Identifying 2024 Opportunities in Equities and Fixed Income

Portfolio Managers of the actively managed Hennessy Equity and Income Fund (HEIFX/HEIIX) discuss the attractiveness of higher-quality value companies, how the current environment favors active management, the Federal Reserve’s plan to cut rates, and how the fixed income portfolio is positioned.

-

Samuel D. Hutchings, CFAPortfolio Manager

Samuel D. Hutchings, CFAPortfolio Manager -

Gary B. Cloud, CFAPortfolio Manager

Gary B. Cloud, CFAPortfolio Manager -

Peter G. Greig, CFAPortfolio Manager

Peter G. Greig, CFAPortfolio Manager

Equity Allocation

Would you please share your thoughts about growth vs. value-oriented companies over the past year and looking ahead?

Growth stocks substantially outperformed value companies in 2023. The Russell 1000® Growth Index rose 42.7% and the Russell 1000® Value Index climbed only 11.5%, which may reflect irrational exuberance around artificial intelligence (AI) and AI stocks.

Given the run-up in the valuation of some growth companies, along with the current uncertainty in the market over interest rates, inflation and geopolitical events, we favor value-oriented companies over growth stocks.

Within that category, we especially favor higher quality factors, which is how the equity portfolio is currently positioned. Historically, higher-quality factors tend to outperform lower quality factors in flat, down, or slightly positive markets.

After 2023 performance, the S&P 500 weightings are highly concentrated in a few names. How might this trend favor active management in the years ahead?

As of the end of 2023, the top 10 stocks comprised over 30% of the S&P 500® Index’s weighting. Previously, when the Index was this concentrated—in 1973 and 2000—there was a digestion period in the market that took years to unwind and favored active management. In fact, after the 2000 period we experienced a lost decade in Index returns whereas active management, in many cases, had more favorable results.

In a comparison of the S&P 500 versus the S&P 500 Equal Weight Index, the difference between their one-year rolling returns in 2023 was nearly as high as it was in the late 1990s. Back then, the difference reversed meaningfully after the internet bubble popped, leading to much stronger returns for the average stock. During the lost decade, the Equal Weight Index produced 5.1% in annualized returns while the S&P 500 fell 1%.

Importantly, valuations look attractive for the average stock in the S&P 500. While the top 10 stocks trade at an average of over 26x forward earnings, the average stock’s forward earnings was 19x. We believe active management can uncover those attractively valued opportunities to outperform the overall Index going forward.

Would you please discuss how you think about a company’s capital allocation decisions in your investment approach?

We do not have a preference over companies’ capital allocation decisions as long as they are in the best interest of the business and shareholders. It is worth noting that historically companies that have paid the most on dividends and stock buy backs have a long-term track record of outperformance compared to companies that employ alternative uses of cash. However, we do support reinvestment in the business if those investments can earn a return above the company’s weighted cost of capital.

Regardless, capital allocation decisions are important, which is why we focus on the strength of management teams. Our investment process tends to focus on companies that generate high levels of cash that typically have ample opportunities

to invest in projects as well as return capital to shareholders.

Finally, we believe it is important to evaluate all capital allocation decisions in the context of the business and where the company is in its lifecycle.

Please share your thoughts on equity valuations and the portfolio’s composition relative to the S&P 500.

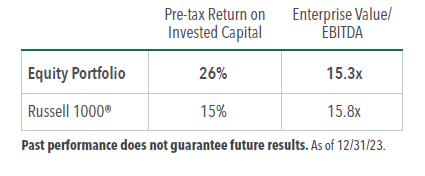

The equity sleeve of the portfolio has a return on invested capital of 26% compared to the Russell 1000® Index of 15%. The Fund’s net debt was also lower than the benchmark, at 1.4x versus the Index’s 1.7x. In terms of valuation, the equity portfolio’s enterprise value relative to EBITDA (earnings before interest, taxes, depreciation and amortization) was 15.3x vs. the benchmark’s 15.8x. Therefore, the Fund’s equity portion provides a higher return on invested capital and less leverage at a discount

to the Index. Given overall market valuations and continued uncertainty in the market, we believe the Fund’s quality-focused equities are positioned to potentially outperform.

Fixed Income Allocation

What are your thoughts about the Federal Reserve’s plan to cut rates in 2024?

During 2023, the Fed shifted its stance from rapidly increasing the overnight rate to pausing additional rate hikes. Now, based on December’s Summary of Economic Projections, they are planning on three rate cuts in 2024 due to declining inflation. Despite that, the market has already priced in approximately six rate cuts for the calendar year, which seems excessive. With all of those rate cuts priced in, financial conditions have eased significantly and could potentially lead to another wave of inflation. However, what’s more likely is a scenario where inflation remains at, or slightly above, trend and growth slows from its above trend pace in 2023.

