Freeport-McMoRan: A Supplier of Responsibly Produced Copper

With a global shift to renewable energy and rising urbanization, copper demand is expected to grow while supply remains constrained. We believe copper miners, such as Freeport-McMoRan, are poised to benefit from this trend.

-

Ben Cook, CFAPortfolio Manager

Ben Cook, CFAPortfolio Manager

The Energy Transition

The world’s energy mix is gradually shifting toward a cleaner source of fuels. The pursuit of climate goals and the attractiveness of lower costs are incenting many countries around the world to mitigate carbon emissions by transitioning to renewable sources of energy including wind, solar, and battery technologies. In fact, by 2025, renewable energy is expected to generate more than one-third of the world’s electricity, according to the International Energy Agency.1

To encourage the use of cleaner energy sources, government policy makers have implemented mandates and set targets. China has mandated that electric vehicles comprise 20% of all sales by 2025 and 40% by 2030 and the Biden administration set a target that 50% of vehicle sales should be electric by 2030.2 As a consequence, electric vehicles’ share of the overall car market is projected to increase significantly from the 18% level in 2023.3

Copper’s Role in the Energy Transition

Copper has superior properties compared to other metals that make it ideal for clean energy. Copper is a good conductor of heat and electricity, it can be easily bent and shaped into wires or sheets, and it is 100% recyclable. Copper is also the most efficient nonprecious conductor of heat and electricity, making energy sources that contain copper operate more efficiently.

Wind, solar, and battery technologies are mineral intensive, and among the most heavily used is copper. For example, electric vehicles use up to 4 times more copper than traditional vehicles.4 In addition, electric vehicles charging station infrastructure will need to be developed, and public direct current fast charging stations use over 10 times more copper than home chargers.5

Due to these important consumption drivers, copper could see an 11% demand growth from EVs and chargers, a 19% growth from grid expansion, and a 7% growth from renewable energy technologies between 2020 and 2040.6

Other Uses of Copper

Copper is also used as a main ingredient in steel and is needed to construct railways and electrical grids. Copper wire is used in telecommunications, copper pipes in water supply, and copper is used in construction for cladding, electrical wiring, heating systems, oil and gas lines, rainwater systems, and roofing. In addition, copper’s antimicrobial effect has many useful properties for the health care industry and public health initiatives.

Only approximately 50% of the world’s population lived in an urban area in 2020. By 2045, the urban population is anticipated to increase 1.5 times to 6 billion.7 As urbanization rises and populations expand, especially in countries such as China and India, more copper will be needed for the construction of cities as well as the buildout of infrastructure and communications.

Constrained Supply of Copper

While demand is expected to continue rising for copper, the supply of copper may be slow to keep pace for a number of reasons. Current inventories are low by comparable historical levels, and slow approval rates have meant longer lead times for potential new copper production capacity. As clean energy and electric vehicle sales increase, it is estimated that there could be a copper supply gap of approximately 4 million tonnes by 2030.8 For these reasons, we believe, copper prices will remain elevated over the foreseeable future.

Freeport-McMoRan

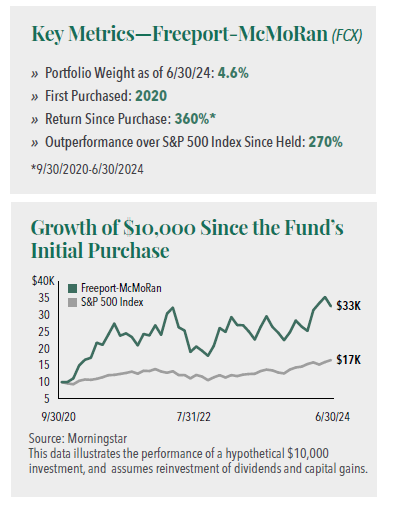

One company poised to be a primary beneficiary of expected rising copper use is Freeport-McMoRan.

Freeport-McMoRan, a leading international mining company headquartered in Phoenix, Arizona, was established in 1988 after the discovery of the Grasberg copper and gold deposit in Papua, Indonesia. With its 2007 acquisition of Phelps Freeport, the company was transformed into a dynamic industry leader as it combined the assets and technical teams of the two companies.

Currently, Freeport operates large geographically diverse assets with significant proven and probable reserves of copper, gold, and molybdenum.

Its operations in Asia, North America, and South America make up a portfolio of assets including:

• The Grasberg minerals district in Indonesia, one of the world’s largest copper and gold deposits. From 1990 through 2019, the open pit produced over 27 billion pounds of copper and 46 million ounces of gold.9

• Seven open-pit copper mines and two molybdenum mines in North America. The company has significant undeveloped reserves and resources in North America, with numerous potential long-term development projects.

• Two copper mines in South America, the Cerro Verde operation in Peru and El Abra in Chile. The Cerro Verde mine also produces molybdenum concentrate and silver. According to the company, Cerro Verde’s expanded operations benefit from its large-scale, long-lived reserves and cost efficiencies and have continued to perform well.

