Strong EPS Growth Rates and a Discussion of Portfolio Holdings

The Hennessy Focus Fund Managers discuss the Fund’s growth rates and valuation, recently added positions, holdings that may take longer to recover, and their current watchlist.

-

David Rainey, CFACo-Portfolio Manager

David Rainey, CFACo-Portfolio Manager -

Brian Macauley, CFACo-Portfolio Manager

Brian Macauley, CFACo-Portfolio Manager -

Ira Rothberg, CFACo-Portfolio Manager

Ira Rothberg, CFACo-Portfolio Manager

Would you please discuss the valuations and earnings growth rates for the Fund vs. its benchmark?

As of December 31, 2020, the Fund traded at 16.6x our estimate of 2021 earnings, a significant discount to 23.4x for the Russell 3000® Index, and the widest discount in over a decade.

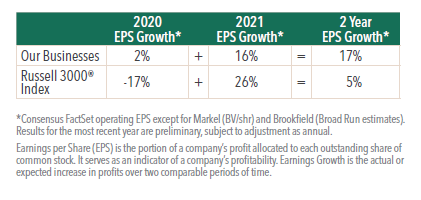

While the past year has been challenging for many stocks, we are pleased with the fundamental performance of the businesses we own in the Fund. The look-through earnings of the Fund held up much better than the broader market in 2020 with a 2% expected increase compared to a 17% expected decline for the Russell 3000® Index. Taking a two-year view that incorporates both the decline in corporate earnings in 2020 and the expected rebound in 2021, our businesses still look quite good with 17% cumulative earnings growth versus 5% for the broader market. We believe the significant divergence between these growth rates speaks to the quality and resiliency of the businesses we own.

Would you provide an update on holdings added to the Fund in 2020?

In 2020, we initiated positions in four companies: RH, Allegiant Travel Co., CDW, and Fastenal.

RH is an upscale home furnishings company that experienced headwinds early in 2020 due to COVID-19 related shutdowns. RH took advantage of the tumultuous economic environment within the commercial real estate market to secure new leases and expand its presence in additional desirable markets. Mid-year, the company benefited from a surge in consumer demand, as monies not spent in other consumer categories combined with more time spent at home led to an increase in home improvement and décor spending.

On top of the opportunity to more than double sales in North America, the company is poised to begin opening galleries internationally, and we believe RH has the potential to become a $20 billion global brand, versus $2.8 billion in annual sales today.

Shares trade at about 23X our estimate of next 12 months’ EPS, a significant discount to luxury brand peers.

Allegiant Travel Co. is an ultra-low cost airline serving small and mid-sized cities with direct flights to leisure destinations. While other airlines slashed routes as they struggled with significant declines in passenger traffic, Allegiant added 70 routes to its existing 500, growing the airline’s footprint by 14% since the beginning of the pandemic. Allegiant’s management expects this expansion to continue, with the potential to expand its operations to between 500 and 1,000 additional routes over the long-term. We believe it is a well-run business, as it was able to avoid issuing equity during the pandemic and was one of a few airlines globally that reported positive adjusted EBITDA in 2020 Despite recent strong stock performance, we foresee strong growth potential as the company currently trades at an undemanding 11x our estimate of normalized earnings.

CDW is a leading value-added reseller, or “VAR”, providing technology hardware, software and services to a wide variety of organizations. CDW is about 50% larger than its next closest competitor, giving it important scale advantages, and yet it has just 5% market share, allowing plenty of opportunity for further growth. Importantly, CDW has a strong sales culture enabling it to build close customer relationships and become a trusted advisor in the procurement of IT solutions.

The trend of cloud computing is making IT systems even more complex, increasing the importance of CDW to its customers. CDW has a long history of high single digit sales growth and mid-teens earnings per share growth, which we believe the company is positioned to continue.

Today the company trades at about 22x 2021 earnings, a modest discount to the broader market.

Fastenal is a distributor of industrial MRO (Maintenance, Repair, and Operations) products including fasteners, safety products, hardware, cutting tools and much more. Fastenal has a long history of growth thanks to its strategy of moving closer and closer to customers to better understand their MRO needs. Most recently the company has launched its “onsite” program where it places Fastenal employees and inventory in or adjacent to a customer facility. This has unleased great efficiencies for both Fastenal and these customers. We believe this service innovation will allow Fastenal to continue its attractive rates of sales and earnings compounding far into the future.

Fastenal trades at about 27x 2021 earnings estimates, a premium to the market, but earnings have been damped by the pandemic and we expect a rebound as we exit the pandemic.

Which holdings are expected to take longer to recover from the impact of the pandemic?

While the COVID-19 vaccines may help governments ease restrictions, certain sectors may continue to face headwinds in the short term. These are just three portfolio companies we believe may not make a full recovery from the pandemic in the next year or two. We continue to hold each of these businesses after reevaluating them using new assumptions.

