Portfolio Update: Position Changes and Investment Outlook for 2024

In this letter we share some thoughts from the Portfolio Managers at Broad Run Investment Management, LLC, the Fund’s sub-advisor.

-

David Rainey, CFACo-Portfolio Manager

David Rainey, CFACo-Portfolio Manager -

Brian Macauley, CFACo-Portfolio Manager

Brian Macauley, CFACo-Portfolio Manager -

Ira Rothberg, CFACo-Portfolio Manager

Ira Rothberg, CFACo-Portfolio Manager

Commentary

Fund (HFCIX) performance was solid in 2023, up 21.31% (Russell Midcap® Growth Index up 25.87%, Russell 3000® Index up 25.96%). In contrast, earnings growth at our businesses was roughly flat in 2023, but appears poised for a healthy rebound in 2024 as the twin headwinds of inflation and higher interest rates have been largely absorbed. In general, our more rate sensitive holdings (including Brookfield Corporation, CarMax, NVR, RH, and Encore Capital) suffered earnings declines in 2023, while our other holdings enjoyed double-digit earnings growth as a group. We are optimistic that our rate sensitive businesses will be among our best performers in the coming year, especially if the Federal Reserve kicks off a rate easing cycle as is currently expected.

In this letter we discuss: (1) our new position in Altus Group, (2) adding to the AST SpaceMobile position, (3) reducing our position in SS&C, and (4) a more thorough update on the underlying earnings growth at our businesses in 2023, and our outlook for 2024.

New Position: Altus Group Ltd.

We are admirers of software and information services business models, but have generally found such opportunities too richly valued to own over the past several years. However, in Altus Group, we believe we have found such a business—with recurring revenue, monopolistic market positioning, high customer retention, and significant growth potential—at a reasonable multiple of current cash earnings. We added a 1.0% position to the Fund during the quarter.

Altus Group is a provider of a portfolio of software and services to the commercial real estate (CRE) market in Canada, the U.S., the U.K., France, Germany, and Australia. Altus’s solutions are primarily focused on property valuation for the purposes of tax appeals, investment underwriting, transaction facilitation, investor reporting, insurance claims, and litigation.

Altus Group was created in 2005 through the merger of three leading Canadian property tax appeals consultants. Over the next six years Altus focused on growing its share of the tax consulting market before making an important pivot in 2011 with the acquisition of Argus. Argus was then, and is still today, the leading software used by institutional CRE owners to model and value commercial properties. Since that pivot, Altus has made several acquisitions of CRE-related software businesses and today revenue is split about evenly between software and services.

Services - Property Tax Appeals

Altus’s original business of property tax appeals is a high-quality, cash generative business contributing about 35% of overall revenue.

Property taxes are one of the largest expenses for CRE owners, so contesting tax authority assessments is a common practice with an attractive return on investment (ROI). In fact, the industry tends to be counter-cyclical with revenue increasing in more difficult times when tax authorities are slow to recognize decreases in property values. Revenue is primarily earned on a contingency basis where Altus receives a percentage of the tax savings achieved on behalf of clients.

Altus is often the largest, or one of the largest providers of tax appeal services in its markets. Its market share in Canada, the U.K., and the U.S. is about 60%, 25%, and 7%, respectively, providing credibility, and unmatched data and resources. Customer relationships tend to be sticky; once Altus is familiar with a client’s property portfolio and successfully delivers savings, it becomes difficult to displace.

This business has a solid financial profile with modest growth and 30%-plus EBITDA margins. We expect this business to grow revenue organically at a 3-5% rate with possible revenue and margin upside from the introduction of more technology enabled services.

Services - Property Appraisal & Development Consulting

Altus also provides property appraisal and development consulting services, composing about 15% of overall company revenue.

Clients come to Altus for valuation appraisals used in investor net asset value (NAV) calculations, litigation support, and general due diligence. Similar to the property tax appeals business, engagements tend to be recurring and relationships sticky based upon trust and historical familiarity with client properties. In development consulting, Altus primarily provides feasibility studies for new CRE construction.

