Energy Sector - Capital Discipline, Consolidation, and Attractive Valuations

Portfolio Managers Ben Cook and Josh Wein summarize the Energy sector in 2023, the emphasis on capital discipline, reasons for consolidation, where the Fund is finding opportunity, and valuations and free cash flow yields.

-

Ben Cook, CFAPortfolio Manager

Ben Cook, CFAPortfolio Manager -

L. Joshua Wein, CAIAPortfolio Manager

L. Joshua Wein, CAIAPortfolio Manager

What surprised you regarding the Energy sector in 2023?

There were several surprising events that illustrate the resiliency and strength of the oil and gas industry:

1.Despite a decline in drilling activity, the U.S. upstream industry grew production volume of both crude oil and natural gas. The industry has become more productive and cost efficient and therefore, has been able to do more with less. With approximately 20% fewer rigs running on a year-over-year basis, volume growth has been significant.

2.Oil prices remained stable despite geopolitical risks. Despite ongoing Russia/Ukraine conflict and the attack in Israel, non-OPEC supply contributions primarily from the U.S. have reduced volume loss risks and, in turn, dampened volatility in global crude oil pricing.

3.China’s economy slowed. Following the reopening of its economy in 2023, China was expected to be a large contributor to the strength of the global economy along with a big component of oil and gas demand. Instead, the Chinese economy weakened, presenting headwinds to commodity prices particularly for oil.

4.With respect to renewable energy, the price of lithium significantly dropped in 2023. Lithium carbonate prices from China dropped approximately 80% to reach early 2021 price levels. While demand growth expectations remain high, excessive pricing has invited new entrants into lithium development, including companies like ExxonMobil. We believe lithium is a critical industrial material essential to the production of batteries used in electric vehicles and other clean energy technologies. By 2030, lithium demand is expected to quadruple.

How important has better capital discipline been for the Energy industry?

Increased capital discipline is likely the most significant industry development that has occurred over the last several years. The energy industry has moved toward a capital allocation process focused on shareholder-friendly actions such as reducing debt and returning cash to shareholders. Importantly, these measures enhance corporate resiliency in the face of commodity volatility, which in turn improves investment appeal and promotes capital competitiveness.

Would you please discuss merger and acquisition activity in the oil and gas industry in 2023?

Last year, we saw several significant acquisition announcements in the Energy sector including ExxonMobil acquiring Pioneer Natural Resources and Chevron Corporation purchasing Hess Corporation.

Historically acquisitions occurred simply for growth reasons. Now, across the value chain, deals are being pursued for strategic reasons as companies seek increased operating efficiencies and financial benefits. For example, in the upstream sub-sector, companies are aggregating acreage positions, which allows for productivity gains and cost savings post transaction. With consolidation, these companies are also able to accelerate their debt reduction and improve shareholder return.

We believe M&A will continue in 2024. In fact, in January, Chesapeake Energy announced its plan to purchase Southwestern Energy.

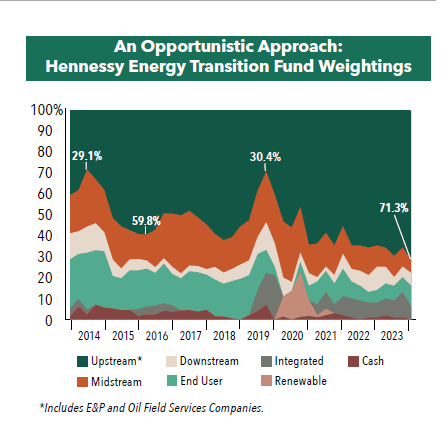

Where are you finding the most attractive opportunities in the Energy sector?

We believe the opportunity lies in certain largecap upstream companies, including those in the integrated and exploration and production subsectors, given attractive fundamental valuation and shareholder-friendly capital allocation strategies.

In addition, we see strong demand for U.S. natural gas given substantial project development plans. Liquefied natural gas (LNG) export capacity is expected to grow dramatically with new facilities coming online late 2024 and early 2025. In fact, export capacity from the U.S. should double by 2027. We believe this growth in natural gas exportation should benefit the U.S. upstream and the midstream sectors.

Would you please discuss the Energy sector’s current valuations?

The Energy sector is currently trading at an attractive valuation relative to the overall market with a better free cash yield:

•As of 12/31/23, the free cash yield of the S&P 500 Energy Index on 2024 estimated free cash levels was approximately 7.5% compared to the S&P 500 Index’s 4.1%.

•As of 12/31/23, the S&P 500 Energy Index traded at approximately 6.1x on an enterprise value to estimated forward 12-month EBITDA, compared to the overall S&P 500, which traded at 14.7x. Energy companies also traded below their historical 10-year average, which was approximately 6.7x as of year-end 2023.

- In this article:

- Energy

- Energy Transition Fund

You might also like

-

Portfolio Perspective

Portfolio Perspective

Midstream FundPotential Natural Gas Tailwinds for Midstream Companies

Ben Cook, CFAPortfolio Manager

Ben Cook, CFAPortfolio Manager L. Joshua Wein, CAIAPortfolio ManagerRead the Commentary

L. Joshua Wein, CAIAPortfolio ManagerRead the CommentaryThe following commentary highlights how recent events in Venezuela affect midstream investors, how midstream companies could benefit from interest rate cuts, rising natural gas and LNG demand, and AI-driven efficiencies, while maintaining disciplined capital allocation, strong shareholder returns, and attractive valuations.

-

Portfolio Perspective

Portfolio Perspective

Energy Transition FundThe Role of Natural Gas to Meet AI Energy Demand

Ben Cook, CFAPortfolio Manager

Ben Cook, CFAPortfolio Manager L. Joshua Wein, CAIAPortfolio ManagerRead the Commentary

L. Joshua Wein, CAIAPortfolio ManagerRead the CommentaryIn the following commentary, Portfolio Manager Ben Cook and Josh Wein highlight the Fund’s 2025 outperformance, discuss the impact the events in Venezuela may have on the energy sector, and outline key 2026 Energy sector opportunities.

-

Portfolio Perspective

Portfolio Perspective

Gas Utility FundNatural Gas Utilities as a Potential Growth Story

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager L. Joshua Wein, CAIAPortfolio ManagerRead the Commentary

L. Joshua Wein, CAIAPortfolio ManagerRead the CommentaryWith AI-driven power demand, rising capital investments, LNG growth, and pipeline infrastructure expansion, natural gas utilities are being repositioned as potential growth stories with attractive valuations and dividends.