Tokio Marine Insurance Group

Tokio Marine is Japan’s largest general insurance group with a solid track record in the domestic market and an expanding overseas business. Tokio Marine is one of three Japanese insurers that has significant market share and enjoys high profitability and strong pricing power due to industry consolidation.

-

Masakazu Takeda, CFA, CMAPortfolio Manager

Masakazu Takeda, CFA, CMAPortfolio Manager -

Angus Lee, CFAPortfolio Manager

Angus Lee, CFAPortfolio Manager

One of the World’s Largest and Oldest Insurance Groups

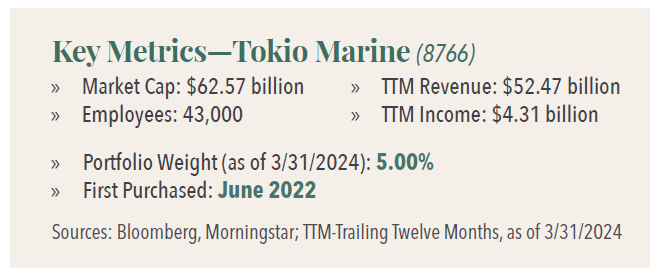

Founded in 1879, Tokio Marine was Japan’s first non-life insurance company and has grown to become one of the largest and longest-standing insurance groups in the world. The company is a collection of insurance businesses and includes over 250 subsidiaries and 26 affiliates in more than 480 cities in 46 countries and regions around the world. Tokio Marine has approximately 43,000 employees.1

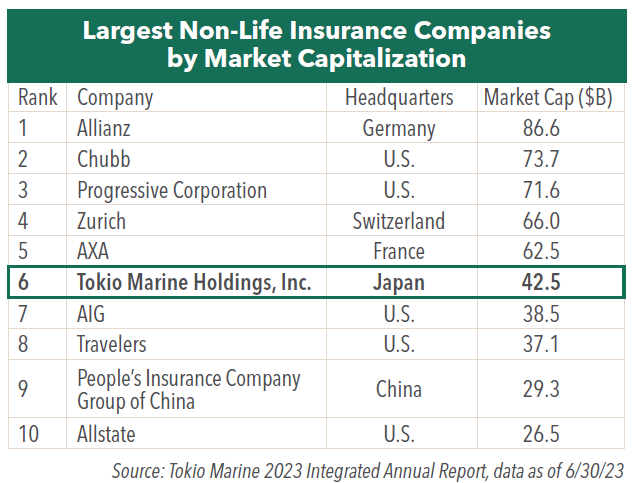

In terms of market capitalization, Tokio Marine was ranked the sixth largest non-life insurance company in the world in 2023. Due to industry consolidation, the Japanese market is dominated by three insurance groups, of which Tokio Marine is the largest.

Expansion of Its International Operations

As an insurance business that underwrites risks all over the world, global risk diversification is the cornerstone of Tokio Marine’s strategy. In fact, Tokio Marine was an international company from its earliest beginnings. In 1880, one year after its founding, the company began underwriting operations in global cities including London, Paris, and New York City.

Its full-scale expansion of operations in the European and U.S. markets occurred when it began actively expanding its overseas insurance business via multiple acquisitions that began in 2008.

Tokio Marine’s Major Acquisitions:

• Kiln – acquired for $763 million in March 2008

• Philadelphia Insurance Companies – acquired for$3.6 billion in December 2008

• Delphi Financial Group – acquired for $1.5 billion in May 2012

• HCC – acquired for $6.8 billion in October 2015

• Pure – acquired for $2.3 billion in February 2020

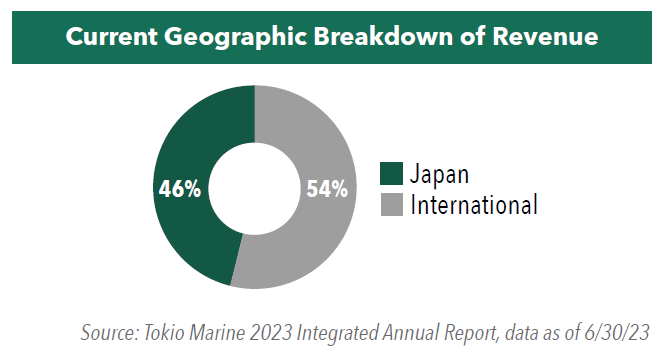

M&A transactions have diversified Tokio Marine’s business. Japan is an archipelago prone to earthquakes and typhoons and is also a country with a high ownership of automobiles. As such, the bulk of Japanese insurance portfolios is comprised of auto and fire insurance policies.

As insurance is a business of risk management, Tokio Marine has focused on purchasing overseas insurance businesses where there is a low correlation with natural disasters in Japan. This overseas exposure in the specialty insurance category provides business diversification, which should translate into lower equity risk premium moving forward.

These companies have strong growth potential and high profitability. They also have few overlapping risks with existing businesses and are thus contributing to enhancing capital efficiency, increasing profits, and stabilizing the business platform.

As a result of these acquisitions, more than half of Tokio Marine’s profits originate from overseas operations.

Shareholder-Friendly Business Practices

When there are no strong acquisition targets, Tokio Marine focuses on its shareholder return policy. Particularly in situations where the stock is undervalued, continuous share buybacks and dividend increases can be powerful tools. In share buybacks, the more undervalued the stock is, the more shares can be bought, resulting in higher earnings per share for shareholders. Management has the financial flexibility to improve return-on-equity (ROE) by suppressing unnecessary increases in shareholders’ capital through these measures.