This business is the lowest margin segment at Altus, but it is capital light and provides a further touchpoint for Altus across its client base. We expect this business to continue growing revenue in line with its historical 3-5% rate and to maintain EBITDA margins in the mid-teens.

Software & Analytics

Altus’s largest business, composing about 50% of revenue, provides CRE software and analytics on a subscription basis.

As mentioned previously, the core of this business is Argus, which was acquired in 2011. Argus is the de facto standard modeling and valuation tool used in the CRE industry in North America and parts of Europe. Argus software is used to model and value CRE properties in great detail including hundreds or even thousands of property specific data points.

Argus’s dominant position is the result of high switching costs and network effects. Many Argus users spend the majority of their day inside of the software modeling and analyzing properties they are looking to buy, optimize, or sell. There are few substitute products, and to switch to them would be very disruptive to employee productivity.

Most CRE owners are regularly buying and selling properties to optimize their portfolio and generate returns. There are typically many constituents involved in a CRE transaction including the seller, buyer, brokers, advisors, and banks. Throughout the transaction process, these parties are exchanging Argus models with one another. If one party attempted to use a different software it would throw sand in the gears of the transaction, forcing parties to convert files back and forth with the risk of delay, data loss, and human error. In many cases using an alternative software is not even an option since Argus is contractually specified for use in the transaction.

Argus models are essentially “the language” that CRE industry participants speak. It is taught in over 200 universities, is reinforced through daily use, and is the basis of trade in high stakes transactions. These strong competitive advantages are evident in Argus’s gross retention rate, which is in the mid-to-high 90 percent range. When customers do churn, in the majority of cases it is because they were acquired or went out of business.

New Management with a New Vision for Software & Analytics

Argus has been the dominant CRE valuation tool for several decades, and it had grown nicely along the way. But prior leadership of the company came from the tax consulting business, so it was slow to begin the transition of Argus to the cloud, and its various other CRE software acquisitions were never fully integrated.

In 2020, the Board brought in a new management team with a track record of success in directly applicable software / data / analytics businesses. That new team, consisting of Jim Hannon as CEO, Jorge Blanco as CPO, Ernie Clark as CMO, and Dave Ross as CTO, had worked together at companies including FICO and Callcredit. In Argus they saw an excellent business that was not realizing its full potential. By applying their playbook from prior experience, they saw an opportunity for significant improvement and value creation.

Since taking over, management has continued the transition to the cloud and introduced numerous other actions to improve the products, reorient the go-to-market strategy, refine pricing, and open up new growth opportunities. Argus, and the other CRE software products, are now integrated in logical solution sets based upon customer needs rather than siloed offerings with independent sales teams. Financial results and market feedback have been very good so far, and Argus remains in the early innings of harvesting the benefits of this transformation.

One of the biggest opportunities for growth and value creation will come from introducing proprietary CRE data and analytics tools. A key benefit of moving to the cloud is that Argus now has visibility into its customers’ CRE valuation models. Historically that information was stored locally at the customer premises. Using a “give to get” business model, Argus customers agree to contribute their proprietary data from their existing models into an anonymized central database in exchange—for a fee—for access to the datasets and analytics tools Argus creates from that database. Argus now has access to detailed data on nearly one million unique commercial properties, enabling insights heretofore unavailable to the industry. Key use cases include performance benchmarking and predictive analytics to understand future asset performance and acquisition / improvement / divestment opportunities.

Argus is bringing “big data” to the CRE industry, with the potential to add alpha for users, which would be tremendously valuable. The first of these products is just now rolling out so we do not yet know how commercially successful the offerings will be, but one of management’s core theses in coming into Altus was that such solutions could be transformative for the business.

We believe Argus can grow its revenue at a high-single-digit to low double-digit rate over the next five-to-ten years. We believe the low end of this range is attainable even if new data and analytics offerings receive a tepid response. Further, Argus has roughly 20% EBITDA margins today, well below the 35-40% margins typically seen at scaled leading software and analytics businesses. With very high incremental margins, we expect high-single-digit revenue growth to drive EBITDA margins in the high 30% range over a five-to-ten-year horizon. In total, we are projecting mid-teens or higher EBITDA growth at this segment.

