its business model as internet marketplace combined with its current stage of having reached breakeven after years of laying the groundwork. To illustrate the potential for exponential future earnings growth, let’s look at the revenue trend in relation to the headcount of late. The company’s consolidated staff numbers remained largely flat since 2018 at around 1,650-1,750 employees. On the other hand, , due to the sharp rise in user activities on Mercari’s platform last year, its Japan GMV rose from JPY 626 billion ($5.7bn) to 785 billion ($7.2bn) (+25% YoY), while U.S. GMV surged from $680 to $1,172 million (+70% YoY). Clearly, the company handled huge volume increases well with its existing workforce. As such, nearly 80% of revenue increase was converted into profit growth (Revenue: JPY 76.1 billion ($694 mn) to 106.1 billion ($968 mn); Operating Profit (OP): JPY -19.2 billion ($175 mn) to 5.1 billion ($46.5 mn)). This kind of delta is very typical of an internet business entering a high growth phase. Although Mercari falls under the e-commerce/shopping category, the packaging part of the transaction is assumed by the individual sellers (who will then take it to the courier), which helps Mercari’s capital efficiency as well as operating leverage a great deal.

Corporate Culture

At the beginning of this commentary, we wrote about the company’s ambition to become a global internet service. This vision was set even before they have built a solid foundation in its home market Japan. The founder in focus here is Shintaro Yamada (age 43).

Whilst in university, his first job was an internship at Rakuten, Japan’s e-commerce pioneer, where he developed an auction website. Then, in 2001 upon graduating, he created a mobile gaming company called Unoh. It was later acquired by the U.S. gaming company Zynga in 2010. After the sale of the business, Yamada took a hiatus during which he traveled around the world in search for new inspiration. That’s when he hit on the idea of “helping society thrive by circulating our limited resources,” which in turn gave birth to the Mercari marketplace app in 2013. From the beginning, Yamada set out with a view towards making Mercari a global service.

In a 2019 interview article, Yamada recollects how his vision was initially met by skepticism, as he quotes his naysayers “Can something created by Japanese people in the Japanese market really be used globally?” But he kept on going, evangelizing core values: “Go Bold,” “All for One,” “Be a Pro” to his employees. According to OpenWork, a Japanese anonymous review site for company employees, we are often encouraged to find comments highlighting how highly people are motivated inside Mercari as they take these values to heart and work towards achieving that goal of becoming a global player with the U.S. market being the primary focus. At its Japan headquarters, nearly 40% of the software engineers are foreign nationality such as India, the U.S., and China. 90% of new engineers joining the firm each year is foreign nationality. These foreigners are committed to working in Japan thanks to their love of living in the country. While we understand the limitations of the insights these review sites can provide to outsiders, Mercari definitely has more positive remarks than other comparable internet companies publicly traded in Japan.

In the Fund’s portfolio, there are several founder-led companies who are all market cap leaders in Japan today after decades of being in business. Notably, they are Nidec (founder/chairman Shigenobu Nagamori, age 76), Fast Retailing (founder/chairman/president/CEO Tadashi Yanai, age 72) and SoftBank Group (founder/chairman/president/CEO Masayoshi Son, age 63), who are three of the most powerful entrepreneurs in the country. Interestingly, what these three figures have in common is that they all aspire to become number one in their respective fields by putting out grandiose visions:

BHAGs – Big Hairy Audacious Goals

• Nagamori of Nidec has a group-wide revenue goal of JPY 10 trillion ($91 bn) by FY2030 (currently at JPY 1.6 trillion ($14.6 bn)).

• Yanai of Fast Retailing set a vision to achieve JPY 5 trillion ($45.6 bn) revenue and JPY 1 trillion ($9.1 bn) recurring profit by 2020 in 2009 when they were only JPY 685 billion ($6.2 bn) and 101 billion ($921 mn), respectively.

• Son of SoftBank Group unveiled a vision in 2015 to increase the company’s market cap to JPY 200 trillion ($1.8 tn) by 2040 (2.5 trillion ($22.8 bn) market cap at the time), also another vision in 2018 to create a company that “can grow, 300 years down the road.”

Although Yamada does not set grandiose numerical targets per se, we think his ambitious ethos puts him in the same league as these legendary Japanese entrepreneurs. Of course, overly stretched goals, if implemented inappropriately, could lead to unethical behaviors/cutting corners by employees so we fully acknowledge that instituting BHAGs alone is never sufficient. But there should be some correlation between being a strong visionary and the eventual success of the business.

Financials

Turning to the financials, Mercari has about JPY 263 billion ($2.4 bn) in total assets, of which JPY 171 billion ($1.6 bn) is in cash as of June 2021. The bulk of this cash, however, is in escrow, meaning it does not belong to Mercari but it belongs to Mercari users. Adjusting for this, the actual cash balance is about JPY 50 billion ($456 mn). On the right hand side of the balance sheet, shareholders’ equity represents JPY 40 billion ($365 mn), which equates to only 15% of total assets, but again if adjusted for the cash escrow, the ratio rises to about 30%.

At the end of June this year, management announced the issuance of convertible bonds in two tranches worth a total of JPY 50 billion ($456 mn). This is a smart move as it is zero coupon and the conversion price is more than 50% above the current share price levels. If it converts to equity sometime over the next few years before maturity (2026 & 2028), it will strengthen its capital base at a much higher share price (approximately a 3% dilution). If it doesn’t convert, it is effectively an interest-free loan. With an enhanced war chest, Mercari can go on the offensive.