Tokio Marine‘s policy is to sustainably increase dividends per share in line with its profit growth. For fiscal 2023, due to its consistent profit growth, the company has been steadily expanding the foundation for dividends, which is the 5-year average adjusted net income. As planned, by raising the dividend payout ratio to the targeted global peer level of 50%, we forecast a 21% increase in dividends per share compared with the previous year, marking the 12th consecutive year of dividend growth.2

Policy Shareholdings — Unique to Japan

In the 1960s the non-life insurance companies including Tokio Marine purchased minority shares in other companies to build and maintain business relationships in corporate insurance. These strategic equity holdings, or “policy shareholdings” have large unrealized gains worth billions of dollars today and have been tapped to fund growth. Strong cash flows from market oligopoly, ample proceeds from the periodic sales of equity holdings together with able management teams are factors that give the Japanese insurance companies a competitive edge and makes them uniquely attractive in the global insurance space.

Tokio Marine has successfully capitalized on this financial strength to go global and is now competing with the likes of Allianz and Chubb (Tokio Marine may even eclipse these rivals in the future in terms of scale and capital efficiency).

Attractive Valuation and Dividend Yield

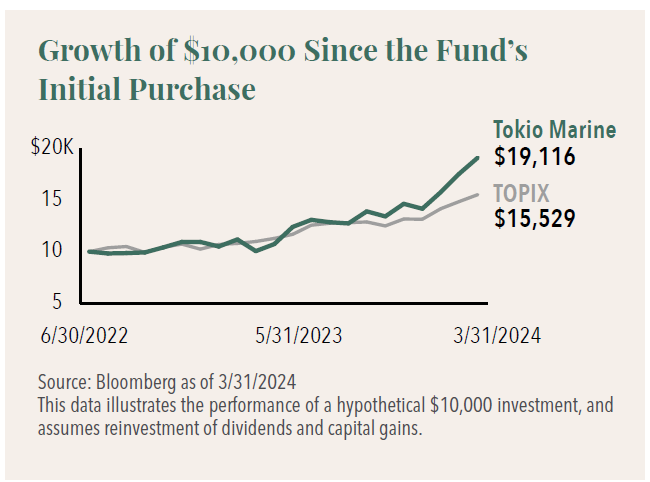

Insurance businesses have historically been generally regarded as mundane and mature in Japan. However, since the industry has been growing faster than the country’s GDP, we view Tokio Marine as anything other than mundane.

In addition to its abundant cash flows and strategic shareholdings, we believe Tokio Marine looks undervalued. As of 12/29/2023, Tokio Marine had a price-to earnings (P/E) ratio of approximately 14x, 1.6x price to-book (P/B), and a dividend yield of 3%.

In addition, over the past decade, Tokio Marine has achieved an average annual growth rate higher than that of Chubb (U.S.), Allianz (Germany), and AXA (France) with its adjusted ROE approaching 17%. Considering the potential to become a top-tier global insurance company in terms of profit scale and profitability, we consider the stock an attractive portfolio holding.

Current and future holdings are subject to risk.

- In this article:

- Japan

- Japan Fund

1 Source: Tokyo Marine Group Overview.

2 Tokio Marine 2023 Integrated Annual Report, data as of 6/30/23.

You might also like

-

Portfolio Perspective

Portfolio Perspective

Japan Small Cap FundJapanese Small-Caps’ Earnings Resilience and Improving Returns on Capital

Takenari Okumura, CMAPortfolio Manager

Takenari Okumura, CMAPortfolio Manager Tadahiro Fujimura, CFA, CMAPortfolio ManagerRead the Commentary

Tadahiro Fujimura, CFA, CMAPortfolio ManagerRead the CommentaryIn the following commentary, the Portfolio Managers cover small-cap outperformance drivers, pro-growth fiscal policy, governance reform, yen volatility, portfolio repositioning, profitability and capital efficiency trends, valuation gaps, and their 2026 outlook.

-

Portfolio Perspective

Portfolio Perspective

Japan FundA Differentiated Portfolio Focused on Margin of Safety and Upside Potential

Masakazu Takeda, CFA, CMAPortfolio Manager

Masakazu Takeda, CFA, CMAPortfolio Manager Angus Lee, CFAPortfolio ManagerRead the Commentary

Angus Lee, CFAPortfolio ManagerRead the CommentaryThe Portfolio Managers summarize the significant events that drove markets over 2025 and how the Fund remains focused on quality, capital discipline, and valuation, with a clear preference for stock picking over index exposure.

-

Investment Idea

Investment IdeaCompelling Valuations in Japan

Masakazu Takeda, CFA, CMAPortfolio Manager

Masakazu Takeda, CFA, CMAPortfolio Manager Angus Lee, CFAPortfolio Manager

Angus Lee, CFAPortfolio Manager Tadahiro Fujimura, CFA, CMAPortfolio Manager

Tadahiro Fujimura, CFA, CMAPortfolio Manager Takenari Okumura, CMAPortfolio ManagerRead the Investment Idea

Takenari Okumura, CMAPortfolio ManagerRead the Investment IdeaJapanese equities are currently trading at compelling valuation levels compared to other developed equity markets around the world and relative to their own historical averages. We believe the Japanese market deserves a closer look.