When we blend Argus with the slower growth services businesses, we believe the overall company will grow revenue at a high-single-digit rate and EBITDA at a low double-digit rate over the next five to ten years. Today, Altus trades for about 22x our estimate of 2024 cash earnings. This is a discount to what comparable quality information services and vertical market software providers trade at, especially considering Altus’s superior revenue growth and margin expansion profile. Further, we expect the company to begin to use its free cash flow to return capital to shareholders over time, delivering a roughly mid-teens rate of earnings per share (EPS) compounding over the long term.

It is important to note that the CRE end market has been under significant pressure over the last year due to sharply rising interest rates and secular challenges in the office segment. In the second quarter of 2023, total CRE transactions were down 63% year-over-year. However, we believe Altus is well insulated from this stress. As we’ve mentioned, Altus’s property tax appeals business displays counter-cyclical attributes, and the Argus software business is a subscription-based offering with contracts averaging three years in duration. Argus’s revenue is not tied to transaction volume, and it has multiple growth drivers working in concert to move the business forward. Finally, we observe that Altus’s software business grew recurring revenue 19% year over year in the first half of 2023, despite the challenges facing the end market.

Position Update: AST SpaceMobile

As a reminder, AST is attempting to build a first-of-its-kind satellite network enabling wireless broadband connectivity to unmodified smartphones anywhere in the world. It is partnering with leading mobile network operators (MNOs)—such as AT&T and Vodafone—using the MNOs’ spectrum to reach end users with a 50/50 revenue share business model.

This is a huge total addressable market. There are 5.5 billion global wireless subscribers that experience dead zones and/or weak coverage on a regular basis. 1.0 billion global subscribers do not have broadband data coverage, and approximately 2.5 billion people have no cellular service at all. Not only is AST pursuing an enormous financial opportunity, it has the potential to transform the lives of billions of people by bringing them connectivity for the first time.

We characterized this investment as a “special situation” when we established it two and a half years ago, and we would still characterize it as such today. It does not meet our typical compounder criteria, but our significant proprietary research leads us to believe that it has a compelling risk-return profile. While there remains a risk of complete capital loss, this is more than offset by the increasingly real potential of 20x, 30x, or 50x upside.

From the beginning, our research led us to believe that AST’s technological approach had “cracked the code” to delivering ubiquitous space-based broadband coverage to unmodified mobile phones. There were many doubters, including some knowledgeable industry insiders, who asserted that AST would never be able to (1) unfurl a satellite large enough to deliver this service, (2) keep that satellite powered up and stable while moving 17,000 miles per hour in low earth orbit, or (3) establish a signal strong enough to connect with unmodified mobile phones. Over the last two and a half years AST has proven these skeptics wrong while achieving the following milestones:

• Unfurling of the largest commercial communications array ever at 693 sq. feet – Nov 2022

• First-ever 2G voice call from space directly to everyday smartphones – Apr 2023

• First-ever 4G LTE connection from space directly to everyday smartphones – Jun 2023

• First-ever 5G voice calls from space directly to everyday smartphones – Sep 2023

• First-ever 5G data speeds of 14 Mbps from space directly to everyday smartphones – Sep 2023

In our opinion, AST has demonstrated that its core technology works. This has been confirmed by comments from key commercial partners AT&T, Rakuten, and Vodafone. While other technological hurdles remain (unfurling even larger satellites, signal handoff from one satellite to the next, and managing interference, among others), we believe they are minor compared to the distance that has been traveled so far. Getting to this point is a significant accomplishment and a credit to the team at AST. That said, it has taken about twice as long as we originally expected, so capital needs have been higher, and equity dilution has been worse than we originally underwrote.

With the most significant technological hurdles cleared, AST is now focused on commercializing its service. The company has nearly completed building the first five of its commercial satellites, which are slated for launch in the second quarter. Beyond this launch, AST is seeking to fund the next 20 satellites at a total cost of about $600 million. To this end, on January 18, AST announced $155 million in strategic investment from AT&T, Google, and Vodafone as part of $306.5 million in aggregate new financing (inclusive of an approximately $100 million follow-on public offering). This covers about half the funding needed for the 20 satellites, with the remainder expected to come from additional strategic partners (in the form of advanced commercial payments) and low-cost quasi-governmental financing.

