Holding a Portfolio of High-Quality Equities and Bonds in a Volatile Market

The Portfolio Managers of the Hennessy Equity and Income Fund (HEIFX/HEIIX) discuss the equity and fixed income markets over the first half of 2022 and the attractiveness of high-quality securities in an environment of continued market volatility.

-

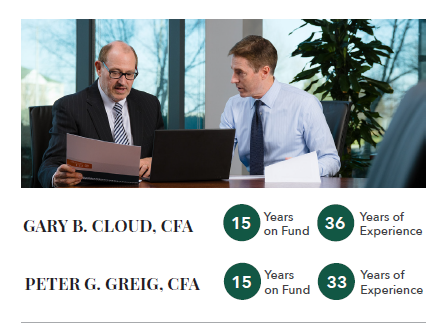

Gary B. Cloud, CFAPortfolio Manager

Gary B. Cloud, CFAPortfolio Manager -

Peter G. Greig, CFAPortfolio Manager

Peter G. Greig, CFAPortfolio Manager

Equity Allocation

What are your thoughts on the heightened levels of inflation we are experiencing?

The Russian attack on Ukraine this year has been a watershed event, underscoring the importance of a resilient supply chain. Given that these countries are among the largest wheat and fertilizer producers, food inflation may be present for some time. For the past 40 years, the economic environment worldwide has benefited from globalization, which has largely been disinflationary. Now deglobalization is a rising trend, suggesting possible structural inflation.

In addition, the Federal Reserve has begun to aggressively increase interest rates and appears to be more focused on reducing consumer prices.

What qualities do the Fund’s equity holdings possess that make them attractive in this environment?

In an inflationary environment, we believe companies that can pass cost increases to customers have become more attractive. For the equity portion of the portfolio, we are long-term investors looking for high-quality companies with durable competitive advantages that help companies pass on rising costs to their customers. Also, many of our holdings have higher gross margins than their peers, and therefore, when these companies do experience cost increases, they do not have to raise prices as much as their peers.

The Fund’s equity holdings have strong balance sheets, lower debt levels and impressive free cash flow. Therefore, as interest rates rise, these companies should be less impacted by the higher cost of borrowing.

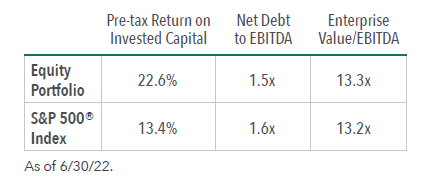

As of the end of the second quarter, we believe the Fund’s equity portfolio looks attractive relative to the overall market. Our holdings trade in line with the S&P 500® Index on an EV/EBITDA basis despite being of higher quality based on return on capital (ROC). We believe these factors, generally found in high-quality companies, can help to reduce the overall risk in the portfolio.

Would you please discuss a holding that exemplifies your investment process?

One holding to highlight is Air Products & Chemicals, Inc., the world’s leading hydrogen supplier. Air Products provides industrial gases and gasification technologies that allow countries to use their own resources to augment imported energy. With the geopolitical situation in Ukraine and Russia, increasing energy independence has become more attractive.

Part of its business is installing equipment onsite. These contracts are generally 10 to 25 years, making it a visible and predictable business. Air Products also includes price escalators in the contract which can offset cost increases.

However, in the 1Q22, the stock price fell due to the other part of its business, which is on the merchant side. This business has experienced recent industry consolidation with the top players controlling approximately 65% of the market. While for the past 15 years, it has been a rational pricing environment, with the rise of natural gas prices in Europe, these companies need to pass on the additional costs to their customers. We believe Air Products should be able to pass through cost increases onto their customers, albeit with a lag. We are also encouraged by the company’s pipeline of new business which is estimated at $15 billion in projects.

We believe Air Products will continue to reward shareholders. It has grown its dividends for over 40 years at a 10% annual rate. Air Products also has a strong balance sheet, with net debt to EBITDA under 1x and is run by an experienced CEO.

What is your outlook for equities for the remainder of 2022?

In the first half of 2022, higher levered companies and businesses with a lower ROC outperformed companies with lower leverage and higher ROC. We believe this trend is unusual; over longer periods, companies with higher ROC ratios tend to outperform.

While equities may remain in an extended period of market volatility, many companies’ earnings estimates have not fallen. Regardless of the macroeconomic environment, we believe the Fund is situated to perform well due to its portfolio quality and attractive valuation compare to the overall market.

Fixed Income Allocation

Would you please comment on the interest rate increases by the Federal Reserve as well as the shape of the yield curve?

In March, the Fed began increasing interest rates, hiking the overnight rate three times in 2022 by 25 basis points (bps), 50 bps, and 75 bps, respectively. With a cumulative hike of 150 bps, the overnight rate has ranged from 1.50% to 1.75%.

The market is expecting more rate hikes, although the magnitude is unknown. On July 27, the Fed is likely to raise rates 50 to 75 bps depending on the inflation data, and by the end of 2022, the market expects a cumulative increase of 175 bps, with the overnight rate ending the year in the 3.25-3.50% range.

