Hennessy Funds 2025 CIO Roundtable

Hennessy Funds’ Portfolio Managers recently gathered for our annual CIO Roundtable. For the 11th year in a row, they discussed the latest market trends, shared insights, and explored strategies for navigating the ever-changing investment landscape.

-

Neil J. HennessyChief Market Strategist and Portfolio Manager

Neil J. HennessyChief Market Strategist and Portfolio Manager -

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager -

Ben Cook, CFAPortfolio Manager

Ben Cook, CFAPortfolio Manager -

Masakazu Takeda, CFA, CMAPortfolio Manager

Masakazu Takeda, CFA, CMAPortfolio Manager

Hennessy Funds’ Portfolio Managers recently gathered for our annual CIO Roundtable. For the 11th year in a row, they discussed the latest market trends, shared insights, and explored strategies for navigating the ever-changing investment landscape.

The discussion included many topics that have captured investors’ interest this year, such as mega-tech’s leadership driven by rapid developments in artificial intelligence (AI) and significant capital expenditures to harness the power of AI. They also covered areas receiving far less media attention but offering meaningful potential for investors, including where they are finding investment opportunity in the Energy and Financial sectors and the Japanese market.

We are pleased to share the insights from our esteemed team members across our 17 mutual funds and ETFs.

Opportunities Beyond Tech

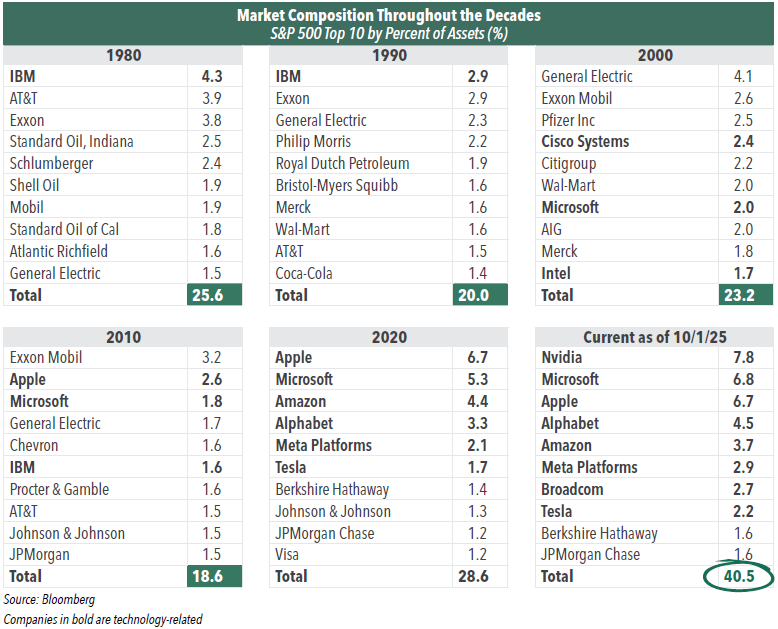

Technology’s dominance has become apparent in recent years. This leadership comes into focus when examining the composition of the top 10 stocks in the S&P 500 over multiple decades. In 1980 and 1990, IBM was the only technology company represented among the top 10, while Exxon/ExxonMobil has consistently ranked among the largest companies during those same periods as well as the two decades to follow. Over the years, more tech-related companies have grown to become the largest companies in the Index. Currently, eight of 10 are tech-related.

Perhaps the most striking change is the growing concentration of the Index. In 1980, 1990, 2000, and 2010, the top 10 stocks comprised approximately 20% of the S&P 500. Today, that figure has climbed to roughly 40%, surpassing even the high concentration level seen during the Dot-Com bubble.

This top-heavy concentration appears to reflect a progression of the tremendous innovation capabilities by mega-tech companies. With investors eager to capitalize on these advancements, capital appears to be flowing toward many technology and AI firms, some of which lack viable products or meaningful revenue, prompting some to draw comparisons to the Dot-Com era of the late 1990s.

At the current price level, some tech-related companies may have less room for error. More importantly, this focus is overshadowing what we see as attractive opportunities elsewhere:

Financials

• The Financials sector contains large, wellcapitalized banks with the earnings power to invest in technology, attract top talent, and leverage capital markets effectively.

Utilities and Energy

• Certain utilities and energy companies stand to potentially benefit directly from the increased adoption of AI.