With 25 satellites in orbit (5 + 20), we believe AST can offer very useful intermittent service and achieve operating cash flow breakeven. At 40-45 satellites, AST should be able to offer near continuous service in several of the world’s most commercially attractive markets. And additional satellites from that point will improve capacity, coverage, and speed.

Today, there is little network differentiation between the three major wireless carriers in the U.S. In this commoditized industry, a breakthrough new capability such as ubiquitous broadband coverage has the potential to drive meaningful market shifts among players. AT&T, as AST’s exclusive partner in the U.S., is positioned to reap significant strategic and financial value from this arrangement through increased new subscribers, higher ARPU, and lower customer churn.

At the Fast Company Innovation Festival on September 19, John Stankey, CEO of AT&T, stated that 30-40% of his subscribers would be likely to pay extra for the improved connectivity AST can provide. Assuming $5 per subscriber per month, and 30% adoption across AT&T’s 106 million U.S. subscribers, this would translate into approximately $2 billion of incremental revenue split equally between AT&T and AST. Since AST is providing this capability on a wholesale basis, AT&T will shoulder the cost of customer acquisition, customer service, billing, and backhaul. As a result, we expect AST’s service EBITDA margins to exceed 90%. And the U.S. is just one of many markets AST will cover with its early constellation. Outside the U.S., AST has memoranda of understanding with 40+ other MNOs representing more than 2.4 billion subscribers.

The decline in share price over the last few years stands in sharp contrast to the fundamental progress the company has made over that time. As such, we added to our position in the fourth quarter, bringing it from about a 1.7% position to a 3.0% position as of year-end. We think this strikes the right balance between the huge upside potential, and the technological and financing risk inherent in the business plan.

Reduced Position: SS&C Technologies

We initiated a position in SS&C Technologies in the third quarter of 2019. The company is a leading provider of software and outsourcing solutions to customers in the financial services industry. Its products are essential to customers with high switching costs and recurring revenue. It is led by founder and 13% shareholder Bill Stone. Bill has built the business over the last 37 years via opportunistic acquisition, buying high quality but fairly mature assets, and creating value via aggressive cost cutting.

Our original thesis was that, with just 5% global market share, there was substantial additional runway for SS&C to continue its acquisition driven business model. If successful deploying capital at just one half the volume it had done historically (at the same ROI), returns for shareholders would compound at a 15-20% rate. And if attractive acquisitions were not available, low-to-mid single digit organic revenue growth and share repurchases would allow for low double-digit EPS compounding.

Unfortunately, in the four years that we have owned the business, the acquisition environment has been very challenging with few deals consummated by SS&C. We believe this is partly a function of the company’s price discipline, but also a function of significant private equity activity, including a dramatic rise in capital under management at software focused buyout firms such as Thomas Bravo, Vista Equity Partners, and Francisco Partners. Perhaps the higher interest rate environment will reward SS&C for its patience, but our belief is that the market for these types of acquisitions is more competitive now and this challenge is more secular than cyclical.

Further, SS&C has faced a large increase in operating and financial costs. Wage inflation has been a headwind, and SS&C has not yet demonstrated pricing power sufficient to offset these increased costs. Additionally, the business has financial leverage and rising rates have added to interest expense. There remains a reasonable pathway for SS&C to find its footing and generate adequate organic growth and price increases to get back to its historical margins, but our confidence in that scenario has been reduced. As a result, we cut SS&C from 2.5% of assets to 1.0% of assets in the quarter, and redeployed the proceeds into AST SpaceMobile and Altus Group where we see more opportunity.

2023 Portfolio Earnings Update

As we have discussed in the past, investment returns for equities can be broken down into three factors: growth in earnings, dividends, and change in valuation. In the short term, change in valuation can have a meaningful impact on investment results, but in the long term, change in valuation becomes much less important as growth in earnings and dividends accumulate to drive the majority of results.

