Equity and Income Opportunities in a Higher Interest Rate Environment

In the following commentary, the Portfolio Managers of the Hennessy Equity and Income Fund (HEIFX/HEIIX) provide a recap of the equity market, discuss expectations for interest rates, and give insight into where they are finding high-quality securities.

-

Stephen M. Goddard, CFAPortfolio Manager

Stephen M. Goddard, CFAPortfolio Manager -

J. Brian Campbell, CFAPortfolio Manager

J. Brian Campbell, CFAPortfolio Manager -

Samuel D. Hutchings, CFAPortfolio Manager

Samuel D. Hutchings, CFAPortfolio Manager -

Gary B. Cloud, CFAPortfolio Manager

Gary B. Cloud, CFAPortfolio Manager -

Peter G. Greig, CFAPortfolio Manager

Peter G. Greig, CFAPortfolio Manager

Equity Allocation

What are you overall thoughts on the 2022 stock market?

Although the S&P 500® Index declined 18% and the Federal Reserve hiked interest rates a total of 425 basis points in 2022, we believe many companies’ earnings and employment levels held up better than expected.

However, it has only been nine months since the first rate increase. Typically, there is a lag in how long it takes for rate increases to fully impact the economy. Also, consumers entered this environment much stronger than they had in the past due to higher rates of savings attributed to the pandemic and strong employment numbers.

While time will tell how much recession fears are already priced into the market, we believe investors should continue to focus on high-return, high-quality companies that have the financial wherewithal to weather various economic cycles.

How do the equity portfolio’s metrics compare to the overall market?

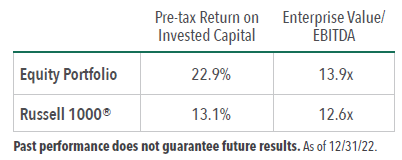

As of the end of 2022, on an Enterprise Value/EBITDA basis, the equity portion of the portfolio was slightly higher than the market at 13.9x compared to 12.6x for the Russell 1000® Index. However, we believe the Fund’s equity portfolio is higher-quality relative to the Index with a return on invested capital (ROIC) of 22.9% versus 13.1%. We believe holding companies with a higher ROIC can help to reduce the overall equity risk in the portfolio.

Given the market decline in 2022, where are you finding opportunity?

As bottom-up investors, we focus on selecting individual companies rather than making sector bets. With the market decline in 2022, we have looked for opportunities where high-quality companies have been punished based on idiosyncratic fears. One example is Starbucks, a purchase made in the second half of 2022.

The company has been on our watchlist since 2019. In 2022, the stock price declined over 20% due to fears of how China’s Covid lockdowns and the company’s recent unionization efforts would affect the business. We believe these events are short-term in nature and the unionization efforts do not pose a large financial risk. We believe the weakness in the market provided an opportunity to buy a high-quality company with healthy operating margins with a greater than 30% return on invested capital and a conservative balance sheet. Starbucks has some of the strongest economics in the retail sector and a high return on investment. With a long runway of potential growth, we believe it can continue to compound through time.

Financials has the highest sector weighting in the equity portfolio. What is your investment case for holding financial companies?

We believe the Fund’s Financials holdings should do well in a lower growth, higher interest rate environment.

For example, both Progressive Corp. and Berkshire Hathaway have exposure to auto insurance, which has been a historically resilient business as car insurance is required and drivers may drive less in a recessionary period, reducing the number

of potential claims. As an added benefit, both companies have been able to raise prices to offset the inflationary costs on repairs. In a period of potentially improving loss ratios, Progressive and Berkshire should benefit from better pricing and improved profitability.

A higher rate environment should benefit Charles Schwab, which we purchased in 2019 on the belief that the company offered a compelling long-term opportunity. The company has a differentiated asset gathering model which should continue to grow regardless of the rate environment. Schwab targets Financial Advisors, who want to be independent from the large wirehouses, by providing them free tools and services. Schwab also offers brokerage services at low to no cost and monetizes these accounts by investing the clients’ uninvested cash in government-backed investments. As rates rise, Schwab should be able to invest at higher rates and earn higher incremental returns.

Fixed Income Allocation

What are your expectations regarding interest rates and Federal Reserve actions as we head into 2023?

At the beginning of 2023, the fed funds rate was set at a range of 4.25% to 4.50%, up from the Zero Interest Rate Policy a year ago. We believe the fed funds rate should peak sometime in early 2023. It is likely there will be a 25 basis point increase announced at the Fed’s February meeting. Although the Fed’s view is to hold the rate above 5%, we believe that after the February rate increase, there could be only an additional hike of only 25 basis points, if at all depending on economic data, potentially resulting in a fed funds rate of less than 5%.

