Natural Gas: Essential to Reliable Power

Utilities have delivered strong returns in 2025, fueled by demand trends, earnings growth and their defensive nature, positioning natural gas utilities as a compelling opportunity amid market uncertainty.

-

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager -

L. Joshua Wein, CAIAPortfolio Manager

L. Joshua Wein, CAIAPortfolio Manager

Key Takeaways

» Utilities are benefiting from near-record electricity and natural gas demand—fueled by AI data centers, electrification, extreme weather, and U.S. industrial onshoring.

» Natural gas is now viewed as essential to reliable power—especially for data centers and peak energy demand.

» U.S. LNG exports are diversified, with capacity set to double by 2028—supporting long-term global demand despite geopolitical headwinds.

» Utilities trade below long-term averages and the broader market and offer strong dividend yields and consistent dividend growth.

What is driving Utilities’ significant outperformance over the S&P 500 on a YTD and one-year basis?

In 2025, Utilities’ earnings are being driven by near record levels of demand for electricity and natural gas due to several factors including:

• Extreme heating and cooling days, and overall growth in residential and commercial usage

• Data center demand, catapulted by rapid growth in artificial intelligence (AI)

• Continued electrification

• Onshoring of manufacturing

As a result, Utility stocks reflect this increase in demand and earnings growth, while continuing to be attractive to dividend investors and those seeking more defensive, less volatile stocks.

In general, the current administration’s policies have been beneficial to Utilities and the Energy sector in general. Efficiencies and reduction in regulation are leading to faster and less stringent regulatory reviews. This trend may lead to a more rapid and necessary build out of energy infrastructure in various parts of the U.S. that have seen decades of under-investment.

How has surging natural gas demand changed the role of gas in the energy transition?

We believe natural gas is no longer viewed primarily as a transition fuel to a purely renewable world, but rather as a primary and indispensable component of a greener energy future. For example, data centers require uninterruptable power with on-site power generation, most of which uses natural gas. In addition, it has been shown that on peak demand days due to extreme temperatures, natural gas provides the vast majority of the extra, incremental demand.

In general, companies are responding rapidly to this current and potential future demand by continuing to increase and steer capital expenditures toward natural gas. However, the growth is measured and driven by signed forward contracts with greater assurances that demand will remain intact.

How has electrification in the U.S. impacted the consumption growth rates of natural gas?

The U.S. has seen record levels of electricity generation from natural gas, which accounted for 43% of all generation in 2024. As the world shifts to electricity-powered modes of transportation, electric heat pumps, and the electrification of industrial processes including heating chemical production and manufacturing, we should see this demand continue to increase.

Indeed, switching from natural gas powered appliances to electric powered ones is significantly less efficient: natural gas delivered directly to a home is approximately 92% efficient from drill to burner tip when used directly by the consumer, while natural gas used to generate electricity which is then delivered via power lines to the consumer is only 38% efficient.

Would you please discuss the growth in exportation of U.S. liquefied natural gas (LNG)? To what extent will China’s tariff imposed on U.S. LNG affect demand?

The U.S. continues to be the leading exporter of LNG to the rest of the world, a trend which doesn’t appear to be abating, despite China’s tariff on U.S. LNG. China only accounted for 5% of U.S. LNG exports in 2024, and it appears to be unclear if tariffs would cause a meaningful reduction in that amount.

Overall, worldwide exports of LNG from the U.S. continue to become more diversified over time, with 2024 seeing 53% to Europe (down from 66% in 2023), 33% to Asia, and 14% to other destinations, including South America and the Caribbean. Hence, much of the world depends on U.S.-produced LNG.

In addition, capacity is expected to double in the U.S. from 2024 to 2028, with a significant amount of this increase already under contract in the future.

How do Utilities’ valuations compare to the overall market currently and historically?

Utilities’ valuations (the S&P 500 Utilities Sector) compare favorably both on an historical and comparative basis. Based on forward looking 2026 earnings, utilities are trading at approximately 16.9x estimated earnings per share (EPS), versus long-term (10 year) average of 18.9x and S&P 500 at 20.5x.

Would you please provide dividend details and growth rates for the Fund?

As of June 30, 2025, 46 out of 47 holdings pay a dividend with an average yield of 3.51%.1 All except three companies have increased their dividend in past year, with an average increase of 4%.

What is the current composition of the Fund?

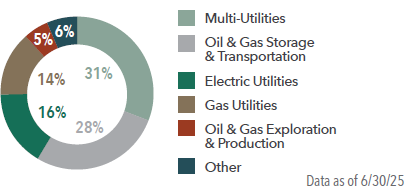

There are five primary sub-industries represented in the Fund. As of June 30, 2025, multi-utilities and electric utilities comprised nearly 47% of the Fund’s assets, pipeline and LNG export companies made up 33%, and pure play natural gas utilities composed 14%. The remaining 6% of the Fund is made of Berkshire Hathaway and water utilities.

- In this article:

- Energy

- Gas Utility Fund

You might also like

-

Portfolio Perspective

Portfolio Perspective

Midstream FundPotential Natural Gas Tailwinds for Midstream Companies

Ben Cook, CFAPortfolio Manager

Ben Cook, CFAPortfolio Manager L. Joshua Wein, CAIAPortfolio ManagerRead the Commentary

L. Joshua Wein, CAIAPortfolio ManagerRead the CommentaryThe following commentary highlights how recent events in Venezuela affect midstream investors, how midstream companies could benefit from interest rate cuts, rising natural gas and LNG demand, and AI-driven efficiencies, while maintaining disciplined capital allocation, strong shareholder returns, and attractive valuations.

-

Portfolio Perspective

Portfolio Perspective

Energy Transition FundThe Role of Natural Gas to Meet AI Energy Demand

Ben Cook, CFAPortfolio Manager

Ben Cook, CFAPortfolio Manager L. Joshua Wein, CAIAPortfolio ManagerRead the Commentary

L. Joshua Wein, CAIAPortfolio ManagerRead the CommentaryIn the following commentary, Portfolio Manager Ben Cook and Josh Wein highlight the Fund’s 2025 outperformance, discuss the impact the events in Venezuela may have on the energy sector, and outline key 2026 Energy sector opportunities.

-

Portfolio Perspective

Portfolio Perspective

Gas Utility FundNatural Gas Utilities as a Potential Growth Story

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager L. Joshua Wein, CAIAPortfolio ManagerRead the Commentary

L. Joshua Wein, CAIAPortfolio ManagerRead the CommentaryWith AI-driven power demand, rising capital investments, LNG growth, and pipeline infrastructure expansion, natural gas utilities are being repositioned as potential growth stories with attractive valuations and dividends.