For this reason, as long-term investors, our analytical focus is on trying to understand a business’s future earnings and dividends. We track how these metrics develop at each business we own, in aggregate across all the businesses we own, and at the portfolio level taking into account the impact of cash. This analysis helps us understand how these businesses are performing by providing a measure of progress independent of the vicissitudes of the stock market. At the end of each year, we report a summary of this information to give you additional perspective on your investment with us.

Please note, in this letter when we refer to “earnings” or “EPS” for our businesses, we mean earnings on a per-share basis, adjusted for certain items. We make these adjustments to arrive at what we believe to be a better measure of the true economic earnings of the businesses.

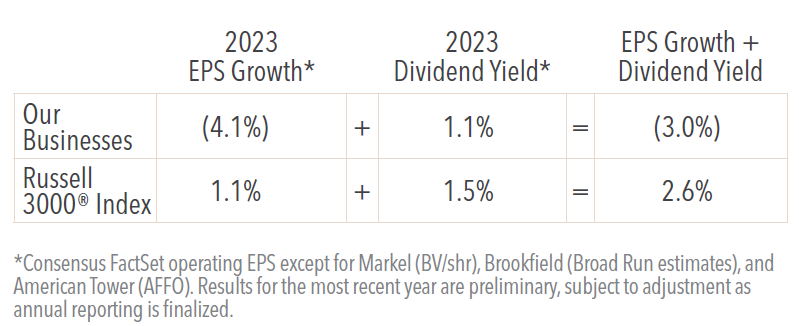

As mentioned previously, there was a bifurcation in the fundamental earnings performance of our businesses in 2023 based largely upon their sensitivity to interest rates. Our more rate sensitive holdings (including Brookfield Corporation, CarMax, NVR, RH, and Encore Capital) had earnings declines in 2023, while our other holdings as a group enjoyed double-digit earnings growth. In aggregate, we estimate our portfolio EPS declined 4.1% and we received 1.1% in dividends. The broader market is estimated to have done better with 1.1% EPS growth and a 1.5% dividend for the Russell 3000® Index.

