Banking on More Mergers and Acquisitions in 2022

While the pandemic slowed deal activity, the stage is set for deal making in 2022, we examine several trends that could reshape the banking ecosystem and likely provide a tailwind to bank stocks over the years to come.

-

David EllisonPortfolio Manager

David EllisonPortfolio Manager -

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager

We believe the pandemic has forced the hands of many banks—especially midsize and regional lenders—that have failed to adapt their business models quickly enough to the demands of today’s customer.

Furthermore, a new class of disruptive, digitally driven “fintech” competitors has emerged. Those traditional lenders unable to invest in an organic technology transformation will increasingly be faced with the prospect of partnering, acquiring, or being acquired by these fast-growing technology-forward platforms.

Below, we examine several trends that could reshape the banking ecosystem and likely provide a tailwind to bank stocks over the years to come.

Key Takeaways

» A challenging earnings environment and thin net interest rate margins will fuel the “bigger is better” mentality.

» A priority for many banks is reducing their physical footprint.

» Many larger banks plan to develop native digital capabilities, form joint ventures, or acquire fintech platforms that can harness the benefits of existing scale while delivering a better digital customer service experience.

Bank Deals Are Trending

Unions of equal and tuck-in acquisitions have continued to motivate lenders to consolidate in search of cost synergies and other economy of scale benefits. A challenging earnings environment characterized by relatively slow loan growth and thin net interest rate margins will only fuel the “bigger is better” mentality. Of course, the largest money center banks were constrained in their acquisition efforts in 1994 when Congress barred large banks with greater than 10% of the country’s deposits from making acquisitions.

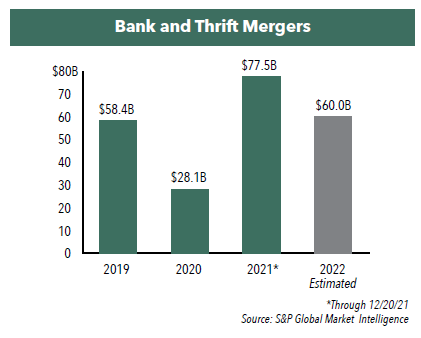

According to S&P Global Market Intelligence, 208 bank and thrift mergers with an aggregate deal value of $77.5 billion had surfaced through December 20, 2021, up from $28.1 billion in 2020 (when most banking activity stalled due to the pandemic) and $58.4 billion in 2019. U.S. bank and thrift M&A aggregate deal value in 2021 has already surpassed the highest level since before the global financial crisis, and S&P expects bank M&A activity to be as robust in 2022, reaching at least $60 billion.

We believe traditional merger rationales will persist and be accompanied by more strategic deals focused primarily on building incremental technology capabilities that will augment the digital customer experience across account management, lending, and ancillary businesses such as wealth management and payments.

Addition Through Subtraction

Reducing a costly physical footprint is a priority for many banks evolving their customer service experience. As more banking services become digitized and initiated online and through mobile applications, banks will increasingly reorient away from costly physical bank branches.

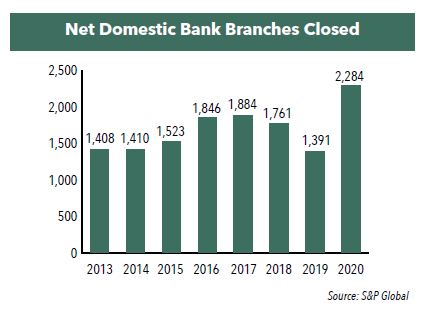

Federal Deposit Insurance Corporation (FDIC) bank branches have dwindled from a high of 85,566 branches as of year-end 2009 to 74,935 branches in 2020. Over the last seven years, branch closures have consistently grown. We expect this trend to continue through the end of the decade and ultimately serve as a margin tailwind for banks able to successfully transition online.