Mistras Group provides testing and inspection services used to evaluate the structural integrity and reliability of energy, industrial, and public infrastructure projects. The company has historically derived approximately 60% of its revenue from the oil and natural gas industry and 13% from aerospace and defense. Despite its short-term challenges, we believe the company has strong upside from a cyclical rebound. A recovery in oil prices may spur increased spending by its oil and gas customers, which will help Mistras’ cash flows recover, propelling its share price upwards significantly. Its valuation is compelling, trading at 7x next 12 month EV/EBITDA, compared to its 5-year average of about 9x prior to the oil price decline that began in the summer of 2018.

Hexcel Corporation is a global manufacturer of advanced composite and lightweight structural materials, including carbon fiber reinforcements and resin systems. The majority of the company’s sales are to the hard-hit commercial aerospace industry. We expect excel’s revenue growth to mirror the trajectory of the rebound in aircraft production. If air travel looks to be on a path to a full recovery by 2024, we believe that Hexcel shares could provide an attractive annualized total return over the next three years. While Hexcel’s share price continues to remain below its pre-pandemic level, we believe it is a well-run company with a strong competitive advantage and positive long-term growth prospects as composites penetration increases with the next generation of aircraft.

Marlin Business Services Corp. is a provider of equipment leases and working capital loans to small businesses, many of which saw significant declines in their revenue as a result of the pandemic. A fear of large credit losses weighed on Marlin’s share price in 2020, yet losses have been well contained. As a result, Marlin’s share price rebounded from trading at about 25% of the company’s book value at the height of the pandemic to about 90% of its book value as of 3/17/21. While it may take a few years for its originations to rebound to prior peak levels, we believe that Marlin’s attractive technology-driven origination platform and strong yields on new originations are attractive to potential acquirers. Over the last several years, a number of Marlin’s equipment leasing competitors were purchased by private equity or regional banks with lower capital requirements at greater than two times book value. Now that delinquencies and net charge-offs are trending in line with pre-pandemic levels, we believe that Marlin is likely to be acquired at a healthy premium to book value.

Would you discuss the Fund’s current watchlist?

Our watchlist consists of 75 companies that we would like to own if valuation and/or other circumstances allowed. This list reflects our collective knowledge after almost two decades together scouring the markets and conducting research to identify businesses that meet our five criteria (high-quality business, large growth opportunity, excellent management, low “tail risk,” and discount valuation).

The watchlist spans the market capitalization spectrum and most sectors. Today, most industries have seen demand substantially recover and are trading at or near all-time highs. However, a few industries remain severely impacted by the pandemic (e.g., travel and leisure). While the market appears willing to ascribe ever-increasing multiples of sales to technology businesses with recurring revenue, many businesses with less near-term visibility trade at low multiples of normalized earnings. It is in these pockets of the market where we believe the best opportunities lie.

- In this article:

- Domestic Equity

- Focus Fund

You might also like

-

Portfolio Perspective

Portfolio Perspective

Focus FundSeeking Companies with Strong Growth at Attractive Valuations

David Rainey, CFACo-Portfolio Manager

David Rainey, CFACo-Portfolio Manager Ira Rothberg, CFACo-Portfolio Manager

Ira Rothberg, CFACo-Portfolio Manager Brian Macauley, CFACo-Portfolio ManagerRead the Commentary

Brian Macauley, CFACo-Portfolio ManagerRead the CommentaryThe Portfolio Managers rely on their strategy of owning durable, well-run businesses capable of turning adversity into opportunity and adapting to macroeconomic surprises. The following Hennessy Focus Fund Commentary recaps the 2025 market and highlights areas of opportunity ahead.

-

Portfolio Perspective

Portfolio Perspective

Focus FundFrom Rate Cuts to AI: Positioning the Portfolio for Potential Opportunity

David Rainey, CFACo-Portfolio Manager

David Rainey, CFACo-Portfolio Manager Ira Rothberg, CFACo-Portfolio Manager

Ira Rothberg, CFACo-Portfolio Manager Brian Macauley, CFACo-Portfolio ManagerRead the Commentary

Brian Macauley, CFACo-Portfolio ManagerRead the CommentaryThe Portfolio Managers discuss holdings that could potentially benefit from lower rates, tariffs, and artificial intelligence (AI). The team also provides an update on AST SpaceMobile and discusses potential opportunities in select Technology and Health Care companies.

-

Company Spotlight

Company Spotlight

Focus FundO’Reilly Automotive—Revved for Growth

David Rainey, CFACo-Portfolio Manager

David Rainey, CFACo-Portfolio Manager Ira Rothberg, CFACo-Portfolio Manager

Ira Rothberg, CFACo-Portfolio Manager Brian Macauley, CFACo-Portfolio ManagerRead the Spotlight

Brian Macauley, CFACo-Portfolio ManagerRead the SpotlightO’Reilly Automotive is a leader in the automotive aftermarket parts industry in the U.S. The company’s scale, unique distribution infrastructure, and customer service-oriented culture should allow it to take market share in a fragmented U.S. market for years to come.