The Attractive Business of Japanese Insurers

We believe Japanese general insurance companies look attractive. Due to industry consolidation, three insurers control market share and enjoy high profitability and strong pricing power yet remain attractively priced.

-

Masakazu Takeda, CFA, CMAPortfolio Manager

Masakazu Takeda, CFA, CMAPortfolio Manager

Key Takeaways

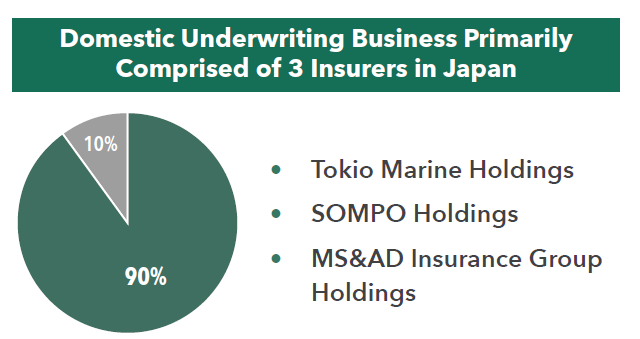

» The general insurer market is dominated by three groups: Tokio Marine Holdings, SOMPO Holdings, and MS&AD Insurance Group Holdings.

» Due to the oligopolistic nature of the industry, these insurers possess many attractive characteristics.

» Despite abundant cash flows and strategic shareholdings, we believe the insurers look undervalued.

The Non-Life Insurance Business in Japan

As a business model, insurance companies receive premiums and in return, compensate the policyholder for the cost of damages such as repairs in the event of a car accident or a fire on behalf of the policyholder. The insurer earns a profit by investing the premiums received until the insurance claim is paid. If no insurance claim occurs or the actual payout is less than the received premium, the insurer can retain the difference. Thus, the main sources of revenue consist of investment income and underwriting income.

The non-life insurance market generally offers general insurance or property and casualty (P&C) insurance covering personal property and liability. In Japan, the market is dominated by three insurance groups:

1. Tokio Marine Holdings – Japan’s largest general insurance group with a solid track record in the domestic market and an expanding overseas business.

2. SOMPO Holdings – Japan’s second-largest insurance company.

3. MS&AD Insurance Group Holdings – a listed holding company with five directly invested group insurance companies in Japan.

Following the Financial System Reform called the “Japanese Big Bang” in the 1990s, the industry consolidated, resulting in these three companies controlling nearly 90% of the domestic underwriting business.

In contrast, in 2023, the U.S.’s property and casualty insurance industry is comprised of 25 companies with the largest company having less than a 10% market share,1 making the competitive landscape far more intense.

The Competitive Edge of Japanese General Insurers

Due to the oligopolistic nature of the industry, these insurers possess many attractive characteristics including abundant profits and strong pricing power to protect their margins from ongoing inflation.

Policy shareholdings – Unique to Japan

In addition, in the 1960s the insurers purchased minority shares in other companies to build and maintain business relationships in corporate insurance. These strategic equity holdings, or “policy shareholdings” have large unrealized gains collectively worth between $8 billion and $16 billion in market value as of the end of March 20242. The insurers have been annually liquidating these stakes, using the proceeds to engage in mergers and acquisitions, increase dividends, and buy back shares.

Strong Capital Allocators

We believe the management of all three listed mega-insurance groups is practicing exemplary capital allocation with their abundant domestic profits as well as the proceeds from the sales of policy shareholdings.

Mergers and Acquisitions (M&A)

One way is engaging in overseas M&A, particularly in the U.S. specialty insurance space. The U.S. is the largest insurance market in the world, more than 15 times the size of Japan3, giving Japanese insurers plenty of acquisition opportunities. As such, approximately 80% of the transaction volume comes from the U.S., where they mainly target the specialty insurance category such as liability insurance, medical insurance among others. Such additions can complement the existing domestic insurance portfolio.

As an example, Tokio Marine has made five large acquisitions since 2008.

Tokio Marine’s Major Acquisitions:

• Kiln – acquired for $763 million in March 2008

• Philadelphia Insurance Companies –acquired for $3.6 billion in December 2008

• Delphi Financial Group – acquired for$1.5 million in May 2012

• HCC – acquired for $6.8 million in October 2015

• Pure – acquired for $2.3 million in February 2020

As a result, its overseas contribution accounts for nearly half of its consolidated financial performance.

M&A transactions also diversify their business. Japan is an archipelago prone to earthquakes and typhoons and is also a country with a high ownership of automobiles. As such, the bulk of insurance portfolios is made up of auto and fire insurance policies. As insurance is a business of risk management, overseas exposure in the specialty insurance category brings diversification effects, which should translate into lower equity risk premium moving forward.