Japanese Equities

• Geographic diversification also plays a key role, as investing in different regions including Japan can help balance a portfolio against the concentrated effects of techdriven growth. We believe well-run, high-quality companies in areas of the market like these are positioned to benefit from the technological changes and could thrive in a dynamic market environment.

The Energy Demands of AI

The energy required to power AI computing and data centers is staggering and is set to grow rapidly over the coming years. Between 2003 and 2023, the growth rate in U.S. electricity generation averaged just 0.23% annually. Over the next five years, however, the growth rate is expected to accelerate over 15 times more to 3.8% annually, driven largely by the expansion of AI infrastructure.

To put this in perspective, a single gigawatt of power generation capacity can supply electricity to about 750,000 homes. At this scale, the anticipated 90 gigawatts of additional capacity required for AI and data centers could power nearly 70 million homes, roughly equivalent to the population of the U.K. and France each.

The pace of growth is creating challenges for the utility industry, which is struggling to expand capacity fast enough to meet demand. While long-term solutions such as renewable energy and grid modernization are being explored, near-term energy needs are being met primarily by natural gas. New gas-fired power plants are currently under construction in Texas, Pennsylvania, and Ohio, offering a cost-effective way to supply electricity to these energyintensive operations.

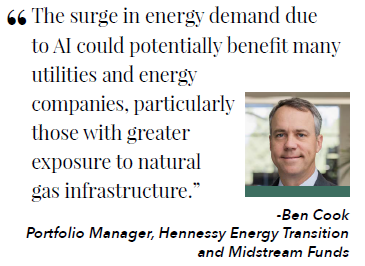

For investors, this surge in energy demand highlights several considerations beyond the Technology sector to utilities and energy companies that are poised to benefit from increased demand, particularly those with greater exposure to natural gas infrastructure.

AI’s Effect on the Bond Market

The growth and financial strength of these tech giants are also reshaping the corporate bond market. As these companies look to fund this AI transformation, it may also reshape the investment grade corporate bond market. Historically, corporate bond issuance has averaged around $1.4 trillion per year, much of which has been used to refinance maturing debt. Net new issuance after accounting for maturities has averaged roughly $400 to $500 billion annually over the past decade.

Enter the hyperscalers, such as Amazon, Microsoft, Google, and Meta, who are expecting to issue $400 to $500 billion in corporate bonds over the next five years to fund capital expenditures for AI infrastructure including data centers. This represents significant net new supply to the market, nearly doubling the average annual level of the past decade.

Such a surge could meaningfully shift the composition of broad benchmarks including the Bloomberg U.S. Aggregate Bond Index and the Bloomberg Intermediate U.S. Government/Credit Index. While these companies are among the highest-rated issuers, with strong cash flow and low leverage, the increase in debt is raising some concern among credit investors about long-term leverage risk. Any downgrades, however unlikely given current conditions, could further alter the constituency of these indices. At the same time, credit spreads remain near historically tight levels, adding another layer of consideration for investors navigating this evolving market.

Japanese Equities – What New Leadership Might Bring

In October 2025, Sanae Takaichi was elected Japan’s new leader, becoming the country’s first female prime minister. We have strong confidence that the corporate governance reform trend will remain on track under her leadership. In addition, we believe the positive trends that have driven the Japanese market will continue including the normalization of interest rates, higher inflation, and growing inbound tourism.

We anticipate one notable change in corporate governance next year. Previously, the government targeted companies trading below book value, and meaningful improvements have already been made in that segment. The focus is now shifting to “blue-chip” companies trading higher than book value that demonstrate suboptimal capital allocation. We believe this shift in focus could act as a catalyst for the market in 2026.

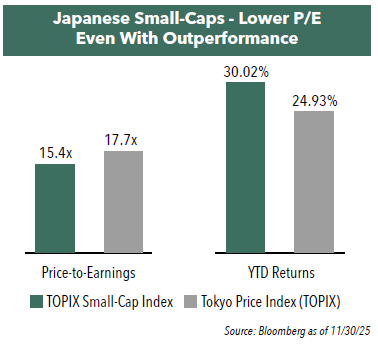

Corporate governance reforms should also positively affect small domestic Japanese companies, driven by activist investor activity who seek to improve capital efficiency and enhance shareholder value, leading to an increase in equity prices. In addition, although small-caps in Japan have outperformed their larger peers in 2025, their valuations remain discounted on price-to-earnings and price-tobook metrics compared to large companies. We anticipate as investors realize the attractiveness of certain domestic small companies in Japan, this discount could narrow.

