Defining the Energy "Value Chain"

Energy is a large and complex sector. The sector’s broad sub-industries can be divided into a “value chain,” each segment of which has different characteristics and offers different investment opportunities.

-

Ben Cook, CFAPortfolio Manager

Ben Cook, CFAPortfolio Manager

Upstream

At one end of the Energy sector’s “value chain” are the “upstream” companies. The upstream segment includes exploration & production (E&P) and oil-field equipment & services companies that are engaged in the search for, and production of, crude oil and natural gas. Upstream companies’ profits tend to be highly correlated with commodity prices.

Midstream

Midstream companies store and transport oil, natural gas, and natural gas liquids. The midstream segment includes pipelines and liquefied natural gas (LNG) exporters, as well as other companies engaged in the transportation and storage of crude oil, natural gas, and natural gas liquids. Many midstream companies have the ability to pass through changes in commodity prices to their customers and, as a result, their profitability is relatively insulated from fluctuations in the price of oil or natural gas.

Downstream

Downstream companies refine crude oil and market the finished products, such as gasoline and jet fuel, to customers in the U.S. and abroad. Profits from downstream business also tend to be relatively well-insulated from commodity price fluctuations.

End Users

At the other end of the energy value chain are the “end users.” These are companies that use energy products intensively in their operations, either as a fuel or a feedstock. The price of energy can have an important effect on the competitiveness of these companies.

Integrated Oil & Gas

The largest segment of the Energy sector is comprised of Integrated Oil & Gas companies, sometimes referred to as “supermajors,” which have operations across all parts of the energy value chain. Examples of these companies include Exxon Mobil, Chevron, or BP. Balanced by its upstream and downstream operations, an integrated oil and gas company may have less concern about commodity price volatility.

Renewable Energy

Renewable energy, once a niche segment, is rapidly becoming an important source of energy in the U.S. and globally as climate concerns increase and innovation brings costs down. Companies within the sector provide clean and renewable energy, including solar, wind, hydroelectric, biomass, and geothermal. Renewable energy sources are expected to represent a growing share of the global energy mix over the next several decades.

Opportunity Across the Value Chain

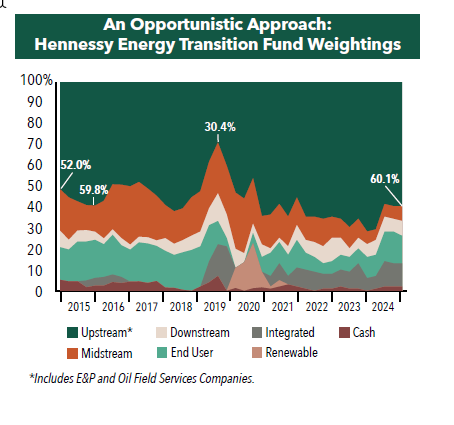

The portfolio managers of the Hennessy Energy Transition Fund (HNRGX) have the flexibility to opportunistically invest in the various sub-sectors of the energy value chain. In practice, relative subsector weightings within the portfolio are shifted over time as market conditions change in order to help maximize total portfolio return while minimizing portfolio risk.

Historically, subsector portfolio weightings have often shifted in order to navigate commodity price volatility. For example, in anticipation of crude oil market weakness during mid-2014, portfolio exposure to the upstream sector was reduced to only 29.1% of the total portfolio, well below the historical average upstream weighting of 59.5%. As a result, the Fund was relatively well insulated from the effects of the 60% decline in the price of crude oil over the subsequent nine months.

In contrast, in March 2016, the Fund’s upstream sector exposure was raised to nearly 63% of the total portfolio in anticipation of crude oil price strength, which ultimately benefited Fund performance as crude oil prices advanced nearly 40% over the subsequent nine months.

During 2020, the Fund began investing in renewable energy companies. By September 2020, portfolio exposure to renewable sector companies had reached approximately 21%. With the Biden administration victory in the 2020 Presidential election, renewable company equity performance was propelled higher in anticipation of supportive sector policy measures. While sector tailwinds were indeed strong, valuation level across the subsector became excessive by year end. Accordingly renewable company exposure was reduced, falling to less than 1% of total portfolio exposure by February of 2021.

Since early 2021, portfolio exposure to the upstream sub-sector has remained elevated in order to capitalize on improving sub-sector investment merit. Steadily improving commodity fundamentals, attractive valuation and desirable corporate capital discipline have combined to make the sub-sector a logical choice for investment in the evolving energy transition.

- In this article:

- Energy

- Energy Transition Fund

You might also like

-

Portfolio Perspective

Portfolio Perspective

Midstream FundPotential Natural Gas Tailwinds for Midstream Companies

Ben Cook, CFAPortfolio Manager

Ben Cook, CFAPortfolio Manager L. Joshua Wein, CAIAPortfolio ManagerRead the Commentary

L. Joshua Wein, CAIAPortfolio ManagerRead the CommentaryThe following commentary highlights how recent events in Venezuela affect midstream investors, how midstream companies could benefit from interest rate cuts, rising natural gas and LNG demand, and AI-driven efficiencies, while maintaining disciplined capital allocation, strong shareholder returns, and attractive valuations.

-

Portfolio Perspective

Portfolio Perspective

Energy Transition FundThe Role of Natural Gas to Meet AI Energy Demand

Ben Cook, CFAPortfolio Manager

Ben Cook, CFAPortfolio Manager L. Joshua Wein, CAIAPortfolio ManagerRead the Commentary

L. Joshua Wein, CAIAPortfolio ManagerRead the CommentaryIn the following commentary, Portfolio Manager Ben Cook and Josh Wein highlight the Fund’s 2025 outperformance, discuss the impact the events in Venezuela may have on the energy sector, and outline key 2026 Energy sector opportunities.

-

Portfolio Perspective

Portfolio Perspective

Gas Utility FundNatural Gas Utilities as a Potential Growth Story

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager L. Joshua Wein, CAIAPortfolio ManagerRead the Commentary

L. Joshua Wein, CAIAPortfolio ManagerRead the CommentaryWith AI-driven power demand, rising capital investments, LNG growth, and pipeline infrastructure expansion, natural gas utilities are being repositioned as potential growth stories with attractive valuations and dividends.