Energy Stocks Offer Growth Potential and Higher Dividends

Portfolio Managers Toby Loftin and Tim Dumois discuss the Fund’s correlation to oil prices, how energy companies are responding to shareholder preferences, and the outlook for energy markets.

Could you comment on the Fund’s correlation to the price of oil?

The performance of the Fund is correlated with oil prices. However, the Fund’s correlation is relatively low compared with its peer group of funds. The BP Energy Fund’s 3-year correlation with the price of oil (West Texas Intermediate, or WTI) is 0.67, which is in the bottom quartile compared with other funds investing in the Energy sector. There are two main reasons for this lower correlation:

»The Fund invests in companies that are significant consumers of energy, or “end users.” Lower energy prices can benefit many end user companies by lowering their costs and making them more competitive in world markets.

»The Fund also invests in energy companies whose businesses are less correlated to the price of oil, such as Quanta Services, an engineering and construction company serving the pipeline and electric power industries.

How are energy companies becoming more shareholder-friendly?

Energy companies have been responding readily to shareholder requests for more careful use of capital, and in particular, for an increase in return of capital to shareholders in the form of dividends and share buy-backs. Over the last two years, over 41% of companies in the Energy sector have repurchased at least $5 million worth of stock, and 22% have increased their dividend. For example, Pioneer Natural Resources, a company that had historically paid little cash out to shareholders, increased its dividend and announced a significant $2 billion share buyback in late 2018. Anadarko Petroleum Corp. has also returned billions of dollars in cash to shareholders, repurchasing over $1 billion worth of stock in 2017 and over $2 billion in the first nine months of 2018.

What is your outlook for the growth in demand for oil and natural gas?

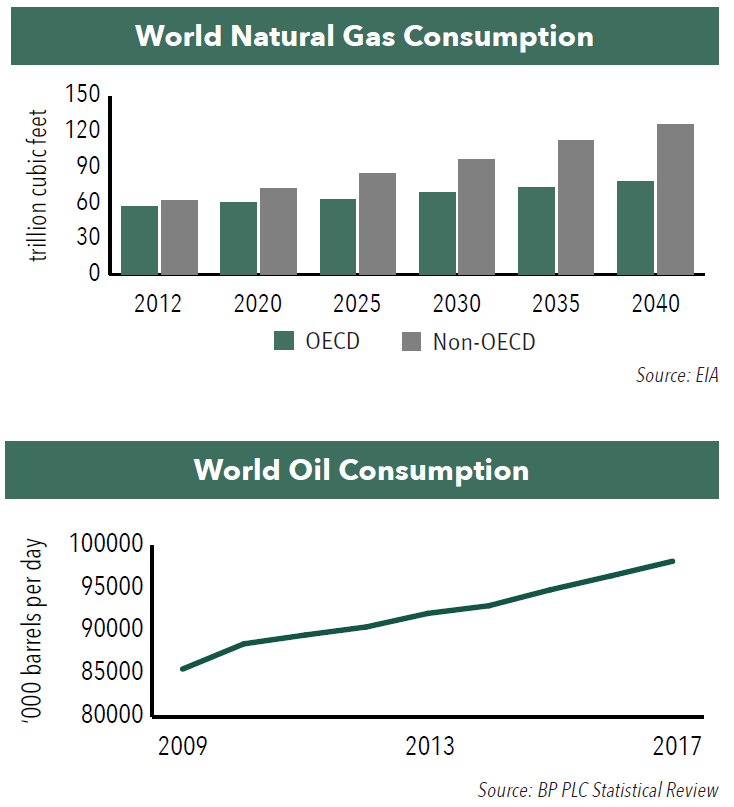

We believe the demand for oil will continue to grow at about 1.5 million barrels per day–or a little over 1.5%–annually. Roughly two-thirds of this demand growth is coming from developing countries, such as China.

While some investors might worry that demand will falter if the oil price rises, we believe it is worth remembering that oil consumption tends to grow very steadily, and has only dropped year-over-year three times in the last 30 years.

Demand for natural gas is also growing. In the U.S., consumption of natural gas has risen at about 1.7% annually from 2010 to 2017 and jumped 12% in the first ten months of 2018, driven primarily by an increase in consumption by electric power generation companies. Demand is also rising in the rest of the world. The EIA forecasts that world consumption of natural gas will rise by more than 50% over the next 21 years, driven primarily by growth from developing countries.

What is your outlook for the price of oil and how is it influencing the sub-industry weightings in the Fund?

We view the recent OPEC-Plus agreement to cut production as a major positive supporting oil price, and we expect this to contribute to a tighter oil market in 2019. It is estimated that the Saudi government needs a $70-$80/barrel Brent oil price to balance its budget, and so we believe that the country remains motivated to keep prices near that range. Given our constructive outlook for the price of oil, the Fund is currently overweight exploration and production (E&P) companies.

What might cause you to alter sub-industry weightings?

There are a number of macro factors that help drive portfolio weightings in each segment of the energy value chain.

- Outlook for the price of oil. A positive outlook for the price of oil may contribute to an overweight position in E&P and oil service companies, as profits in both sectors are closely tied to the price of oil.

- GDP growth. In a recession, the Fund might be more heavily weighted towards the large, integrated oil and gas companies that have operations throughout the energy value chain. The Fund might also be more heavily weighted towards high-quality midstream companies whose businesses depend more on volume than commodity prices.

- Relative valuation. Relative valuation will always be taken into consideration when determining sub-industry weightings.

Our work in assessing macro factors is always balanced by our intensive, “boots on the ground” industry and company research process, which is designed to uncover mispricing opportunities and drive performance.

- In this article:

- Energy

- Energy Transition Fund

You might also like

-

Portfolio Perspective

Portfolio Perspective

Midstream FundPotential Natural Gas Tailwinds for Midstream Companies

Ben Cook, CFAPortfolio Manager

Ben Cook, CFAPortfolio Manager L. Joshua Wein, CAIAPortfolio ManagerRead the Commentary

L. Joshua Wein, CAIAPortfolio ManagerRead the CommentaryThe following commentary highlights how recent events in Venezuela affect midstream investors, how midstream companies could benefit from interest rate cuts, rising natural gas and LNG demand, and AI-driven efficiencies, while maintaining disciplined capital allocation, strong shareholder returns, and attractive valuations.

-

Portfolio Perspective

Portfolio Perspective

Energy Transition FundThe Role of Natural Gas to Meet AI Energy Demand

Ben Cook, CFAPortfolio Manager

Ben Cook, CFAPortfolio Manager L. Joshua Wein, CAIAPortfolio ManagerRead the Commentary

L. Joshua Wein, CAIAPortfolio ManagerRead the CommentaryIn the following commentary, Portfolio Manager Ben Cook and Josh Wein highlight the Fund’s 2025 outperformance, discuss the impact the events in Venezuela may have on the energy sector, and outline key 2026 Energy sector opportunities.

-

Portfolio Perspective

Portfolio Perspective

Gas Utility FundNatural Gas Utilities as a Potential Growth Story

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager L. Joshua Wein, CAIAPortfolio ManagerRead the Commentary

L. Joshua Wein, CAIAPortfolio ManagerRead the CommentaryWith AI-driven power demand, rising capital investments, LNG growth, and pipeline infrastructure expansion, natural gas utilities are being repositioned as potential growth stories with attractive valuations and dividends.