Importance of High-Quality Equity and Fixed Income During COVID-19 Outbreak

The Portfolio Managers of the Hennessy Equity and Income Fund discuss the impact of coronavirus on the equity and fixed income markets, finding opportunities in the equity market, changes made to the Fund, and their long-term outlook for interest rates.

-

Gary B. Cloud, CFAPortfolio Manager

Gary B. Cloud, CFAPortfolio Manager -

Peter G. Greig, CFAPortfolio Manager

Peter G. Greig, CFAPortfolio Manager

Equity Allocation - Jonathan T. Moody , CFA of The London Company

How is the portfolio positioned to help manage downside risk during periods of volatility?

Our focus has always been on minimizing downside risk regardless of the market environment. As a core equity manager with a strong value bias, we see ourselves as long-term owners of high-quality businesses. We look for companies with strong balance sheets, high returns on capital, and sustainable free cash flow, and we plan to hold them for the long term.

While we feel confident about the portfolio’s long-term potential, in the first quarter of 2020, there was really no place to hide in the equity market. Correlations among equities were close to one as stock prices declined significantly in unison. However, over time, we believe high-quality, financially strong companies will outperform their peers.

Would you please discuss changes that were made to the equity portfolio in 1Q20?

We have not made wholesale changes to the portfolio as we believe it was already relatively well positioned to withstand the COVID-19 crisis. The current environment only reinforces our view of the importance that our companies have lower levels of leverage, higher levels of free cash flow, and higher returns on capital.

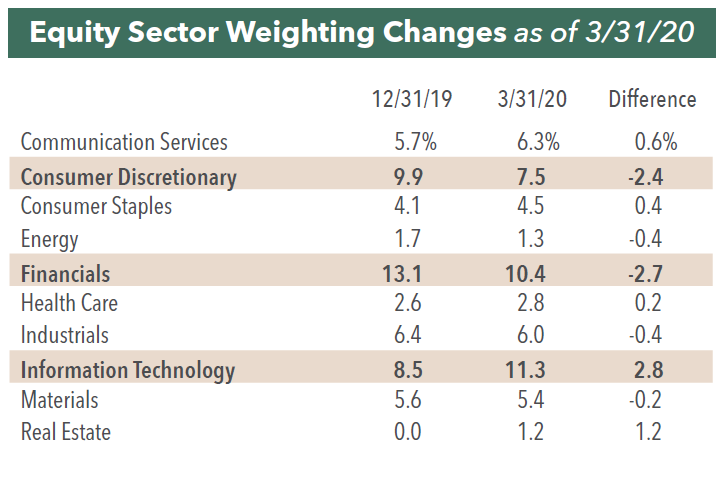

However, we have made some changes to reduce the Fund’s exposure to some sectors including Consumer Discretionary and Financials and increase weightings in our highest conviction names. For those companies with immediate coronavirus-related concerns, we reduced the exposure or exited the position entirely.

For example, we sold Carnival Corporation. We initially purchased Carnival because it was a family-run business in an oligopolistic industry with a strong balance sheet and low net debt to EBITDA (earnings before interest, taxes, depreciation, and amortization) of about 2x. However, the coronavirus could change the company’s financial situation. Notably, we were concerned the company’s leverage coming out of the current cycle may be higher than we were comfortable with due to the company’s capital commitments.

What purchases have you made in 1Q20?

We have taken advantage of recent volatility to add to our highest conviction holdings and companies that could benefit from the current environment. One example is Verizon Communication, a leader in the U.S. wireless industry with a net debt to EBITDA of about 2.7x and, in our opinion, a stable dividend.

We also added new positions in Citrix Systems and STORE Capital.

- Citrix Systems is a leader in remote application delivery and has enabled many to work remotely over the past several months. The company’s software is essential to allow employees to effectively work at home. Revenue remains very visible with the company’s subscription-based revenue model. We believe the company is well positioned to weather an economic downturn as the company has a strong balance sheet.

- STORE Capital is a diversified REIT (real estate investment trust) that owns single-tenant net lease retail properties. In many cases, the company properties are profit centers for the leases, and management has access to store level financials. We believe STORE has a strong financial standing, and it has seen insider buying, which indicates that its share price was attractive to its executives.

What impact could the current economic environment have on companies’ ability to pay dividends?

Given the balance sheet strength of many of our portfolio holdings, we believe our dividend-paying companies will continue their payouts. While we do not foresee any dividend cuts on the horizon, the situation could change the longer the economy is shut down.

Going forward, while the economic risks remain largely unknown, we will continuously stress test the portfolio to assess the Fund’s 30 equity holdings on an individual basis.

Fixed Income Allocation - Gary B. Cloud, CFA and Peter G. Greig, CFA of FCI Advisors -

Would you please discuss your thoughts regarding interest rates in the U.S. following the “double black swan” events of the coronavirus and the oil price crash?

We have long been proponents of “lower for longer” interest rates, and therefore, the portfolio’s fixed income portion had been positioned with that bias before the coronavirus outbreak. However, as the impact of the global health crisis overwhelmed the financial markets, we were astonished by the speed and size of the rate cuts that the Federal Reserve enacted. The result was a 1.5% cut in interest rates over a seven-day period, far outpacing the seven-month span during the 2008 financial crisis that resulted in a similar reduction in rates.