Valuations

Internet growth stocks are hard to value with a definitive margin of safety. There is not much tangible book value, dividend yield, or low price to equity (P/E) multiples to quantitatively argue for limiting the downside risk. But when the potential upside

far out weigh the potential downside, even though such downside could be larger than other holdings we own, we believe it is a sensible decision to add the investment to the current portfolio so long as the position is conservatively sized.

In terms of near-term business outlook, now that the full year has passed since the outbreak of COVID-19, the GMV growth rate will face tougher comps such that the rate of increase will meaningfully come down in the current quarter (July-Sept). This has been a known risk. However, we do believe that the use of the online flea market is still in the very early innings and will eventually become a part of people’s lifestyle routine. The value proposition of using the app (bigger reach, better price transparency, unlimited store shelves, etc.) instead of holding a garage sale is quite compelling. Here, we are drawing on the experience of the early 2000s when the SARS outbreak catapulted the e-commerce businesses. Even after the outbreak subsided, the habit stuck around and accelerated.

The way we think about the current valuation is that Mercari’s Japan business alone is worth more than the market cap around which we accumulated the shares. Let’s say, if the GMV for Japan Mercari, which is the most reliable part of the company, continues to compound at 15% over the next 3 years (since 2016, annual Japan GMV has grown at 42% Compound Annual Growth Rate (CAGR) to JPY 785 billion ($7.2 bn)), then adjusted OP should swell to JPY 45 billion ($410 mn) from 5 billion ($4.5 mn). This assumes the historical average take-rate of 9.4% and management’s mid-term adjusted Operating Profit Margin (OPM) target of 40%. Based on the market cap of JPY 780 billion ($7.2 bn) at the time of our investment, the P/E multiple comes out to 24.8x. Once the U.S. business and other new services start to contribute, the valuations should get attractive further..

Speaking of other growth pillars, management also discussed Merpay and Mercari Shops extensively at the recent earnings briefing. Merpay is a domestic in-app payments service that allows the users to pay, receive funds during platform transactions. Just like other global payments apps, Mercari is trying to build its own payment ecosystem in Japan by allowing the users to spend seamlessly through online/offline stores outside the platform. Newly introduced services associated with Merpay include Merpay Smart Payment, which functions as BNPL (Buy Now Pay Later) feature, as well as small loan programs, which relies on its proprietary user behavior data to assess credit worthiness. According to management, these new initiatives are not loss-leaders. In fact, they are already making small contributions to the bottom line, speaking to the relative ease of monetizing bolt-on services in the presence of significant platform effects.

Another new launch is a service called Mercari Shops, which is essentially a Shopify-like service. Mercari assists small domestic merchants in setting up online stores through a mobile app and helps them access the potential customers on the platform. We believe these are relatively low risk undertakings. Needless to say, we have assigned no value to these in my valuation exercise to be conservative, but they can be an added bonus if they work.

Lastly, we should also brace for a complete opposite scenario where management continues to follow the path of red ink in light of strengthening its long-term competitive moats in various business activities. This is especially likely if Mercari succeeds in the current businesses faster than management has planned. This paradox is nothing new to successful modern internet companies. Amazon repeated this process for years until it became one of the most formidable and largest market cap companies in the world. As long as the losses are intentional and not forced losses in nature, we would be happy to continue holding the stock as sound investment.

Click here for a full listing of Holdings.

- In this article:

- Japan

- Japan Fund

You might also like

-

Portfolio Perspective

Portfolio Perspective

Japan Small Cap FundJapanese Small-Caps’ Earnings Resilience and Improving Returns on Capital

Takenari Okumura, CMAPortfolio Manager

Takenari Okumura, CMAPortfolio Manager Tadahiro Fujimura, CFA, CMAPortfolio ManagerRead the Commentary

Tadahiro Fujimura, CFA, CMAPortfolio ManagerRead the CommentaryIn the following commentary, the Portfolio Managers cover small-cap outperformance drivers, pro-growth fiscal policy, governance reform, yen volatility, portfolio repositioning, profitability and capital efficiency trends, valuation gaps, and their 2026 outlook.

-

Portfolio Perspective

Portfolio Perspective

Japan FundA Differentiated Portfolio Focused on Margin of Safety and Upside Potential

Masakazu Takeda, CFA, CMAPortfolio Manager

Masakazu Takeda, CFA, CMAPortfolio Manager Angus Lee, CFAPortfolio ManagerRead the Commentary

Angus Lee, CFAPortfolio ManagerRead the CommentaryThe Portfolio Managers summarize the significant events that drove markets over 2025 and how the Fund remains focused on quality, capital discipline, and valuation, with a clear preference for stock picking over index exposure.

-

Investment Idea

Investment IdeaCompelling Valuations in Japan

Masakazu Takeda, CFA, CMAPortfolio Manager

Masakazu Takeda, CFA, CMAPortfolio Manager Angus Lee, CFAPortfolio Manager

Angus Lee, CFAPortfolio Manager Tadahiro Fujimura, CFA, CMAPortfolio Manager

Tadahiro Fujimura, CFA, CMAPortfolio Manager Takenari Okumura, CMAPortfolio ManagerRead the Investment Idea

Takenari Okumura, CMAPortfolio ManagerRead the Investment IdeaJapanese equities are currently trading at compelling valuation levels compared to other developed equity markets around the world and relative to their own historical averages. We believe the Japanese market deserves a closer look.