Seeking to Achieve a More Favorable Balance?

-

Stephen M. Goddard, CFAPortfolio Manager

Stephen M. Goddard, CFAPortfolio Manager -

Gary B. Cloud, CFAPortfolio Manager

Gary B. Cloud, CFAPortfolio Manager

For decades, investors have relied on traditional balanced funds to gain portfolio diversification and minimize volatility. With a classic 60% allocation to equities and a 40% allocation to fixed income, balanced funds have historically provided long-term oriented investors with impressive relative capital appreciation, but with lower volatility as compared to an all-equity portfolio.For investors seeking the benefits of a professionally managed blend of stocks and bonds, consider the following two advantages:

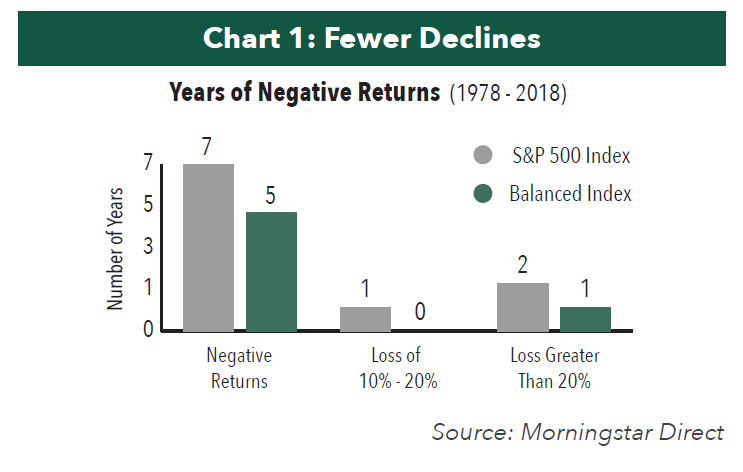

1. Fewer Sharp Declines

Over the long-term, a hypothetical balanced portfolio comprised of 60% in the S&P 500 Index and 40% in the Bloomberg Barclays Capital Intermediate U.S. Government/Credit Index protected capital better than an all-equity portfolio. Over the course of four decades (1978-2018), the S&P 500 Index experienced a loss of between 10% - 20% once and a loss of more than 20% twice. The balanced portfolio experienced zero losses of between 10% and 20% over the period, and a loss of over 20% just once, in 2008, when it posted a loss of 22%.

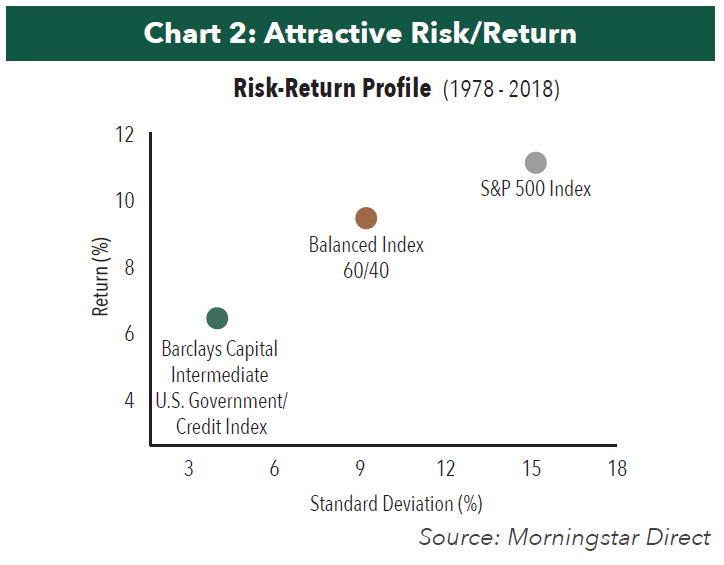

2. More Favorable Risk/Return Relationship

As might be expected, the S&P 500 Index has provided more return than the Bloomberg Barclays Capital Intermediate U.S. Government/Credit Index over time. However, the additional return is accompanied by more risk. During the 1978-2018 time frame, the S&P 500 Index returned 11.39% with a risk factor of 15.20%, as measured by standard deviation, whereas the Bloomberg Barclays Capital Intermediate U.S. Government/Credit Index returned 6.84% with a standard deviation of only 4.16%. A hypothetical balanced 60/40 allocation enjoyed 86% of the return of an all-equity portfolio with 39% less risk during the same time frame.

- In this article:

- Multi Asset

- Equity and Income Fund

You might also like

-

Portfolio Perspective

Portfolio Perspective

Equity and Income FundA Focus on High-Quality Companies and Disciplined Positioning in Fixed Income

Stephen M. Goddard, CFAPortfolio Manager

Stephen M. Goddard, CFAPortfolio Manager Samuel D. Hutchings, CFAPortfolio Manager

Samuel D. Hutchings, CFAPortfolio Manager Gary B. Cloud, CFAPortfolio Manager

Gary B. Cloud, CFAPortfolio Manager Peter G. Greig, CFAPortfolio ManagerRead the Commentary

Peter G. Greig, CFAPortfolio ManagerRead the CommentaryIn the following commentary, the Portfolio Managers discuss portfolio changes and where they are finding opportunity in the equity and fixed income markets.

-

Portfolio Perspective

Portfolio Perspective

Equity and Income FundNavigating Volatility in Equities and Fixed Income

Stephen M. Goddard, CFAPortfolio Manager

Stephen M. Goddard, CFAPortfolio Manager Samuel D. Hutchings, CFAPortfolio Manager

Samuel D. Hutchings, CFAPortfolio Manager Gary B. Cloud, CFAPortfolio Manager

Gary B. Cloud, CFAPortfolio Manager J. Brian Campbell, CFAPortfolio ManagerRead the Commentary

J. Brian Campbell, CFAPortfolio ManagerRead the CommentaryThe Portfolio Managers of the Hennessy Equity and Income Fund discuss how they navigated the volatile markets during the first half of the year, outlining portfolio changes and areas where they are uncovering opportunities.

-

Portfolio Perspective

Portfolio Perspective

Equity and Income FundAn Opportunistic Balance of High-Quality Stocks and Investment Grade Bonds

Stephen M. Goddard, CFAPortfolio Manager

Stephen M. Goddard, CFAPortfolio Manager Samuel D. Hutchings, CFAPortfolio Manager

Samuel D. Hutchings, CFAPortfolio Manager Gary B. Cloud, CFAPortfolio Manager

Gary B. Cloud, CFAPortfolio Manager Peter G. Greig, CFAPortfolio ManagerRead the Commentary

Peter G. Greig, CFAPortfolio ManagerRead the CommentaryIn the following commentary, the Portfolio Managers of the actively managed Hennessy Equity and Income Fund provide their perspective on investing in high-quality companies and investment grade bonds in 2025.