Dividend-paying businesses with attractive earnings yield

When there are no strong acquisition targets, these non-life insurers focus on their shareholder return policy. When it comes to share buybacks and dividend payouts, these companies are in an excellent position. Particularly in situations where the stock is undervalued, continuous share buybacks and dividend increases can be powerful tools. In share buybacks, the more undervalued the stock is, the more shares can be bought, resulting in higher earnings per share for shareholders. Especially in the case of MS&AD and SOMPO whose price-to-book ratios (P/B) are less than 1x, these actions increase the per share book value. Management has the financial flexibility to improve return on equity (ROE) by suppressing unnecessary increases in shareholders’ capital through these measures.

In terms of dividend payments, all three groups have increased their dividend per share at a 10-year compound annual growth rate of between 10% and 18% and boosted dividend yields to 5.0% as of 2023.

For instance, Tokio Marine management has been steadily raising the payout ratio from the 20% range in FY2014 to over 50% in FY2023 while sufficiently funding the growth initiatives necessary to maintain its organic growth.

An Opportunity to Benefit

Insurance businesses have historically been generally regarded as mundane and mature in Japan. We view these Japanese insurers as anything other than mundane because the industry has been growing faster than the country’s GDP.

In addition to their abundant cash flows and strategic shareholdings, we believe the insurers look undervalued.

As of 12/29/2023, Tokio Marine had a price-to earnings(P/E) ratio of approximately 14x, 1.6x price to-book (P/B) and a dividend yield of 3%. Over the past decade, Tokio Marine has achieved an average annual growth rate higher than that of Chubb (U.S.), Allianz (Germany), and AXA (France) with its adjusted return-on-equity (ROE) approaching 17%. Considering the potential to become a top-tier global insurance company in terms of profit scale and profitability, we consider the stock attractive.

Both MS&AD and SOMPO are trading below 1x P/B. Part of the reason is that the performance of their stock prices over the past seven years has not kept pace with the growth of their earnings per share (EPS), suggesting they are undervalued.

• From the fiscal year ending in March 2017 through the fiscal year March 2024 company forecasts, the cumulative growth rate of MS&AD’s earnings per share (EPS) totals 82%, while the stock price growth over the same period is only 44%.

• SOMPO’s EPS growth is 81% compared to a stock price growth of 57%.3

Forward P/E for both stocks based on the companies’ forecasted net profits are just 10x for MS&AD and 8x for SOMPO. Additionally, the dividend yields are nearly 5%, considerably above the market average.

Finally, there is an opportunity for re-rating the valuation multiples, which could bring a significant upside to these stocks.

One way to access these insurers is through the Hennessy Japan Fund, which holds all three businesses. We consider these insurers “growth in disguise” stocks—a company with compelling growth prospects yet the stock appears to be undervalued. In the current environment, these Japanese businesses appear to offer outsized opportunity.

- In this article:

- Japan

- Japan Fund

- Japan Small Cap Fund

1 National Association of Insurance Commissioners (2024)

2 The YUHO annual securities reports.

3 MSAD annual report.

You might also like

-

Portfolio Perspective

Portfolio Perspective

Japan Small Cap FundJapanese Small-Caps’ Earnings Resilience and Improving Returns on Capital

Takenari Okumura, CMAPortfolio Manager

Takenari Okumura, CMAPortfolio Manager Tadahiro Fujimura, CFA, CMAPortfolio ManagerRead the Commentary

Tadahiro Fujimura, CFA, CMAPortfolio ManagerRead the CommentaryIn the following commentary, the Portfolio Managers cover small-cap outperformance drivers, pro-growth fiscal policy, governance reform, yen volatility, portfolio repositioning, profitability and capital efficiency trends, valuation gaps, and their 2026 outlook.

-

Portfolio Perspective

Portfolio Perspective

Japan FundA Differentiated Portfolio Focused on Margin of Safety and Upside Potential

Masakazu Takeda, CFA, CMAPortfolio Manager

Masakazu Takeda, CFA, CMAPortfolio Manager Angus Lee, CFAPortfolio ManagerRead the Commentary

Angus Lee, CFAPortfolio ManagerRead the CommentaryThe Portfolio Managers summarize the significant events that drove markets over 2025 and how the Fund remains focused on quality, capital discipline, and valuation, with a clear preference for stock picking over index exposure.

-

Investment Idea

Investment IdeaCompelling Valuations in Japan

Masakazu Takeda, CFA, CMAPortfolio Manager

Masakazu Takeda, CFA, CMAPortfolio Manager Angus Lee, CFAPortfolio Manager

Angus Lee, CFAPortfolio Manager Tadahiro Fujimura, CFA, CMAPortfolio Manager

Tadahiro Fujimura, CFA, CMAPortfolio Manager Takenari Okumura, CMAPortfolio ManagerRead the Investment Idea

Takenari Okumura, CMAPortfolio ManagerRead the Investment IdeaJapanese equities are currently trading at compelling valuation levels compared to other developed equity markets around the world and relative to their own historical averages. We believe the Japanese market deserves a closer look.