A Supportive Environment for High-Quality Equities

Portfolio Managers of the Hennessy Equity and Income Fund discuss value-oriented stock leadership, recent additions to the portfolio, and their outlook for stocks. They also share their views on inflation, interest rates, and the market.

-

Mark E. DeVaul, CFA, CPAPortfolio Manager

Mark E. DeVaul, CFA, CPAPortfolio Manager -

Gary B. Cloud, CFAPortfolio Manager

Gary B. Cloud, CFAPortfolio Manager -

Peter G. Greig, CFAPortfolio Manager

Peter G. Greig, CFAPortfolio Manager

Equity Allocation

How has the market transition from growth to value investing in 2021 impacted the Fund’s equity portfolio?

The investor shift to value-oriented companies may have aided relative performance of the equity sleeve of the portfolio compared to the Russell 1000® Index, but it has not impacted our time-tested stock investment strategy. We employ a bottom-up process focused on mitigating downside loss and risk mitigation, and seek companies with sustainable high returns on capital, consistent cash flow generation, and strong balance sheets. Importantly, we do not make portfolio changes based on a change in factors that may be leading the market, rather our stock selection is based on the quality of a company’s underlying business.

Can you comment on recent additions to the portfolio?

During the first quarter of 2021, we added Facebook (FB), a high margin business trading at a discount to the broader market based on EV/EBITDA at the time of purchase.

Facebook owns several attractive businesses, including Facebook, Instagram, Messenger, and WhatsApp, which collectively have over 3 billion active monthly users. The company benefits from strong network effects and has consistently grown users every year since its inception. Any improvements in user engagement and/or the effectiveness of Facebook’s ad tools will likely drive performance. Additionally, the company continues to increase the supply of ads on its sites to drive volume.

Facebook’s monthly active user base has increased significantly in recent years, while digital advertising revenue has posted strong growth. The company posts operating margins over 35%.

Facebook has over $50 billion in net cash and generates roughly $40 billion in annual operating cash flow, which the management reinvests in research and development and capital expenditures. Remaining cash is generally used for acquisitions/equity investments or returned to shareholders through share buybacks. In 2017, the company started buying back shares.

In the first quarter, we also initiated a position in Church & Dwight (CHD), which develops and manufactures household, personal care, and specialty products. The Arm & Hammer product family is the largest, comprising baking soda, laundry detergent, cat litter, and oral care products, but the company has 12 other “power brands” that represent over 80% of sales and profits.

The company runs a lean organization with an intense focus on operational efficiency and profitable growth. The asset-light nature of the business allows for strong free cash flow generation, solid margins, and attractive returns on capital. Operating margin is close to 20% and the company generates operating cash flow of roughly $1 billion per year. CHD also maintains a strong balance sheet with $2.2 billion in net debt and a leverage ratio of 1.9x.

Finally, we purchased Old Dominion Freight Line (ODFL) during 1Q21. We view the company as one of the best-in-class less-than-full truckload (LTL) providers. The current economic environment is positive for the company with strong sales growth and tight capacity. Barriers to enter the industry are high as it is difficult to replicate ODFL’s national distribution network. Although the stock traded at an elevated 22x trailing 12 months EBITDA as of 6/30/21, we believe the company can compound strong earnings growth over the next few years.

How have the portfolio holdings been impacted by widespread supply shortages and higher input costs?

Widespread supply shortages and higher input costs have had positive and negative impacts on some holdings. For example, limited shipments of new cars helped used auto sales and pricing at CarMax, tight shipping capacity led to stronger volume and surcharges at FedEx, and a tight supply of building products and higher demand helped The Home Depot and Lowe’s. Conversely, component shortages led to weaker sales at firms including Cisco Systems and Citrix Systems, and labor shortages impacted Old Dominion Freight as they struggled to find drivers.

We believe our portfolio holds many companies that have pricing power to offset higher input costs because of brand strength, distribution systems, or other competitive advantages. These factors should help them do well in a potentially higher inflationary environment.

What is your outlook for stocks over the rest of 2021?

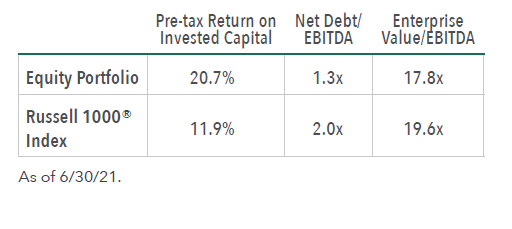

We maintain a positive view on the economy with the continued rollout of vaccines, additional fiscal stimulus, and accommodative governmental policies and expect strong real GDP growth in 2021 (over 6%). Over the longer term, we remain optimistic about the prospects for the U.S. economy, with real GDP growth in the 2-3% range. This more normalized growth rate should lead to a focus on solid company fundamentals. We believe the companies in the Hennessy Equity and Income Fund are poised to benefit, as they have historically generated higher returns on capital, possess stronger balance sheets and are priced at reasonable valuations relative to the broader market.

Fixed Income Allocation

What are your expectations for inflation over the next 1-2 years?

