Interest Rates, Inflation, and Energy

Portfolio Manager Ben Cook, CFA discusses his thoughts on how higher prices have affected the economy, the capital discipline of many energy companies, renewable energy, and valuations.

-

Ben Cook, CFAPortfolio Manager

Ben Cook, CFAPortfolio Manager -

L. Joshua Wein, CAIAPortfolio Manager

L. Joshua Wein, CAIAPortfolio Manager

What has been the impact of the Russian invasion of Ukraine on energy prices?

Russia is a major supplier of energy to Europe. In 2020, about 70% of Russian natural gas exports went to Western Europe by pipeline and made up about 45% of the region’s import demand. At the beginning of 2022, three major arteries moved Russian gas to Europe. Any disruption could place Europe’s natural gas balance in a precarious position, particularly given that the year started with record low natural gas inventories.

From a volumetric perspective, maximum liquefied natural gas (LNG) import capacity into Northwest Europe could compensate for Russian gas flows. However, taking into consideration transit time and competition from Asia, the shipment of LNG is not an immediate substitute.

With regard to crude oil, Russia exports about 2.5 million barrels per day globally, and about 50% of oil and condensate exports are directed toward Europe.

Clearly, any impact to Russian supplies could create additional challenges as European refiners seek alternatives. As a result, oil has moved meaningfully higher as the potential for disruption has increased along with the tighter oil market due to years of underinvestment. Based on these factors, we believe the price of a barrel of oil could reach as high as $125 to $150 this year.

How have higher energy prices affected the economy and Energy companies?

Although energy as a percentage of the overall U.S. consumer price index (CPI) is only roughly 8%, oil and natural gas comprise a portion of the input costs for many other goods and services. Consequently, over the past five years, the West Texas Intermediate (WTI) oil price has had a strong correlation to CPI.

Globally, the extent to which oil prices rise becomes a function of how much demand starts to erode. Countries that are large importers of oil such as India and China will be challenged by significantly higher prices. For example, with every $10-15 in oil prices above $75, GDP could be reduced by as much as 0.25%.

As it relates to Energy stocks, history shows that Energy has been the best-performing sector in an inflationary environment. In our view, hydrocarbon energy-producing companies represent one of the best hedges with which to position for an inflationary environment. As prices of commodities rise, Energy companies often generate higher levels of cash, which offsets the negative inflationary impact on consumer purchasing power.

In this environment, how would Energy companies deploy this increased cash?

A return of capital to shareholders has become a priority for many Energy companies. Therefore, as cash levels have risen, many companies have repaid debt at an accelerated pace. In addition, shareholder-friendly actions in the form of stock buybacks and increased dividend payouts have taken priority over reinvestment.

As a group, the hydrocarbon Energy sector is more fiscally disciplined than they have been historically as many management teams recognize the risk in overspending. Many companies also recognize that a key to better stock performance has been

a move toward shareholder-friendly capital allocation decisions.

Importantly, over the next 12 months, oil demand could outstrip global production capacity. This trend will provide an impetus for reinvestment to grow the business. Hydrocarbon producers will likely deploy cash for reinvestment, but only after cash returns to shareholder targets have been achieved.

In this way, Energy companies should continue to adhere to free cash yield levels that allow for continued shareholder return. We expect that companies will only spend surplus free cash, thereby preserving balance sheet and shareholder return integrity.

Would you please discuss how renewable and traditional energy companies fit together in this evolving energy landscape?

Renewable energy sources which include wind and solar power will likely play an increasing role in satisfying growing global power demand. In fact, renewable energy is expected to be the fastest growing category among the primary fuel mix for the next 10 years or so.

Yet, renewable energy growth is dependent on global policy implementation, relative cost advantage, and reliability. These factors will likely slow the pace of adoption and prolong the world’s dependence on hydrocarbons.

This trend should drive increased use of cleaner-burning hydrocarbons, particularly in the developing world which will require more power as living standards improve. As a result, natural gas is a likely companion to renewable energy due to its abundance and varied use applications, with both offering a solution to growing global energy needs.