Digital Trends Driving Deals

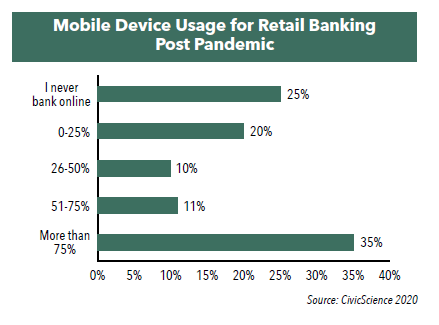

Like almost every aspect of modern life, banking is becoming more digitized by the day, and the pandemic accelerated this trend as in-person transactions became associated with risk-taking for some consumers. During the pandemic, 75% of U.S. adults indicated that they planned on using their mobile devices for banking following the lifting of everyday in-person restrictions.

Generational differences in digital dependence will only accelerate mobile and online adoption. Consumers in the Millennial and Generation Z age ranges are increasingly relying on mobile-only interactions. According to the Chase Digital Attitudes Banking Study1, today, 99% of Gen Z and 98% of Millennials are relying on a mobile banking app to view account balances, check credit scores, and deposit checks.

Deal Strategy

While some larger banks have been actively pursuing opportunities to develop native digital capabilities (essentially disrupting themselves), some will partner and form joint ventures while others will opt to acquire fintech platforms that can harness the benefits of existing scale (across retail and commercial clients) while delivering on a better digital customer service experience.

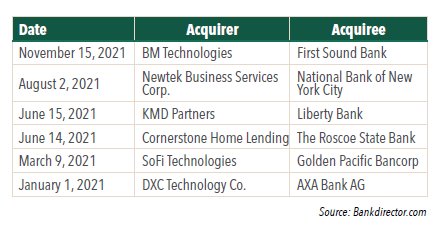

Conversely, for fintech companies that have scale and achieved lofty valuations, the strategy going forward will increasingly be focused on acquiring smaller bank charters to compete more directly and fall under a traditional regulatory framework. The following six deals have been announced in 2021:

Benefits of Active Management Within the Financials Sector

With bottom-up research, we seek to own a select group of companies that we believe offer the best opportunity within the Hennessy Large Cap Financial Fund and Hennessy Small Cap Financial Fund’s universe of 400-500 investable companies. The Funds maintain highly concentrated, high conviction portfolios, which may provide our investors the opportunity to outperform the overall sector.

- In this article:

- Financials

- Large Cap Financial Fund

- Small Cap Financial Fund

You might also like

-

Portfolio Perspective

Portfolio Perspective

Large Cap Financial FundSmall Cap Financial FundSolid Industry Fundamentals & Continued Consolidation

David EllisonPortfolio Manager

David EllisonPortfolio Manager Ryan C. Kelley, CFAChief Investment Officer and Portfolio ManagerRead the Commentary

Ryan C. Kelley, CFAChief Investment Officer and Portfolio ManagerRead the CommentaryPortfolio Managers Dave Ellison and Ryan Kelley review 2025 bank performance, fintech-driven consolidation, attractive valuations, and their constructive 2026 outlook.

-

Portfolio Perspective

Portfolio Perspective

Large Cap Financial FundSmall Cap Financial FundSeeking Innovation in the Financials Industry

David EllisonPortfolio Manager

David EllisonPortfolio Manager Ryan C. Kelley, CFAChief Investment Officer and Portfolio ManagerRead the Commentary

Ryan C. Kelley, CFAChief Investment Officer and Portfolio ManagerRead the CommentaryPortfolio Managers Dave Ellison and Ryan Kelley discuss what’s driving performance in the Hennessy Large Cap Financial Fund, how tariff increases affect banks, the interest rate environment, and the opportunities in financials.

-

Viewpoint

ViewpointNavigating the Financial Landscape in 2025

David EllisonPortfolio ManagerWatch the Video

David EllisonPortfolio ManagerWatch the VideoHennessy Funds Portfolio Manager Dave Ellison discusses the key drivers behind the financial sector's strong performance in 2024, the impact of potential rate cuts and regulatory changes, and the evolving landscape of banking in 2025. He also explores the challenges and opportunities facing both large and small banks, the role of AI, and the critical risks to watch, from traditional credit concerns to transformative technological shifts.