Opportunity in Financials: Beyond Large Cap Banks

Over the last two decades, the Financials Sector has become much more diverse. Financial companies operating in markets where growth is being driven by new processes and technological innovation have become an important part of the sector, offering investors high growth potential and additional diversification.

Key Takeaways

- The Financials Sector today includes many high-growth, diversified financial companies.

- Technological innovation is driving growth for many diversified financial companies operating in industries such as global payments and investment management.

- Investors looking to benefit from these industry trends may want to consider the Hennessy Large Cap Financial Fund.

The Changing Face of Financials

When many investors think of large-cap Financials, large national and super regional banks often come to mind. Fundamentally the banking industry continues to do well. For the full year 2018, large banks reported earnings growth of 20% and higher operating margins.1 Valuations continue to be reasonable, and banks are maintaining good credit quality by sticking with conservative lending practices.

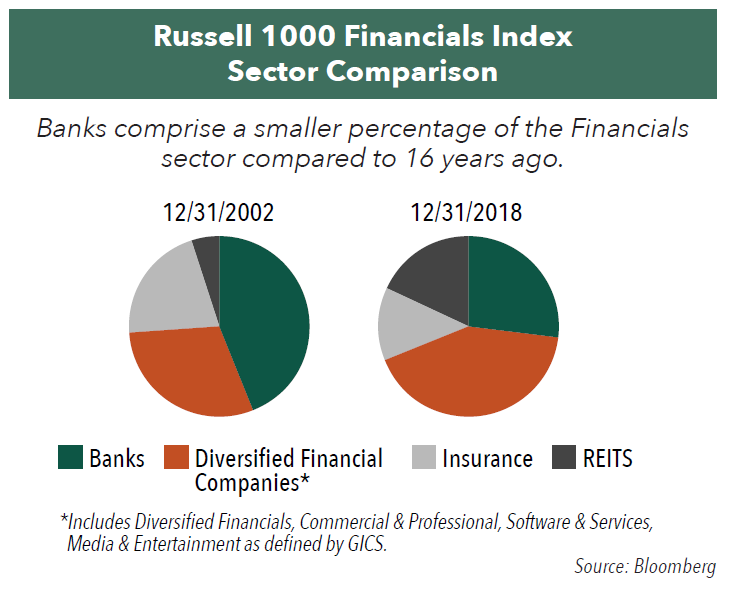

Banks are a much smaller percentage of the Financials Sector than they used to be—27% today vs. 44% in 2002.1 In fact, over the past 16 years, the Financials Sector has changed to now include many more “diversified financial companies,” or companies that operate outside the banking industry. In 2002, many of the largest diversified financial companies, such as Visa and MasterCard, existed but were not public. Others, such as PayPal and Square, had not yet been founded. Today, diversified financial companies in industries such as investment services, global payments, and brokerage, make up over 42% of the Financials Sector.

Fast Growing Markets

Many of these diversified financial companies operate in new, fast-growing markets, and enjoy competitive barriers to entry such as branding or technological advantages. For many of these companies, earnings growth is being driven by secular growth trends and advancements in technology.

Their operations are only loosely tied to cyclical factors, such as gross domestic product (GDP) growth or the movement of interest rates. Moreover, their operations also tend to be highly profitable, reporting an average return on equity of 25% in their latest filing, compared to 23% for the S&P 500 Index.1

Global Payments

Consumers and corporations, both in the U.S. and globally, have been steadily increasing the volume of payments they make with a credit or debit card, rather than paying with a check or cash. Since 2000, credit card purchase volume in the U.S. has increased almost three-fold, a growth rate of almost 6.5% annually. Internationally, card usage has been growing even faster. Credit and debit card purchase volume through the Visa network in international markets has been rising by over 17% annually since 2007.2

Network companies including Visa and MasterCard, as well as integrated credit card providers such as American Express and Capital One Financial, are all benefiting from this growth. Many of these companies have instantly recognizable brand names and state-of-the-art technology running vast global networks, making entry into their businesses by new competitors very difficult.

Technological Innovation

Technological innovation is also driving growth in the global payments market. Products from Square Inc. now allow small and mid-sized businesses to accept card payments from anywhere, while person-to-person mobile platforms, such as PayPal and Zelle,3 offer friends an easy way of splitting the bill for pizza, and online consumers a way to use their credit card with added security. Both markets are growing exponentially.

Another industry experiencing growth as a result of advances in technology is investment management. The growth of passive investing has been a powerful trend. Index mutual funds and ETFs have grown from 15% of the fund market in 2007 to 35% in 2017, or growth of over 16% per year in dollar terms.4 While passive investing has negatively impacted active asset management companies, it has been a growth area for index providers such as MSCI. Payments to index providers are usually tied to client assets under management, so, as passive assets grow, so do revenues and profits for index providers. The growth of passive investing has also been beneficial for custodian banks, such as State Street and US Bancorp, who provide custodial, accounting, and back-office services to asset management companies with index and ETF products.

An Opportunity to Benefit

We believe diversified financial companies operating in industries such as electronic payments and asset management may present investors with compelling investment opportunities. As an actively managed Fund, with a concentrated portfolio and an overweight position in diversified financial companies, the Hennessy Large Cap Financial Fund allows investors the opportunity to participate in these broader industry trends.

- In this article:

- Financials

- Small Cap Financial Fund

- Large Cap Financial Fund

1 Bloomberg.com

2 Statista.com

3 Zelle is a mobile payments platform owned by several large banks.

4 2018 Investment Company Fact Book

Quasar Distributors, LLC is a subsidiary of US Bank Global Fund Services.

You might also like

-

Portfolio Perspective

Portfolio Perspective

Large Cap Financial FundSmall Cap Financial FundSolid Industry Fundamentals & Continued Consolidation

David EllisonPortfolio Manager

David EllisonPortfolio Manager Ryan C. Kelley, CFAChief Investment Officer and Portfolio ManagerRead the Commentary

Ryan C. Kelley, CFAChief Investment Officer and Portfolio ManagerRead the CommentaryPortfolio Managers Dave Ellison and Ryan Kelley review 2025 bank performance, fintech-driven consolidation, attractive valuations, and their constructive 2026 outlook.

-

Portfolio Perspective

Portfolio Perspective

Large Cap Financial FundSmall Cap Financial FundSeeking Innovation in the Financials Industry

David EllisonPortfolio Manager

David EllisonPortfolio Manager Ryan C. Kelley, CFAChief Investment Officer and Portfolio ManagerRead the Commentary

Ryan C. Kelley, CFAChief Investment Officer and Portfolio ManagerRead the CommentaryPortfolio Managers Dave Ellison and Ryan Kelley discuss what’s driving performance in the Hennessy Large Cap Financial Fund, how tariff increases affect banks, the interest rate environment, and the opportunities in financials.

-

Viewpoint

ViewpointNavigating the Financial Landscape in 2025

David EllisonPortfolio ManagerWatch the Video

David EllisonPortfolio ManagerWatch the VideoHennessy Funds Portfolio Manager Dave Ellison discusses the key drivers behind the financial sector's strong performance in 2024, the impact of potential rate cuts and regulatory changes, and the evolving landscape of banking in 2025. He also explores the challenges and opportunities facing both large and small banks, the role of AI, and the critical risks to watch, from traditional credit concerns to transformative technological shifts.