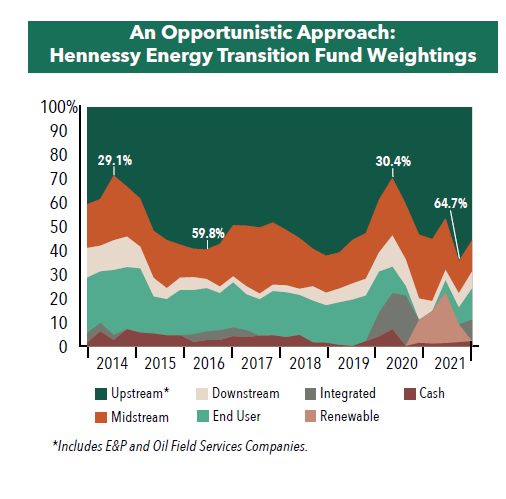

With the Hennessy Energy Transition Fund, we seek to invest in both renewable and hydrocarbon-based companies. However, over the past several months, many renewable companies, which continue to trade at lofty valuation levels, have had difficulty executing on their operating plan due to rising raw material costs and supply chain issues. While there may be opportunity to invest in renewables in the future, we believe there is better investment merit in traditional hydrocarbon Energy companies given the potential for cash generation and the rising rate environment.

Are there any other investable areas of interest related to renewable energy growth?

Yes. There are a variety of ways to play the energy transition. For example, many renewable energy components rely on inputs such as copper and aluminum. As demand for renewable energy grows, an increased amount of raw material is needed in the manufacturing process.

With the flexibility to invest across the energy chain, the Fund has purchased copper producer Freeport McMoRan. In an environment of elevated copper prices, the company is generating higher levels of free cash flow. Looking ahead, we believe it is poised to benefit from the transition to cleaner energy sources as more and more copper will be needed.

How do valuations currently look?

The Energy sector currently looks attractively priced. Based on consensus estimates as of February 2022:

• U.S. exploration and production (E&P) companies trade about a 65% discount to the S&P 1500 on an EV/EBITDA basis, which is wider than the 5-and 10-year average discount of 45% and 35%, respectively.

• Oil E&P companies trade at 4x and 3.7x 2022 and 2023 EBIDTA estimates, respectively.

• Natural gas weighted E&P companies trade at 4x and 3.4x 2022 and 2023 EBITDA estimates, which is at the low end of the historical valuation range of approximately 4x to 6x forward EBITDA.

• Midstream companies traded at 8.1x on a 2023 EV/EBIDTA basis, which is 14% below the 5-year average of 9.5x.

• C-Corp Midstream companies traded at 10x on a 2023 EV/EBIDTA basis, which is 7% below its 5-year average valuation of 10.7x.

Along with these attractive valuations, we believe the solid sector fundamentals and the prospect for rising interest rates offer strong appeal for long-term investors.

- In this article:

- Energy

- Energy Transition Fund

You might also like

-

Portfolio Perspective

Portfolio Perspective

Midstream FundPotential Natural Gas Tailwinds for Midstream Companies

Ben Cook, CFAPortfolio Manager

Ben Cook, CFAPortfolio Manager L. Joshua Wein, CAIAPortfolio ManagerRead the Commentary

L. Joshua Wein, CAIAPortfolio ManagerRead the CommentaryThe following commentary highlights how recent events in Venezuela affect midstream investors, how midstream companies could benefit from interest rate cuts, rising natural gas and LNG demand, and AI-driven efficiencies, while maintaining disciplined capital allocation, strong shareholder returns, and attractive valuations.

-

Portfolio Perspective

Portfolio Perspective

Energy Transition FundThe Role of Natural Gas to Meet AI Energy Demand

Ben Cook, CFAPortfolio Manager

Ben Cook, CFAPortfolio Manager L. Joshua Wein, CAIAPortfolio ManagerRead the Commentary

L. Joshua Wein, CAIAPortfolio ManagerRead the CommentaryIn the following commentary, Portfolio Manager Ben Cook and Josh Wein highlight the Fund’s 2025 outperformance, discuss the impact the events in Venezuela may have on the energy sector, and outline key 2026 Energy sector opportunities.

-

Portfolio Perspective

Portfolio Perspective

Gas Utility FundNatural Gas Utilities as a Potential Growth Story

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager L. Joshua Wein, CAIAPortfolio ManagerRead the Commentary

L. Joshua Wein, CAIAPortfolio ManagerRead the CommentaryWith AI-driven power demand, rising capital investments, LNG growth, and pipeline infrastructure expansion, natural gas utilities are being repositioned as potential growth stories with attractive valuations and dividends.