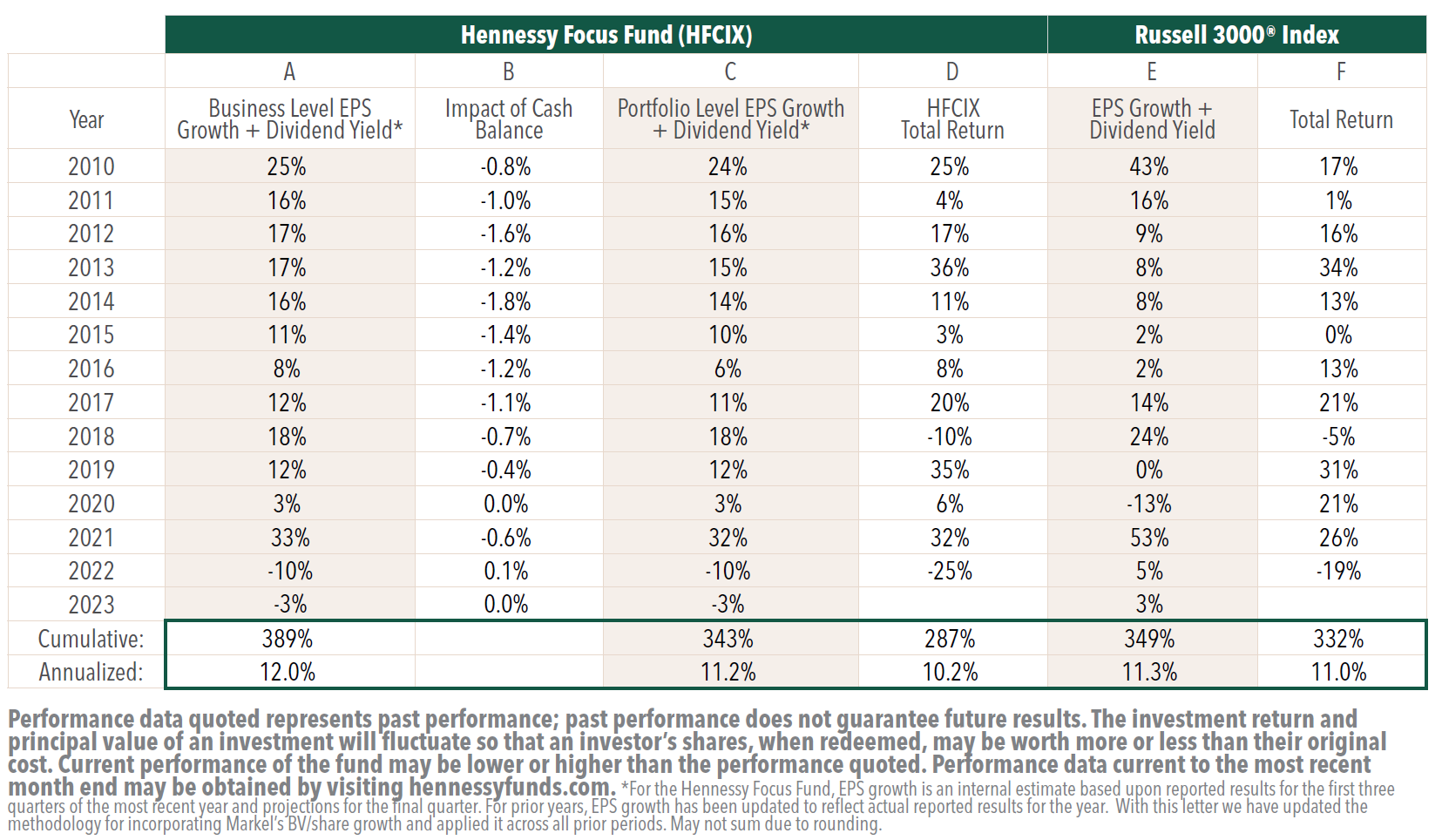

As a reminder, we underwrite our investments to target a mid-teens rate of return. We seek this return via the compounding of earnings over time rather than through a change in valuation or by cleverly trading in or out of a stock. As a result, our long-term portfolio performance is primarily driven by the earnings growth of the underlying businesses that we own.1 You can see this relationship in the table below. Over the last fourteen years, our portfolio level EPS CAGR is 11.2%, inclusive of dividends and cash drag [column C], compared to a realized total return of 10.2% [column D]. Please note that there is a loose relationship between earnings power and price performance in any given year, but that relationship strengthens considerably over longer periods of time.

Our objective is to own a portfolio of businesses that deliver a mid-teens rate of compounding over the long term, without incurring significant risk of permanent capital loss. We remain steadfast in this pursuit, and, despite the lack of earnings progress in our portfolio over the last two years, we believe that we are well positioned to deliver over time.

Investment Outlook

We believe that most of the headwinds from higher rates, higher costs, and reduced affordability are now behind us, with several of our businesses poised to rebound from depressed levels of earnings in 2023.