In response to those expectations, the yield curve has moved up and flattened, with short-term rates increasing more than long-term rates. Since the beginning of the year, the 2-year yield has risen from 0.73% to as high as 3.43% in June while the 10-year yield has increased from 1.51% to a high of 3.50%.

What are investment grade and high yield spreads relative to Treasuries?

We have seen significant increases in both investment grade and high yield spreads. As of June 2022, the investment grade spread was 165 bps above Treasuries; at the beginning of the year, the spread was 100 bps. In comparison, the high yield nominal yield was 8.75% with a spread over Treasuries of 5.50%. Bank loan yields were 9.5% and the spread was 6% over the 3-year Treasury.

More importantly, spreads are at levels that were briefly reached in 2018 and 2020—two previous occasions when the Fed attempted to tighten. Yet the Fed’s response at those times was to swiftly change course so it was only about 3 to 4 months that credit spreads were at the levels they are today. The Fed’s reaction has been different this time.

Would you please discuss bond issuance in 2022 compared to 2021?

There has been a decline in bond issuance in 2022 compared to past years. While the availability of credit remains, it has become more expensive, which has reduced the demand. With low yields in 2020 and 2021, many companies issued debt as it was an opportunity to raise their cash levels as well as lock in inexpensive financing.

Yet the contraction of issuance is expected to be higher in the high yield market compared to the investment grade market. For example, the investment grade market gross supply was $712 billion as of June 2022 and for fiscal year 2022, it is forecasted to be $1.25 trillion, which is a 40% reduction in the last half of the year compared to the first part of the year.

In other words, companies were previously issuing approximately $130 billion each month but looking ahead, issuance may only be $79 billion per month.

In comparison, the high yield market issued $483 billion in bonds in 2021. In 2022, the forecasted amount is $175 billion, an approximate 65% reduction relative to 2021. Last year, there was $835 billion in leveraged loans and bank loans; this year there may only be $375 billion issued.

With the Fund focused primarily on investment grade bonds, how is the fixed income portion of the portfolio positioned?

Within the fixed income sleeve, 52% is in corporate bonds, 31% in government bonds, and 8% in highly rated mortgage and asset-backed securities. The Fund also has a small allocation to preferred stocks. Since the Fed’s first rate hike in March 2022, the Fund has had a neutral duration policy. As of June 30, 2022, the portfolio’s effective duration was 4.0 with an effective maturity of 4.5 years.

- In this article:

- Multi Asset

- Equity and Income Fund

You might also like

-

Portfolio Perspective

Portfolio Perspective

Equity and Income FundA Focus on High-Quality Companies and Disciplined Positioning in Fixed Income

Stephen M. Goddard, CFAPortfolio Manager

Stephen M. Goddard, CFAPortfolio Manager Samuel D. Hutchings, CFAPortfolio Manager

Samuel D. Hutchings, CFAPortfolio Manager Gary B. Cloud, CFAPortfolio Manager

Gary B. Cloud, CFAPortfolio Manager Peter G. Greig, CFAPortfolio ManagerRead the Commentary

Peter G. Greig, CFAPortfolio ManagerRead the CommentaryIn the following commentary, the Portfolio Managers discuss portfolio changes and where they are finding opportunity in the equity and fixed income markets.

-

Portfolio Perspective

Portfolio Perspective

Equity and Income FundNavigating Volatility in Equities and Fixed Income

Stephen M. Goddard, CFAPortfolio Manager

Stephen M. Goddard, CFAPortfolio Manager Samuel D. Hutchings, CFAPortfolio Manager

Samuel D. Hutchings, CFAPortfolio Manager Gary B. Cloud, CFAPortfolio Manager

Gary B. Cloud, CFAPortfolio Manager J. Brian Campbell, CFAPortfolio ManagerRead the Commentary

J. Brian Campbell, CFAPortfolio ManagerRead the CommentaryThe Portfolio Managers of the Hennessy Equity and Income Fund discuss how they navigated the volatile markets during the first half of the year, outlining portfolio changes and areas where they are uncovering opportunities.

-

Portfolio Perspective

Portfolio Perspective

Equity and Income FundAn Opportunistic Balance of High-Quality Stocks and Investment Grade Bonds

Stephen M. Goddard, CFAPortfolio Manager

Stephen M. Goddard, CFAPortfolio Manager Samuel D. Hutchings, CFAPortfolio Manager

Samuel D. Hutchings, CFAPortfolio Manager Gary B. Cloud, CFAPortfolio Manager

Gary B. Cloud, CFAPortfolio Manager Peter G. Greig, CFAPortfolio ManagerRead the Commentary

Peter G. Greig, CFAPortfolio ManagerRead the CommentaryIn the following commentary, the Portfolio Managers of the actively managed Hennessy Equity and Income Fund provide their perspective on investing in high-quality companies and investment grade bonds in 2025.