A Portfolio Positioned for a Strong Economy

Portfolio Managers of the Hennessy Equity and Income Fund discuss their views on higher interest rates, inflation and supply chain shortages, and the fixed income and equity markets in 2022.

-

Stephen M. Goddard, CFAPortfolio Manager

Stephen M. Goddard, CFAPortfolio Manager -

Samuel D. Hutchings, CFAPortfolio Manager

Samuel D. Hutchings, CFAPortfolio Manager -

Gary B. Cloud, CFAPortfolio Manager

Gary B. Cloud, CFAPortfolio Manager -

Peter G. Greig, CFAPortfolio Manager

Peter G. Greig, CFAPortfolio Manager

Equity Allocation

How might the likelihood of higher rates in 2022 impact your forecast of growth and value equities?

Historically in a rising rate environment, value companies have outperformed growth stocks. Typically, growth stocks tend to be valued on their future earnings growth and cash flows. As the economy matures, quality value stocks generally have outperformed.

Currently, the valuations of growth stocks compared to value stocks are at the widest deviation since the tech bubble in the late-1990s. In addition, higher quality companies have also underperformed the overall market. In fact, for the first time in December 2021, quality stocks as defined as companies with high return of capital, low debt to capital, and higher free cash flow generation, traded at a discount to the overall market, which hasn’t happened in 20 years.

We believe these extremes in valuations indicate an inflection point in the market where value and high-quality companies should outperform their lower quality growth counterparts, particularly if the market generates moderate single-digit returns over the next decade.

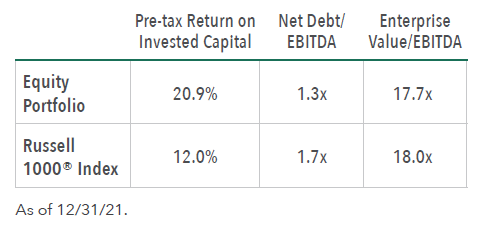

The Fund’s equity portfolio holds what we believe to be high-quality companies that are undervalued relative to the overall market. As of the end of 2021, the Fund’s equity portfolio has a return on capital that is nearly twice that of the Russell 1000® Index yet trades at a discount.

How have the portfolio holdings been impacted by widespread supply shortages and higher input costs?

Supply chain and labor shortages along with input costs have affected nearly every company. However, in a healthy demand environment, many companies can pass through their higher costs to consumers.

We seek to identify companies with sustainable competitive advantages and a higher return on capital compared to the overall market. Many of the Fund’s equity holdings have pricing power due to brand strength, market dynamics, or contractual cost factors. These factors should allow these companies to pass increased costs to their customers. Currently, we are seeing this trend in many of our holdings, including Nestle, Church and Dwight, Altria, Air Products, Old Dominion Freight Line, and Martin Marietta Materials.

Please comment on the recent addition of Fiserv to the portfolio.

In 2021, we added Fiserv, a company that provides technology which allows merchants to accept credit cards and banks to issue and process credit cards. It also has a solid financial institution business which provides banks outsourced account processing. Run by a shareholder friendly management team, Fiserv has a stable, recurring revenue business, high margins, strong free cash flow generation, and a solid balance sheet.

We believe an opportunity exists as the market seems overly concerned with the entry of fintech startups in the merchant-acquiring business. Yet this segment of Fiserv’s business only represents 30% of operating profit. Interestingly, the market may not value Fiserv’s ability to innovate and compete. For example, Fiserv’s industry-leading point-of-sale device, Clover, is now processing more volume and growing faster than its closest competitor Square. Clover grew its gross payment volumes 47% in the third quarter of 2021 to a $196B annualized run rate.

We believe Fiserv’s strong fundamentals have been overlooked. Solutions provided to financial institutions represent about 70% of operating profit. These relationships generally have long-term contracts often with price escalators, high switching costs,

and low churn. Banks are often reluctant to switch providers because of a potential disruption to clients. Because of this, Fiserv has demonstrated resilience through economic cycles as represented by 35 years of double-digit EPS growth. Over the next five years, management expects to generate $25 billion in free cash flow and plans to return a substantial portion of that via share repurchases. At under 13x forward EV/EBITDA, the stock currently trades at a discount to the market while it historically has traded at a premium

Fixed Income Allocation

Would you please comment on the Federal Reserve’s plan to hike interest rates in 2022?