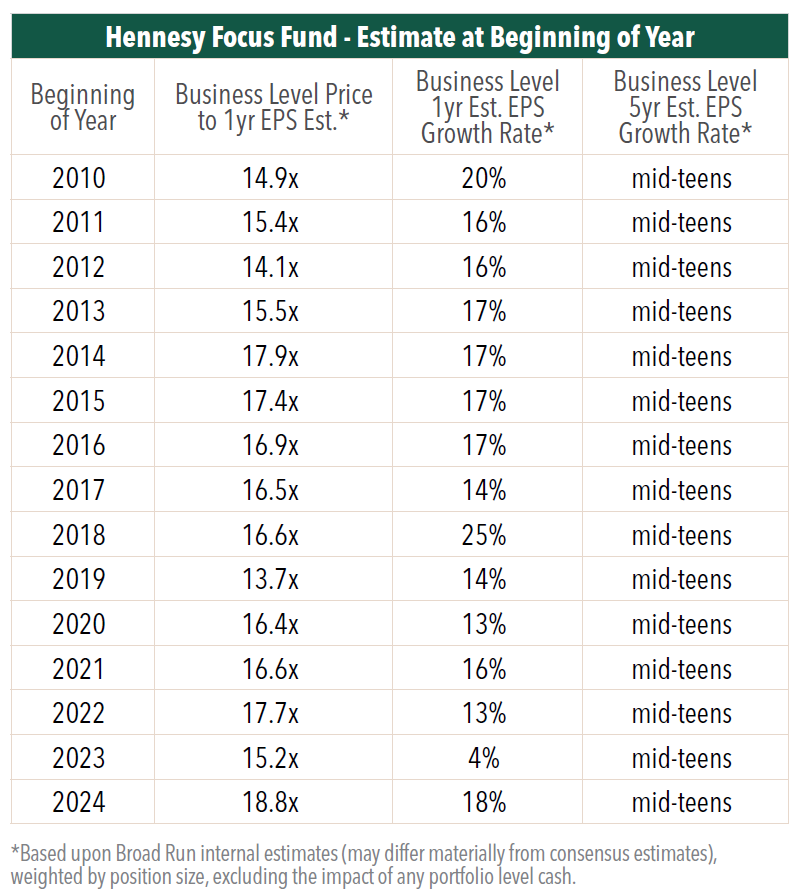

We are forecasting a 18% rate of earnings growth for the portfolio in 2024, with a mid-teens rate thereafter. At year end, our portfolio was trading at 18.8x our 2024 earnings estimates. This is both a lower current valuation and higher expected growth rate than the Russell 3000® Index at 22.0x 2024 consensus earnings estimates and 12% expected growth. From this valuation level we expect portfolio returns will roughly track the rate of earnings growth produced by our portfolio over the next five years.

Click here for a full listing of Holdings.

Click here for full, standardized Fund performance.

- In this article:

- Domestic Equity

- Focus Fund

You might also like

-

Portfolio Perspective

Portfolio Perspective

Focus FundFrom Rate Cuts to AI: Positioning the Portfolio for Potential Opportunity

David Rainey, CFACo-Portfolio Manager

David Rainey, CFACo-Portfolio Manager Ira Rothberg, CFACo-Portfolio Manager

Ira Rothberg, CFACo-Portfolio Manager Brian Macauley, CFACo-Portfolio ManagerRead the Commentary

Brian Macauley, CFACo-Portfolio ManagerRead the CommentaryThe Portfolio Managers discuss holdings that could potentially benefit from lower rates, tariffs, and artificial intelligence (AI). The team also provides an update on AST SpaceMobile and discusses potential opportunities in select Technology and Health Care companies.

-

Company Spotlight

Company Spotlight

Focus FundO’Reilly Automotive—Revved for Growth

David Rainey, CFACo-Portfolio Manager

David Rainey, CFACo-Portfolio Manager Ira Rothberg, CFACo-Portfolio Manager

Ira Rothberg, CFACo-Portfolio Manager Brian Macauley, CFACo-Portfolio ManagerRead the Spotlight

Brian Macauley, CFACo-Portfolio ManagerRead the SpotlightO’Reilly Automotive is a leader in the automotive aftermarket parts industry in the U.S. The company’s scale, unique distribution infrastructure, and customer service-oriented culture should allow it to take market share in a fragmented U.S. market for years to come.

-

Portfolio Perspective

Portfolio Perspective

Cornerstone Mid Cap 30 FundPortfolio Drivers: Consumer Discretionary and Industrials

Neil J. HennessyChief Market Strategist and Portfolio Manager

Neil J. HennessyChief Market Strategist and Portfolio Manager Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager L. Joshua Wein, CAIAPortfolio ManagerRead the Commentary

L. Joshua Wein, CAIAPortfolio ManagerRead the CommentaryCornerstone Mid Cap 30 Fund Portfolio Managers Ryan Kelley and Josh Wein review the Fund’s investment strategy, discuss the most recent rebalance, and highlight the recent change in market cap range of potential investments.