The Fed’s future actions remain unknown. Keep in mind that a year ago, the Fed indicated it would raise rates three times for a total of 75 bps in 2022, but then enacted a significantly different plan that included seven rate hikes, four of which were 75 basis points each.

Would you please comment on the current yield curve and direction for 2023?

The yield curve shape is deeply inverted with long-term rates lower than short-term rates. As of the beginning of 2023, the spread between 2-year and 10-year bonds was 56 basis points, after reaching a 40-year high in early December at 84 basis points. It appears Treasury yields with longer maturities such as 10, 20 and 30 years reflect the market’s belief that the U.S. will experience a mild recession and that the Fed may cut rates in the near future.

How the yield curve changes in 2023 is largely dependent on economic data. There are reasons to believe the economy will slow down and most of the inflation data except housing and rent are looking more constructive. However, it is more important to consider the Fed’s reaction. Given the inverted yield curve, history suggests that short-term rates could decline more than long-term rates from current levels.

Where are you seeing current opportunities in the bond market?

Following the worst annual return in modern history, we see opportunities across the entire market. Bond yields are also near 15-year highs. For example, at the beginning of 2023, the Bloomberg Intermediate Government/Credit Index had an attractive yield of nearly 4.6%.

As of the beginning of 2023, the current credit spread for investment grade bonds was about 1.3% above Treasuries. With an inverted yield curve, short to intermediate bonds such as those with 5-year maturities look attractive, and floating rate bank bonds and preferred stocks as a satellite asset class continue to look attractive.

For the Fund’s fixed income portion, we focus on purchasing Treasuries, agencies, and high-quality corporate obligations and add select non-investment grade obligations to enhance yield.

How has the Fund’s fixed income duration changed over the course of 2022?

The Fund’s fixed income duration has shortened over the year mostly as a function of rising interest rates. As interest rates increase, duration shortens as a function of the discounting of the cash flows. The Bloomberg Intermediate Government/Credit Index has gone from more than 4.1 years to about 3.8 years.

The portfolio entered 2022 with a slightly shorter duration policy as we expected interest rates to rise although not to the extent that they did, and then moved into a neutral duration policy where the portfolio remained for the second half of the year.

As of December 31, 2022, the portfolio’s effective duration was 3.8 with an effective maturity of 4.4 years.

- In this article:

- Multi Asset

- Equity and Income Fund

You might also like

-

Portfolio Perspective

Portfolio Perspective

Equity and Income FundA Focus on High-Quality Companies and Disciplined Positioning in Fixed Income

Stephen M. Goddard, CFAPortfolio Manager

Stephen M. Goddard, CFAPortfolio Manager Samuel D. Hutchings, CFAPortfolio Manager

Samuel D. Hutchings, CFAPortfolio Manager Gary B. Cloud, CFAPortfolio Manager

Gary B. Cloud, CFAPortfolio Manager Peter G. Greig, CFAPortfolio ManagerRead the Commentary

Peter G. Greig, CFAPortfolio ManagerRead the CommentaryIn the following commentary, the Portfolio Managers discuss portfolio changes and where they are finding opportunity in the equity and fixed income markets.

-

Portfolio Perspective

Portfolio Perspective

Equity and Income FundNavigating Volatility in Equities and Fixed Income

Stephen M. Goddard, CFAPortfolio Manager

Stephen M. Goddard, CFAPortfolio Manager Samuel D. Hutchings, CFAPortfolio Manager

Samuel D. Hutchings, CFAPortfolio Manager Gary B. Cloud, CFAPortfolio Manager

Gary B. Cloud, CFAPortfolio Manager J. Brian Campbell, CFAPortfolio ManagerRead the Commentary

J. Brian Campbell, CFAPortfolio ManagerRead the CommentaryThe Portfolio Managers of the Hennessy Equity and Income Fund discuss how they navigated the volatile markets during the first half of the year, outlining portfolio changes and areas where they are uncovering opportunities.

-

Portfolio Perspective

Portfolio Perspective

Equity and Income FundAn Opportunistic Balance of High-Quality Stocks and Investment Grade Bonds

Stephen M. Goddard, CFAPortfolio Manager

Stephen M. Goddard, CFAPortfolio Manager Samuel D. Hutchings, CFAPortfolio Manager

Samuel D. Hutchings, CFAPortfolio Manager Gary B. Cloud, CFAPortfolio Manager

Gary B. Cloud, CFAPortfolio Manager Peter G. Greig, CFAPortfolio ManagerRead the Commentary

Peter G. Greig, CFAPortfolio ManagerRead the CommentaryIn the following commentary, the Portfolio Managers of the actively managed Hennessy Equity and Income Fund provide their perspective on investing in high-quality companies and investment grade bonds in 2025.