Looking forward, we continue to maintain our “lower for longer” outlook. We believe that not only will short-term rates continue to hover around the 0% level, but also that long-term rates will remain significantly lower than they began the year for the foreseeable future.

Would you please discuss the high yield and investment grade markets in 1Q20?

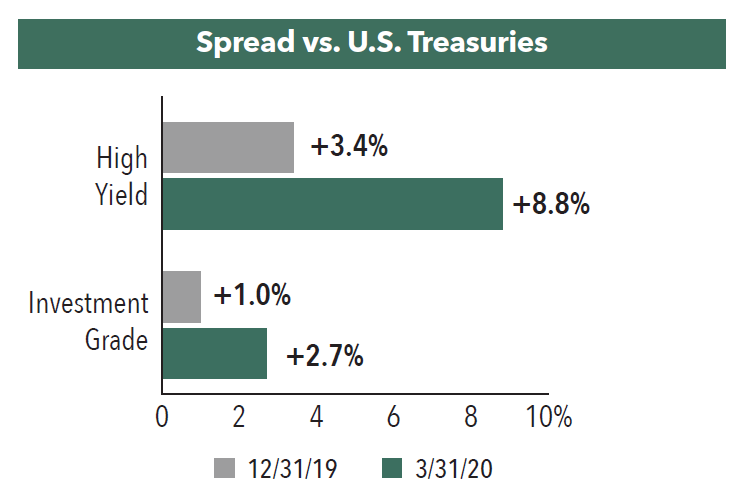

The investment grade market held up better than the high-yield market during the quarter, as uncertainty surrounding the macroeconomic effects of the global health crisis spurred investors into higher-quality, lower risk investments. Although impacted by the volatility, both sectors performed better than their historical performance during the 2008 financial crisis. Credit spreads in the investment grade market widened by about 2.7% versus Treasuries, compared to over 5% in 2008. Likewise, high yield spreads widened by about 7.5% versus Treasuries, compared to some high-yield issues that reached up to 20% in 2008. However, unlike in 2008, both investment grade and high yield sectors experienced correlations in spread widening across industry subsectors, and particularly within the energy subsector.

We believe that significant speed and size of the government’s stimulus efforts have worked to stabilize the markets and inject a significant amount of liquidity into the system. One factor we see as a sign of confidence returning to the market was the record investment grade issuance in the final weeks of the quarter, as large blue-chip companies

began reissuing debt following six weeks of no new issuance.

Did you make any changes to the portfolio in the first quarter?

While we have made slight tactical adjustments, we have made no material changes to the portfolio’s allocations across U.S. Treasuries, U.S. government agency-backed debt, and investment grade corporate bonds. We are carefully evaluating each credit holding for the possibility of downgrades or other fundamental issues.

- In this article:

- Multi Asset

- Equity and Income Fund

You might also like

-

Portfolio Perspective

Portfolio Perspective

Equity and Income FundA Focus on High-Quality Companies and Disciplined Positioning in Fixed Income

Stephen M. Goddard, CFAPortfolio Manager

Stephen M. Goddard, CFAPortfolio Manager Samuel D. Hutchings, CFAPortfolio Manager

Samuel D. Hutchings, CFAPortfolio Manager Gary B. Cloud, CFAPortfolio Manager

Gary B. Cloud, CFAPortfolio Manager Peter G. Greig, CFAPortfolio ManagerRead the Commentary

Peter G. Greig, CFAPortfolio ManagerRead the CommentaryIn the following commentary, the Portfolio Managers discuss portfolio changes and where they are finding opportunity in the equity and fixed income markets.

-

Portfolio Perspective

Portfolio Perspective

Equity and Income FundNavigating Volatility in Equities and Fixed Income

Stephen M. Goddard, CFAPortfolio Manager

Stephen M. Goddard, CFAPortfolio Manager Samuel D. Hutchings, CFAPortfolio Manager

Samuel D. Hutchings, CFAPortfolio Manager Gary B. Cloud, CFAPortfolio Manager

Gary B. Cloud, CFAPortfolio Manager J. Brian Campbell, CFAPortfolio ManagerRead the Commentary

J. Brian Campbell, CFAPortfolio ManagerRead the CommentaryThe Portfolio Managers of the Hennessy Equity and Income Fund discuss how they navigated the volatile markets during the first half of the year, outlining portfolio changes and areas where they are uncovering opportunities.

-

Portfolio Perspective

Portfolio Perspective

Equity and Income FundAn Opportunistic Balance of High-Quality Stocks and Investment Grade Bonds

Stephen M. Goddard, CFAPortfolio Manager

Stephen M. Goddard, CFAPortfolio Manager Samuel D. Hutchings, CFAPortfolio Manager

Samuel D. Hutchings, CFAPortfolio Manager Gary B. Cloud, CFAPortfolio Manager

Gary B. Cloud, CFAPortfolio Manager Peter G. Greig, CFAPortfolio ManagerRead the Commentary

Peter G. Greig, CFAPortfolio ManagerRead the CommentaryIn the following commentary, the Portfolio Managers of the actively managed Hennessy Equity and Income Fund provide their perspective on investing in high-quality companies and investment grade bonds in 2025.