In December 2021, the Fed moved up its timeline on its plans to taper bond purchases as well as potentially increase rates three times in 2022 and three more times in 2023. We support this decision and have expected this news from the Fed. Currently, short-term interest rates reflect the market’s outlook. As we move closer to the first rate hike, we expect short-term yields to move higher, so the 2-year note yield could reach as high as 125 to 150 basis points. Longer yields could move slightly higher but not to the same extent as short-term yields, which would cause the yield curve to flatten.

We believe there will be a global coordinated effort of central banks raising rates. As soon as the Fed announced its plans, the Bank of England raised its overnight rates and the European Central Bank followed suit in rapid succession.

What tactical changes would you consider as rates move higher?

In 2021, there was no material change in duration in the Fund’s fixed income sleeve duration. As of 12/31/21, the portfolio’s effective duration was 3.93 with an effective maturity of 4.43 years.

In a potentially higher interest rate environment, we initially look to passively reduce our interest rate exposure by allowing our portfolio holdings to mature and potentially synchronize the portfolio aging with a move higher in longer term rates. We continue to believe there is opportunity for higher yields at the long end of the curve, as high as 1.75% to 2%. If we are correct and higher interest rates do occur, we will look to extend the duration of the portfolio.

Where are you finding the most attractive opportunities in the fixed income universe?

Given the outlook for potentially strong economic growth, we continue to be biased toward corporate credits over full market cycles as we believe corporate bonds will outperform other credits. We can increase our corporate exposure in two ways: 1) increase the absolute level of corporate bond holdings as a percentage of the portfolio, and 2) extend the duration of credit exposure.

Toward the end of 2021, we saw a fairly significant increase in credit spreads, which has presented opportunity to find more attractive issues, particularly in the BBB-rated area of the market. We continue to look for issues of specific companies that provide superior relative value compared to overall corporate bond market and their sector.

- In this article:

- Multi Asset

- Equity and Income Fund

You might also like

-

Portfolio Perspective

Portfolio Perspective

Equity and Income FundNavigating Volatility in Equities and Fixed Income

Stephen M. Goddard, CFAPortfolio Manager

Stephen M. Goddard, CFAPortfolio Manager Samuel D. Hutchings, CFAPortfolio Manager

Samuel D. Hutchings, CFAPortfolio Manager Gary B. Cloud, CFAPortfolio Manager

Gary B. Cloud, CFAPortfolio Manager J. Brian Campbell, CFAPortfolio ManagerRead the Commentary

J. Brian Campbell, CFAPortfolio ManagerRead the CommentaryThe Portfolio Managers of the Hennessy Equity and Income Fund discuss how they navigated the volatile markets during the first half of the year, outlining portfolio changes and areas where they are uncovering opportunities.

-

Portfolio Perspective

Portfolio Perspective

Equity and Income FundAn Opportunistic Balance of High-Quality Stocks and Investment Grade Bonds

Stephen M. Goddard, CFAPortfolio Manager

Stephen M. Goddard, CFAPortfolio Manager Samuel D. Hutchings, CFAPortfolio Manager

Samuel D. Hutchings, CFAPortfolio Manager Gary B. Cloud, CFAPortfolio Manager

Gary B. Cloud, CFAPortfolio Manager Peter G. Greig, CFAPortfolio ManagerRead the Commentary

Peter G. Greig, CFAPortfolio ManagerRead the CommentaryIn the following commentary, the Portfolio Managers of the actively managed Hennessy Equity and Income Fund provide their perspective on investing in high-quality companies and investment grade bonds in 2025.

-

Portfolio Perspective

Portfolio Perspective

Equity and Income FundA Comprehensive Market Overview and Update On the Fund's Positioning

Stephen M. Goddard, CFAPortfolio Manager

Stephen M. Goddard, CFAPortfolio Manager Gary B. Cloud, CFAPortfolio Manager

Gary B. Cloud, CFAPortfolio Manager Mark E. DeVaul, CFA, CPAPortfolio Manager

Mark E. DeVaul, CFA, CPAPortfolio Manager J. Brian Campbell, CFAPortfolio Manager

J. Brian Campbell, CFAPortfolio Manager Peter G. Greig, CFAPortfolio Manager

Peter G. Greig, CFAPortfolio Manager Samuel D. Hutchings, CFAPortfolio ManagerRead the Commentary

Samuel D. Hutchings, CFAPortfolio ManagerRead the CommentaryIn the following commentary, the Portfolio Managers of the actively managed Hennessy Equity and Income Fund (HEIFX/HEIIX) share their perspective on the equity and fixed income markets, a new equity holding, where on the yield curve they are finding opportunity, and their outlook for the remainder of 2024.