Energy - Attractively Valued Sector with Higher Free Cash Flow Yields

In the following commentary, Portfolio Manager Ben Cook and Josh Wein discuss the Fund’s disciplined process throughout the volatility driven by tariff uncertainty and geopolitical developments.

-

L. Joshua Wein, CAIAPortfolio Manager

L. Joshua Wein, CAIAPortfolio Manager -

Ben Cook, CFAPortfolio Manager

Ben Cook, CFAPortfolio Manager

Key Takeaways

» Our repeatable investment process allowed us to capitalize on equity price dispersion.

» Tariff impacts have been limited to those segments of the energy value chain dependent on the import of certain raw materials, resulting in cost increases in oilfield service companies and capital equipment manufacturers.

» Our portfolio weightings have not changed in response to the volatility in crude oil prices; we prefer to focus on favorable longer-term fundamentals.

» We believe the Energy sector is attractively valued and offers higher free cash flow yields than the overall market.

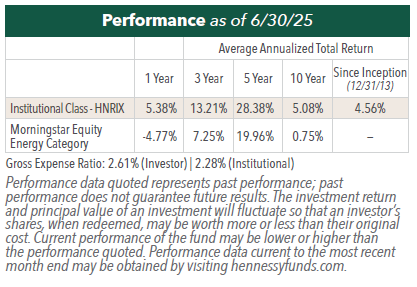

What has driven the Fund to outperform the Morningstar Equity Energy category over the 1-, 3-, 5- and 10-year periods as of June 30, 2025?

During the period, prices in the Energy sector were generally more volatile than the S&P 500 Index, presenting us with meaningful sector fluctuation.

In this environment, our repeatable active management investment process allowed us to capitalize on equity price dispersion across both traditional hydrocarbon and renewable energy value chains. Looking ahead, we expect energy fundamentals to remain in flux, and as a consequence, we expect market volatility will remain elevated, providing further opportunities for investment gain.

How have Energy companies been affected by the tariff uncertainty?

Tariff impacts have been limited to those segments of the energy value chain that are dependent on the import of certain raw materials, namely steel and aluminum, which continue to be burdened by tariffs of as much as 50%. As a result, oilfield service companies and capital equipment manufacturers that require these materials are seeing some cost increases. Trade partners issuing reciprocal tariffs could potentially impact energy exports particularly to China. However it’s notable that recent negotiations have resulted in more favorable trade terms in certain export markets. We’ll be watching headlines for additional trade negotiation progress going forward.

Oil prices have experienced significant volatility in recent periods, influenced by various geopolitical developments and ongoing global tensions. Could you share your perspective on the factors driving oil price fluctuations in the current environment?

Escalation and subsequent de-escalation in geopolitical supply disruption risks in the Middle East have prompted wide swings in the risk premium in crude oil by as much as $10 to $15 per barrel. While meaningful disruption has yet to occur amidst the Israel-Iran conflict, the potential impact of outage in the Middle East prompted buyers to bid up and later sell down crude oil futures contracts on global markets. Prior to the conflict, crude oil markets were acclimating to softening supply and demand fundamentals, driven by the rising OPEC+ output and the potential weakness in global economic activity amidst a lingering tariff induced trade war with major U.S. trading partners.

How do you assess the potential impact of this volatility on different sectors or holdings within your portfolio—specifically, which types of assets or companies might benefit, and which could face challenges as a result?

Amidst the current market volatility, our investment process remains unchanged, and up to this point portfolio weightings have not changed in response to the volatility in crude oil prices. While a short-term uptick in crude oil pricing can benefit producers temporarily, geopolitical risks can quickly fade, presenting meaningful downside risks. We prefer to focus on favorable longer-term fundamentals which tend to underpin more durable tailwinds to equity and sector performance.

For example, we believe U.S. natural gas demand trends continue to be constructive, as the multi-year ramp in liquefied natural gas (LNG) export capacity and expanding power demand needs associated with artificial intelligence (AI) will continue to support natural gas consumption growth. Further, we see U.S. natural gas as a logical beneficiary of U.S. trade negotiations, as trade partners pursue expanded trade balances with the U.S.

How do Energy sector valuations compare to the S&P 500 Index?

Regarding valuation, the S&P 500 Energy index is trading at 7.1x Enterprise Value (EV) to next 12-month Earnings before Interest Taxes Depreciation and Amortization (EBITDA), versus the S&P 500 Index which is currently trading at a multiple of 15.5x EV to next 12-month EBITDA. On a free cash yield basis, the S&P 500 Energy Index currently yields 5.9%, comparing favorably to the S&P 500 Index which yields 3.3%, on that same basis.

What is your outlook for Energy for the rest of 2025?

Despite geopolitical and tariff uncertainty, we expect commodity demand to remain healthy both in the U.S. and abroad given the positive outlook for global economic growth. Spare capacity of crude oil is expected to continue to wind down particularly within OPEC+, ultimately tightening the industry’s ability to quickly respond to market needs.

Demand concerns should continue to abate as trade negotiations conclude, and greater market certainty should help to increase market confidence in the outlook for economic growth.

Natural gas remains a bright spot for energy investors and growing U.S. LNG exports and rising power demand needs for AI computing will undoubtedly expand the appetite for the fuel around the globe.

In sum, we think energy fundamentals are sound and will likely provide upside as U.S. companies continue to reward shareholders with healthy returns in the form of buybacks and share repurchases.

- In this article:

- Energy

- Energy Transition Fund

You might also like

-

Portfolio Perspective

Portfolio Perspective

Midstream FundPotential Natural Gas Tailwinds for Midstream Companies

Ben Cook, CFAPortfolio Manager

Ben Cook, CFAPortfolio Manager L. Joshua Wein, CAIAPortfolio ManagerRead the Commentary

L. Joshua Wein, CAIAPortfolio ManagerRead the CommentaryThe following commentary highlights how recent events in Venezuela affect midstream investors, how midstream companies could benefit from interest rate cuts, rising natural gas and LNG demand, and AI-driven efficiencies, while maintaining disciplined capital allocation, strong shareholder returns, and attractive valuations.

-

Portfolio Perspective

Portfolio Perspective

Energy Transition FundThe Role of Natural Gas to Meet AI Energy Demand

Ben Cook, CFAPortfolio Manager

Ben Cook, CFAPortfolio Manager L. Joshua Wein, CAIAPortfolio ManagerRead the Commentary

L. Joshua Wein, CAIAPortfolio ManagerRead the CommentaryIn the following commentary, Portfolio Manager Ben Cook and Josh Wein highlight the Fund’s 2025 outperformance, discuss the impact the events in Venezuela may have on the energy sector, and outline key 2026 Energy sector opportunities.

-

Portfolio Perspective

Portfolio Perspective

Gas Utility FundNatural Gas Utilities as a Potential Growth Story

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager L. Joshua Wein, CAIAPortfolio ManagerRead the Commentary

L. Joshua Wein, CAIAPortfolio ManagerRead the CommentaryWith AI-driven power demand, rising capital investments, LNG growth, and pipeline infrastructure expansion, natural gas utilities are being repositioned as potential growth stories with attractive valuations and dividends.