Focused on Seeking Outperformance

Increased attention is being paid to the inclusion of focused mutual funds in portfolio allocations. Studies have shown that concentrated portfolios can provide meaningful performance advantages over time.

-

David Rainey, CFACo-Portfolio Manager

David Rainey, CFACo-Portfolio Manager -

Brian Macauley, CFACo-Portfolio Manager

Brian Macauley, CFACo-Portfolio Manager -

Ira Rothberg, CFACo-Portfolio Manager

Ira Rothberg, CFACo-Portfolio Manager

Mutual funds that hold a relatively large number of positions are often thought to have less risk than funds that hold fewer positions. However, studies have shown that concentrated portfolios, generally those with fewer than 25 portfolio holdings, do not have a higher risk profile and can provide meaningful performance advantages over time.

A review of academic studies shows the following:

High Conviction Investment Ideas Have Outperformed

The investment ideas in which active mutual fund managers had the greatest conviction consistently outperformed the rest of the positions in their portfolios and the market, between 1984 and 2007, by about 1 to 2.5 percent per quarter, depending on the benchmark.1

Highly Concentrated Funds Have Outperformed

Mutual fund managers willing to make “big bets” by concentrating their portfolios’ assets have outperformed managers of more highly-diversified portfolios. In a study known as, ‘Big Bets,’ it was found that domestic stock portfolios with large weightings in a relatively small number of holdings delivered higher returns—both before and after expenses—than portfolios which held more uniformly weighted positions. These focused, “big bets” portfolios delivered approximately 30 basis points of additional performance each month, or roughly 4 percentage points of additional return each year.2

Focused Funds Have Not Exhibited Higher Risk

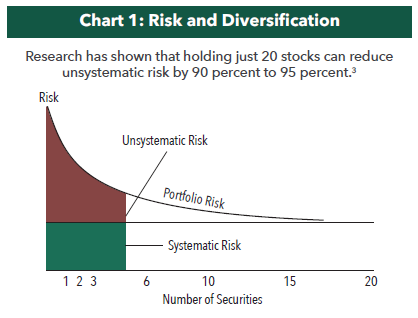

Some investors may believe that concentrated mutual funds expose investors to greater risk than more highly-diversified options. While systematic risk cannot be eliminated, research has shown that holding approximately 20 stocks can significantly reduce unsystematic risk (see Chart 1).3

- In this article:

- Domestic Equity

- Focus Fund

You might also like

-

Conference Call Recap

Conference Call RecapTop Takeaways from the Cornerstone Growth / Cornerstone Mid Cap 30 Funds Conference Call

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager L. Joshua Wein, CAIAPortfolio Manager

L. Joshua Wein, CAIAPortfolio Manager Neil J. HennessyChief Market Strategist and Portfolio ManagerRead the Call Recap

Neil J. HennessyChief Market Strategist and Portfolio ManagerRead the Call RecapPortfolio Managers Ryan Kelley and Josh Wein of the Hennessy Cornerstone Growth and Cornerstone Mid Cap 30 Funds recently discussed the Funds’ time-tested investment process.

-

Portfolio Perspective

Portfolio Perspective

Cornerstone Growth FundEarnings Growth, Value and Momentum - A Strategy for Success

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager L. Joshua Wein, CAIAPortfolio ManagerRead the Commentary

L. Joshua Wein, CAIAPortfolio ManagerRead the CommentaryIn the following commentary, the Portfolio Managers of the Hennessy Cornerstone Growth Fund discuss the Fund’s formula-based investment strategy and how it drives the Fund’s sector and industry positioning.

-

Portfolio Perspective

Portfolio Perspective

Cornerstone Large Growth FundSeeking Attractive Valuations and High Profitability

Neil J. HennessyChief Market Strategist and Portfolio Manager

Neil J. HennessyChief Market Strategist and Portfolio Manager Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager L. Joshua Wein, CAIAPortfolio ManagerRead the Commentary

L. Joshua Wein, CAIAPortfolio ManagerRead the CommentaryIn the following commentary, the Portfolio Managers of the Hennessy Cornerstone Large Growth Fund discuss the Fund’s formula-based investment process and how it drives the Fund’s sector and industry positioning.