The U.S. has recently experienced elevated year-over-year monthly inflation levels that have not been seen in decades. Core PCE inflation may be as high, on average, as 3 to 3.5% in 2021, and in 2022 it may exceed the Federal Reserve’s 2% target. However, over the longer term, we believe inflation may revert to levels closer to the Fed’s target. Although some aspects of the current U.S. inflation are temporary, such as the escalating price of lumber, and may decrease over time as inventories adjust, we believe many areas of the economy will face transitory inflation.

Would you please discuss the Fed’s signaling they will raise rates in 2023?

Due to the strength of the rebound in the U.S. economy, it is not surprising that the Fed is planning on increasing interest rates as well as possibly tapering its asset purchases sooner than expected. We believe it is reasonable that the Fed may increase the Federal Funds rate a few times in 2023, however rates will likely remain historically low for the time being. Given these continued low rates, we believe risk assets are well-positioned, which supports the Fund’s 70%/30% equity to fixed income allocation.

We had been expecting slightly higher rates in 2021, and therefore, have been tactically positioning the fixed income portfolio, with an effective duration of 4.0 years compared to the Bloomberg Barclays Intermediate U.S. Government/Credit Index benchmark of 4.2 years. The fixed income portfolio has an effective maturity 4.5 years compared to the benchmark’s 4.5 years.

What is the spread between U.S. rates compared to other developed nations?

We believe the U.S. has the most liquid, stable, and relatively high-yielding fixed income market, and is therefore attractive to global fixed income investors. Among developed markets, the U.S. currently offers the highest yield. For example, the 5-year U.S. Treasury is 90 basis points, significantly higher than the German, French, or Greek equivalent of -56 bps, -51 bps and 2 bps, respectively, as of June 30, 2021. For rates to move significantly higher, we believe we would need a synchronized move in global government rates.

What are your thoughts on the $11 trillion outstanding in corporate debt?

The biggest beneficiaries of a zero-interest rate policy and quantitative easing have been investment grade and high-yield debt issuers. Given higher equity valuations and growing market capitalization, current debt levels are well supported in the capital structure of investment grade companies. In fact, for companies in the S&P 500 Index, interest expense as a percent of overall revenue has rarely been lower.

As fixed income buyers, we find the current environment more challenging to uncover attractive credit, as many bonds are currently fully priced, and spreads are tight. With 46% of the fixed income portfolio held in corporate obligations as of June 30, 2021, our focus is on individual company fundamentals and their net debt levels.

- In this article:

- Multi Asset

- Equity and Income Fund

Return on invested capital is used to assess a company’s efficiency at allocating capital. Core Personal Consumption Expenditures (PCE) Inflation represents the prices of goods and services purchased by consumers in the U.S.

Earnings growth is not representative of the Fund’s future performance

You might also like

-

Portfolio Perspective

Portfolio Perspective

Equity and Income FundA Focus on High-Quality Companies and Disciplined Positioning in Fixed Income

Stephen M. Goddard, CFAPortfolio Manager

Stephen M. Goddard, CFAPortfolio Manager Samuel D. Hutchings, CFAPortfolio Manager

Samuel D. Hutchings, CFAPortfolio Manager Gary B. Cloud, CFAPortfolio Manager

Gary B. Cloud, CFAPortfolio Manager Peter G. Greig, CFAPortfolio ManagerRead the Commentary

Peter G. Greig, CFAPortfolio ManagerRead the CommentaryIn the following commentary, the Portfolio Managers discuss portfolio changes and where they are finding opportunity in the equity and fixed income markets.

-

Portfolio Perspective

Portfolio Perspective

Equity and Income FundNavigating Volatility in Equities and Fixed Income

Stephen M. Goddard, CFAPortfolio Manager

Stephen M. Goddard, CFAPortfolio Manager Samuel D. Hutchings, CFAPortfolio Manager

Samuel D. Hutchings, CFAPortfolio Manager Gary B. Cloud, CFAPortfolio Manager

Gary B. Cloud, CFAPortfolio Manager J. Brian Campbell, CFAPortfolio ManagerRead the Commentary

J. Brian Campbell, CFAPortfolio ManagerRead the CommentaryThe Portfolio Managers of the Hennessy Equity and Income Fund discuss how they navigated the volatile markets during the first half of the year, outlining portfolio changes and areas where they are uncovering opportunities.

-

Portfolio Perspective

Portfolio Perspective

Equity and Income FundAn Opportunistic Balance of High-Quality Stocks and Investment Grade Bonds

Stephen M. Goddard, CFAPortfolio Manager

Stephen M. Goddard, CFAPortfolio Manager Samuel D. Hutchings, CFAPortfolio Manager

Samuel D. Hutchings, CFAPortfolio Manager Gary B. Cloud, CFAPortfolio Manager

Gary B. Cloud, CFAPortfolio Manager Peter G. Greig, CFAPortfolio ManagerRead the Commentary

Peter G. Greig, CFAPortfolio ManagerRead the CommentaryIn the following commentary, the Portfolio Managers of the actively managed Hennessy Equity and Income Fund provide their perspective on investing in high-quality companies and investment grade bonds in 2025.