Importantly, if inflation continues to fall, the level of the real fed funds rate, or the inflation-adjusted funds rate, becomes more restrictive. For example, if inflation declines 1% from its current level, the Fed would need to reduce the overnight rate four times, or 100 basis points, for the real fed funds rate to stay the same. This is why we believe the Fed will reduce rates in 2024, but not at the same pace the market anticipates.

How are your expectations for the rate environment factored into the fixed income sleeve of the portfolio?

Toward the end of 2023, following the news that the Fed may cut rates, the Fund’s fixed income portfolio was positioned with a neutral duration target compared to the benchmark. We achieve this neutral stance by having exposure across the yield curve, rather than through a barbelled or bulleted stance. With significant uncertainty as to the Fed’s true neutral rate, future inflation expectations, and overall economic growth, we don’t believe this is the proper environment to make a material bet on the direction of interest rates. We believe we can add more value for investors by managing the Fund’s exposure to investment grade corporate bonds since we believe that they will outperform over a market cycle.

Notably, investment grade corporate spreads—the compensation for owning a corporate credit over a Treasury—have tightened over the past year. At the beginning of 2023, corporate bond investors earned 1.3% above the average Treasury rate. Throughout the year, the spread reached a high of 1.7%, and ended the year at a 1% spread.

As a result, we have reduced the Fund’s overweight to the sector. While the Fund remains roughly 30% overweight corporate credit on a duration-adjusted basis, it is lower than the overweight of 65% in early 2023.

What is your outlook for fixed income in 2024?

Despite the end-of-the-year rally in yields, rates are still near their highest levels in 15 years, providing an opportunity for fixed income investors that we have not seen through most of the past decade. As of 12/31/23, the Fund had a yield-to-worst of 4.7%, and in 2024, we believe the asset class remains attractive. As always, security selection remains paramount as we assess the relative value and risk/reward of individual credits.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance quoted. Performance data current to the most recent month end, and standardized performance can be obtained by viewing the fact sheet or by clicking fund name below.

- In this article:

- Multi Asset

- Equity and Income Fund

HEIIX 30-Day SEC Yield was 1.44%.

You might also like

-

Portfolio Perspective

Portfolio Perspective

Equity and Income FundA Focus on High-Quality Companies and Disciplined Positioning in Fixed Income

Stephen M. Goddard, CFAPortfolio Manager

Stephen M. Goddard, CFAPortfolio Manager Samuel D. Hutchings, CFAPortfolio Manager

Samuel D. Hutchings, CFAPortfolio Manager Gary B. Cloud, CFAPortfolio Manager

Gary B. Cloud, CFAPortfolio Manager Peter G. Greig, CFAPortfolio ManagerRead the Commentary

Peter G. Greig, CFAPortfolio ManagerRead the CommentaryIn the following commentary, the Portfolio Managers discuss portfolio changes and where they are finding opportunity in the equity and fixed income markets.

-

Portfolio Perspective

Portfolio Perspective

Equity and Income FundNavigating Volatility in Equities and Fixed Income

Stephen M. Goddard, CFAPortfolio Manager

Stephen M. Goddard, CFAPortfolio Manager Samuel D. Hutchings, CFAPortfolio Manager

Samuel D. Hutchings, CFAPortfolio Manager Gary B. Cloud, CFAPortfolio Manager

Gary B. Cloud, CFAPortfolio Manager J. Brian Campbell, CFAPortfolio ManagerRead the Commentary

J. Brian Campbell, CFAPortfolio ManagerRead the CommentaryThe Portfolio Managers of the Hennessy Equity and Income Fund discuss how they navigated the volatile markets during the first half of the year, outlining portfolio changes and areas where they are uncovering opportunities.

-

Portfolio Perspective

Portfolio Perspective

Equity and Income FundAn Opportunistic Balance of High-Quality Stocks and Investment Grade Bonds

Stephen M. Goddard, CFAPortfolio Manager

Stephen M. Goddard, CFAPortfolio Manager Samuel D. Hutchings, CFAPortfolio Manager

Samuel D. Hutchings, CFAPortfolio Manager Gary B. Cloud, CFAPortfolio Manager

Gary B. Cloud, CFAPortfolio Manager Peter G. Greig, CFAPortfolio ManagerRead the Commentary

Peter G. Greig, CFAPortfolio ManagerRead the CommentaryIn the following commentary, the Portfolio Managers of the actively managed Hennessy Equity and Income Fund provide their perspective on investing in high-quality companies and investment grade bonds in 2025.