Beyond Tech: Broader Challenges

While the stock market has shown remarkable resilience, the U.S. economy faces some notable challenges. Certain industries are under pressure. For example, several restaurant chains are hitting 52-week lows and several bellwether large firms have announced potential white-collar layoffs, in part driven by AI-related efficiency initiatives. At the same time, stress is emerging in subprime auto loans, with nearly 7% of borrowers at least 60 days behind on payments, the highest level since the early 1990s. Credit card rates remain elevated at an average of 23%, creating a favorable environment for banks but adding financial strain for low and moderate income consumers relying on credit.

The housing market also presents challenges. Mortgage rates currently hover around 6%, though many homeowners locked in 3% rates a few years ago. As a result, fewer people are moving, creating a shortage of 1 to 2 million homes and a shift toward rental housing due to affordability concerns continues to constrain supply. Consumer confidence will be critical in determining future demand, and any potential Federal Reserve rate cuts could help ease mortgage rates and support the housing market.

Meanwhile, the consumer landscape is increasingly bifurcated. Overall consumer confidence is down, yet spending remains strong among high-income households and workers with in-demand skills, which created a powerful wealth effect. In contrast, lowerincome households are reducing expenditures, highlighting an economy where pockets of strength are offset by broader weaknesses.

Adding to these challenges are persistent macroeconomic and geopolitical headwinds, including tariff volatility and ongoing inflationary pressures. Taken together, these factors underscore that, despite the market’s resilience, investors should remain mindful of uneven sector performance, consumer dynamics, and broader economic risks.

Looking Ahead: A Shift in Market Leadership?

As long-term, active investors, our Portfolio Managers aim to invest in well-run, profitable companies, whether in Technology or other sectors that provide compelling opportunities beyond the current market darlings.

In 2025, stock market performance has been highly concentrated, with limited breadth of leadership across sectors. Looking ahead to 2026, we anticipate investors may shift their focus toward areas that have underperformed for some time, including Energy and Utilities. With approximately $17 trillion sitting in bank deposits, a portion of these funds could flow into the equity markets, potentially supporting broader participation.

Additionally, the market consensus points to two or three interest rate cuts by the Federal Reserve in 2026. A lower interest rate environment could be supportive for banks and financials, encouraging lending activity. Taken together, these factors suggest that 2026 may offer opportunities in sectors that have been largely overlooked this year, as well as potential for a welcomed renewed market breadth.

With an ever-changing landscape, we encourage investors to take a long-term perspective while maintaining a diversified portfolio to weather changing market conditions.

- In this article:

- Overall Market

- Cornerstone Mid Cap 30 Fund

- Energy Transition Fund

- Focus Fund

- Cornerstone Growth Fund

- Cornerstone Large Growth Fund

- Cornerstone Value Fund

- Total Return Fund

- Equity and Income Fund

- Balanced Fund

- Gas Utility Fund

- Small Cap Financial Fund

- Large Cap Financial Fund

- Technology Fund

- Japan Fund

- Japan Small Cap Fund

- Midstream Fund

You might also like

-

Market Outlook

Market OutlookStaying Disciplined, Finding Opportunity

Ryan C. Kelley, CFAChief Investment Officer and Portfolio ManagerRead the Commentary

Ryan C. Kelley, CFAChief Investment Officer and Portfolio ManagerRead the CommentaryAgainst a backdrop of dominance of large-cap technology companies and artificial intelligence (AI), Ryan Kelley, Chief Investment Officer, shares his views on compelling opportunities that offer a favorable setup for long-term investors.

-

Market Outlook

Market OutlookThe More Things Change, the More They Trade the Same

Neil J. HennessyChief Market Strategist and Portfolio ManagerRead the Commentary

Neil J. HennessyChief Market Strategist and Portfolio ManagerRead the CommentaryAlmost 50 years in the market taught me one truth: the headlines change, the patterns don’t.

-

Market Outlook

Market OutlookBeyond the Headlines: Investment Opportunities in Uncertain Times

Ryan C. Kelley, CFAChief Investment Officer and Portfolio ManagerRead the Commentary

Ryan C. Kelley, CFAChief Investment Officer and Portfolio ManagerRead the CommentaryRyan Kelley, Chief Investment Officer, discusses 2025 market volatility, strength in sectors like Utilities, Energy, and Financials, and the appeal of mid-cap stocks. He emphasizes staying diversified and focused on the long term amid ongoing uncertainty.