The company’s copper reserves are geographically diverse. Indonesia represents about 28% of the company’s copper deposits while North America holds 44% and South America possesses 28%.

Sustainability Efforts to Responsible Copper Production

As a leading producer of copper and other metals critical to technologies that support a more sustainable, lower-carbon future, Freeport finds it essential to progress its company in a responsible and sustainable manner. To achieve its sustainability goals, the company has focused on three pillars:

1. Robust governance

2. Empowered people and resilient communities

3. Thriving environments

In its 2023 Annual Report on Sustainability, Freeport shares its ideologies that shape the company’s priorities:

• Increased global demand for copper should be met responsibly. Freeport believes it must manage its impacts and positively contribute within and beyond its operational boundaries.

• The challenges of tomorrow demand innovation. Freeport embraces the idea that the future of mining and responsible production requires ingenuity and evolution across the value chain.

• Rising sustainability expectations are an opportunity to create greater value. Its sustainability-related commitments to shareholders challenge Freeport to continually improve and become a better and more productive company.

• Resilience and adaptability are essential characteristics and priorities for any organization striving to achieve enduring sustainability progress. Meeting the world’s changing needs requires a collaborative culture, the capabilities to evolve, people empowered to innovate and challenge the status quo, and the financial strength necessary to chart new paths and weather any storm.

• Transparency and accountability are crucial to building and maintaining trust. Freeport is committed to openly engaging with and listening to its stakeholders, to sharing progress, and to being held accountable.

A few 2023 concrete steps taken to advance its climate strategy include:

• Deciding to transition PT-FI’s Grasberg operations’ existing power supply from coal to liquified natural gas over the next several years.

• Signing a new power purchase agreement in Peru to enable Cerro Verde to reach 100% renewable sources beginning in 2026.

Investment Summary

Freeport is an industry leader with size, scale, and durability. The company maintains a portfolio of high-quality copper and gold assets with embedded growth that is difficult to replicate. Freeport also has technically proficient and proven capabilities in mining with an experienced management team.

We believe Freeport remains attractive due to the following:

• Financial Strength. The company appears to be financially strong, with a focus on deleveraging its balance sheet. Since June 30, 2021, Freeport has reduced its net debt (excluding downstream projects) from $3.4 billion to $0.3 billion at June 30, 2024, and going forward, the company expects to opportunistically repurchase debt in the open market. In a consistently elevated copper price environment, this position should improve cash flows, and ultimately, reward shareholders in the form of share buybacks and dividends.

• Shareholder Interest. Freeport has distributed $4.3 billion to its shareholders from June 30, 2021 to June 30, 2024, 31% of the total in Base Dividend, 25% of the total in Variable Dividend, and 44% in Share Repurchases.12 It has also demonstrated a willingness to ramp cash returns to investors as improved financial and operational results have allowed for both a base dividend as well as variable dividend payout.

• Compelling Valuations. The company currently trades in line with its 10-year average historical valuation despite dramatic improvement in balance sheet strength and share repurchases

Overall, we believe Freeport-McMoRan is a high-quality business with a long runway of opportunity and well-positioned to benefit from the ongoing energy transition.

- In this article:

- Energy

- Energy Transition Fund

You might also like

-

Portfolio Perspective

Portfolio Perspective

Midstream FundPotential Natural Gas Tailwinds for Midstream Companies

Ben Cook, CFAPortfolio Manager

Ben Cook, CFAPortfolio Manager L. Joshua Wein, CAIAPortfolio ManagerRead the Commentary

L. Joshua Wein, CAIAPortfolio ManagerRead the CommentaryThe following commentary highlights how recent events in Venezuela affect midstream investors, how midstream companies could benefit from interest rate cuts, rising natural gas and LNG demand, and AI-driven efficiencies, while maintaining disciplined capital allocation, strong shareholder returns, and attractive valuations.

-

Portfolio Perspective

Portfolio Perspective

Energy Transition FundThe Role of Natural Gas to Meet AI Energy Demand

Ben Cook, CFAPortfolio Manager

Ben Cook, CFAPortfolio Manager L. Joshua Wein, CAIAPortfolio ManagerRead the Commentary

L. Joshua Wein, CAIAPortfolio ManagerRead the CommentaryIn the following commentary, Portfolio Manager Ben Cook and Josh Wein highlight the Fund’s 2025 outperformance, discuss the impact the events in Venezuela may have on the energy sector, and outline key 2026 Energy sector opportunities.

-

Portfolio Perspective

Portfolio Perspective

Gas Utility FundNatural Gas Utilities as a Potential Growth Story

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager L. Joshua Wein, CAIAPortfolio ManagerRead the Commentary

L. Joshua Wein, CAIAPortfolio ManagerRead the CommentaryWith AI-driven power demand, rising capital investments, LNG growth, and pipeline infrastructure expansion, natural gas utilities are being repositioned as potential growth stories with attractive valuations and dividends.